Huang Renxun's Anxiety

![]() 08/07 2025

08/07 2025

![]() 530

530

Author/Qing Fu

Editor/Jiajia

"I always think that while we achieve something, others may also be creating greatness," Huang Renxun said in a mid-July interview with CCTV News, devoid of arrogance but brimming with anxiety, perpetually fearing NVIDIA's imminent collapse.

Indeed, China boasts the world's most vibrant AI industry atmosphere, with both the nation and enterprises viewing AI as the future industry. Furthermore, China is the global hub of the new energy intelligent driving industry, with annual automobile production and model iteration speeds far surpassing traditional automakers in Europe, America, Japan, and South Korea.

However, it's unfortunate that China's AI market and intelligent driving industry are gradually distancing themselves from NVIDIA. Beyond well-known reasons, the rise of China's AI chip industry has shattered NVIDIA's monopoly, rendering it no longer the "sole" choice.

[1] Monopoly Amidst Prosperity

"Everyone wants to be the first to get the chips, everyone wants to get the most chips," Huang Renxun said three years ago, brimming with happy troubles. With AI breakthroughs, NVIDIA, once a gaming graphics card specialist, sold out—in 2023 alone, the market gap for NVIDIA AI training chips exceeded 400,000 units.

This was particularly evident in the Chinese market, where imports were hindered by external factors. The original price of the H800 GPU complete machine was 1.95 million yuan, which soared to 2.45 million yuan, and Chinese enterprises had to wait over 52 weeks to receive their goods.

Despite such stringent delivery conditions, Chinese internet vendors had no choice, as NVIDIA's Hopper series chips were unbeatable in terms of training speed and efficiency for large AI models.

Taking NVIDIA's H100 as an example, its FP16 computing power reaches 1979 TFLOPS, and its memory bandwidth is 4.8TB/s, more than twice that of mainstream domestic chips. It supports NVLink interconnection (900GB/s bandwidth), with a training efficiency of over 90% for a thousand-card cluster, while the interconnection bandwidth of domestic chips is only 1/2-1/4 of that.

At that time, there was a generational gap between NVIDIA's AI chips and domestic AI chips. However, beyond performance parameters, what was more crucial for internet vendors was their adaptability and cost.

Currently, over 90% of AI developers build their technology stack based on CUDA. Hopper series chips can directly run PyTorch/TensorFlow models, whereas domestic chips require PTA conversion (resulting in another 30% performance loss) and manual adjustment of 128 distributed communication parameters.

One offers robust performance and can be used directly, while the other offers inferior performance and requires manual adjustment post-purchase. It's evident which one enterprises would choose.

Even at the risk of potential future supply disruptions, NVIDIA AI chips remain the top choice for Chinese enterprises developing large AI model businesses.

Omdia's year-end report in 2024 revealed that ByteDance purchased 230,000 and Tencent purchased 230,000 NVIDIA Hopper chips.

It was precisely due to its absolute dominance in performance, production capacity, and ecosystem that the AI wave propelled this AI chip supplier to the pinnacle:

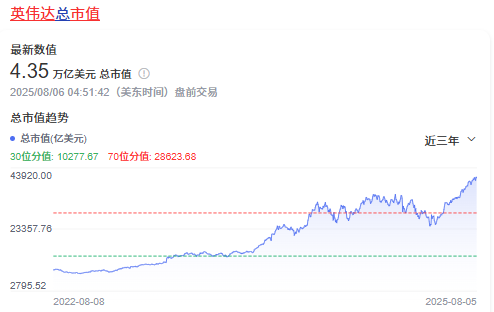

On July 9, 2025, NVIDIA's market value surpassed the 4 trillion USD mark, surpassing Microsoft and Apple to boldly top the global market value ranking.

(Source: Baidu Stock Market Pass)

(Source: Baidu Stock Market Pass)

Notably, in the 2024 global GDP ranking, Japan ranked fourth with 4.03 trillion USD, meaning that NVIDIA alone was equivalent to a country's economy at that time.

[2] Domestic Impact

No dynasty lasts forever, and a company's monopoly position will also be fiercely impacted by newcomers. The one who cracked open the giant was Zhou Hongyi, the outspoken CEO.

"All the chips we recently procured are Huawei's," Zhou Hongyi bluntly stated that 360 chose domestic AI chips when asked by a reporter during this year's Internet Conference whether they would still purchase NVIDIA's H20.

The reason is straightforward: compared to the crippled AI chips NVIDIA can provide to China, domestic chips have caught up in performance and production capacity.

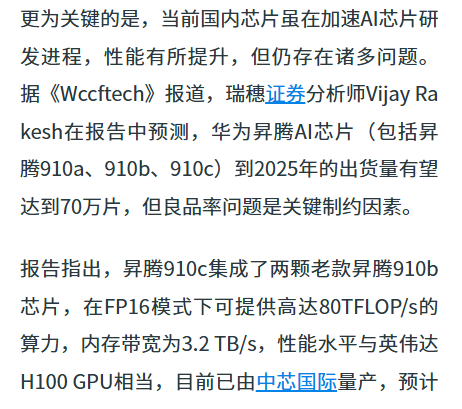

Taking Huawei's most advanced Ascend 910C chip as an example, it is composed of two 910B chips, with a peak performance of 800 TFLOP/s in FP16 operations and a memory bandwidth of 3.2 TB/s, reaching 60% of the performance of NVIDIA's H100 chip.

This signifies that NVIDIA is no longer the only solution for Chinese AI manufacturers. In fact, 360 is not the only company that has abandoned NVIDIA and chosen domestic AI chips.

ByteDance plans to purchase AI chips domestically worth 5.5 billion USD, 60% of which are domestic AI chips from Huawei, Cambricon, etc.

iFLYTEK is even more committed to Huawei's Ascend chips, stating that in terms of AI inference efficiency, the Ascend 910B chip has increased from about 20% of NVIDIA's product performance in 2024 to nearly 80% in 2025.

Technology is advancing, and the yield of Ascend 910C chips is also increasing.

Data shows that the early yield of Ascend 910C was only 20%, meaning that only one out of every five chips produced was qualified, leading to high costs and low production volumes.

Now, with advancements in manufacturing processes, the yield of Ascend 910C is expected to increase to 38%, and this improvement in yield alone can double production capacity.

Mizuho Securities analyst Vijay Rakesh predicts that the entire Huawei Ascend 910 series, including 910A, 910B, and 910C, will ship over 700,000 units in 2025.

If we calculate based on the demand for 2.7 million domestic AI chips in 2024, Huawei alone can meet 26% of domestic demand with its production capacity.

(Source: DoNews)

(Source: DoNews)

It can be said that domestic chips have risen in both production capacity and performance, transforming from previously being used as backups to becoming front-runners.

"Previously, when everyone used Ascend, they didn't think it was very advanced. It was only because of the US supply cut that they had no choice but to use Ascend. Now things are changing. Although there is a slight gap in single-card computing power, our system's performance is not inferior to theirs, and our overall efficiency is ahead."

According to the 21st Century Business Herald, through super-node technology, the throughput of Ascend 910C's DeepSeek is equivalent to that of H100.

It is clear that domestic AI chips have compensated for their performance shortcomings, which will inevitably seize market share and space from NVIDIA's AI chips.

"Four years ago, NVIDIA's market share in China was as high as 95%. Now it's only 50%. If there were no NVIDIA, they would also use a lot of local technology," Huang Renxun publicly complained in May this year that NVIDIA was experiencing the most severe impact in the Chinese market.

The giant is still towering, but cracks have already appeared in its foundation.

[3] Missing Out on the Future

As the helmsman of a company with a market value of 4 trillion USD, is Huang Renxun's anxiety unfounded?

After all, NVIDIA still holds the most advanced AI chip technology, occupies an absolute monopoly market share, and has the CUDA platform that almost all AI developers rely on.

Huang Renxun's anxiety stems not from the present but from future trends. Treasury Finance has compiled a set of data from Bernstein and IDC reports:

In 2023, Chinese AI chips accounted for only 15% of the Chinese market share.

In 2024, with the rise of chips like Huawei's Ascend and Cambricon's MLU590, the domestic chip market share reached 29%, with a year-on-year increase of 14% in market share and sales of 6 billion USD.

It is estimated that in 2025, the market share of Chinese chip manufacturers will reach 42%, with sales surging to 16 billion USD.

In 2026, it is expected that the market share of domestic AI chips will reach the 50% mark.

The rapid progress of domestic AI chips means a shrinking market share for NVIDIA.

More importantly, NVIDIA's losses are not immediate but will come in the future when China's AI industry rises comprehensively.

China Academy of Information and Communications Technology estimates that by the end of 2023, the total global scale of computing power infrastructure reached 910 EFLOPS (FP32), with China accounting for 26% of global computing power, ranking second only to the United States at 32%.

This is just the prelude to China's computing power explosion.

From 2024 to the first half of this year, more than 250 intelligent computing centers have been built or are under construction nationwide; the Ministry of Industry and Information Technology has even stated that China's planned growth in computing power scale will exceed 100 EFLOPS from 2024 to 2025.

The rapid growth in computing power will greatly drive the demand for AI chips.

According to Frost & Sullivan predictions, from 2025 to 2029, the annual compound growth rate of China's AI chips will reach 53.7%, and by 2029, the market size will reach 1.34 trillion yuan, with an increase of over 1 trillion yuan.

(Source: Internet)

(Source: Internet)

The prospects for China's AI chip market are enticing, but this 1 trillion incremental market cake will all go to domestic AI chip markets such as Huawei and Cambricon.

Moreover, as Huawei, Cambricon, and other AI chips enter the commercial profit phase, they will enter a virtuous cycle of "super profits - high R&D - high product performance", which will also shake NVIDIA's technological hegemony.

In fact, we can see NVIDIA's sense of crisis from Huang Renxun's attitude towards Huawei's AI chips.

In July 2024, when talking about Huawei Ascend's adoption of 7nm chips, Huang Renxun publicly stated: "The 7 in 7-nanometer chips is just a number, not a real 7 nanometers. Huawei's chips are more than 10 years behind NVIDIA."

But on July 16 of the following year, when asked whether Huawei's AI chips could replace NVIDIA in AI training, Huang Renxun said that it was only a matter of time before Huawei's chips replaced NVIDIA in AI training, hoping to bring more advanced chips into China.

In November 2022, ChatGPT released by OPEN AI directly pulled human society into the era of artificial intelligence, making AI the most cutting-edge and imaginative industry.

This AI wave also brought fire to NVIDIA, the "shovel seller" in the gold rush—to get enough chips, Silicon Valley mogul Larry Ellison hosted a banquet for Huang Renxun, requesting during the meal that NVIDIA sell more AI chips to Oracle.

This was the starting point for Huang Renxun and NVIDIA to climb to the peak. Their supply determined the training effectiveness and industry ranking of large models for leading enterprises like Microsoft and Google.

But just as the technological explosion mentioned in "The Three-Body Problem," under the restriction of AI chip imports, Chinese AI chip enterprises have entered a period of technological explosion, making significant progress in chip performance, manufacturing processes, production yields, and other aspects, and beginning to compete with NVIDIA for the Chinese market.

Although there is still a gap from the current perspective, for NVIDIA, who knows if there will be a "Deep Seek" in China's AI chip field? Perhaps, as a research report said: When technological independence becomes a rigid demand for survival, every percentage point of performance breakthrough is rewriting the rules of the game.

For the rapidly growing Chinese AI chip industry, what will be NVIDIA's future in the Chinese market?

END