Remembering Bird Mobile Phones: A Fallen King

![]() 06/06 2025

06/06 2025

![]() 595

595

Were it not for the recent abnormal fluctuations in its stock price, few would have noticed *ST Bird. The former titan of the feature phone era now stands on the brink of delisting.

One month ago, the company was issued a delisting risk warning due to its negative non-deductible net profit and operating revenue falling below 300 million yuan after excluding non-core business revenues lacking commercial substance.

Over a decade ago, Bird transitioned from branded mobile phones to mobile phone and accessory manufacturing, primarily targeting the overseas market. However, in recent years, it has faced operational challenges due to a decline in overseas orders.

During this period, Bird explored businesses in smart devices and vehicle-mounted central control panels but has yet to establish a secondary growth curve.

Even if there were significant profit margins in mobile phones and accessories, the company's struggles would persist. Despite annual revenues exceeding 100 million yuan, the gross profit margin is less than 2%, making it difficult to shoulder major responsibilities.

Amidst this crisis, the company has stated that it will vigorously develop new products, accelerate iterations of vehicle-mounted central control panels, and expand channels and customer base to drive revenue growth.

On the Verge of Delisting

On May 29, *ST Bird (600130.SH) disclosed an announcement regarding abnormal fluctuations in its stock price, stating that from May 26 to 28, the cumulative deviation of closing price gains over three consecutive trading days exceeded 12%. According to Shanghai Stock Exchange regulations, this constitutes abnormal stock trading fluctuations.

After self-inspection, the company and its subsidiaries reported normal production and operation, and the controlling shareholder, Bird Technology Group, confirmed the absence of undisclosed major information or other relevant circumstances.

At yesterday's closing, the company's stock price was 3.69 yuan per share, up 3.65%.

Known for its Bird mobile phones, the brand has long vanished from the domestic mainstream market. Following the decline of its mobile phone business, the company shifted to mobile phone and accessory manufacturing, vehicle-mounted central control panels, and smart devices.

In 2024, revenues from these three major businesses were 118 million yuan, 85 million yuan, and 38 million yuan, respectively.

Last year, the company achieved an operating revenue of approximately 361 million yuan and a net profit attributable to shareholders of 5.1111 million yuan, down 13.62% and 63.37% year-on-year, respectively. Over the same period, the non-deductible net profit increased from a loss of 2.7721 million yuan in the previous year to a loss of 13.9755 million yuan, marking the ninth consecutive year of negative values since 2016.

More crucially, Bird has reached the brink of delisting. Last year, the company's non-deductible net profit was negative, and after excluding non-core business revenues lacking commercial substance, its operating revenue fell below 300 million yuan, triggering a delisting risk warning on April 30.

After auditing by Tianjian Certified Public Accountants, the company's operating revenue was 285 million yuan after deducting a total of 75 million yuan in material sales revenue, rental income, investment property sales, logistics services, gravel sales, and trademark licensing income.

In the first quarter of this year, despite increased revenue, the company struggled to increase profits, achieving an operating revenue of 95.3943 million yuan and a net profit attributable to shareholders of 2.0775 million yuan, up 26.32% and down 37.14% year-on-year, respectively.

To revoke the delisting risk warning as soon as possible, the company has stated that it plans to promote overall revenue growth by intensifying new product development, accelerating iterations of vehicle-mounted central control panel products, and expanding channels and customer base.

What Was Missed?

Currently, *ST Bird's main businesses include research, development, production, and sales of mobile phones and motherboards. In recent years, the company has expanded into IoT module processing and vehicle-mounted central control equipment. However, due to limited investment in research and development and market expansion, its competitiveness in an increasingly fierce market environment is insufficient, contributing minimally to the company's performance.

In 2024, revenues from smart devices and vehicle-mounted central control panels were only tens of millions of yuan. Among them, revenue from the vehicle-mounted central control panel business decreased by 12.44% year-on-year.

In the company's revenue structure, the largest segment remains mobile phones and accessories. However, revenue in this segment fell by 44.24% year-on-year last year, with a gross profit margin of only 1.99%.

The company's traditional mobile phone business began to decline after 2016. That year, revenue from mobile phones and accessories was approximately 1.719 billion yuan, dropping to approximately 212 million yuan by 2023. Over the same period, revenue from the entire mobile phone business declined, falling from 932 million yuan in 2016 to 18.2437 million yuan in 2023.

In terms of sales volume, in 2016, the company sold a total of approximately 5.9447 million 2G, 3G, and 4G mobile phones. In 2024, the company no longer listed separate data, only stating that it sold 1.2396 million "mobile phones and accessories".

During the feature phone era, the company boasted annual sales exceeding 10 million units, towering above its competitors. However, entering the smartphone era, with the rise of Xiaomi, Huawei, and BBK Electronics, the market was squeezed, and Bird mobile phones gradually disappeared from the mainstream market.

This is just the surface; behind it lies the company's lack of technological accumulation. In its early days, the company cooperated with French telecom giant Sagem and relied on the other party's complete mobile phone solutions to win the market.

In 2008, after transferring 50% of its equity in the joint venture Ningbo Bird Sagem to France's Sagem, the company's research and development capabilities declined, and the Bird brand's market discourse power was gradually weakened.

At the end of 2013, the company decided to make a comeback and launched two thousand-yuan smartphones into the market, followed by the "Super Dragon" series of products, planning to tap into the third- and fourth-tier markets. However, under the joint siege of Apple, BBK Electronics, Huawei, and Xiaomi, Bird mobile phones were unable to recover and gradually faded out of the mainstream market.

In its 2016 annual report, the company acknowledged that its R&D strength was weak, production scale limited, and brand appeal low, making it more difficult to overcome operational difficulties.

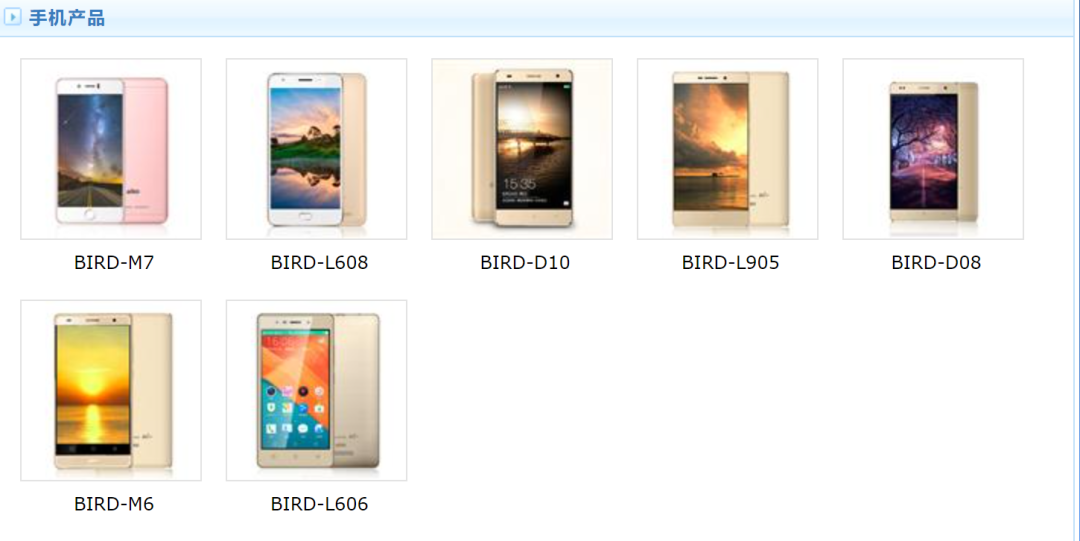

Today, the Bird brand can only occasionally be found in the senior mobile phone market.

Combat Effectiveness Weakened

*ST Bird's founding business was pagers. In 1998, the company sold over one million pagers, with sales exceeding 200 million yuan, accounting for 20% of the market share.

With the popularization of mobile phones, the company ventured into the mobile communication market and transformed into a mobile phone manufacturer. Twenty-five years ago, the Chinese mobile phone market was dominated by foreign brands, with international names like Motorola, Nokia, and Ericsson leading the way.

The emergence of Bird mobile phones brought about a structural transformation in this market. In 2003, Bird mobile phone sales exceeded 10 million units, securing the top position in the industry.

The company invited international superstar Coco Lee to endorse its products, and the slogan "The fighter among mobile phones" became a nationwide hit. By addressing common pain points of mobile communication products at the time, such as weak signals and easy disconnections, the company successfully captured the market and became a top player.

Many people should still remember Bird's two classic products from that era: the flip-open "Bird S2000" and the "Bird Lady Star", targeting business men and female consumers, respectively.

Later, the company also launched the smartphone "Doeasy", almost the earliest smartphone product among domestic mobile phone manufacturers.

In 2007, the launch of the iPhone marked the official arrival of the smartphone era. Squeezed by Apple and domestic manufacturers, Bird implemented a transformation strategy in 2010, shifting from branded mobile phones to mobile phone and accessory manufacturing, selling low- to mid-range mobile phones to emerging markets such as Africa, South Asia, and parts of South America.

Through this transformation, the company's performance improved, with a net profit attributable to shareholders of 42.2592 million yuan in 2010, a year-on-year increase of 168.89%.

Of course, had Bird made a complete turnaround earlier, it might not be in such an awkward position now.

In 2006, Zhu Zhaojiang, a grassroots salesperson at Bird, suggested that the company should explore the African market as soon as possible. After his suggestion was not adopted, he resigned and moved south to Shenzhen to found Transsion Holdings (688036.SH), achieving the commercial myth of becoming the king of mobile phones in Africa.

While Transsion Holdings grew rapidly, Bird struggled to maintain operations through the sale of real estate, financial management, and compensation for expropriation.

Once the king of the feature phone era, *ST Bird has fallen from its peak to the bottom in this way, leaving only a legend and almost no signs of a turnaround.