Focusing on Food Delivery or Internationalization: A Critical Decision

![]() 08/06 2025

08/06 2025

![]() 623

623

On July 31, JD.com announced on the Hong Kong Stock Exchange that it had acquired Germany's largest consumer electronics group, CECONOMY, through a wholly-owned indirect subsidiary for an estimated value of approximately €2.2 billion, equivalent to over RMB 18 billion.

CECONOMY operates in the consumer electronics business, with over 1,000 offline stores across Europe and a well-established online sales platform.

Post-acquisition, CECONOMY will maintain independent operations, while leveraging JD.com's technology and expertise to accelerate its transformation into Europe's leading omnichannel consumer electronics platform.

This isn't the first time JD.com has attempted to acquire CECONOMY. The two parties had contact as early as 2023, but negotiations failed at that time.

In 2024, JD.com also participated in the bidding for the UK electronics retailer Currys but later decided to abandon it after "careful consideration".

Similar to CECONOMY, Currys operates in multiple European countries, with over 800 offline stores and its own digital channels.

This underscores the consistency in JD.com's targets for overseas mergers and acquisitions. JD.com aims to replicate its domestic success in the consumer electronics field, essentially recreating a new JD.com overseas. The acquisition of CECONOMY marks a milestone but could also be the beginning of a more challenging journey.

Liu Qiangdong's Patience and Dream

Liu Qiangdong's vision for JD.com's internationalization was established early on.

At the annual meeting in 2014, Liu Qiangdong mentioned that internationalization was his ultimate dream. If this dream materialized, he would retire and focus on his grandchildren.

Unfortunately, this dream remains unfulfilled to this day.

However, while Liu Qiangdong hasn't yet held his grandchildren, he welcomed a son in recent years, which could be considered a silver lining.

In a sharing session in June this year, Liu Qiangdong explained the rationale behind JD.com's venture into food delivery and hotel services, once again highlighting his vision: He hopes to hand over domestic business as soon as possible and focus full-time on international expansion.

However, JD.com's international business has faced numerous challenges since its inception, with continuous fluctuations and frequent management adjustments.

In 2015, JD.com launched a Russian-language site for Global Sales, but operations ceased, and JD.com withdrew from the Russian market in 2016, following the departure of Xu Xinquan, President of the Overseas Business Department.

Subsequently, Liu Qiangdong appointed Shen Haoyu as President of International Business, but after only eight months, Shen Haoyu resigned, replaced by Zheng Xiaoming, who had previously worked at LeTV. Later, JD.com made several investments and acquisitions in Southeast Asia, but its international business still fell short of expectations.

During an internal meeting in 2019, Liu Qiangdong criticized the international business as a negative example. The following year, there were further management changes, with Yan Xiaobing, a veteran, appointed as the head of JD.com's International Business Department. However, Yan Xiaobing didn't stay long and retired due to family and health reasons after a year, replaced by Chen Guanhan.

It's unclear whether the frequent personnel adjustments were due to unsatisfactory business performance, whether these adjustments had a negative impact on the business, or whether Liu Qiangdong's own will was erratic and lacked patience.

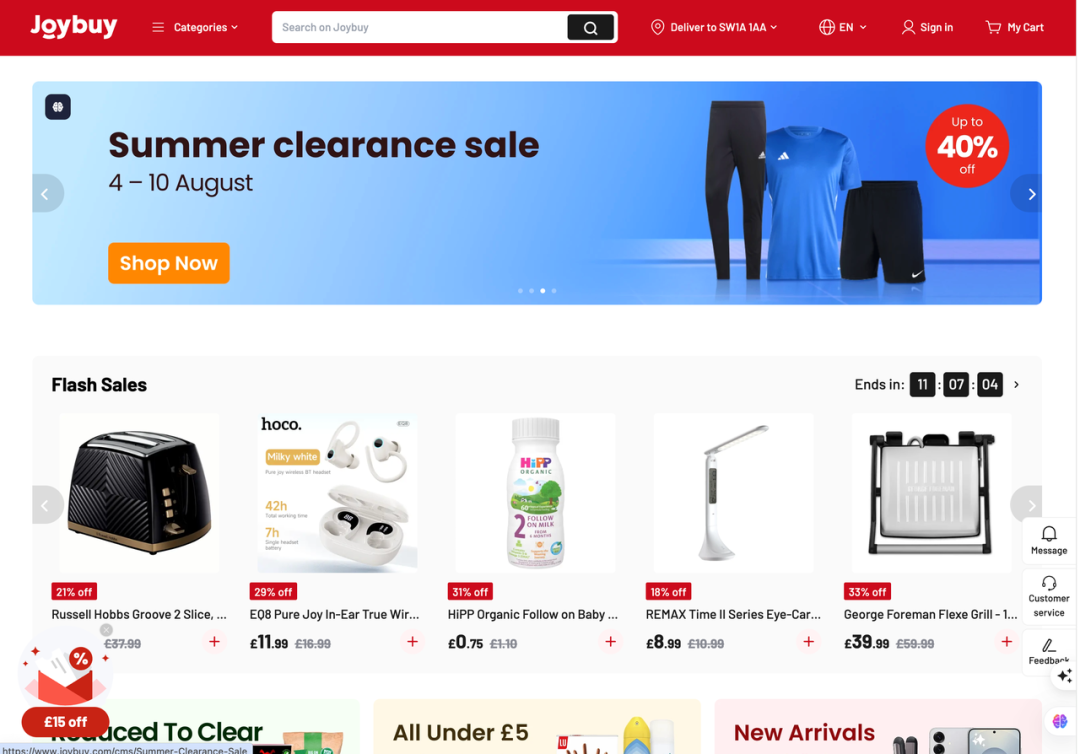

Currently, JD.com's overseas business can be broadly divided into three parts: Ochama, a European new retail business launched in 2022; Global Sales, which sells JD.com's self-operated and third-party seller products overseas; and Joybuy, a self-operated platform refocused on Europe after multiple adjustments.

In summary, JD.com's current overseas layout has three characteristics:

Firstly, there is a regional adjustment, with a shift in focus from Russia and Southeast Asia to Europe. This mirrors the development trajectory of TikTok and Temu, both of which started in developed markets before expanding globally.

Secondly, it focuses on consumer electronics, starting from a familiar terrain before venturing into deeper waters. Whether it's the current acquisition of CECONOMY or previous bids for Currys, this strategy remains consistent.

Finally, it continues to build a supply chain fulfillment system and constructs an overseas warehousing network centered on JD Logistics. While domestic express logistics is widespread, foreign express delivery remains a fulfillment weakness, giving JD.com a competitive edge. In Liu Qiangdong's words, it's about "globalizing supply chain services with logistics as the carrier."

However, it's crucial to note that entering overseas markets requires not only leveraging domestic experience and strategies but also finding ways to integrate locally.

A key strategy in JD.com's overseas expansion plan is to target overseas Chinese communities. For instance, JD.com's Global Sales primarily targets overseas Chinese users. Ma Yanjiao, a senior executive at Ochama, previously mentioned that a breakthrough Ochama needs to make is to step out of the Chinese community and enter the local European circle.

This strategy is effective in targeting users. Overseas Chinese, especially in developed markets, generally have higher purchasing power. These discerning middle-class users are usually more concerned about product quality, aligning well with JD.com's platform tone.

However, from a fulfillment efficiency and long-term growth perspective, targeting overseas Chinese from the outset may not be ideal.

While overseas Chinese tend to cluster locally, they are dispersed throughout their host countries as a whole, which isn't conducive to achieving scale effects and efficiency improvements in transactions at the fulfillment level.

Furthermore, the tendency of overseas Chinese communities to "circle themselves" means they aren't ideal seed users, making it difficult for the platform to use them as a springboard to penetrate the broader local mainstream population in the future.

Focusing on Food Delivery or Internationalization vs. Failing in Food Delivery or Choosing Internationalization

In recent years, the primary development logic in the domestic e-commerce sector has undoubtedly been the rise of Pinduoduo and Douyin E-commerce, capturing significant industry growth that should have belonged to Alibaba and JD.com.

Alibaba's response focuses on preserving its e-commerce stock and pursuing AI growth.

By canceling the independent spin-off of Alibaba Cloud and further integrating it into the group, while significantly increasing capital expenditures and holding high the banner of open-source large models, Alibaba's new story of AI and cloud computing is currently showing promising results.

On JD.com's side, besides its main e-commerce business, it seems difficult to find an alternative business narrative like Alibaba.

Fortunately, thanks to its platform model of "self-operated, genuine products, and issuing invoices," state subsidies have maximized JD.com's breathing room.

The first-quarter financial report of this year shows that JD.com's net revenue for the quarter increased by 15.8% year-on-year, and its Non-GAAP operating profit increased by 31.4% year-on-year.

However, Liu Qiangdong is undoubtedly aware, like the outside world, that state subsidies will eventually cease. Leveraging the window period brought by state subsidies to open up a new long-term situation for JD.com can permanently resolve the current difficulties faced by JD.com.

The consensus is to break through, but how to break through poses a problem.

If we temporarily erase the timeline after February this year and put ourselves in Liu Qiangdong's shoes at that time, we'll find that there aren't many options available.

In 2024, Liu Qiangdong set three major directions for JD.com: content ecosystem, open ecosystem, and instant retail. The construction of both the content and open ecosystems can't produce immediate results and requires long-term and continuous investment and operation. Moreover, after years of internal competition, e-commerce has entered a phased steady state. Lightly starting a war to "provoke competitors" doesn't align with JD.com's interests and may exhaust its already limited resources.

Therefore, instant retail is relatively more suitable as the current focus target because it falls within the range of JD.com's existing resource layout.

Although Dada and JD Daojia are considered "small-scale operations," years of continuous operation have at least established a complete instant retail system from supply to fulfillment.

In Liu Qiangdong's view, using this system as a starting point, on the one hand, by investing heavily in subsidies, and on the other hand, by targeting competitors' weaknesses and industry pain points and leveraging public opinion to create a big impact with a small force, there's hope to shake up the existing landscape of food delivery and instant retail.

Of course, with Alibaba, led by Jiang Fan, quickly placing heavy bets on Taobao Flash Sales, JD.com is now in a dilemma.

If it continues to maintain a tug-of-war with Meituan and Taobao Flash Sales, Meituan has extremely high organizational efficiency and no less money than JD.com, while Taobao Flash Sales has lower organizational efficiency but much more money than JD.com.

On the other hand, if it doesn't continue to increase investment or maintain at least the current intensity of subsidies, the existing market share will continue to shrink, and previous investments will become complete sunk costs. According to a report by "LatePost," by the second quarter, JD.com had already invested over RMB 10 billion in its food delivery business.

Therefore, a hindsight question today is whether Liu Qiangdong should have chosen to go overseas rather than food delivery as a breakthrough.

Compared to food delivery, going overseas is superior in at least three aspects:

Firstly, JD.com's business understanding and resource accumulation in e-commerce are far stronger than in food delivery or instant retail. While these experiences can't be fully replicated overseas, a significant portion of them are necessarily universal.

Secondly, the ceiling for going overseas is higher, and competition is less intense. Unlike the domestic e-commerce industry, which was rapidly "accelerated," the overseas e-commerce market still maintains high growth in multiple regions, and the existence of a large number of independent stations further illustrates the massive development space for platforms.

Thirdly, e-commerce losses are lower in absolute terms, and the monetization model is more stable and controllable. Wang Puzhong mentioned in an interview that Alibaba has invested RMB 150 billion in Ele.me and may reach RMB 200 billion by the end of this year. Such a high investment hasn't even yielded any mid- to short-term visible return expectations. In contrast, Temu is expected to lose approximately RMB 27 billion in 2023 and is expected to achieve profitability by 2025, according to China Merchants Securities.

Of course, JD.com has already invested heavily in the food delivery sector, and the acquisition of CECONOMY is a done deal.

Therefore, the more important question is how to balance the relationship between the two. The ideal scenario is clearly to launch attacks on both fronts and achieve success on both sides, but limited resources constitute an objective constraint. Strategic trade-offs may not be imminent but may ultimately be unavoidable.

A particular issue to consider is Liu Qiangdong's motivation for once again betting on internationalization. JD.com's attitude towards going overseas has undergone multiple reversals, reflected in the shutdown and merger of multiple related businesses in the past and the comings and goings of those in charge of international business. If today's decision is merely a result of realizing that the food delivery stove isn't heating up and turning back to internationalization, then an unwavering determination and a lack of resolve to tackle difficulties may only lead to a repetition of history.

Focusing on food delivery or internationalization: This is a question.

Failing in food delivery or choosing internationalization: This is another question.

End

JD.com's capabilities are clearly insufficient to support its fight on both fronts of food delivery and going overseas, so Liu Qiangdong made a choice.

Years later, when recalling this, Liu Qiangdong may realize that he wasted an excellent window period.

He could have transformed JD.com's years of accumulation in supply chain, warehousing, and fulfillment systems into a competitive advantage in overseas markets. Even if he had focused on just one Southeast Asian country, it might have paved a path similar to Shopee.

Today, as state subsidy benefits gradually fade and the food delivery war intensifies, with returns on investment becoming increasingly uncontrollable, JD.com is being forced into a protracted battle from which it is difficult to extricate itself. The once-in-a-lifetime opportunity window has ultimately slipped away.

In this game that will determine JD.com's direction for the next decade, perhaps the choice itself is far more important than effort.