OPPO's Market Turbulence: Navigating the Next Turning Point

![]() 06/24 2025

06/24 2025

![]() 842

842

In the flurry of device launches over the past couple of months, the Honor 400 series has stolen the spotlight, whereas the OPPO Reno 14 has kept a relatively low profile, almost appearing forsaken. Nevertheless, OPPO's founder, Chen Mingyong, believes deeply in the company's core philosophy of integrity. Literally, integrity means doing things solidly and without meddling, inherently making the brand less sensitive to short-term market fluctuations.

However, business competition evolves swiftly, and in the smartphone industry—where innovation efficiency and scale catching-up are paramount—OPPO faces multidimensional challenges. Years of striving for premiumization have been hampered by factors like price drops, limiting scale. The low- to mid-end market is fiercely competitive, with every breakthrough proving arduous.

Specifically, in the first quarter of 2025, OPPO's foldable phone share in the European market declined by a striking 63% year-on-year, plummeting from third place to seventh.

Concurrently, data from global research institutions Counterpoint, IDC, and Canalys all underscore a similar fact: OPPO was one of the few top-five smartphone manufacturers to experience a shipment decline in the first quarter of 2025, with a global market drop ranging from 5% to 9%. In the Chinese market, while OPPO ranks third with a 15.7% share, this stands in stark contrast to the surge of another brand.

Flashing back to the first quarter of 2023, OPPO was firmly at the top of the domestic market with a 19.6% share. In just two years, it has slipped from first to fourth. OPPO's downward trajectory not only reflects the pressure on a leading domestic manufacturer but also illustrates the brutal reshuffling curve in the Chinese smartphone market. A decade ago and now, many brands find themselves on opposite sides of the spectrum.

| The Transition from Device Proliferation to Hit Product Focus, and the Rules of Breakthrough Have Changed |

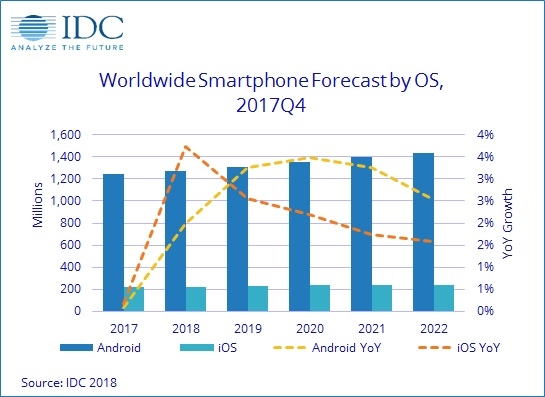

The strategy of device proliferation was typical in the early days of the smartphone blue ocean era. During this period, the market was still cultivating user perception. Even in the 4G era, the smartphone industry grew rapidly, peaking in 2017. For manufacturers, the annual product matrix and distribution efficiency directly determined their scale, which in turn influenced market competition and brand momentum.

"Lenovo, Meizu, Gionee, HTC, Coolpad, Honor, Xiaomi... In those days, fierce competition among numerous players unfolded daily. Our office would often receive groups of people, and during busy times, we couldn't even tell who belonged to which vendor," emphasized an individual with two decades of experience in the communications industry, reflecting on the smartphone market competition of that era.

OPPO's approach was to focus on integrity, solidifying its presence in lower-tier markets. From 2015 to 2025, in addition to launching countless sub-SKU models across major sub-product lines like the K series, A series, Reno series (focusing on fashion and the mid-range), and Find series (focusing on flagships), OPPO also nurtured sub-brands like OnePlus and realme, forming the industry's largest product matrix.

"Many models, fast distribution, and sufficient performance," OPPO's early market strategy was precise and swift, driving increased market penetration and offering diverse consumer choices. This was the survival philosophy of the early smartphone industry. Compared to other brands that gradually fell behind, OPPO was the first to promote the slogan of fashionable and slim design, catching up in all aspects of hardware and software such as screens and cameras, and introducing VOOC flash charging technology with the slogan "Charge for 5 minutes, talk for 2 hours," propelling it into the ranks of mainstream domestic phone manufacturers.

A decade has passed, and the competitive logic in the smartphone industry has dramatically shifted from hardware to software. The broader context is that the industry is becoming increasingly saturated, with an ample supply of product models, and annual shipments have stabilized at around 280-300 million units, nearly halved from the previous 400-500 million units. Simultaneously, selling points like "gaming, photography, camera, screen, battery..." have become standard for smartphones. As a result, the winning formula from the era of device proliferation has now become a heavy burden.

In the current era of technology democratization, the performance of mid- to low-end devices is gradually becoming excessive and homogeneous, and the competitive barriers that OPPO built early on in terms of performance and design are beginning to erode, with market competitiveness increasingly under pressure.

Coupled with the fact that some manufacturers have begun to introduce flagship technologies such as "satellite calling" and "top-level drop resistance" to lower-end models, even with OPPO's three-brand strategy, it is still difficult to win in terms of volume. By 2024, agency data revealed that OPPO failed to rank high in the high-end market, and the mid-range market also faced erosion from competitors.

"It is quite challenging to focus on creating a hit product while simultaneously managing three major product lines, with the allocation of R&D and sales resources being a significant hurdle," pointed out a communications industry expert. Reality has proven this point: OnePlus's market share fell from 2% in 2021 to 0.9% in 2024, almost becoming part of the "others" category.

Furthermore, each product loses differentiation in certain functions, configurations, and price points, making internal competition inevitable. In stark contrast, the new energy vehicle industry has seen brands like Geely and NIO initiate waves of brand integration, consolidating previously homogeneous or even competing internal brands into a cohesive force. Returning to the mobile phone industry, it is evident whether the strategy of device proliferation still holds absolute competitiveness.

| Premiumization Requires Two Tough Battles, with Oligopolistic Fortresses |

Based on China's smartphone industry experience over the past decade, to firmly establish a presence in the high-end market, it is often necessary to break through the two major barriers of core original technology and high-end perception.

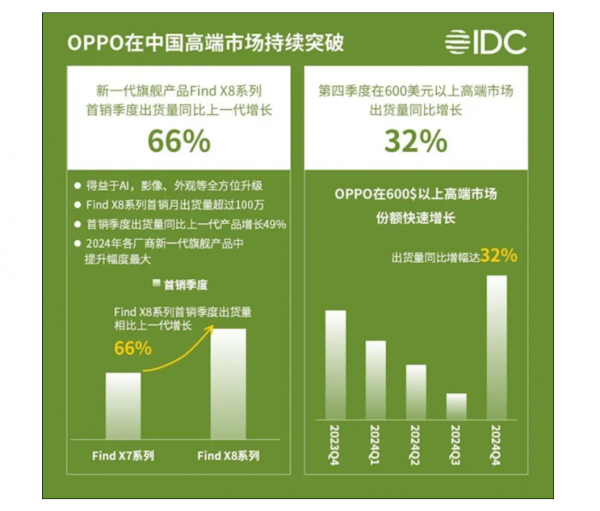

Returning to OPPO, after years of aspiring to premiumization, it has achieved certain results. For example, when the OPPO Find X8 series was launched at the end of 2024, it sparked heated market discussion. Shipments in the first sales quarter increased by 66% year-on-year compared to the previous generation, delivering new results in high-end breakthroughs and driving a 32% year-on-year increase in shipments of OPPO models priced above 4K in the fourth quarter. Until this year's Q1, the OPPO Find X8 series continued to sell well.

However, this does not mean that OPPO has established an absolute moat in the flagship sector. According to some media reports, just one or two months after the launch of this flagship product, prices in individual channels plummeted by hundreds of yuan, and fluctuations in secondary market prices to some extent affected the pull of OPPO's high-end models.

Many dealers have expressed that "OPPO's high-end phones have good parameters, but the brand cannot support a premium. At the same price, some consumers would rather buy a used iPhone." In contrast, after the launch of a certain dominant flagship series, the price of popular models can even be inflated by nearly a thousand yuan.

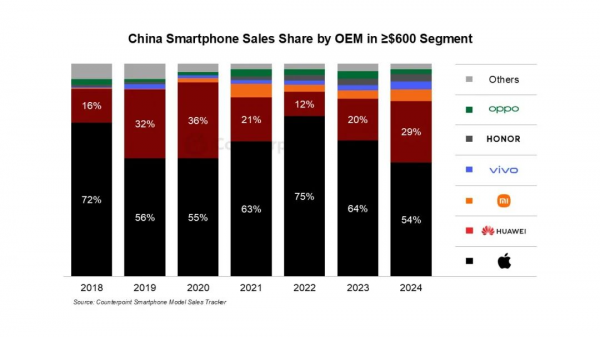

Behind the price plunge lies the lack of product premiumization ability, and at a deeper level, the embarrassment of insufficient core technology moat, which is the first major hurdle in breaking through to the high end. Over the past few decades, Apple has relied on its fully self-developed operating system ecosystem to form a leading advantage in long-board technology and still occupies half of the Chinese high-end mobile phone market.

Looking back, in 2023, OPPO suddenly shut down its chip design company Zeku and disbanded the R&D team, with billions of R&D funds invested over the years going to waste. The failure of self-developed chips not only deprived OPPO of a weapon for differentiated competition but also exposed a lack of strategic determination.

A person close to OPPO's terminal market said that in the industry, self-developed technologies such as chips and operating systems are usually seen as symbols of premiumization. For example, Huawei, which returned strongly with its Kirin chips and native HarmonyOS operating system, leads the Chinese high-end mobile phone market with a high annual growth rate.

"Customized self-developed chips allow manufacturers to embed their understanding of users and scenarios, algorithms, etc., into the chips, enabling better integration of algorithms with the entire chip architecture and higher computing efficiency," Li Jie, President of OnePlus, also expressed a similar idea.

Conversely, these factors affect brand positioning. Under the concept of luxury flagship phones emphasizing prestige and quality, the core of premiumization in the smartphone industry lies in occupying consumer perception. When parameters fail to translate into brand premiumization, the high-end dream of the Find series is always hindered by a ceiling.

As a result, on the list of China's high-end mobile phone market share in 2024 released by Counterpoint, Apple, Huawei, Xiaomi, vivo, and Honor ranked in the top five, with OPPO ranking sixth. IDC data also shows that OPPO's market share in foldable phones is far lower than that of domestic manufacturers such as Huawei and Xiaomi, highlighting its insufficient premiumization offensive.

| Channel Changes Usher in New Challenges, and the Survival of "Mom-and-Pop Stores" is Under Pressure |

Beyond products, OPPO's rise to prominence is, to some extent, a textbook on channel sinking. During its peak period, hundreds of thousands of stores were spread across China's township markets, with "mom-and-pop stores" building a solid channel barrier for OPPO due to their low operating costs and flexible pricing.

Times have changed. As OPPO marches towards the high-end market, its once advantageous channels are increasingly under pressure.

"In the industry, mom-and-pop stores tend to prioritize low prices and volume, each picking their own battles, which not only disrupts the manufacturer's overall pricing system but also affects the brand's premiumization space." Currently, most consumers prefer to purchase high-end products in shopping malls. According to iResearch data, the proportion of offline retail volume in large shopping centers has approached 30%, while the proportion of street and community stores continues to decline, with smartphones being a particularly prominent category in this transition.

Currently, OPPO's high-end presence in some lower-tier markets is somewhat insufficient. Although Liu Bo, former President of OPPO China, announced that 2,000 new Mall stores had been opened in 2024, totaling 6,500, good business districts in some cities have already been occupied by brands such as Huawei and Apple.

Even if OPPO's traditional mom-and-pop stores can still rely on the manufacturer's pickup and sales rebate policies, the SO volume (referring to activations sold to consumers) they can contribute is increasingly limited, and even some customers have started to become complacent. From an industry perspective, it is not just OPPO; the survival of mom-and-pop stores deserves deep consideration by the entire mobile phone industry.

| From Competing on Parameters to Competing on AI, the Winning Hand Has Not Yet Emerged |

Returning to the evolution of mobile phone technology itself, since abandoning self-developed chips, OPPO has shifted its technological breakthrough direction to the field of AI. In early 2024, OPPO integrated AI R&D resources to establish an AI Center, which currently has more than thousands of patent applications in this field and has applied certain results to products. According to Tianyancha data, at the end of last year, OPPO officially completed its investment in Wave Intelligence, a startup AI company focusing on vertical large models.

For example, the Find X7 series became the first carrier of technological transformation—deploying the 7 billion-parameter Andes large model on the device side for the first time, enabling functions such as AI call summarization and AI noise cancellation, becoming China's first AI phone certified by the Ministry of Industry and Information Technology.

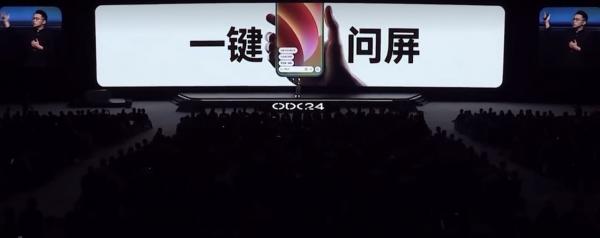

At the developer conference in October of the same year, OPPO released the ColorOS 15 operating system, introduced the "one-click screen inquiry" function, and was the first to propose the three-stage evolution path of AIOS (AI operating system): from "AI for System" to "System for AI" to "AI as System".

On the Find X8 series, AI capabilities were further upgraded to the "AI one-click flash note" function, which can automatically capture screen content and store it in "Xiaobu Memory." These innovations have won OPPO phased returns. In 2024, OPPO ranked first globally in the market share of mid- to high-end mobile phones priced between $450 and $500.

However, OPPO is not the only one deploying in this field. The AI arms race is becoming increasingly intense, reminiscent of previous competitions among players focusing on screens, sun protection, eye care, etc. vivo proposed "AI reconstructing the operating system," Honor incorporated AI agents into MagicOS 9.0, aiming for "mobile phone autonomous driving." Even Apple has deeply integrated AI into Siri, enabling it to extract information from text messages and execute complex commands.

"Currently, the majority of AI phones deploy large models on the device side and incorporate agents, with every manufacturer striving in this direction," emphasized industry observers. "The challenge lies in how to harmonize computing power, models, chips, and scenarios to deliver a product that astonishes users, akin to the groundbreaking iPhone 4."

Hence, when technological advancements have yet to culminate in a transformative user experience, OPPO's AI narrative still necessitates a more robust foundation of innovation.

Nonetheless, as Lei Jun asserts that "domestic mobile phones are entering the decisive phase of elimination," it remains uncertain whether Chen Mingyong's adherence to the principle of "integrity" will continue to be effective. The era of dominating the market through aggressive channel expansion and a sea of devices is a relic of the past.

Images sourced from the official website. Infringement will be promptly addressed.