"The Ascent and Decline of the 'Cold King' Are Inconsequential; What Truly Counts Is the Shifting Expectations for China's Chip Sector"

![]() 09/08 2025

09/08 2025

![]() 498

498

Redefining the Competitive Landscape

Authored by Chen Dengxin

Refined by Li Jinlin

Formatted by Annalee

The chip industry is abuzz with anticipation.

Recently, Cambrian has taken center stage: its stock price soared past that of Kweichow Moutai, earning it the moniker "Cold King" in the capital market, only to plunge subsequently and face widespread criticism.

The true mettle of Cambrian remains to be proven, yet the ascent of domestic chips is an irresistible force.

For years, overseas chip behemoths have wielded unchallenged influence. However, with the relentless march of domestic substitution, the competitive dynamics have subtly shifted. The Kirin chip made a triumphant return at a launch event after a four-year hiatus, the Kunlun Core 30,000-card cluster was activated, and domestic DDR5 was unveiled...

Undoubtedly, China's chip industry has gathered immense momentum.

Emerging as a New Export Benchmark

Once upon a time, domestic chips were synonymous with obsolescence.

In 1977, Wang Shouwu, the pioneer of China's semiconductor science, lamented, "Across the nation, there are over 600 semiconductor production facilities, yet their combined annual integrated circuit output is merely one-tenth of the monthly production of a single 2,000-employee factory in Japan."

Since then, domestic chips have embarked on a arduous journey of catching up.

The challenge lies in the fact that falling behind once means struggling to keep pace at every turn. Bridging decades of gaps is no small feat. For a considerable period, domestic chips found themselves in a precarious position, neither acclaimed nor widely adopted.

The article "China's Chip Industry: 60 Years of Turmoil, from Inception to a Spark Igniting a Prairie Fire" highlights, "This has led to a 'vicious cycle'—domestic semiconductors and software, due to their late entry and numerous issues, are not extensively utilized; the lack of buyers and users further deprives the domestic industry chain of subsequent funds for technological upgrades and makes it difficult to identify product flaws."

As the adage goes, where there's a will, there's a way.

On one hand, bolstered by substantial funding from large funds, industrial funds, and the capital market, the domestic chip industry chain has continued to forge ahead, gradually shedding its image of vulnerability over time.

Data from the China Semiconductor Industry Association reveals that the chip industry chain is segmented into three parts: design, manufacturing, and packaging/testing. The packaging/testing segment, with the lowest technological complexity, accounted for over 50% of sales in 2007. Post-2015, the design and manufacturing segments gained traction, steering the industry chain towards a more balanced trajectory. By 2023, the proportions of the three segments stood at 44.56%, 31.56%, and 23.88%, respectively.

The Kirin Chip's Triumphant Return After Four Years

This is exemplified by SMIC.

SMIC, entrusted with the responsibility of spearheading the "domestic chip" industry, took just over 40 days from submitting its prospectus to listing, harnessing the power of the capital market to fuel its growth. This, in turn, has propelled the upgrading of the domestic chip industry chain, breaking the technological monopoly in chip manufacturing processes.

On the other hand, tech companies in sectors such as mobile phones, automobiles, and the internet have been ramping up their investments in domestic chips, becoming pivotal drivers for the iteration of the domestic chip industry chain.

For instance, ByteDance has invested in next-generation memory chip company XinYuan Semiconductor, GPU chip design unicorn Moore Threads, and AI chip company Xim Computing.

Another example is Alibaba's T-Head Semiconductor, which has developed a new generation of AI inference chips compatible with NVIDIA's CUDA ecosystem, aiming to bridge the gap in the mid-range market.

Against this backdrop, domestic chips have gained significant strength.

Data from the General Administration of Customs reveals that in 2024, the export volume of integrated circuits reached 298.1 billion units, marking an 11.31% year-on-year increase.

Export revenue soared to $159.5 billion, a 17.28% year-on-year surge, surpassing mobile phones to become the single commodity with the highest export value.

Source: Semiconductor Insights

It is evident that despite encountering numerous hurdles, the rise of domestic chips is unstoppable.

Why Are Industry Giants Betting on Domestic Chips?

China's chip industry is quietly reshaping the competitive landscape, and there are three key reasons behind this transformation.

Firstly, autonomy and controllability.

Given the complex international situation, particularly the escalation post-2018, autonomy and controllability have become imperative rather than optional for various industries.

Among them, HiSilicon Semiconductor deserves special recognition.

In 2004, Huawei established HiSilicon Semiconductor as a wholly-owned subsidiary, gradually ascending to become the undisputed leader in the domestic SoC field, with its market share once reaching the pinnacle in China.

However, when the black swan event struck, HiSilicon encountered setbacks.

Xu Zhijun, then rotating chairman of Huawei, stated at HAS 2021, "For Huawei, HiSilicon is a chip design department, not a profit-making entity. Therefore, we do not impose profit-making requirements on it. We are merely maintaining this team."

After a period of dormancy, HiSilicon has made a resurgence.

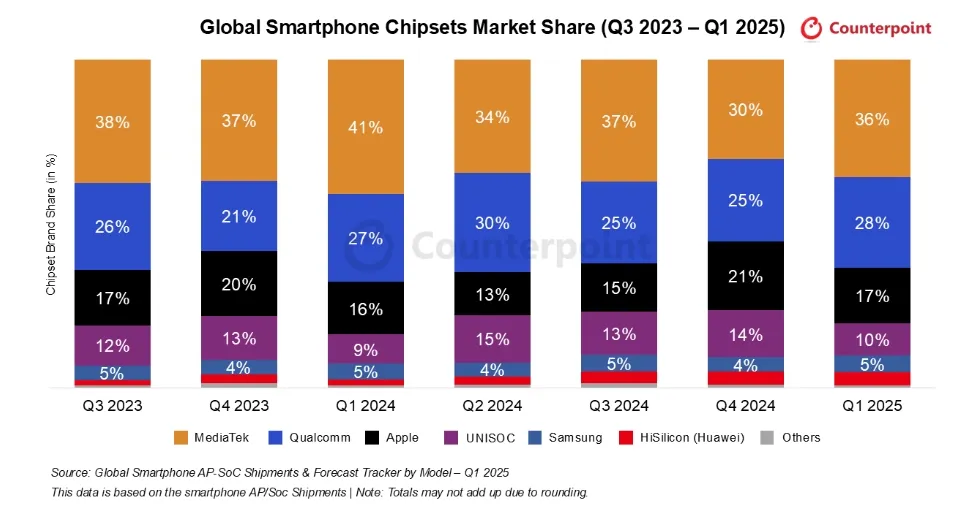

Data from Counterpoint Research shows that in the first quarter of 2025, HiSilicon's market share in the global smartphone application processor market was 4%, compared to 2% in the same period last year, marking significant strides.

Source: Counterpoint Research

Nowadays, Huawei's Mate XTs has officially announced the utilization of the Kirin 9020 chip, openly signaling that the domestic chip supply chain has achieved full-link autonomy and controllability.

Secondly, the pursuit of high-end markets.

Currently, ascending to the high-end market has become a consensus in the mobile phone industry, placing greater demands on the core competitiveness of products. Thus, self-developed chips are perceived as a shortcut to the high-end market.

Lin Zhi, chief analyst at WitDisplay, stated in an interview with the media, "Chips are the pivotal elements that define the differentiated experience of mobile phones. In the AI-driven smartphone era, the deep synergy between chips and software will directly influence the brand image and product competitiveness of mobile phone manufacturers."

In fact, Apple has developed its own A-series and M-series chips, breaking free from the constraints of chip giants and dominating the global high-end consumer electronics market through an integrated hardware and software approach.

Domestic mobile phone brands are following a similar trajectory.

Taking Xiaomi as an example, it launched its first SoC chip, the Surge S1, as early as 2017, followed by the ISP chip Surge C1, the battery management chip Surge G1, and others.

Lei Jun once admitted, "If Xiaomi aspires to become a hardcore tech company, chips are a peak it must scale and a tough battle it cannot avoid."

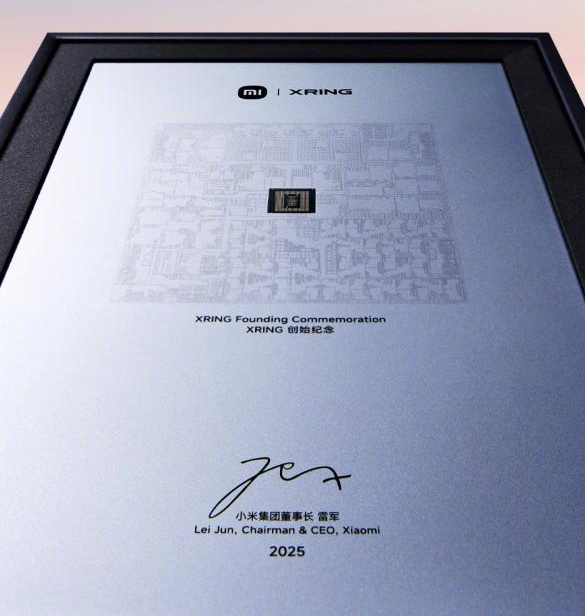

After numerous setbacks, Xiaomi's Xuanjie O1 was unveiled in 2025.

This signifies that Xiaomi has become the second Chinese mobile phone brand, after Huawei, to achieve commercial mass production of flagship SoC chips, significantly enhancing its voice in the high-end market.

"Although Xuanjie O1 still has a considerable gap compared to world-class giants, I always believe that as long as we embark on the journey of catching up, we are on the path to victory," Lei Jun said.

Source: Lei Jun's Weibo

Thirdly, cost reduction and efficiency enhancement.

In recent years, cost reduction and efficiency enhancement have become core demands for internet companies, especially amidst the backdrop of tight computing power, where balancing high efficiency and low cost is particularly challenging.

DeepSeek has stirred the tech world by reducing costs through algorithm optimization and other means.

An industry insider told XinKeDu, "Low-cost software solutions offer high cost-effectiveness, but it does not imply that the demand for computing power can be overlooked. Especially in the context of multimodality, the demand for computing power by large models will grow exponentially, as the continuous upgrading of multimodal model capabilities is an inevitable trend."

Thus, Baidu has provided another solution for the industry: it has activated the country's first 30,000-card cluster based on the Kunlun Core to reduce the unit cost of computing power.

This not only resolves its own computing power supply issues but also significantly offsets the premium on computing power.

Finally, catering to differentiated demands.

In the automotive sector, overseas chip giants have long held sway over the market. Although their general-purpose solutions are mature and reliable, they inevitably lead to homogenization. The aspiration of "having what others don't and being better than others" has always been the wish of various industries.

After all, automakers have a clear understanding of which SiC chips are suitable for their needs. Self-development not only yields superior results but also saves time and effort, thereby seeking differentiated competitiveness.

For this reason, Li Auto, XPENG, NIO, BYD, and others have ventured into self-developed automotive-grade chips such as intelligent driving chips, SiC chips, and IGBT chips.

Xie Yan, Chief Technology Officer of Li Auto, commented on the self-developed intelligent driving chip M100, "Unlike other AI chips on the market, we adopted a true software-hardware co-design approach. The chip, compiler, runtime system, and Halo operating system were designed together from the outset. Therefore, we can more seamlessly vertically integrate hardware and software modules into a more powerful AI inference system and continuously expand it in the future."

In summary, the capital market's enthusiasm towards Cambrian is not merely hype but also a recognition of the remarkable progress of domestic chips. With the comprehensive blossoming of domestic chips, it is not far-fetched to envision them competing with overseas giants in the future.

Thus, the market harbors greater expectations for domestic chips.