Google Leads the AI Charge: What Other Opportunities Does AI Hold?

![]() 07/30 2025

07/30 2025

![]() 719

719

Recalling the second quarter's AI transformations, share prices have undergone a remarkable resurgence, with NVDA surging from a low of 86 yuan to the current 175 yuan. Despite this, AI's progress has remained steadfast, merely momentarily disrupted by myriad short-term factors. The second wave of the AI narrative has undeniably commenced.

Will Google's AI narrative turn a corner?

Last week, Google's second-quarter earnings exceeded expectations, with advertising revenue remaining resilient amidst the rise of AI search. Google's total search volume continued to grow by 2%, notably with token invocation volume doubling in the second quarter, from 480 trillion in April to 960 trillion in July, signifying rapid growth in demand for Google's AI services.

As depicted in the graph below, Google's token invocation volume began the year at 142.6 trillion per month, multiplying several times within the year. If this trend persists, what might this number reach by year's end? Will it surge tenfold or even twentyfold?

Google's CEO affirmed that AI demand is significant, with AI overview boasting 2 billion monthly active users, an increase of 500 million from the first quarter. Consequently, this year's capex guidance has been elevated to $85 billion, with expectations of continued capital expenditure growth next year. In other words, Google's capital expenditure may reach $100 billion in 2024.

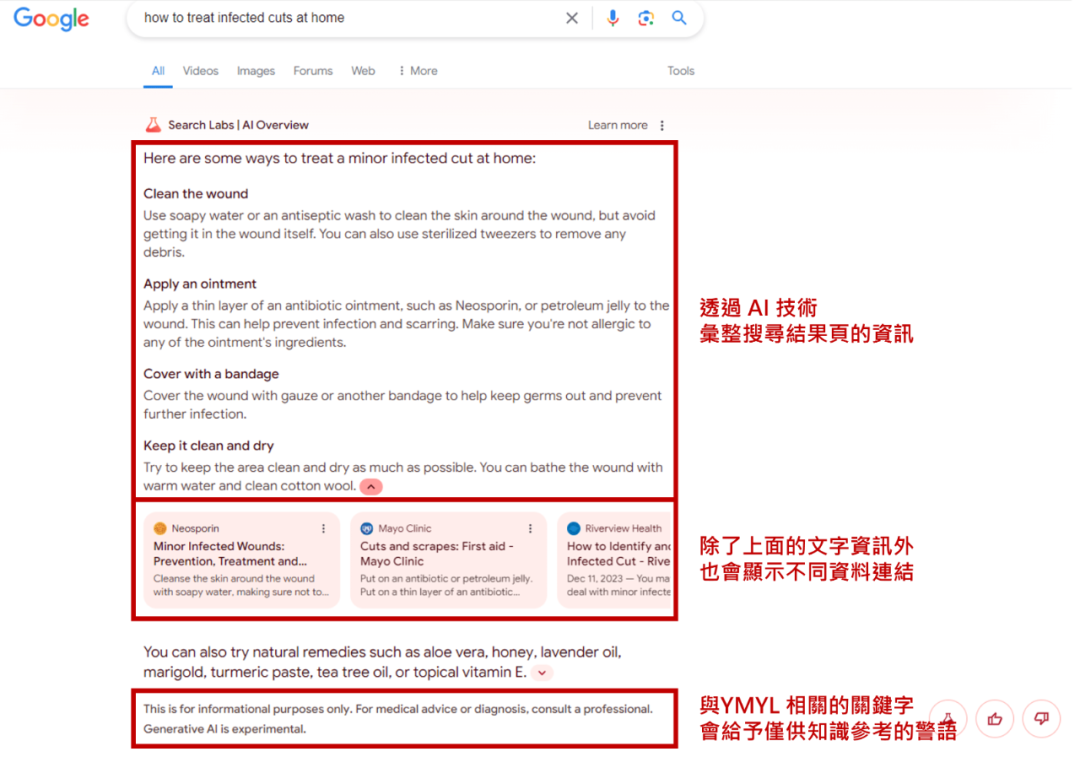

What is AI Overview?

As illustrated in the figure below, an AI summary appears at the top of the search results page, inclusive of the information source. Essentially, it is the answer to a search query derived from a large model. By integrating Gemini into Google Search, Google enables every user to experience Gemini, explaining the surge in Google's token consumption and highlighting its role in AI search.

Interestingly, Google currently enjoys the least market favor, with a valuation of less than 20 times PE.

From this perspective, even "undervalued" Google is augmenting its capex. How might Meta, Microsoft, and Amazon, which are more favored by the market, increase theirs? By $10 billion each, or an even more substantial amount?

Current Concerns Regarding Google:

Firstly, Google's antitrust lawsuit with the Department of Justice has deterred long-only investors, with only hedge funds purchasing Google shares. If the lawsuit is resolved favorably, long-only investors may resume buying.

Secondly, there's the narrative of Google versus AI search. In May, Apple executives stated that Safari search volume had declined, hinting at potential future cooperation with AI search, causing Google's shares to plummet by 8% that day.

However, since that sharp decline, Google's shares have been on an upward trajectory. The reasons are twofold: foreign banks have found that AI search is challenging to commercialize due to higher costs compared to traditional search engines. Additionally, the search volume decline mentioned by Apple executives pertains solely to Apple's search volume and not Google's overall search volume. Notably, following Google's launch of AI Overview, a clear synergistic effect between Gemini and Google Search emerged, resulting in continued growth in Google's search volume in the second quarter.

Two data points illustrate this: post-Overview launch, Google received positive feedback, with most users still relying on Google Search.

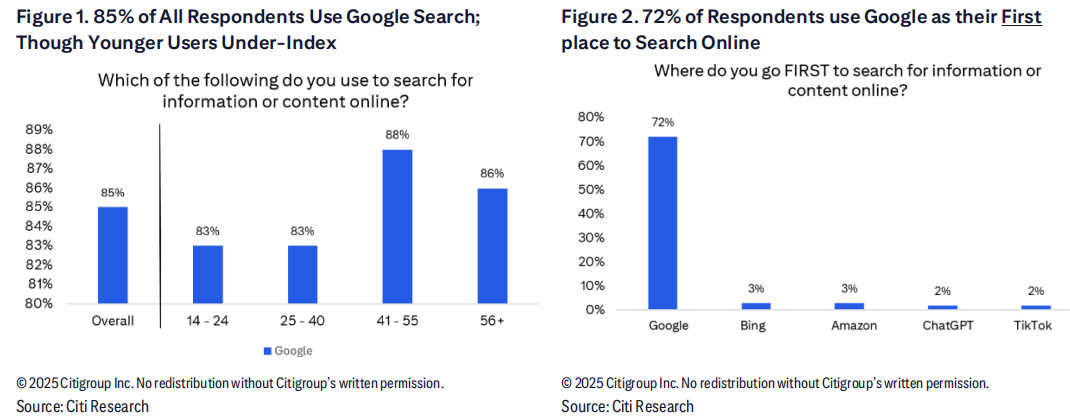

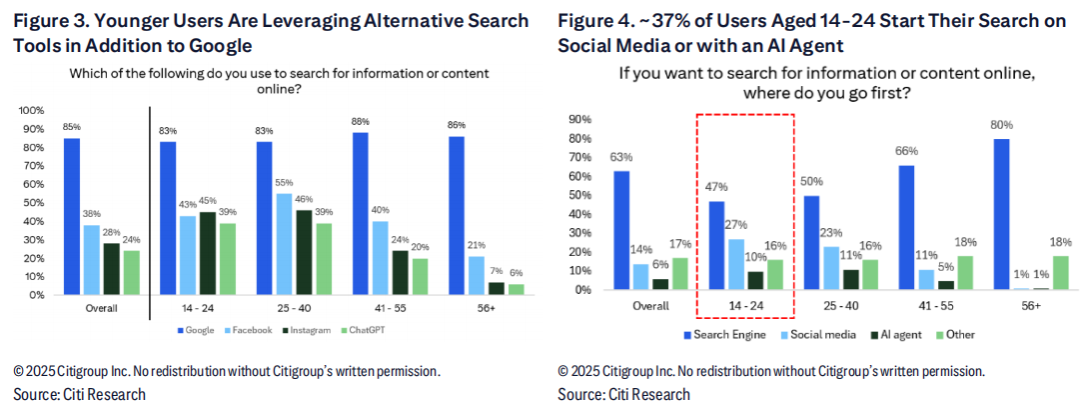

Citi Report: 85% of respondents use Google Search, albeit with a slightly lower index among younger users, peaking among those aged 41-55. 72% of respondents stated that Google is their preferred online search tool, with only 2% choosing ChatGPT and Bing.

Regarding user groups, younger users are more inclined to use other search tools, such as social media (X/INS/TikTok) and AI large models.

While AI search poses a medium-to-long-term concern for Google, it cannot be disproved in the short term.

Therefore, the forthcoming trend may involve long-only investors reallocating their positions in Google after the antitrust lawsuit is resolved, given that Google's search volume is still growing, and the growth rate of AI search may not be as rapid due to higher costs and monetization challenges.

However, considering the market's lingering concern about the long-term narrative that AI search is the ultimate goal, Google's valuation will likely remain modest, such as less than 20 times PE currently, potentially rising to 20-25 times PE in a more favorable scenario.

Thus, Google presents the largest expectation gap among tech stocks. If it can seamlessly integrate search and AI in the future, might the underestimated Google actually emerge as the true pioneer of AI search?

Cheaper AI Hardware Following Capex Increase.

After Google's capex increase, AI hardware collectively surged. The logic is straightforward: token invocation volume is doubling, and the demand for AI services from Meta, Amazon, and Microsoft is exploding. It is virtually certain that these CSPs will also boost their capex during their upcoming earnings calls, as company communications indicate that hardware orders for next year have already been significantly revised upwards.

For instance, optical module companies like InnoLight Technology, Sunway Communication, and Shenghong Technology have witnessed more than a doubling in price since April, yet their valuations are becoming more attractive, with orders continuously increasing. By next year, when the 800G era dawns and 1.6T is released, these companies' performance will accelerate even further than this year. The growth of AI hardware is just beginning to revert to a reasonable valuation.

We have been diligently tracking AI hardware opportunities on our knowledge platform.

Since May 8th, Sunway Communication has surged nearly 200%, and InnoLight Technology has appreciated over 140%.

In May, we highlighted on our platform that the current market valuation was overly conservative and that the market had yet to fully react, anticipating new highs within the year. Our report mentioned that Sunway Communication would be the primary beneficiary of 800G optical modules next year, when the share price was still around 80 yuan.

In early June, we also emphasized that the valuation recovery of AI hardware was just beginning, with InnoLight Technology, Sunway Communication, Shenghong Technology, and Bochuang still offering attractive valuations.

We promptly update valuable sell-side reports and real-time market interpretations on our platform, covering extensive AI opportunities. For instance, in February, we covered a report on MPO and Bochuang, and in July, we highlighted YOFC. All have performed impressively since our initial coverage.

Amid the rising trend of AI capex among U.S. tech stocks, we believe that the AI hardware trend is far from over, and there will be numerous sub-sector Alpha opportunities for us to explore in the future, such as MPO's Bochuang and Credo in the U.S. stock market. Beyond AI, we cover a broader spectrum of companies in Hong Kong stocks, including Mogpin and Brucko for IPO recommendations, Jinyin Technology mentioned in our March report, Chifeng Gold in April, Huahong Semiconductor in May, AI hardware in A-shares, and snack quantity stores in June.

Most recently, in July, we highlighted the opportunity in ETH, which was priced at $3000 at the time but is now nearing the $4000 mark.

In summary, we anticipate that the Hong Kong stock market will improve in the second half of the year, with numerous new stocks continuing the IPO bull market. You can entrust us with the task of exploring opportunities for analysis. Welcome to join our platform!