Apple Watch Gives a Strong Boost to 5G RedCap, but Widespread RedCap Adoption Demands Joint Endeavors

![]() 10/10 2025

10/10 2025

![]() 521

521

At the 2025 Apple Autumn New Product Launch Event, Apple took the wraps off its inaugural 5G smartwatches, namely the Apple Watch Series 11 and the Apple Watch Ultra 3. Both models are equipped with 5G RedCap technology. As a globally recognized brand, Apple's embrace of RedCap unquestionably offers a strong vote of confidence for its application and promotion, motivating and inspiring other relevant manufacturers to follow suit. However, from the author's perspective, the widespread adoption of RedCap spans a broad spectrum of industries. Apple's sole adoption isn't enough to create a comprehensive, large-scale driving force. More sustained breakthroughs across various industry sectors are necessary to discover similar 'Apple-like' roles in different fields.

A Small Step for Apple, a Giant Leap for RedCap

Publicly available information indicates that the Apple Watch Series 11 and Apple Watch Ultra 3, launched by Apple in autumn and being its first smartwatches to incorporate 5G technology, make use of MediaTek's 5G RedCap chips. This confirms that RedCap is well-suited for smart wearables in terms of network quality, power consumption, and other aspects. Of course, RedCap is merely one of the numerous highlights of the smartwatches released by Apple this time. Nevertheless, from multiple angles, this modest step taken by Apple marks a significant leap for the development of RedCap applications.

Firstly, it showcases Apple's unwavering commitment to applying RedCap in wearable devices.

Although Apple isn't the first global manufacturer to adopt RedCap technology in smart wearable devices, it stands out as the most proactive among leading wearable device makers. The application of RedCap heavily relies on the commercialization of network infrastructure. From the current global 5G network deployment standpoint, the RedCap network infrastructure remains quite nascent. Given this, Apple's firm decision to incorporate RedCap into its latest wearable devices, to some extent, reflects its optimism about RedCap's future prospects.

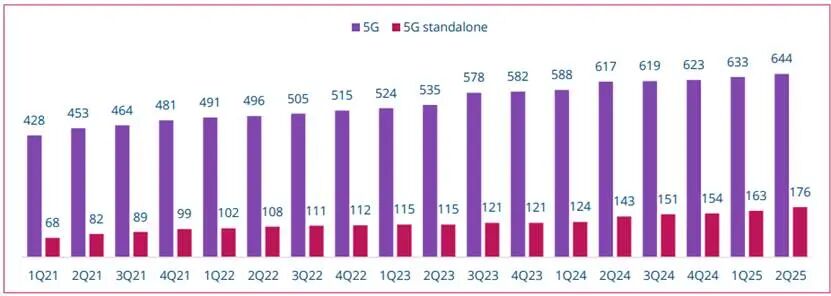

As is well known, the successful application of RedCap necessitates 5G network support for the Standalone (SA) architecture function. According to the latest data from the Global Mobile Suppliers Association (GSA), out of the 644 operators worldwide that have invested in 5G networks, 176 operators, accounting for 27.3%, have commenced investing in 5G SA.

It's evident that most operators globally haven't yet initiated the commercialization of 5G SA networks. Among those that have started investing in 5G SA networks, many are still in the early planning and pilot stages, not truly engaged in large-scale commercialization.

The deployment of 5G SA is merely the first step. For RedCap to be applied, existing networks still need to be upgraded and equipped with relevant functions. GSA data reveals that as of August 2025, 34 operators across 24 countries and regions are investing in RedCap, accounting for only 0.5%. Among them, T-Mobile in the United States, major operators in China, stc in Kuwait, and Dito in the Philippines have all embarked on early commercialization.

The number of operators deploying RedCap is extremely limited. However, Apple's smartwatches still opt for this technology, underscoring Apple's firm stance on applying RedCap in wearable devices. Of course, in regions where RedCap functionality hasn't been deployed, smartwatch communication can revert to LTE networks without impacting the watches' usability.

Secondly, it fulfills the commitments made during the RedCap standard formulation.

During the discussions on research directions for 3GPP Release 17, representatives from various manufacturers put forward research intentions for RedCap. Regarding discussions on application scenarios, all parties consistently identified three scenarios suitable for RedCap applications, including industrial wireless sensors, smart city video surveillance, and wearable devices. Specifically, for wearable devices, 3GPP proposed a reference bandwidth of 5-50 Mbps for downlink and 2-5 Mbps for uplink, with peak rates of up to 150 Mbps for downlink and up to 50 Mbps for uplink. The device's battery should last for several days (up to 1-2 weeks).

As a key scenario proposed during the formulation of 3GPP standards, wearable devices have drawn significant attention from the industry. The adoption of RedCap in Apple's newly released smartwatches creates a typical demonstrative effect, serving as a strong response to the scenario planning during the 3GPP standard formulation. It can be considered as fulfilling the commitments made during the standard formulation, providing support for the transformation and future evolution of the entire RedCap standard.

Thirdly, it spurs the growth of RedCap's consumer-grade application scale.

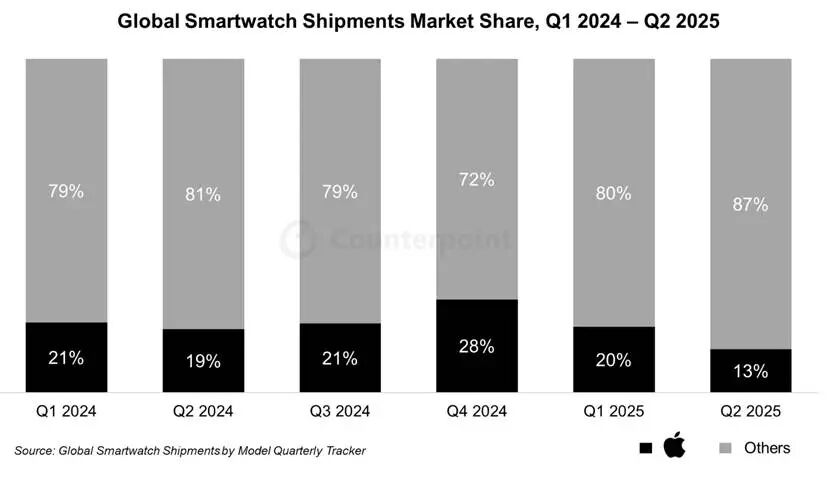

Data indicates that in the second quarter of 2025, Apple Watch's global shipments reached 7.4 million units, representing a year-on-year increase of 28.8%. Counterpoint data shows that global smartwatch shipments in the second quarter of 2025 rose by 8% year-on-year, with Apple's smartwatch shipments accounting for 13% of the total. Huawei's shipments in the second quarter surged by as much as 52% year-on-year, capturing a 21% global market share and surpassing Apple for the first time to become the global leader in shipments. Xiaomi accounted for 9%, ranking third.

Although Apple's shipments have declined, as a leading brand, it still exerts significant influence in the overall smart wearable market. Previously, many of Apple's practices have set the tone for the smart wearable industry, with other manufacturers following in its footsteps. The adoption of RedCap in Apple's smartwatches is expected to have a positive impact on other manufacturers in the industry. In the future, when various wearable brands release cellular-enabled products, they are likely to consider adopting RedCap as well.

According to publicly available data, smartwatches, as consumer IoT products, have achieved large-scale shipments, with global annual shipments exceeding 100 million units. A substantial portion of these smartwatches features cellular IoT connectivity. Driven by large-scale shipments, RedCap can achieve widespread application in smartwatch scenarios, further reducing the costs of RedCap chips and modules, and promoting RedCap's application in other consumer-grade IoT products. For instance, multiple manufacturers are currently promoting and exploring the application of RedCap in lightweight AR and VR devices.

However, Apple isn't the 'savior' of RedCap; the widespread adoption of RedCap still necessitates efforts from multiple parties.

Although Apple Watch's support for RedCap can stimulate the application of consumer-grade products, RedCap targets a wide array of industries. The implementation of RedCap in various industries requires overcoming numerous hurdles. Therefore, in the author's view, Apple's support alone isn't sufficient to drive the overall and large-scale application and implementation of RedCap.

Consumer products and industry application products exhibit significant differences in adopting new technologies. Consumer products undergo rapid iteration, with each new generation requiring new highlights to attract consumers, leading to the continuous application of new technologies in new products. Industry applications, on the other hand, demand reliable and cost-effective digital technology empowerment, considering more factors, and don't necessarily adopt the latest technologies.

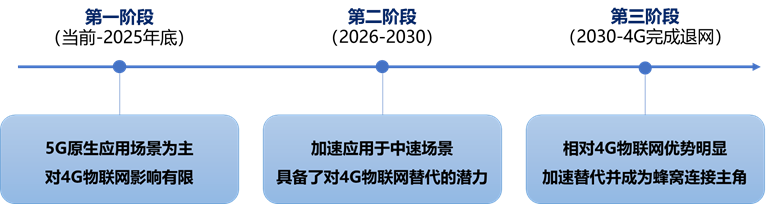

The author has repeatedly emphasized in articles that RedCap applications can be divided into three stages: the first stage focuses on 5G native application scenarios; the second stage accelerates applications in medium-speed scenarios, having the potential to replace 4G IoT; the third stage demonstrates significant advantages over 4G IoT, accelerating replacement and becoming the protagonist of cellular connectivity.

Currently, the focus of RedCap promotion should be on 5G native application scenarios. The author believes that efforts can be concentrated on 5G native rigid demand scenarios and 5G private networks, with the 5G private network sector serving as a key focus. Public data shows that as of August 2025, 64,000 5G industry virtual private networks have been established nationwide. 5G private networks have been integrated into 86 major categories of the national economy, covering core links such as research and development, production and manufacturing, and operation and maintenance services. The cumulative number of application cases has exceeded 138,000. Among them, '5G + Industrial Internet' construction projects have surpassed 20,000, with projects in the production sector accounting for over 86% of the major categories. In these private network environments, core equipment and assets must be connected through 5G networks. Customers require a secure and isolated dedicated network environment to ensure that data remains within factories, parks, and other designated locations, excluding access by 4G devices. Developing IoT connectivity in private network environments is an important task, with RedCap serving as a key component in accomplishing this task.

Additionally, the integration of RedCap with emerging industrial sectors can create diverse demonstrative effects. The author believes that, on the one hand, focus can be placed on the '5G in Vehicles' sector, adopting RedCap in intelligent connected vehicles. Currently, intelligent connected vehicles primarily utilize 4G cellular networks. Against the backdrop of continuous upgrades enabling RedCap functionality in domestic 5G networks, RedCap provides significant support for intelligent connected vehicles. Considering that many vehicles have a lifecycle exceeding 10 years, there is a need to deploy future-proof cellular network functionality. In this context, RedCap offers advantages in terms of cost and network evolution, serving as an important choice for '5G in Vehicles.' On the other hand, integrating with the 'Artificial Intelligence +' sector and exploring more AI application scenarios. For instance, NVIDIA recently released its new-generation computing platform, NVIDIA Jetson Thor, designed specifically for physical AI and humanoid robots. This platform has completed validation with Telit Cinterion's 5G RedCap module, with RedCap serving as an important means of off-board communication for NVIDIA's humanoid robot platform.

In summary, Apple's support brings vast opportunities for the commercial expansion of 5G RedCap. However, the prosperity of RedCap extends beyond the consumer sector and requires joint efforts from various industries. It is hoped that the industry can summarize past development experiences, reach a consensus, and form a collective force to jointly drive the prosperity of the IoT ecosystem.