Mid-range Phones are Booming! From Spec Wars to Demand-Driven, the Industry has Finally "Returned to Basics"

![]() 05/06 2025

05/06 2025

![]() 552

552

Mid-range phones are witnessing a resurgence of innovation.

Phone manufacturers are reevaluating the development trajectory of mid-range devices.

According to a report by research firm IDC, bolstered by the "national subsidy" policy, smartphone shipments in the Chinese market increased by 3.3% year-on-year in the first quarter of 2025. Among these, the mid-range segment emerged as the biggest beneficiary, with consumers increasingly favoring cost-effective products at this price point.

In essence, due to shifts in the overall market environment and consumer preferences, mid-range phones have once again become market darlings, prompting manufacturers to reassess their strategies for these devices.

Mid-range phones: a critical battleground for manufacturers

The evolution of mid-range phones can be broadly categorized into three stages: Initially, manufacturers pursued ultimate performance, ensuring the strongest processor within the price range, sometimes compromising on other aspects to highlight this advantage.

Brands like Redmi, Honor, iQOO, and realme initially focused on the mid-range market. At that time, the smartphone market was relatively untapped, and manufacturers could grow through a flood of models, gradually expanding into multiple series to enrich their product lines.

However, these early mid-range phones were constrained by cost and technology. While they excelled in performance, other features were merely satisfactory. They were better than lower-priced thousand-yuan phones but fell short of flagship devices.

Image source: Lei Technology

The second stage saw mid-range phones begin to inherit features from flagships, such as camera algorithms and design aesthetics. These phones became more comprehensive, even spawning a new "sub-flagship" category. They utilized flagship processors and notable components, aiming for ultimate cost-effectiveness. While they couldn't fully match flagships, they offered 70-80% of their capabilities.

From this point on, mid-range phones entered a fiercely competitive era. They faced rivalry not only from competing products but also from other series within the same brand, especially as the smartphone market transitioned from growth to maturity. Each manufacturer demonstrated their prowess in the mid-range segment.

Image source: Lei Technology

The third stage is upon us now. Amidst diminishing growth opportunities, manufacturers began shifting their focus. Being comprehensive is no longer the primary goal for mid-range phones. Refining user needs and accurately addressing specific demands has become the new mantra.

Data speaks volumes. Xu Qi, an executive at realme, noted that China has approximately 1 billion smartphone users, with 500 million using mid-range phones, accounting for 50% of the market.

This vast market is crucial for every manufacturer. While high-end phones offer high profits and enhance brand influence, mid-range phones form the foundation. Capturing this user base means grasping the pulse of the Chinese smartphone market. Therefore, mid-range phones are a non-negotiable territory for major players.

The "changes" and "unchanging" aspects of mid-range phones

Flagship phones earn their moniker due to top-tier performance, camera quality, quality control, and other aspects. With high costs and premium materials, they naturally have few shortcomings and are supported by brand influence, making consumers willing to pay for the brand narrative.

Mid-range phones, however, are less complex. As a netizen put it, "When buying a mid-range phone, I don't care about the brand. I choose the one with the features I want most. I choose the phone that meets my needs."

Clues from mid-range phones released this year reveal a shift:

Honor launched the new Honor GT Pro, targeting the esports market with upgrades in performance, battery life, and eye protection, aimed at college students and young professionals.

Realme unveiled the new realme GT7, featuring high performance and a large battery, continuing the brand's consistent strategy. OnePlus took a different approach, reintroducing small screens to the mid-range market. The OnePlus 13T is considered a unique small-screen performance flagship in recent years.

Image source: OnePlus official website

Redmi ignited the market with the Redmi Turbo 4 Pro, boasting a "super-sized" 7550mAh battery. This giant battery garnered significant attention. Additionally, the phone's dual-ring light strip and metal frame design align it with flagship phones in all aspects.

Image source: Redmi official Weibo

Do you notice the change? Previously, the goal was "well-rounded phones," with each manufacturer creating a hexagonal warrior within budget constraints. Now, manufacturers pursue the long-board effect—when a product has few shortcomings or most have been addressed, they focus on exploring strengths. Based on this, seeking change and differentiation is the new direction.

However, regardless of changes, mid-range phones remain grounded in cost-effectiveness, an inherent characteristic. Users in this segment are less loyal to brands; their core demand is high cost-effectiveness. At the same price point, consumers will naturally opt for the product offering better value.

Image source: Lei Technology

While cost-effectiveness remains the bedrock, each manufacturer explores different directions: The Honor GT Pro addressed battery life issues criticized in the previous generation, while Redmi also focused on battery life. The OnePlus 13T targeted small screens. Each has their unique strategy.

Manufacturers seem to have grasped a crucial insight: Due to diminishing marginal utility, stacking more specifications may not significantly enhance user experience. Products that precisely match user needs and address pain points are more competitive.

The exclusive ecosystem for mid-range phones is taking shape

Shifts in product thinking necessitate adjustments in the supply chain, software ecosystem, and more. Li Jie, President of OnePlus China, mentioned in an interview that the OnePlus 13T follows the small-screen flagship approach. Many components account for a small proportion and haven't reached scale, leading to higher costs. Despite this, OnePlus convinced suppliers due to optimism about the future of small-screen performance flagships.

As manufacturers drive change, advancements in supply chain technology push product evolution.

Image source: OnePlus official Weibo

This year, Redmi, Honor, and others launched products with large-capacity batteries. Redmi introduced the "Jinshajiang Battery," and Honor the "Qinghai Lake Battery," both products of silicon-carbon battery technology's popularization.

Space within a phone is precious, with cameras, facial recognition, cooling structures, and more occupying significant areas. With limited remaining space and graphite batteries' insufficient energy density, battery life suffered.

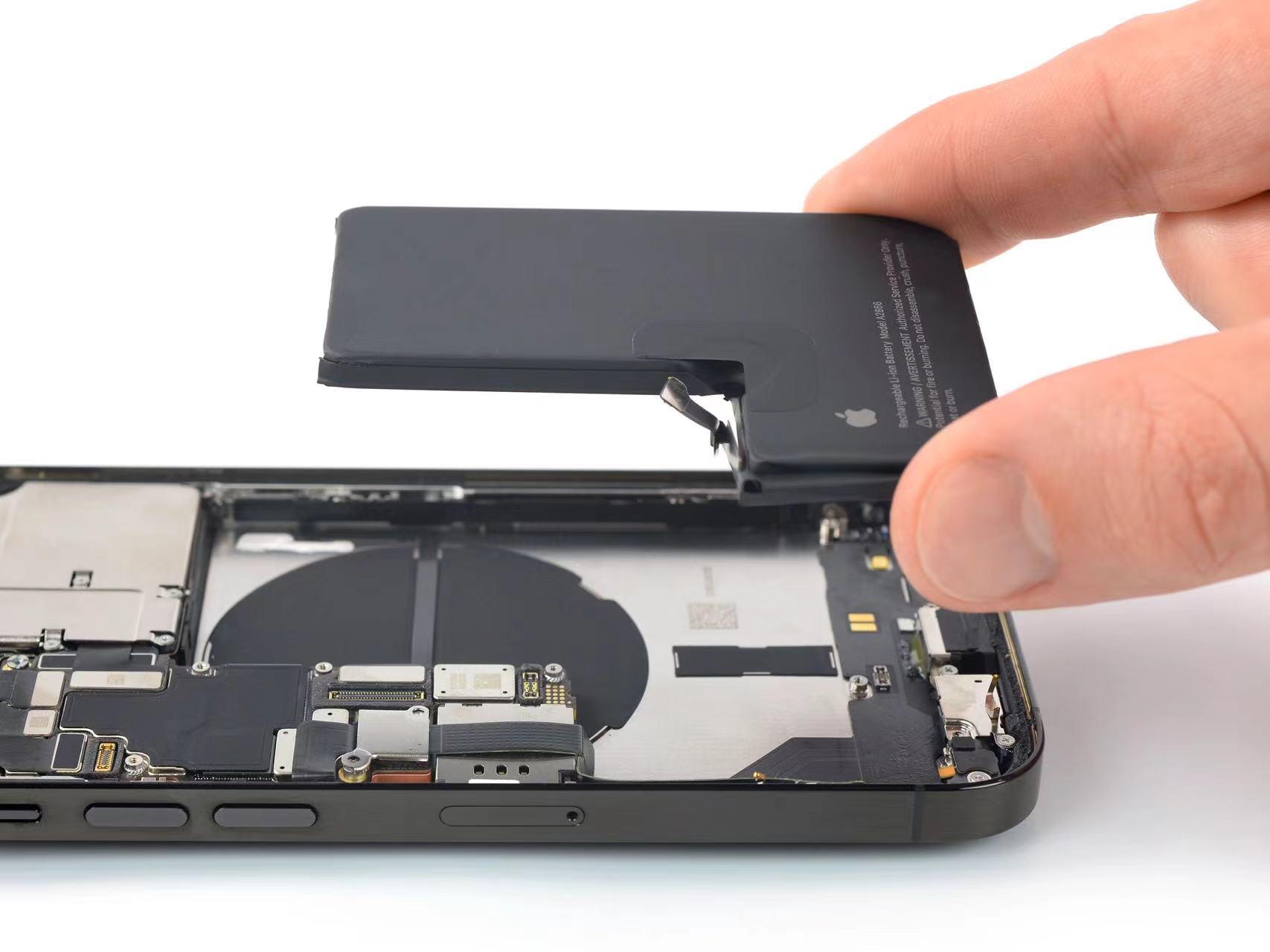

Image source: iFixit

Silicon-carbon batteries offer higher energy density, providing long battery life while maintaining a sleek design, naturally appealing to manufacturers. Thus, we see many mid-range phones with large-capacity batteries and small-screen phones like the OnePlus 13T balancing performance and battery life.

Enhanced battery life also enables new optimizations. AI is a focal point for various manufacturers. Huawei, Meizu, OPPO, Honor, and others have announced their access to deepseek, using AI to optimize interactions, showcasing a trend of leveraging AI to enhance user experience.

Some manufacturers aim to increase visibility through co-branding activities, enhancing brand premium power by collaborating with game developers and event IPs. These are branding games, ultimately aiming to attract more users.

Summary

From the ultimate pursuit of performance to customized optimizations for segmented scenarios, manufacturers are returning to user needs when designing phones.

After all, there's no perfect phone, neither for flagships nor mid-range devices. Only by continuously improving products based on user needs and technological breakthroughs, shifting away from a specifications-centric perspective, and focusing on addressing user pain points, can manufacturers reconstruct their competitive edge in the mid-range era.

Source: Lei Technology

Images in this article are from: 123RF Licensed Image Library Source: Lei Technology