China-US Satellite Constellation Competition|Great Waves

![]() 08/14 2025

08/14 2025

![]() 723

723

Editor|Yang Xuran

The "China-US Satellite Constellation" competition is intensifying.

On August 5, SpaceX announced the official launch of Starlink satellite internet in impoverished Somalia.

A decade ago, Elon Musk envisioned a bold plan: to deploy 42,000 small satellites in low Earth orbit, a few hundred kilometers above Earth's surface, to create a global satellite internet network. This ambitious vision is known as "Starlink".

Since the initial launch of Starlink satellites in 2019, SpaceX has deployed over 7,000 satellites into orbit.

Subsequently, on April 26, 2021, China established a new state-owned enterprise, China Satellite Network Group Co., Ltd. (China Satellite Network Group), specializing in the design, construction, and operation of satellite internet. In the ranking of state-owned enterprises by the State-owned Assets Supervision and Administration Commission (SASAC), it ranks after China Telecom, China Unicom, and China Mobile, indicating that China's top leaders have designated satellite internet and satellite communications as new strategic high grounds.

Source: SASAC List of Central State-owned Enterprises

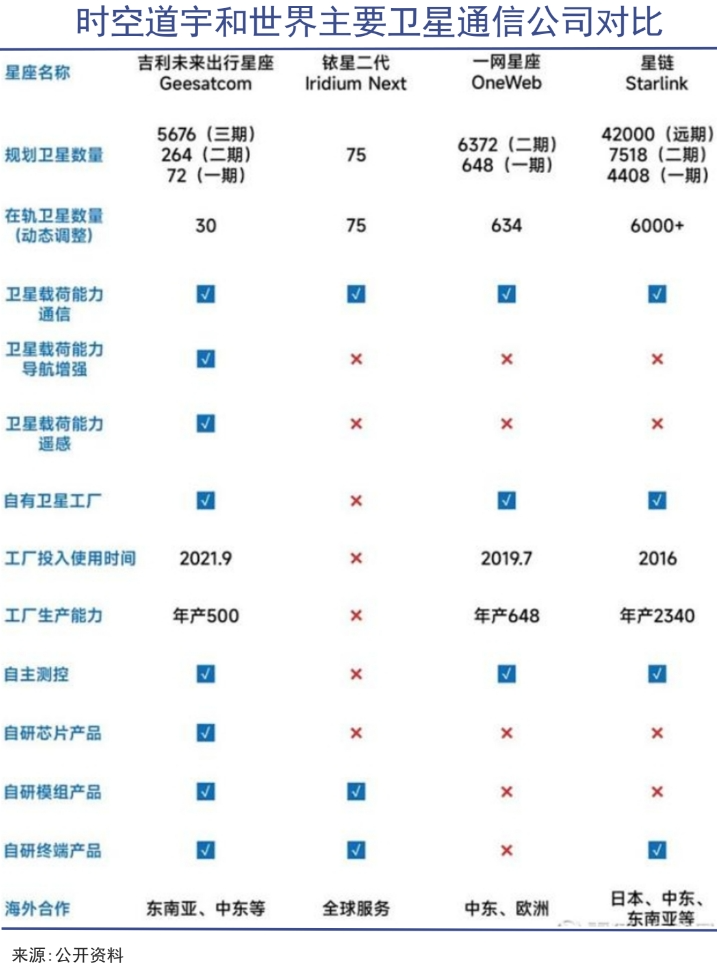

Meanwhile, China's version of the "Starlink" system, composed of commercial aerospace enterprises such as China Satellite Network, Shanghai Huanxin Satellite's "Qianfan Constellation," and Geely's Spacetime Tech, has also been established. This system aims to launch over 27,000 satellites into space in the future.

A fact often overlooked by urban dwellers is that about one-third of the global population still lacks internet access, and 94% of Earth's surface has no internet signal.

As China enters a new era of economic globalization, fields such as mining, ocean shipping, aerospace, military, disaster prevention and mitigation, and intelligent transportation will generate a huge demand for satellite communications.

The satellite industry chain is entering a golden age, albeit one that many people are still struggling to perceive.

China's Satellite Constellation

In just a few years, the "Chinese version of Starlink," built jointly by state-owned and private enterprises, has taken shape.

From August 4 to 9, within less than a week, China successfully completed two satellite launches. Firstly, on August 4 at 18:00, the Long March 12 carrier rocket successfully launched the low Earth orbit (LEO) 07 group of satellites for satellite internet from Hainan. This was the seventh batch launch for China Satellite Network's "State Grid (GW) Constellation," with only a five-day interval from the sixth batch launch on July 30.

Secondly, on August 9 at 0:00, the Jielong-3 carrier rocket successfully launched the fourth orbit of Geely Constellation satellites in a single launch of 11 satellites. The Geely Constellation is built and operated by Spacetime Tech, and after this launch, the number of Geely Constellation satellites in orbit increased to 41.

Earlier, in March, the Long March 8 Y6 carrier rocket sent the fifth batch of Qianfan Constellation satellites into their predetermined orbits in a single launch of 18 satellites.

After these frequent launches, it is roughly estimated that the total number of communication satellites in orbit in China has surpassed 800, accounting for 24% of the global total. China has emerged as a formidable competitor to Musk's Starlink plan, which is backed by the US government and NASA.

The GW Constellation is led by the state-owned enterprise China Satellite Network Group, with the G60 Qianfan Constellation led by Songjiang District in Shanghai and implemented by Shanghai Huanxin Satellite; the Geely Constellation is invested and built by Geely Holdings' Spacetime Tech, with projects like Hongyan Constellation and Hongyun Project also progressing simultaneously.

A blueprint for China's satellite industry, drawn by multiple entities including "central state-owned enterprises + local governments + private capital," has been laid out.

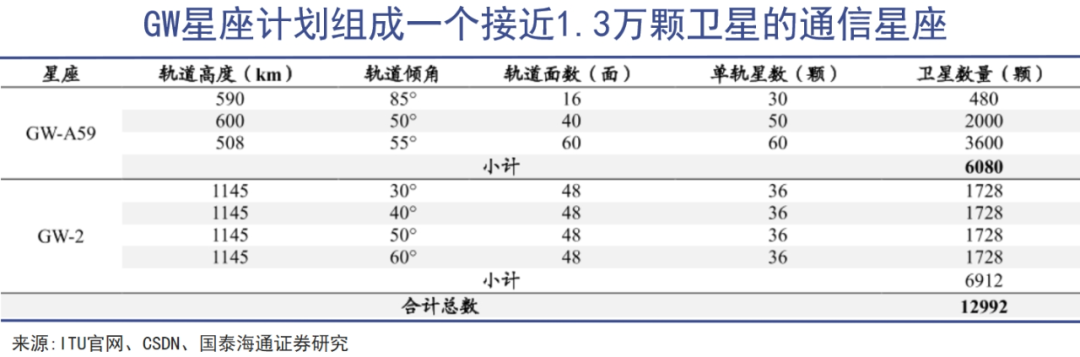

Among them, the GW Constellation is considered the true Chinese version of Starlink, representing China's first giant satellite internet plan and its first space-air integrated 6G internet plan. It plans to deploy a total of 12,992 satellites, with 6,080 satellites in the GW-A59 sub-constellation deployed in extremely low orbits below 500 kilometers and 6,912 satellites in the GW-A2 sub-constellation deployed in near-Earth orbits at 1,145 kilometers.

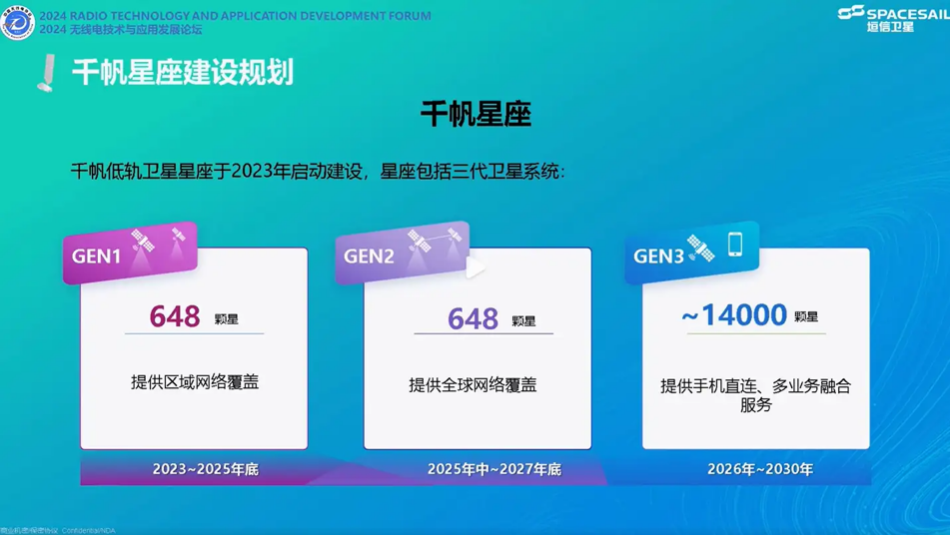

Qianfan Constellation is an important part of the Chinese version of "Starlink," having completed the launch of 90 networking satellites. Its future vision is to create a huge constellation consisting of over 14,000 LEO satellites.

Source: Huanxin Satellite

Spacetime Tech is also accelerating its launch schedule, expecting to increase the number of satellites in orbit to 64 within the next two months. This means that by then, the Geely Constellation will achieve data communication coverage of any surface on Earth, except for the North and South Poles.

After the completion of multiple grand plans, the total number of LEO satellites in China will exceed 27,000.

Currently, SpaceX has deployed over 7,600 satellites in orbit, with Musk planning to eventually launch 42,000. However, the International Telecommunication Union (ITU) stipulates that satellite frequencies and orbits must be deployed within seven years after application, or else the scale will be reduced. To seize the timeline, a "space race" for orbits and communication frequencies has already begun.

To avoid resource invalidation, projects like the GW Constellation and Qianfan Constellation need to complete most of their launch missions by 2030.

The next 5-6 years will be a period of intense satellite development and launch, and also the essential preparatory work for the Chinese version of Starlink. Currently, the Long March series rockets, including the Long March 12 and Long March 5B, have undertaken multiple launch missions, and private rocket companies are also eager to participate. GalaxySpace has already sent 81 satellites into space, while Landspace and iSpace plan to join the launch queue in 2026, further enhancing launch capacity.

It is estimated that by 2030, China will launch over 1,800 satellites annually, forming a normalized deployment capability of "hundreds of rockets and thousands of satellites." In other words, a total of over 10,000 satellites will be launched from 2025 to 2030.

In the next decade, China's LEO internet satellites will undergo three stages of development: "rapid growth - large-scale deployment - long-term operation." Currently, we are still only in the initial deployment stage.

Urgent Needs

The establishment of China's satellite internet is closely tied to the globalization of Chinese enterprises.

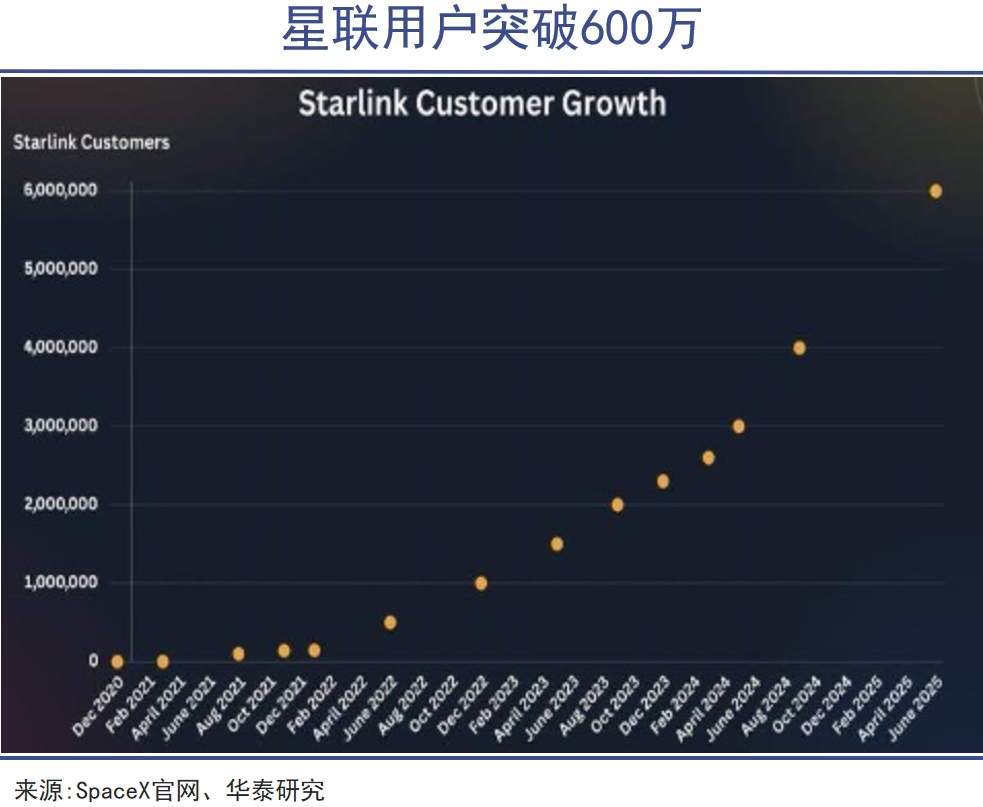

Satellite communications are widely used in mining, shipping, fishery, and military fields. SpaceX, with Starlink leading the way, currently has over 6 million users globally, showcasing significant commercial value. In 2024, Starlink's revenue is expected to reach $8.2 billion, with Musk projecting it to hit $10 billion this year, helping to boost SpaceX's valuation to $400 billion.

Currently, Chinese mining giants such as Minmetals, Zijin Mining, and Tsingshan are embarking on a new round of global integration. There are currently over 300,000 mines globally, with 110,000 in China, and most of these mines are located in remote areas, especially in South America and Africa, where communication signals are extremely unstable or even completely absent. This poses significant obstacles to the intelligent and unmanned transformation and upgrading of mines.

Starting in July 2023, China has successively launched multiple mining satellites, including "MinDa Nanhu," "Zhedi-1," and "Kaiwu Constellation - Test Satellite." Among them, "MinDa Nanhu" is led by China University of Mining and Technology and XCMG Machinery, and is the first dedicated mining satellite in China and even globally.

Thanks to these satellites, it's like having a "God's-eye view," enabling enterprises to excel in resource exploration, mineral monitoring, weather warning, geological environment investigation, and mine disaster relief.

This niche market has also seen the emergence of many aerospace technology startups. For example, K-SPACE, founded in 2024, claims to be the only company globally focused on the mining satellite internet field. It has joined forces with GalaxySpace's "Ceres-1" to build the world's first satellite internet constellation for the mining industry - "Kaiwu Constellation" and "Interstellar Mining Network," planning to launch 20-25 satellites in 2025.

Africa is rich in mineral resources, and Chinese enterprises are already using satellites to prospect for minerals there. On May 20 this year, the Aerospace Planning and Design Group signed a strategic cooperation agreement with Zambia Galaxy Remote Sensing Satellite Technology Company, marking a new phase in the deep application of China's remote sensing satellites and aerial geophysical exploration technology in Africa.

In the great era of Chinese manufacturing going global, ocean shipping is the "lifeline" of international trade. However, traditional maritime communication methods face issues such as insufficient bandwidth, high latency, numerous blind spots, and high costs, making it difficult to meet the needs of modern shipping.

The vast and treacherous ocean can only achieve real-time data transmission and intelligent transformation of shipping through access to satellite communication networks. Like a "digital lighthouse" at sea, satellite internet solves the long-standing communication challenges in the industry.

According to data, after deploying a low Earth orbit satellite IoT, an international shipping company reduced ship communication costs by 40%, reduced sailing safety incidents by 30%, and improved operational efficiency by 20%.

The situation in ocean fishery is similar. Relying on cooperation with local telecommunications operators, Spacetime Tech has joined hands with Oman's Azyan Telecom to provide stable satellite IoT communication services for tens of thousands of local fishing boats, significantly enhancing the safety and accuracy of marine fishery.

Moreover, since satellites are inherently a product of globalization, commercial aerospace companies have a natural inclination towards global cooperation.

Wang Yang, CEO of Spacetime Tech, has clearly stated that Geely's Future Mobility Constellation will be the first to provide global commercial services. In April this year, Spacetime Tech also established a joint venture, ADISB, with Malaysia's ALTEL to promote the localized application of Geely Constellation in the country. In addition, Geely Constellation has also entered North Africa and Latin America, cooperating with Moroccan maritime communications giant Soremar to promote the application of its services in industries such as transportation, energy, and agriculture.

While going global, the "Great Aerospace Era" has also become an opportunity that Chinese enterprises must seize.

Grand Vision Foundation

The satellite communication industry chain can be roughly divided into four major stages: "research and development - launch - operation - application." Currently, China is still in the early deployment phase, with manufacturing and launch serving as the foundation for building an integrated space-air network.

It is based on SpaceX's superior carrying capacity, reusability, and self-built satellite production capacity that the company dominates globally. In May this year, when introducing the Mars colonization plan, Musk stated that SpaceX plans to produce 5,000 V3 satellites annually in the future, eventually reaching a super manufacturing scale of 10,000 satellites per year.

With the accelerated deployment of LEO constellation systems, the demand for satellite manufacturing has increased significantly, and low-cost, high-efficiency manufacturing models are highly popular. Commercial aerospace companies with high security and high carrying capacity are also springing up like mushrooms after rain. Both fields present a picture of fierce competition between national teams and private enterprises.

Ambitious constellation plans must be rooted in manufacturing. Data shows that the global satellite manufacturing market size will reach $24.493 billion in 2024 and increase to $38.969 billion in 2029, with an average annual growth rate of 9.73%.

China Aerospace Science and Technology Corporation's Fifth Academy, Eighth Academy, Aerospace Science and Industry Corporation's Space Engineering Development Co., Ltd., and the Chinese Academy of Sciences' Institute of Micro- and Nano-Satellites (Satellite Innovation Institute) form the three national teams with the capability to develop and produce whole satellites.

The Satellite Innovation Institute has undertaken the research and development of the first-generation 324 satellites for the Qianfan Constellation and has the capacity to produce over 300 satellites annually. In the future, it will support the launch of 36 satellites per rocket to meet the demand for large-scale and dense launches.

The China Academy of Space Technology (CAST), as the backbone of China's satellite industry, was headed by Qian Xuesen and is the birthplace of China's first artificial Earth satellite "Dongfanghong-1" and the first navigation satellite Beidou-1. It owns the listed company China Satcom.

Last year, China Satcom successfully launched 24 small/micro-satellites. The Queqiao-2 relay satellite is a crucial part of the lunar exploration program, providing relay communication services for Chang'e-4, Chang'e-6, and others, and successfully supporting Chang'e-6 in completing its lunar far side sampling mission.

Private sector capabilities should not be underestimated either. MicroNanoSat aims to establish an intelligent production line capable of churning out 150 satellites annually and has already successfully launched 27 satellites. Meanwhile, Spacetime Tech leverages Geely's robust manufacturing prowess to seamlessly integrate satellite production with existing automotive assembly lines, "producing satellites akin to manufacturing cars," thereby shortening the satellite production cycle to under 28 days and achieving an annual production capacity of up to 500 satellites. GuSi Aerospace, another developer of the Qianfan Constellation, has completed the development of 36 satellites and aims to ramp up its annual production capacity to 300 satellites.

Rocket launches also reflect the collaborative efforts of both state-owned and private enterprises. In addition to the Long March series rockets, private rocket companies have come a long way in the past decade and now serve as a crucial complement to China's commercial aerospace launch capabilities.

In 2024, Blue Arrow Aerospace's Zhuque-3 VTVL-1, Deep Blue Aerospace's Nebula-1, and the Eighth Academy of China Aerospace Science and Technology Corporation all conducted Vertical Takeoff and Vertical Landing (VTVL) tests. This year, Tianlong-3, Lijian-2, Hyperbola-3, and Pallas-1 are poised to make their maiden flights.

Among these, the high-capacity Long March 12B, Zhuque-3, Nebula-1, and Tianlong-3 are strong contenders for the title of China's first reusable rocket, offering robust support for the high-density launches of the Qianfan Constellation and GW Constellation.

On the operations and maintenance front, China Satcom, a subsidiary of China Aerospace Science and Technology Corporation, stands as the absolute core enterprise. As of the end of last year, the company managed 17 commercial communication satellites and established China's first Ka-band satellite internet in high Earth orbit, covering the entire territory and key regions along the Belt and Road Initiative, with "Haixingtong" covering over 95% of global maritime routes.

As the second-largest fixed satellite communications operator in Asia and the sixth-largest globally, China Satcom holds over 80% of the domestic satellite communications operation market.

China Satcom has also embarked on an international expansion journey, adding 4 satellite private lines in Africa last year to empower local industries such as mining and energy. It also signed new television projects in India, Pakistan, and the Philippines and provided high-throughput network services in Thailand and Nepal for the first time.

While manufacturing and launching are one-time tasks in the early stages, satellite operation services constitute the value center of the satellite industry chain, akin to thermal or hydropower stations, generating stable and long-term value. For instance, China Satcom's longest-operating satellite (Chinasat 6B) has been in service for 18 years.

As a result, China Satcom's performance is relatively stable, with good cash flow, minimal debt, and costs primarily comprising satellite depreciation.

Written at the end

On April 24, 55 years ago, China successfully launched its first artificial Earth satellite, "Dongfanghong-1," with the song "Dongfanghong" echoing through space, marking the inception of the Chinese people's exploration of the vast starry sky.

Nearly half a century later, China's aerospace industry has long been at the forefront of the world, and successive governments have maintained their commitment to investment and development in this sector. "Shenzhou" has soared into space, "Beidou" has guided the way, the "Chang'e Lunar Exploration Program," Tianwen-1, and the Zhurong Mars rover have ventured to Mars, and the "Tianhe Space Station" has traversed the stars.

While most of these large-scale aerospace projects are aimed at scientific research, the future holds promise for more aerospace endeavors that are increasingly intertwined with commerce and the lives of ordinary people.

Currently, satellite communications and satellite internet have proven to be the most commercially viable projects, especially as they will play a pivotal role in the globalization of Chinese enterprises, inevitably accelerating the entire industry chain.