Revenue returns to the top of A-share game companies, rated better than the market, what did Century Huatong do right?

![]() 11/08 2024

11/08 2024

![]() 482

482

Produced by Leida Finance, Written by: Shi Ye, Edited by: Shen Hai

The leader of the A-share game sector has changed.

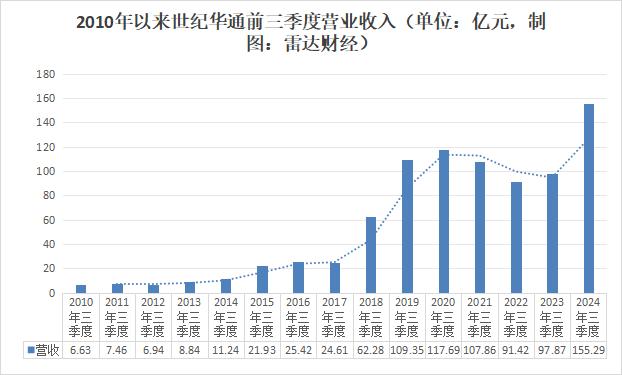

At the end of October, Century Huatong released its third-quarter report for 2024. In the first three quarters of this year, Century Huatong achieved revenue of 15.529 billion yuan, a year-on-year increase of 58.66%, setting a new record since the company's listing.

Wind statistics show that this is also the first time since 2021 that Century Huatong's revenue has ranked first in the A-share game industry.

In terms of profit, Century Huatong also performed impressively. In the first three quarters of this year, the company achieved a net profit of 1.803 billion yuan, a year-on-year increase of 26.17%; and a non-GAAP net profit of 1.782 billion yuan, a year-on-year increase of 47.98%.

Why was Century Huatong able to achieve such high growth? According to Leida Finance's analysis, Century Huatong benefited from the integration of the Legend IP and strong overseas business performance. Additionally, the company has proactively laid out its AI cloud data business.

The company's outstanding performance has also been well-regarded by securities traders. Analysts such as Mao Yuncong from Haitong Securities believe that Century Huatong's classic games have performed stably, with a rich reserve of new games, maintaining a "better than the market" rating.

Revenue returns to the top of the industry after four years

The financial report shows that the company has strengthened its management functions and improved its operating efficiency in accordance with the annual business plan of the management, writing a new "legend" in its performance.

In the third quarter of this year, Century Huatong achieved revenue of 6.253 billion yuan, a year-on-year increase of 67.29%; a net profit of 645 million yuan, a year-on-year increase of 14.95%; and a non-GAAP net profit of 629 million yuan, a year-on-year increase of 34.79%. Both revenue and net profit performance ranked first in the A-share game sector.

Throughout the first three quarters, the company achieved revenue of 15.529 billion yuan, a year-on-year increase of 58.66%, setting a new record since the company's listing.

Century Huatong's explosive revenue growth is not a universal phenomenon across the entire industry. According to the "2024 China Game Industry IP Development Report" released by the Game Publishing Working Committee of the China Audio and Video Software Association, the actual sales revenue of China's game IP market reached 196.06 billion yuan from January to September 2024, and it is expected that the annual revenue will be higher than the previous year's level.

According to Wind statistics, in the first half of this year, the average revenue growth rate of 26 A-share game listed companies was -5.89%, with a median growth rate of -14.27%. The minimum growth rate was -38.93%, and the maximum was 53.33%.

In the first half of this year, Century Huatong achieved revenue of 9.276 billion yuan, a year-on-year increase of 53.33%. This means that Century Huatong's revenue growth rate ranked first in the A-share game industry in the first half of the year.

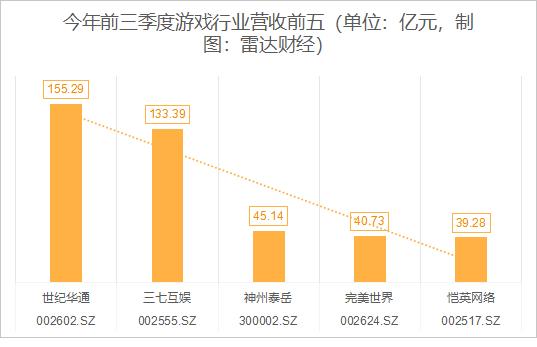

This year's impressive revenue performance has allowed Century Huatong to leapfrog to become the company with the highest revenue in the first three quarters of the A-share market, with revenue of 15.529 billion yuan.

According to Leida Finance's statistics, in the first three quarters of 2020, Century Huatong's revenue ranked first in the game industry. For the following three years, it was surpassed by Shanda Games and ranked second in the industry. In the first three quarters of this year, Century Huatong's revenue returned to the top.

In the first three quarters of this year, the game industry's top four revenue earners were Shanda Games, Shenzhou Taiyue, Perfect World, and Kingsoft Online, with revenues of 13.339 billion yuan, 4.514 billion yuan, 4.073 billion yuan, and 3.928 billion yuan, respectively.

In the first three quarters, Century Huatong achieved a net profit of 1.803 billion yuan, a year-on-year increase of 26.17%.

According to Wind statistics, the average profit of A-share game listed companies in the first three quarters of this year was 282 million yuan, with an average net profit growth rate of -252.54%. Century Huatong's profit performance was far better than its peers.

In the first three quarters, Century Huatong achieved a non-GAAP net profit of 1.782 billion yuan, a year-on-year increase of 47.98%; and operating cash flow of 3.462 billion yuan, a year-on-year increase of 38.72%.

The "unification" of the Legend game market becomes a growth engine

Why has Century Huatong achieved high performance growth while other A-share peers are underperforming? According to Leida Finance's analysis, unifying the Legend game market has made a significant contribution to Century Huatong's performance.

The Legend game originated in South Korea and was introduced to China in 2001 by Shengqu Games, a subsidiary of Century Huatong. Upon its launch, it became an instant hit across China, influencing a generation of gamers.

According to research, the Legend game market still maintains a market size of 20-30 billion yuan annually.

However, the copyright of the Legend game is jointly owned by Actoz Soft, a foreign subsidiary of Century Huatong, and the South Korean game company Wemade Entertainment. The inconsistency in copyright has caused numerous issues, greatly limiting the development of the Legend IP.

However, this pain point changed last year.

It is reported that in August 2023, Actoz Soft and Wemade Entertainment reached a five-year "Game Cooperation Agreement," under which Wemade Entertainment granted Actoz Soft exclusive, non-transferable, and sublicensable rights in mainland China (excluding Hong Kong, Macao, and Taiwan), including rights to the original games (referring to Legend of Mir 2 and Legend of Mir 3), derivative game rights, service tool rights, rights to safeguard rights, derivative product rights, virtual product rights, and film and television production rights. Starting from September this year, the cooperation was further upgraded, with Shengqu Games serving as the new performer of the "Game Cooperation Agreement," continuing to enjoy and exercise these rights.

Following the company's signing of the licensing cooperation agreement with Wemade Entertainment of South Korea last year, the Legend game market achieved "unification" in mainland China, and Century Huatong also accelerated the integration of the three stages of Legend series IP licensing, distribution, and research and development.

The company disclosed in its interim report that its operating products, including The Legend of Mir and Mir 2, continued to explore new gameplay. Among them, the "New Hundred Regions" of The Legend of Mir combines retro and innovation to create a unique gaming experience, achieving remarkable results. The number of active users of The Legend of Mir's PC client games has surged by 82% year-on-year in the past two months, with revenue increasing by 108% year-on-year, mainly due to the newly added open and innovative modes within the game, which effectively attracted the return of Legend's old users and the active participation of new players, resulting in a booming phenomenon of tens of thousands of online users on multiple servers.

According to Century Huatong's disclosure, the company's comprehensive revenue related to Legend increased by approximately 80% year-on-year in the first half of the year, with Legend integration becoming a new growth engine for the company.

Famous economist Song Qinghui told Leida Finance that the Legend game has a large number of players with strong paying capabilities. So far, it has only been a year since Century Huatong achieved "unification," and in the future, with Century Huatong's meticulous craftsmanship, the Legend series of games is expected to bring greater benefits to the company.

Over half of the revenue comes from overseas business

Another important reason for Century Huatong's high revenue growth is the rapid development of its overseas business.

In the third-quarter report, Century Huatong did not disclose overseas revenue. However, when explaining the high revenue growth, the company stated that it was mainly due to the continued rapid growth of its overseas game business and the steady increase in its domestic game business.

In its previous interim report, Century Huatong disclosed that its overseas market revenue was 5.019 billion yuan, with a year-on-year growth rate of 115.28%.

Leida Finance notes that according to the "China Game Industry Report for January-June 2024," in the overseas market, China's self-developed games achieved actual sales revenue of 8.554 billion dollars in the first half of the year, a year-on-year increase of 4.24%. Century Huatong's overseas market revenue growth rate was much higher than the industry's average growth rate of 4.24%.

It is worth noting that in 2023, the company's overseas business revenue growth rate was 51.35%. Given such a high base, it is remarkable that the company was able to achieve double growth in the first half of this year.

Driven by high growth, Century Huatong's overseas revenue accounted for 54.11% in the first half of this year, marking the first time that overseas revenue accounted for more than half of the company's total revenue in an interim report.

According to Leida Finance's analysis, Tap4Fun is the main vehicle for Century Huatong's overseas business. The company has over a decade of experience in overseas game publishing and operation and has been continuously accumulating independent research and development capabilities in recent years. Since 2019, it has increased investment in self-developed products. After four years of refinement, it has achieved breakthroughs in multiple casual game categories, rising to the forefront of the industry.

Today, Tap4Fun has created several globally popular game products, including Family Farm Adventure, LiveTopia, Frozen City, Whiteout Survival, Dragonscapes Adventure, and Valor Legends: Eternity.

Based on data from multiple third-party mobile application market research institutions, Tap4Fun's star product Whiteout Survival has consistently ranked first on China's mobile game overseas revenue charts and successfully entered the global mobile game revenue top 10. Another new game, Truck Star, has achieved monthly revenue of tens of millions of dollars globally within four months of operation. Tap4Fun not only ranks among the top 5 Chinese mobile game publishers in terms of global revenue but has also entered the global top 10.

It is worth noting that on September 18, Sensor Tower released the top 30 domestic mobile game companies by revenue in August. The most notable change was that Tap4Fun surpassed miHoYo to enter the top three of China's monthly publisher revenue rankings for the first time.

Image source: Sensor Tower official website

After its total revenue exceeded 1 billion dollars (approximately 7.1 billion yuan at current exchange rates), in August, Tap4Fun's post-apocalyptic survival strategy mobile game Whiteout Survival set new monthly revenue records in both domestic and overseas markets, ranking first on the overseas mobile game revenue chart for August.

In terms of product reserves, as a classic survival game, the Don't Starve IP series has sold over 25 million copies worldwide. The reserved product Don't Starve Together has attracted over 10 million game reservations across all platforms and received positive reviews from players. Its overseas version has consistently ranked at the top of best-selling lists in Japan and South Korea and has won the Google Play Best Multiplayer Game award.

According to the company's official account, in the first three quarters of this year, Century Huatong's overseas game performance continued to rise. Whiteout Survival consistently ranked first in China's mobile game overseas revenue charts, with global downloads exceeding 90 million, effectively demonstrating its long-term profitability; the puzzle game Truck Star, launched in the first half of the year, has seen continuous revenue growth since its launch. With the outstanding performance of multiple products, Tap4Fun has firmly established itself as one of the top 5 Chinese mobile game publishers in terms of revenue and entered the global top 10, solidifying its leading position in overseas markets.

In Century Huatong's view, the company's overseas business has formed a relatively complete methodology and has the ability to continuously launch hit products.

Investment banks are optimistic about Century Huatong's subsequent development

Recently, the country has introduced multiple new financial policies to inject vitality into the market. These policies have not only stabilized the economic fundamentals but have also had a positive impact on the securities market. Foreign investors are optimistic about Chinese assets, domestic investor confidence has rebounded, and market activity has significantly increased. The game industry and AI-related sectors are also demonstrating long-term growth potential.

With the normalization of game license issuance, the game industry is entering a new development cycle. At the same time, the deepening application of AI technology provides a new engine for cost reduction and efficiency enhancement in the game industry. In the future, with the continuous iteration and launch of VR, MR, and other technologies, the game industry is expected to attract more customer groups and growth opportunities. In the AI sector, with the surge in US stock AI companies such as NVIDIA and AMD, the AI sector in the A-share market has also attracted significant attention. Sub-sectors such as optical modules, servers, semiconductors, and software have all demonstrated strong growth potential.

In addition to the game business, Century Huatong's other two major businesses are AI cloud data services and automotive component manufacturing.

In 2023, the company upgraded its "Cloud Data Business Unit" to the "AI Cloud Data Business Unit." This year, the company has continued to deepen its comprehensive layout related to AI, expanding its involvement in computing power infrastructure and AI application fields. The advanced AI computing center project, in which the company is deeply involved, is positioned as an important AI advanced computing hub in the Yangtze River Delta region, undertaking various large-scale AI algorithm calculations, machine learning, natural language processing, image processing, scientific computing, engineering computing, and other tasks. The project has delivered over 10,000 cabinets and is gradually being put into operation in the Yangtze River Delta by Tencent.

It is worth noting that the company's Shanghai data center project achieved profitability in the first half of the year.

In this regard, analysts such as Mao Yuncong believe that Century Huatong's layout in integrated computing power services offers broad growth prospects for its new business, and its forward-looking layout in integrated computing power services is expected to open up new growth points for the company.

In addition, Shengqu Games, a subsidiary of Century Huatong, has made precise layouts in the AI field.

On the game development side, in September this year, Shengqu Games' Art Center conducted an application experiment based on Generative AI (AIGC) technology, efficiently recreating some iconic scenes from Black Myth: Wukong using Unreal Engine 5 in conjunction with AI-assisted design software.

On the quality control side, the AI automatic cloud testing platform "Jice Info," incubated by Shengqu Games' Quality Management Center, has formed a complete set of AI testing solutions that can achieve fully automated testing of game products and provide customized product testing services for other digital content developers, including games.

On the customer service side, the "Big Dictionary," jointly developed by Shengqu Games' Technology Center and Customer Relationship Management Center, has started internal testing. This customer service system, based on AI large models and RAG technology (Retrieval-Augmented Generation), can not only process complex inquiries using pre-trained language models but also ensure the accuracy and professionalism of responses by relying on a specially constructed knowledge base.

Analysts such as Mao Yuncong believe that Century Huatong's classic games have performed stably, with a rich reserve of new games, maintaining a "better than the market" rating.