Will iPhone 17 Triumph in the Price War and Signal a New Era for Apple?

![]() 09/11 2025

09/11 2025

![]() 667

667

Innovation Falls Short, But Sincerity Shines Through

Authored by Meng Huiyuan

Edited by Li Jinlin

Formatted by Annalee

Apple's annual 'Tech Super Bowl' this year successfully sidesteps the criticism of 'incremental upgrades' that has plagued it in the past two years.

The iPhone 17 series introduces significant performance enhancements while keeping the starting price at 5,999 yuan, mirroring the previous generation's pricing. This strategic move has ignited fervent online discussions, making 'more features, lower price' a trending topic.

The standard iPhone 17 model, lauded by netizens, offers upgraded configurations without a price hike. It even fully complies with national subsidy policies, effectively reducing the price to 5,499 yuan. This positions it as the most cost-effective option among Apple's new offerings.

Industry experts predict that the iPhone 17 could emerge as the next 'long-term favorite' among users, exerting considerable competitive pressure on Android products in the same price range.

It's crucial to note that Apple's sales in the Chinese market have seen a notable decline over the past year or two. According to data from market research agencies, in the fourth quarter of 2024, Apple's smartphone sales in China dropped from the long-held first place to fourth. By the first quarter of 2025, Apple's sales in Greater China reached only $18.51 billion, a year-on-year decrease of 11.1%.

With domestic manufacturers like Huawei and Xiaomi intensifying competition in areas such as battery technology, AI, and foldable screens, Apple—often criticized for its annual 'incremental upgrades'—has reached a pivotal juncture.

A 'Game-Changing' Move from the Standard Edition

'iPhone 16 buyers got a rude awakening with the iPhone 17. With national subsidies, Android phones might as well throw in the towel.'

'I'll still opt for the Pro series this year, but if you're in the market, I'd recommend the standard edition without hesitation.'

'The Pro looks unappealing, the Air has poor battery life—the standard edition offers the best value, especially since the price hasn't increased. It's a steal!'

From a 'value seeker's' perspective, Apple has never released such a 'standard' standard edition before: the 120Hz ProMotion display makes its debut in the standard edition, breaking traditional tier boundaries; storage starts at 256GB without a price increase; it features the Super Retina XDR display, previously exclusive to the Pro series; and with national subsidies, the price drops by 500 yuan. With these multiple advantages, the iPhone 17 undoubtedly earns the title of 'king of cost-effectiveness.'

Reflecting its highly praised reputation, the pre-order data is exceptionally impressive. As of 9 a.m. on September 11, pre-orders for the iPhone 17 standard edition on JD.com have exceeded 2 million. This figure is more than ten times that of the iPhone 16, which had around 170,000 pre-orders on the same platform at the same time last year (one day later). This surge in pre-orders not only reflects consumer recognition of the new device but also suggests it will spark significant market enthusiasm.

Pre-order data for Zinc Scale as of the time of writing

Meanwhile, the new products' better-than-expected performance has not only ignited enthusiasm in the consumer electronics market but also directly impacted the capital market. Data from Eastern Wealth Choice shows that on September 10, several Apple-related stocks surged. By the close of trading, Dongshan Precision hit its daily limit, reaching a new all-time high. Similarly, stocks like Foxconn Industrial Internet, Bojie Technologies, and Yilton Electronics also hit their daily limits. From a longer-term perspective, Apple-related stocks have shown strong growth momentum this year. As of September 10, a total of 13 Apple-related stocks have more than doubled in value year-to-date.

All indicators point to the significance of the 5,999 yuan pricing.

More precisely, Apple's pricing strategy this year is playing its intended role: currently, only smartphones priced under 6,000 yuan in China are eligible for national subsidies. This price point falls just below China's cap for digital product subsidies, allowing Apple to maximize the benefits of national policies and enhance its market competitiveness.

Faced with increasing competitive pressure in the Chinese market, the iPhone 17, which offers more features without raising prices, will undoubtedly have a price advantage over Android flagship phones, helping Apple maintain its market position.

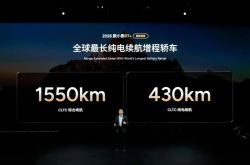

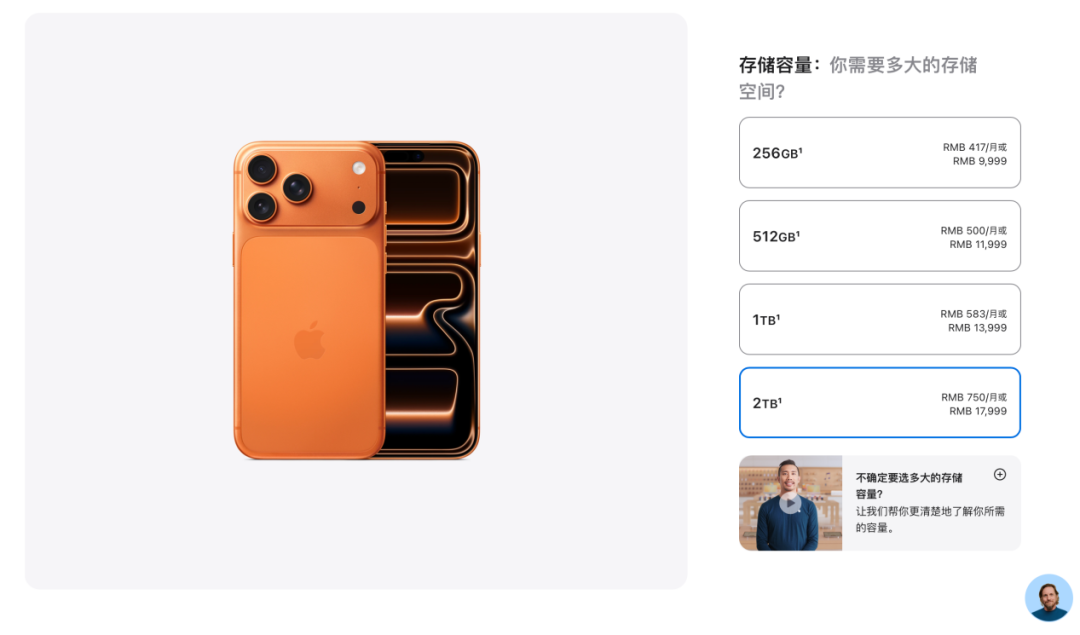

The Pro series introduces a 2TB version for the first time

At the same time, increased U.S. tariffs on smartphones have raised Apple's costs. To offset this, Apple has created an ultra-premium market segment with the Pro Max, using the premium pricing of the 2TB version to balance overall costs. This approach not only meets policy requirements but also ensures the company's profitability.

The iPhone 17 standard edition is seen as a 'game-changer' because it significantly upgrades configurations while maintaining or even effectively lowering prices. This allows it to enter the core price range of mid-to-high-end Android phones, applying pressure through Apple's stronger brand premium and excellent overall experience.

Some commentators argue, 'Android manufacturers won't sleep well. The new iPhone 17 with 256GB is priced at 5,999 yuan officially. Next year during the '618' sale, it'll drop to around 5,000 yuan, and during 'Double 11,' it'll get even cheaper. When resold second-hand for two or three thousand yuan, we'll see how many Android manufacturers go out of business.'

The Strategic Importance of the 'Cost-Effectiveness Card'

In response to Apple's 'cost-effectiveness card,' Lu Weibing, President of Xiaomi's Mobile Phone Division, stated, 'I believe this is definitely the year of the biggest change for the iPhone. The iPhone 17 standard edition is indeed very strong—it's like they squeezed the toothpaste tube too hard... This year will be a major year for smartphone form factor changes, and it's worth looking forward to.'

However, Apple's ability to generate such buzz is less about the innovation of the iPhone 17 series and more about understanding the competitive landscape in the Chinese market. By 'addressing shortcomings and transferring technologies,' Apple aims to reclaim market share previously captured by domestic high-end smartphones.

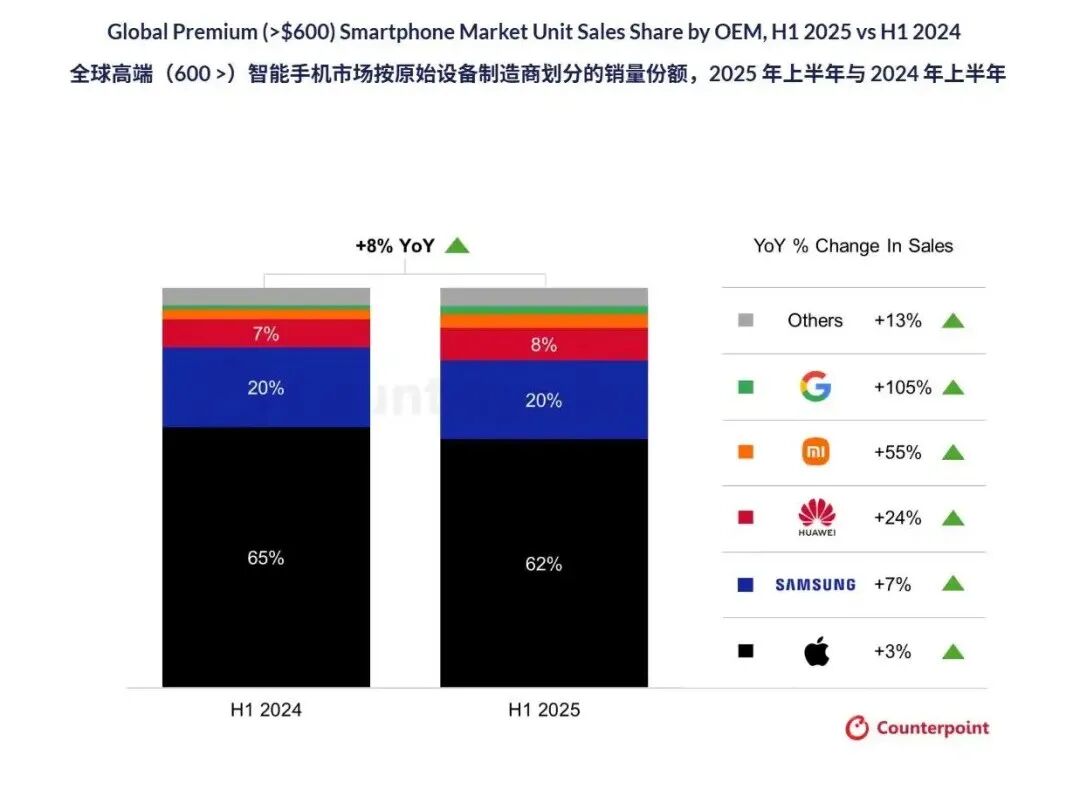

According to a CounterPoint report, from 2022 to 2024, Apple's market share in China's high-end smartphone market (priced at $600 and above) declined yearly from 75% to 54%. Meanwhile, Huawei's share jumped from 12% in 2022 to 29% in 2024, becoming the fastest-growing domestic manufacturer. Additionally, Xiaomi's share increased from about 2% to 5%.

Omdia data shows that compared to last year, Apple's market share in the first half of this year remained stable in the U.S., Western Europe, and Southeast Asia. In India, its market share rose from 5% to 6%, and shipments in other regions increased from 20% to 24%. Only in China did Apple experience a significant decline in share.

Source: Counterpoint Research official website

Over the past year or two, domestic high-end smartphone brands have successfully established themselves in the premium market through continuous technological innovation and precise market positioning, posing a substantial threat to Apple. This shifting market dynamic has forced Apple to adjust its strategy, adopting more aggressive pricing and configuration upgrades to meet the challenge.

Investment bank Jefferies believes that iPhone 17's new pricing strategy will not affect its earnings forecasts for Apple. Instead, the strategy may make it harder for Chinese Android brands to grow in the high-end market, demonstrating Apple's determination to defend its market share, especially in China.

In key areas such as pricing, performance, and display, the iPhone 17's strong performance is also prompting Android manufacturers to reevaluate their pricing strategies and product positioning. Some industry insiders predict that to counter the market pressure from the iPhone 17, Android manufacturers may accelerate the launch of more innovative and competitive products to secure their positions in the fierce market competition.

One of the most anticipated areas is AI.

In 2024, Tim Cook made a high-profile announcement of Apple Intelligence, promising a 'full rollout by 2025.' However, as 2025 arrives, the answer is, 'There are still uncertainties before the end of the year.'

It turns out that despite Apple Intelligence continuously expanding new features globally, unresolved compliance issues mean that the domestic version of the iPhone 17 series still cannot immediately access AI-powered features like visual intelligence, writing tools, and an enhanced Siri.

Even in terms of practical implementation, if Apple ultimately chooses to partner with Alibaba, it would mean compromises on data interfaces, review standards, advertising strategies, and other dimensions. This could further delay the timeline for rolling out these features to consumers.

This delay in technological implementation could cause Apple to miss the window of opportunity for AI deployment, as domestic smartphone brands have already made significant innovations and breakthroughs in AI applications.

Of course, Apple's challenges extend beyond AI to major adjustments in its production supply chain.

Reports indicate that Apple is facing the impact of tariff policies, high dependence on the Chinese supply chain, high costs of supply chain relocation, and numerous issues in production in emerging markets like India.

Omdia estimates that in the second quarter of 2025, over 11 million iPhones shipped from India to the U.S., compared to about 3 million shipped from China. In the previous quarter, nearly half of the iPhones sold by Apple in the U.S. were assembled in India, with Foxconn leading production and the Tata Group rapidly expanding its business after acquiring Wistron.

This means Apple needs to balance supply chain diversification with maintaining production efficiency while undergoing self-reform to address potential trade risks. This overall strategy cannot be achieved overnight and will inevitably involve uncertainties along the way.

From this perspective, China, as one of the world's largest smartphone markets, holds undeniable strategic importance for Apple. This year's 'aggressive pricing strategy' may be a crucial move to stabilize its position amid complex market conditions.

As for whether it will succeed, that depends on how much of the current enthusiasm for the iPhone 17 translates into actual sales figures.