TSMC Moves Forward, SMIC Navigates Its Path

![]() 09/01 2025

09/01 2025

![]() 498

498

Author: Poetry and Starry Sky

ID: SingingUnderStars

China not only needs Huawei but also Xiaomi.

If China had ten Huaweis and ten Xiaomis, its industrial upgrading would undoubtedly succeed. However, while ardent fans of both brands engage in daily online squabbles, SkyStar, connected to a Huawei router, uses his Huawei phone to open the Mijia APP and activate the Xiaomi air purifier.

Technology serves life.

Huawei's most profitable venture isn't consumer electronics but enterprise-grade computing power cards, specifically the Ascend series and its ecosystem (AI servers, etc.).

Particularly after the US imposed a ban on high-end NVIDIA computing cards, Ascend cards became scarce, and Huawei effortlessly raked in profits.

The recently released semi-annual report reveals that Huawei's revenue for the first half of 2025 surpassed 420 billion yuan, with an anticipated full-year revenue exceeding 800 billion yuan and potentially reaching the trillion mark.

Huawei owes these accomplishments to one individual: Liang Mengsong.

Since joining SMIC in 2017, Liang Mengsong has been with the company for eight years. During this period, he remained silent, save for submitting a resignation letter when Jiang Shangyi stirred up trouble, and there isn't even a photo of him available.

The only news traceable is the Mengning Scholarship jointly established by Dr. Liang and his wife, which has supported numerous college students pursuing microelectronics studies.

The only available photos of Dr. Liang are from before 2017, showing him with a radiant smile and heroic demeanor. In fact, Dr. Liang is 73 years old this year.

If China's chip industry is likened to atomic and hydrogen bombs, then Dr. Liang is the Yu Min of the chip world, living a secluded life and maintaining a low profile.

01

SMIC Starts to Accelerate

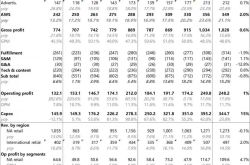

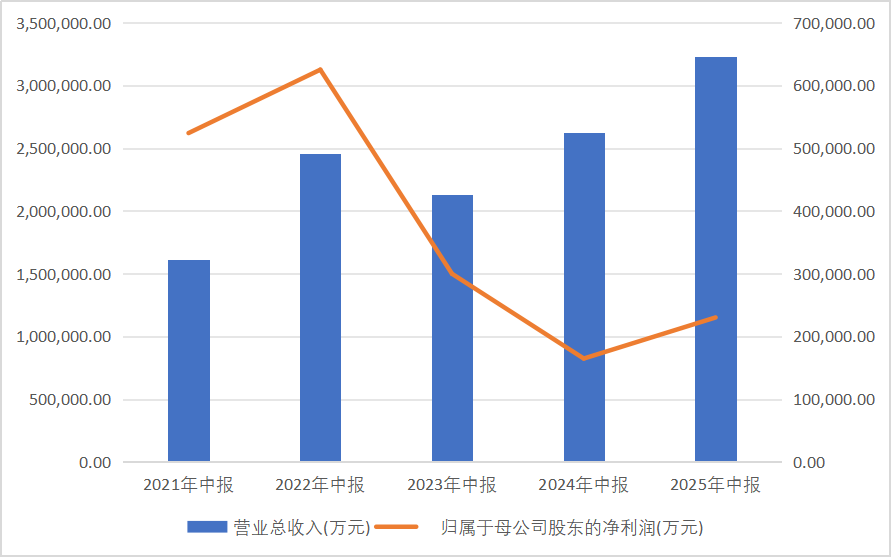

The semi-annual report indicates that in the first half of 2025, SMIC generated revenue of 32.348 billion yuan, a year-on-year increase of 23.14%, up from 26.269 billion yuan in the same period of 2024.

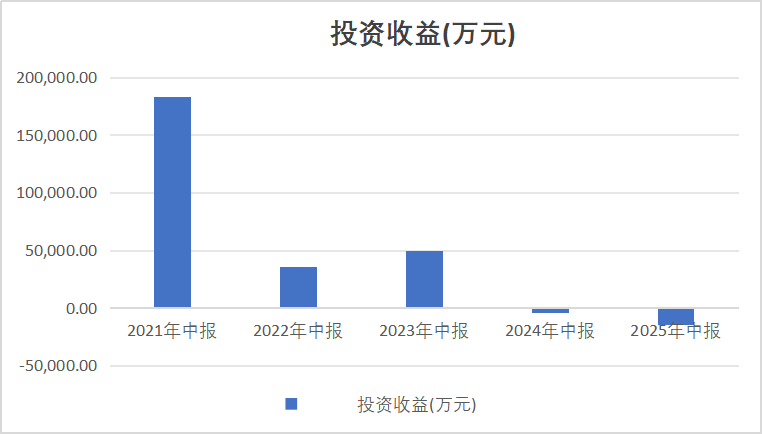

Data Source: iFind

Among this, the revenue from the wafer foundry business amounted to 4.229 billion dollars, a year-on-year increase of 24.6%, accounting for over 95% of total revenue. Net profit attributable to shareholders stood at 2.301 billion yuan, a year-on-year increase of 39.76%; non-recurring net profit was 1.904 billion yuan, up 47.76% year-on-year.

In terms of application fields: Consumer electronics accounted for 40.8% of revenue, becoming the largest application field, with a year-on-year increase of 5.4 percentage points; smartphones accounted for 24.6%, experiencing a significant year-on-year decline of 6.9 percentage points; computers and tablets accounted for 16.2%, maintaining stable growth; industrial and automotive applications accounted for 10.1%, up 2.4 percentage points year-on-year, successfully surpassing the 10% threshold and emerging as the fastest-growing field.

The growth in the consumer electronics sector is primarily fueled by the demand for analog chips (fast charging, power management) and image sensors (CIS). Management stated that these growths stem from accelerated domestic substitution and AI application drivers on the client side.

The expansion in the industrial and automotive sectors is mainly due to a 20% quarter-on-quarter increase in shipments of automotive-grade chips (analog, PMIC, CIS, etc.), but the overall revenue share remains relatively low, and it will take time for capacity to ramp up.

Notably, the decline in smartphones is peculiar, deviating from market trends.

As we all know, Huawei's phone sales have surged recently, and there's virtually no second chance for Huawei's Kirin chip foundry.

Why such a significant drop?

SkyStar speculates that there might be two possibilities. One is that based on volume, Huawei employs centralized procurement to lower prices, leading to a substantial increase in actual shipments but a decrease in revenue; the other is that this business segment is outsourced by a subsidiary and not consolidated, hence not reflected in the consolidated revenue of the financial statements.

Data Source: iFind

Since the company's investment income for the first half of 2025 was negative, it's inferred that the first possibility is the most likely.

02

The Process Issue of Greatest Concern

According to the company's semi-annual report, SMIC has made significant breakthroughs in 28nm process yield, reaching 94%-96%, narrowing the gap with TSMC's same-level process from 15 percentage points to 3 percentage points. The second phase of the Beijing plant, with a monthly capacity of 100,000 wafers, is expected to commence production by the end of 2025, further consolidating the company's leading position in the mature process field.

In terms of special processes, the company has successfully established a fully process-controlled 8-inch trench gate SiC MOSFET process platform with domestic leadership and international advancement. The CP yield of 1200V 40mΩ-grade trench gate SiC MOSFET wafers has surpassed 90%, with a single-wafer yield reaching up to 96%.

Regarding discussions about 7nm, 5nm, etc., they are absent from SMIC's official materials.

You know the reason.

It's generally believed that the N+2 process is equivalent to 7nm, and the N+3 process is akin to 6nm, which some media have promoted as 5nm.

Defensive counterattacks are Dr. Liang's forte. At TSMC, he led his team to outmaneuver IBM; at Samsung, he directed his team to defeat TSMC and secure Apple orders.

Now, at SMIC, he is challenging TSMC's dominance with equipment that is two generations behind.

03

SMIC Follows BOE's Script

Recently, the concept of AI chips has soared. Who is foundrying for Cambricon? Who is foundrying for Huawei's Ascend? Who is foundrying for Loongson Zhongke?

There's only one answer: SMIC, the sole mainland company with speculated 7nm process capabilities (SkyStar's guess, you can guess too).

Consequently, many investors view SMIC as the mainland version of TSMC, investing in accordance with TSMC's logic. However, this logic is flawed.

Because SMIC isn't following TSMC's script but BOE's.

BOE began with a second-hand LG production line, catching up with LG and Samsung, outlasting LG, and nearing Samsung's doorstep. Its panel technology now rivals Samsung's, having burned through hundreds of billions, yet it remains unprofitable.

Why can't BOE turn a profit?

It's precisely because BOE doesn't turn a profit that China's mobile phone, TV, smart wearable, and other panel-intensive industries have risen rapidly, becoming globally unbeatable.

Taking mobile phones as an example, on the surface, Samsung and Apple compete for the top spot, but if you rank them by country, Samsung and Apple combined can't match China.

With the impending breakthrough in EUV lithography technology (also a guess), it's only a matter of time before SMIC becomes a globally leading wafer fab.

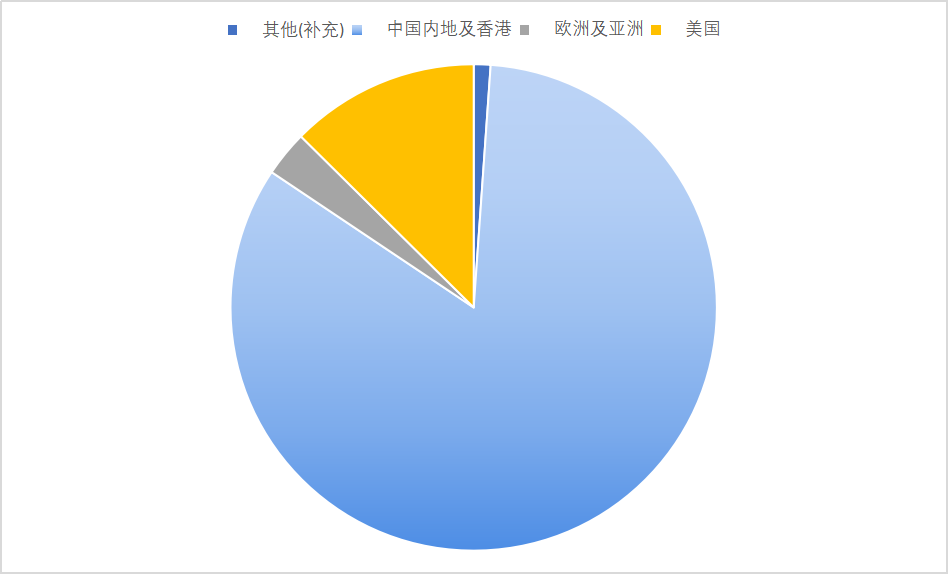

Data Source: iFind

A point beyond ordinary understanding: Even under US sanctions, SMIC still generates around 12% of its sales in the US.

This demonstrates the strength of SMIC's products!

As evidence, although SMIC is a company without an actual controller, the major shareholders, excluding Hong Kong Central Clearing Company Limited, are Datang Holdings, Xinxin Holdings, and the National Semiconductor Fund Phase II, all with state-owned backgrounds.

-END- Disclaimer: This article is based on the public company attributes of listed companies and an analytical study with the core basis being information publicly disclosed by listed companies in accordance with their legal obligations (including but not limited to interim announcements, periodic reports, and official interaction platforms, etc.); Poetry and Starry Sky strives for fairness in the content and viewpoints presented in the article but does not guarantee its accuracy, completeness, timeliness, etc.; the information or opinions expressed in this article do not constitute any investment advice, and Poetry and Starry Sky shall not bear any responsibility for any actions taken using this article. Copyright Notice: The content of this article is originally created by Poetry and Starry Sky and may not be reproduced without authorization.