Can Xingji Meizu Become a War God with Phones, Glasses, or Cars?

![]() 06/06 2025

06/06 2025

![]() 586

586

Image Source: Official Weibo of Xingji Meizu

From Niche to Even More Niche

Written by Li Jinlin

Edited by Li Ji

Typeset by Annalee

Meizu has reemerged, this time aiming to be Xingji Meizu, a brand with dual domestic and international focus.

Recently, Xingji Meizu has successively launched new products such as "war god-level" AI phones priced below 600 yuan, AR glasses, and smart rings, frequently making headlines in both domestic and international markets.

With high visibility, "Mei friends" suddenly realized that Xingji Meizu has transitioned from niche to an even more specialized market. Under the slogan of "AI Equality," domestic and international markets, smartphones, smart devices, and cars have all been included in Xingji Meizu's strategic chessboard.

However, given the fierce competition in the global mobile phone and automotive markets, where leading brands hold obvious advantages, can Xingji Meizu, as a late entrant, rapidly increase its brand influence and market share?

Has the domestic mobile phone king resurfaced after "All in AI"?

Recently, Xingji Meizu has been very active.

First, on May 13, it released the Note 16 series of new phones, featuring the "new standard for national strictly selected phones," with the Note 16 priced at 594.15 yuan after government subsidies. This marked Xingji Meizu's first new thousand-yuan phone release in eight months, with the price dropping into the 500 yuan range.

Coincidentally, May 13 was also the first day of JD.com's "618 Shopping Festival," and Meizu chose this day to release the new phone in order to boost sales and exposure.

Meizu Note16 brings the AI phone price war to the 500 yuan level

A week later, Xingji Meizu Group held an overseas new product launch event, introducing five smartphones from the MEIZU Mblu and MEIZU Note series, as well as new products such as AR smart glasses StarV View and smart ring StarV Ring2, priced from 79 US dollars to 399 US dollars.

Liao Qinghong, Chief Operating Officer of Xingji Meizu, revealed to the media that the company's overseas sales accounted for over 20% last year, with this year's target set at 50%, and a long-term goal of overseas revenue accounting for 70%.

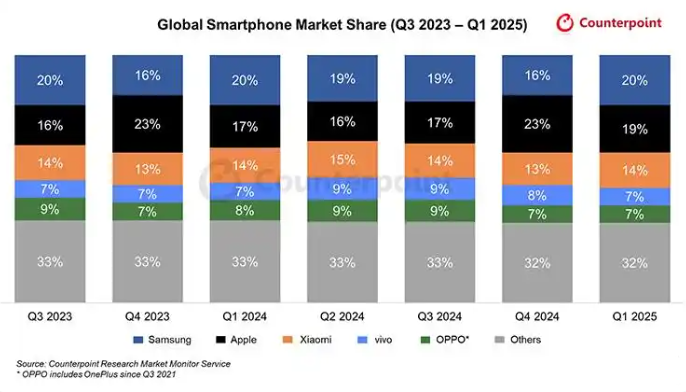

In the current fiercely competitive global mobile phone market, Xingji Meizu aims to gain more market share by focusing on both domestic and international markets. However, despite this seemingly comprehensive layout, in the fiercely competitive international market, aside from Samsung and Apple, brands such as Xiaomi, OPPO, and vivo now also have a firm foothold.

According to the Q1 2025 global smartphone market data report released by market research firm IDC, Samsung and Apple still rank first and second, with shipments of 60.6 million and 57.9 million units, respectively, and market shares of 19.9% and 19%. Xiaomi follows closely behind with shipments of 41.8 million units and a market share of 13.7%, while OPPO and vivo account for 7.7% and 7.4% of the market share, respectively.

For Xingji Meizu to stand out, relying solely on price and product diversity is insufficient; it also needs to make significant efforts in brand recognition and product differentiation.

From a strategic perspective, since Meizu's "rebirth" as Xingji Meizu, "All in AI" has become the brand's main development strategy.

In terms of technology research and development and ecosystem construction, although Xingji Meizu has built a converged AI ecosystem based on Flyme AIOS, it faces significant challenges in the actual implementation process. The research and development of AI technology require continuous high capital investment and top-tier technical talent. Compared to leading technology enterprises, Xingji Meizu does not have obvious resource advantages.

Secondly, in the field of AI phones, there is still a gap with systems such as Apple's iOS and Huawei's HarmonyOS, lacking sufficient technical highlights and unique functions to attract consumers.

Even after the launch of Meizu Lucky08 last year, some users complained that its AI search, AI notes, AI answering, AI call summary, and other functions lacked innovation and were suspected of being repurposed from other brand phones. For example, the AI button is similar to Apple's Shortcuts and XiaoAi Shortcuts.

Image Source: Official Weibo of Xingji Meizu

In terms of smart wearable devices, although AR smart glasses StarV View and smart ring StarV Ring2 demonstrate an innovative layout, there is currently serious homogeneity in the market for smart wearable devices, and related technologies are still in the development stage, with user demand not fully stimulated. Whether Xingji Meizu is fully prepared in terms of technology maturity and product stability still needs to be tested by the market.

Once upon a time, Meizu achieved great success with the M8, M9, and Meilan series, and was once hailed as the "domestic mobile phone king." However, with the failure of the "sea of phones" strategy and the "sale" to Xingji Times under the Geely Group, Meizu seems to have undergone a complete transformation.

It remains unclear whether the sentence in the Mei Friends Plan, "Not coming when you are glorious, nor leaving when you are in a low point," still holds true today.

Can multiple lines running in parallel create miracles through sheer effort?

In fact, whether it's AI phones, AR glasses, or car manufacturing, they all have the potential to become new entry points under the ecosystem story, but how to tell this story well is the current challenge for Xingji Meizu.

At the BEYOND Expo 2025 Technology Conference, Pei Yu, founder of Nothing, bluntly said, "Talking about AI phones now is boring; it's just repackaging old algorithms as AI concepts."

Earlier, Lu Weibing, president of Xiaomi Group, also posted on Weibo, "AI is the future, an omnipresent ability, but AI phones are just a gimmick."

There is considerable competitive pressure in the global mobile phone market

From "being afraid to talk about AI" to "no product without AI," it seems that AI has become a necessary label or marketing tool for new mobile phones. However, setting aside the conceptual frenzy, shouldn't the essence of technology and the real needs of users be the primary concerns in the era of globalization?

Therefore, although Xingji Meizu has brought the AI phone battlefield to the thousand-yuan level with the concept of "AI Equality," trying to use mid-range and even entry-level models as a breakthrough point for AI deployment, targeting the segmented rigid demand scenarios of middle-aged and elderly people, blue-collar workers, and other groups, problems still persist.

For example, the unavoidable cost. Although AI functions can be implemented on mid-range and low-end models to achieve AI Equality, due to limited hardware configuration, the realization of AI functions depends on the cloud. Zhou Xiang, Vice President of Xingji Meizu and head of Flyme AIOS system software, candidly stated, "The cost of calling large model Tokens (the smallest unit after text segmentation) is very expensive."

Although each iteration will reduce costs exponentially, the prerequisite is having a sufficiently large user base and enough data samples. For Xingji Meizu at this stage, this is still a shortcoming.

In addition, Xingji Meizu also regards AR glasses as an important form of the next generation of smart terminals. According to CINNO Research data, in the first quarter of 2025, domestic sales of consumer-grade AI/AR glasses increased by 45% year-on-year. Leading brand Le Bird Innovation ranked first with a 45% market share, and Xingji Meizu also ranked among the top three.

Image Source: Qianzhan Economist

However, looking at the entire AR glasses market, Xingji Meizu has many competitors. Sina Finance statistics show that entrants in the AR field can be broadly classified into three camps: international technology giants such as Microsoft, Meta, Apple, Samsung, and Google; smartphone manufacturers such as Huawei, OPPO, and Xiaomi; and finally, emerging AR companies such as Xreal, Le Bird Innovation, and Rokid.

In recent years, the penetration rate of lightwave guide technology reached 95% in 2024, with costs down 70% compared to 2021, paving the way for lightweight consumer-grade products. Therefore, it is expected that in the future, more manufacturers will enter this competitive market.

Moreover, Xingji Meizu is now deploying multiple lines, targeting not only mobile phones and smart devices but also the automotive manufacturing sector. In September last year, Xingji Meizu's first custom car, the Z10 STARBUFF, was launched. This esports custom model, jointly developed by Xingji Meizu and Lynk & Co., is equipped with hardcore devices such as an esports entertainment cockpit, the Ecarx Macaru computing platform, AMD V2000A desktop-grade chip, AMD RX6600M independent graphics card, water cooling, and a Samsung OLED automotive-grade high refresh rate screen, targeting the car usage scenarios of esports players.

Amid the intense competition in the automotive manufacturing industry, Xingji Meizu's entry point can be considered unconventional. However, the combination of esports entertainment and automotive driving does not seem to have generated the expected level of buzz and sales. As of April, the cumulative sales of the Lynk & Co Z10 series vehicles in 2025 were 1,958 units.

Whether it's AI phones, AR glasses, or car manufacturing, they may all be promising ventures, but it is still uncertain whether Xingji Meizu can truly become the "national strictly selected" brand.