Old Huang Envisions Bold Prospects for the White House, as Domestic Chips "Catch the NVIDIA Wind"

![]() 09/01 2025

09/01 2025

![]() 654

654

China's chip market, currently valued at $50 billion, is projected to grow at an annual rate of 50%. Initially, this narrative was spun by Old Huang for Wall Street and the White House, but surprisingly, it resonated profoundly with Chinese investors and institutions. Given the immense potential and high value of the Chinese market, the "frenzied buying of domestic substitution chip stocks" seems like a logical move.

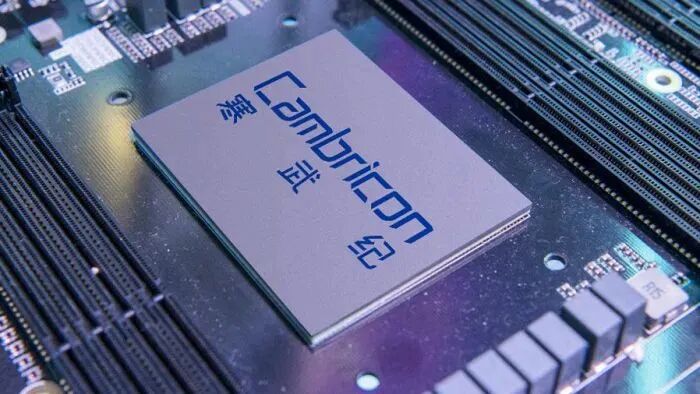

Consequently, as of August 28's close, Cambricon's share price soared to 1587.91 yuan, surpassing Kweichow Moutai's 1446.1 yuan, making it the A-share market's most valuable stock. Since its 2022 low, the share price has skyrocketed 33-fold. While market discussions persist on the reasonability of Cambricon's 600 billion yuan market capitalization, investment banks have already moved ahead. On August 24, Goldman Sachs hiked its target price for Cambricon to 1835 yuan, implying a market capitalization nearing 770 billion yuan.

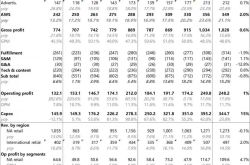

Nicknamed the "King of Cool" and "China's NVIDIA," Cambricon's reputation precedes it. A research report by Soochow Securities in April predicts Cambricon's 2025 full-year revenue at 5.2 billion yuan, aligning with the company's lower estimate of 5-7 billion yuan. Furthermore, Soochow Securities assigns Cambricon a PE ratio of 130 times for 2026, with an estimated net profit of 2.213 billion yuan, resulting in a valuation of 287.7 billion yuan, significantly lower than the current market capitalization of around 600 billion yuan.

While some may mock shareholders for not understanding financial reports, shareholders might retort by saying the same about expectations. As Goldman Sachs' research report summarizes, Cambricon's share price surge is primarily driven by three factors: the surge in capital expenditures by domestic cloud vendors, the trend of domestic substitution of AI chips, and Cambricon's 4 billion yuan private placement for AI large model chip R&D.

It's undeniable that domestic cloud vendors are increasing their expenditures, but the stability of this growth remains uncertain and difficult to verify. Amidst tightening U.S. restrictions on advanced chip exports, even Old Huang's capabilities are limited. Conversely, the acceleration of domestic substitution of AI chips in China appears more certain, with policies like the "Chip and Science Act" and "RTT Rolling Technical Threshold" aiming to cap China's total AI computing power at 10% of the U.S. level.

For a high-growth technology innovation enterprise, focusing solely on static PE ratios is inadequate. However, overamplifying expectations only fuels bubble risks. Thus, Cambricon stepped in to cool the market, announcing expected revenues of 5-7 billion yuan this year, no plans for new products, and that all related rumors are false, misleading the market. The share price surge exceeds that of most industry peers, posing a risk of detaching from fundamentals.

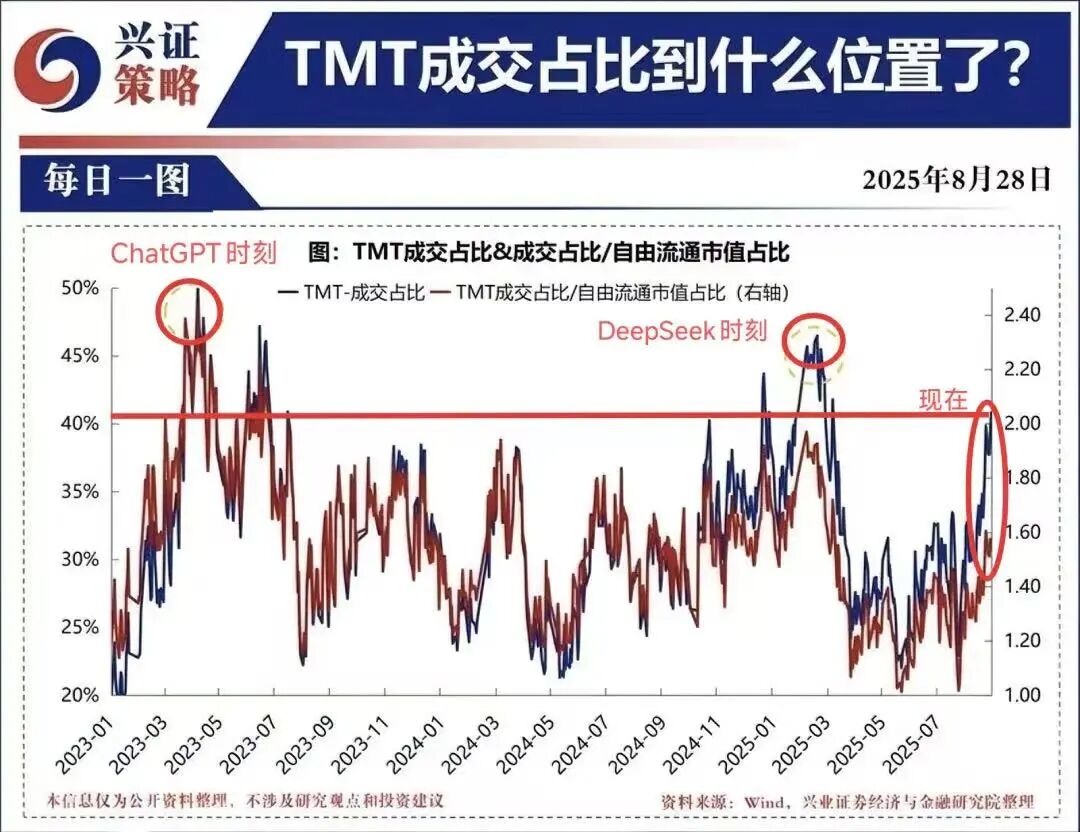

Market enthusiasm currently stands in a precarious zone. In terms of liquidity, the daily trading volume of the entire TMT sector accounts for roughly 41% of A-share total trading volume, comparable to 46.5% during the DeepSeek moment earlier this year and a peak of 50.3% during the 2023 ChatGPT frenzy. While we believe in the domestic substitution story, we must not overlook chip fundamentals. The right price is the cornerstone of investment.

On August 27, domestic GPU company MooreThreads responded to the first round of IPO inquiries on the STAR Market, stating that despite NVIDIA's H20 chip being approved for resale in the Chinese mainland, significant differences exist in their primary customer bases, making them non-competitive. MooreThreads highlighted that the NVIDIA H20, with relatively low computing power, is inefficient for large-scale AI training tasks but excels in AI inference scenarios due to its high-speed interconnect bandwidth and large HBM3 memory.

Currently, domestic chips have made strides in computing power but lag behind NVIDIA in interconnect efficiency and software ecosystem maturity. Most domestic large model training and inference scenarios rely on specialized rather than general-purpose chips, potentially compromising cost-effectiveness. Additionally, domestic chips face challenges in overseas market expansion, intensifying internal competition.

Summary

As revealed in "Chip Wars," the chip industry has transcended mere technology, resembling an armaments race. Behind current changes lies not only supply chain reorganization but also a comprehensive game involving technology routes, market structures, and even national powers.

NVIDIA confronts multiple pressures and conflicts. Without compromise, stable H20 and B-series chip supplies will remain elusive. Currently, there are no signs of compromise or easing from either side.

References:

Is Cambricon's "money-printing machine" worth 600 billion yuan? Source: Tencent Technology

NVIDIA's growth engine has only one wheel Source: Geek Park

The strongest AI chip is about to launch a special edition for China Source: APPSO

Jensen Huang's $50 billion narrative between China and the United States Source: Unfinished Research

MooreThreads responds to the first round of IPO inquiries Source: AI Outpost