The Second Half of Food Delivery Competition: Quality Takes Center Stage, with Meituan Leading the Charge and Alibaba Anticipating a Breakthrough

![]() 07/31 2025

07/31 2025

![]() 612

612

As price subsidies, which directly sway user decisions, fade away, the spotlight in the food delivery sector shifts to emphasizing quality.

Original by Finance New Insight New Consumption Team

With the food delivery market's subsidy war winding down, competition among players is evolving. Since JD.com officially entered the market in February, the once-stable instant retail sector has heated up. By July, the rivalry between Meituan and Taobao Flash Sale intensified, with both offering generous subsidies to capture market share. Especially on "Crazy Saturday," they engaged in a fierce race for order volume, sparking public discussions about "free milk tea," "free purchases," and "riders earning thousands per day." While JD.com's approach was relatively conservative, it too aimed to attract customers with low prices through summer promotions like "free crayfish."

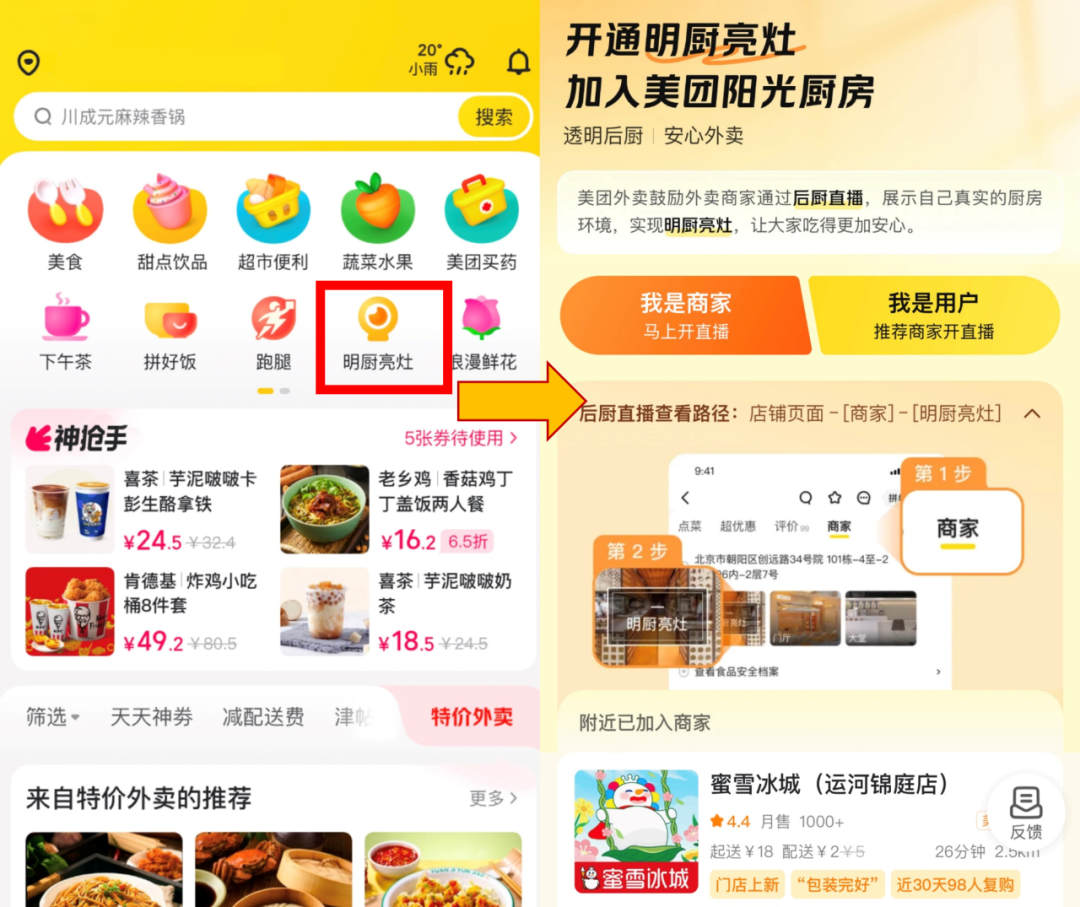

▲Image/Meituan interface screenshot

Subsequently, Meituan and Taobao Flash Sale's order volumes soared to new heights. As authorities stepped in to curb "anti-competitive practices," the price subsidy war cooled down. However, the competition continued, with each platform's promotional focus seemingly shifting to food delivery quality. Recently, Meituan launched "Raccoon Canteen" and the "Million Bright Kitchens Plan" for Pinhao Fan to ensure reliable food delivery, while JD.com introduced its self-operated food delivery brand, Seven Fresh Kitchen. Despite their differing strategies, both prioritize and improve food delivery quality.

For JD.com, Meituan, and Alibaba, the food delivery war essentially revolves around gaining influence in instant retail. However, Meituan and JD.com's quality-focused layouts reflect deeper considerations. For instance, Liu Qiangdong clearly stated that JD.com's food delivery business aims to serve the fresh food supply chain, while Meituan explores new delivery models to gain a competitive edge. From the industry's sustainable development perspective, Meituan and JD.com's emphasis on quality signifies a shift away from extensive price competition toward value-based competition, fostering healthy market competition. If participants address long-standing quality issues and strengthen user trust, it will significantly contribute to the industry's long-term health. Yet, new business models need thorough market validation. What's the potential of Meituan and JD.com's models? How will Alibaba respond? The new "Three Kingdoms" battle in food delivery is far from over.

From a monopoly to a three-way race, the food delivery market's main players have changed this year. Whether it's newcomer JD.com or incumbent Meituan, competition revolves around users, merchants, and riders. Platforms' layouts for merchants and riders ultimately aim to win over users, laying the foundation for the instant retail industry. Users prioritize price, efficiency, and quality. Rider efficiency, influenced by algorithms and transportation capacity, remains uncertain. While all three platforms have taken steps to improve punctuality, none has yet achieved a groundbreaking edge. JD.com initially differentiated itself with its late delivery compensation, but as its business stabilized, this service's scope narrowed.

▲Image/JD.com Food Delivery

Beyond delivery efficiency, as price subsidies wane, quality becomes a new opportunity. Uneven quality, particularly "phantom delivery" without dine-in services, persists. Meituan, Alibaba's Ele.me, and JD.com have long addressed this. In January, Meituan announced five measures to crack down on "phantom delivery" and promoted "open kitchens" to display food preparation processes. Currently, Meituan Food Delivery features an "Open Kitchens" section prominently on its homepage.

▲Image/Ele.me of Meituan

In March, Meituan launched the "Excellent Store Leap Plan," investing over 1 billion yuan by 2025 to support high-quality merchants. In June, this plan was upgraded, with Ele.me investing an additional 1 billion yuan to compete for quality merchants. JD.com positioned its delivery business as "quality dine-in delivery," cracking down on pure takeout restaurants. In April, Liu Qiangdong said, "JD.com is serious about food delivery, aiming to provide quality meals parents, children, and guests can eat confidently." JD.com's official Weibo account echoed this, stating, "JD.com Food Delivery carefully selects quality dine-in restaurants and won't tolerate 'phantom delivery'." However, phantom delivery is a cat-and-mouse game between black and gray industries resisting platform oversight. Despite stricter supervision and reward-punishment mechanisms, large numbers of takeout restaurants inevitably create regulatory blind spots. This may explain why JD.com and Meituan choose to personally strengthen quality control.

From a timeline perspective, Meituan was the first to go offline with its "Raccoon Canteen" model in December 2024, creating centralized food delivery kitchens. This business aggregates brands, enabling cross-merchant ordering and delivery without dine-in services. After a six-month trial, "Raccoon Canteen" officially launched on July 1, positioned as reliable food delivery infrastructure. Users can view operational actions and purchasing records through the "Food Safety Diary" and watch the preparation process via "Open Kitchens" live streams.

Meituan handles offline infrastructure, daily operations, and digital management for "Raccoon Canteen," while merchants simply "move in with bags." This makes the delivery process more transparent than single-store self-operation, minimizing "phantom delivery" food safety issues. The integrated model also offers a more convenient dining experience. Compared to Meituan's "Raccoon Canteen," JD.com's self-operated Seven Fresh Kitchen, launched on July 22, follows a different partnership path. Besides site selection, store construction, and operation, JD.com handles ingredient supply and dish preparation, recruiting brands and chefs as "dish partners" to provide recipes and co-develop dishes. With JD.com deeply involved, low-quality and phantom deliveries struggle to survive. Both platforms adopt a cooperation model, with varying depths of involvement: Meituan prefers a light-asset merchant self-operation model, while JD.com deeply engages in the entire delivery process, from raw material procurement to production and delivery, adopting a heavy-asset model. This shift from a transaction-facilitating third-party platform to a deep participant undoubtedly enhances the coexistence of delivery prices and quality, boosting consumer trust. However, merchants worry about platforms "playing both sides," competing with existing stores. Meituan clarifies it won't operate its own stores, while JD.com states Seven Fresh Kitchen targets high-phantom delivery areas, considering partners' old stores to tap incremental markets without competing for existing business.

▲Image/Seven Fresh Kitchen ordering page screenshot

JD.com's aggressive store expansion reflects confidence in its supply chain and ambitions to seize the market and acquire more increments through Seven Fresh Kitchen. However, nationwide expansion brings uncertainties and challenges. Industry analyst Zhang Shule believes that while food delivery platforms initially provided matching and delivery services, JD.com's self-operated delivery aims to differentiate and attract consumers with quality, forming loyalty. However, this approach isn't guaranteed to work, as self-operated delivery faces taste challenges beyond cost-effectiveness. Meeting varied tastes across regions with quasi-standard delivery, like KFC, may not be solved by a few popular options.

In the face of Meituan and JD.com's aggressive offline strategies in the food delivery sector, it is intriguing to anticipate how Alibaba, another major player, will respond. When JD.com ventured into the food delivery market and locked horns with Meituan, Alibaba and its Ele.me platform maintained a relatively low profile. It wasn't until the competition between the two intensified that Alibaba officially entered the fray by upgrading Taobao Flash Sale. Judging by its subsequent large-scale market entry and substantial increase in order volume, it is evident that despite being a latecomer in the instant retail race, Alibaba's robust resource base gives it the confidence to catch up and potentially surpass its competitors. If we reverse-engineer the scenario, Alibaba's initial hesitation might have been a strategic buffer period, akin to an elephant turning on a dime, or a cautious observation of the market dynamics. Now, as Meituan and JD.com deepen their engagement in food delivery stores, Alibaba's lack of immediate action could be attributed to similar considerations as when it initially joined the fray. Firstly, premium food delivery is still more of a concept than a fully realized reality, making hasty moves potentially risky. Secondly, examining the paths taken by Meituan and JD.com, it's clear that premium food delivery can be approached with varying degrees of intensity, and the optimal path for the market has yet to be conclusively determined. Should Alibaba opt for a lighter approach in the future, the integration pressure would be manageable. Nonetheless, anxiety lingers, as if JD.com and Meituan successfully cultivate a "premium food delivery" mindset among users, Alibaba risks falling behind if it doesn't keep pace.

Whether to distract competitors or secure a future foothold in instant retail, Alibaba's decision to engage in the food delivery battle suggests no intention of abandoning it halfway. Given this, it's only a matter of time before Alibaba rolls out comprehensive layouts for premium food delivery. This is evidenced by the continued growth in Taobao Flash Sale's order volume, even after the subsidy war subsided. For Alibaba, offline layouts for its food delivery business possess clear ecological advantages: if it follows Meituan's "Raccoon Canteen" model, it can leverage its long-standing live streaming capabilities, store rating system, and digital operation prowess on Taobao; if it aligns with JD.com's Seven Fresh Kitchen approach, it has Hema to provide supply chain support and quality assurance for its food delivery operations.

▲Figure/AI creation

Based on Meituan and JD.com's strategies, food delivery platforms have directly entered the market to control quality, effectively setting the tone for the second half of the food delivery market competition. Whether Alibaba will emulate Meituan's path, follow JD.com's lead, or carve out a new trail after careful observation and resource integration remains to be seen. Regardless of whether it's Meituan and JD.com, the early movers, or Alibaba, still observing, the key to success lies in one crucial aspect: whoever can ingrain the concept of "quality" in consumers' minds at the lowest cost of trust will amass the most valuable user resources for the instant retail industry. This battle for quality upgradation, centered around "eating with peace of mind," has only just begun but has already established a clearer and more valuable direction for the industry's future. Reference materials: Dingjiao One, "Can JD.com 'Stir-Fry' Its Way to a Comeback?" Lanxi, "The Food Delivery War: A Brutal Beginning Must End with Brutality" Bohu Finance and Economics, "JD.com's 'Secret Move' in Food Delivery: Liu Qiangdong is About to 'Light the Stove'"