China's Hydrogen Energy Vehicles Surpass 30,000 Units, Marking a Significant Leap and Radical Market Transformation

![]() 08/04 2025

08/04 2025

![]() 540

540

According to the Orange Hydrogen Energy Database, China's fleet of hydrogen fuel cell vehicles surpassed 30,000 units in the first half of this year, establishing a new milestone. However, the market structure has undergone significant changes.

1

Overall Sales

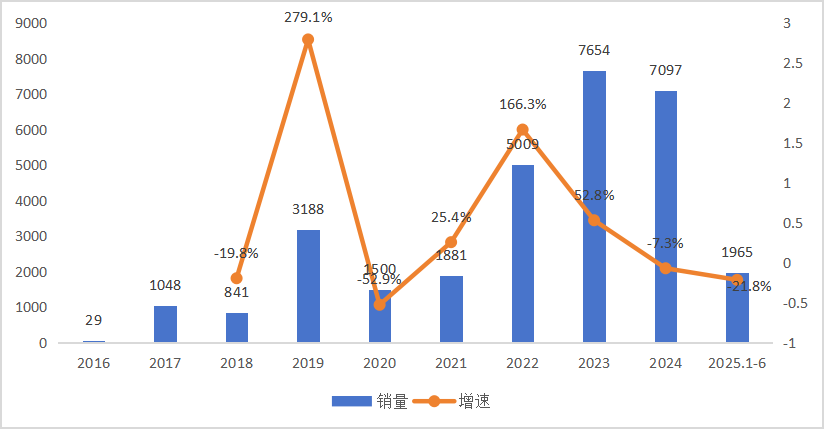

Insurance data reveals that China sold 1,965 hydrogen fuel cell vehicles in the first half of 2025. By this period, the national fleet of fuel cell vehicles reached 30,212 units.

Various factors, including delayed subsidies for demonstration city clusters, excessive corporate fund consumption due to vehicle promotion advances, order replacements, and R&D investments, led to corporate fund shortages. Enterprises adopted a wait-and-see attitude due to the lack of new policies, and despite rapid cost reductions, hydrogen vehicles offered slim profits, resulting in a slower promotion pace in the first half of the year.

Specifically, China sold 1,965 hydrogen fuel cell vehicles in the first half of the year, a 21.8% decrease compared to the 2,512 units sold in the first half of 2024.

Figure 1: Sales and Growth Rate of China's Fuel Cell Vehicles from 2016 to June 2025 (units, %)

Data Source: Orange Hydrogen Energy Database

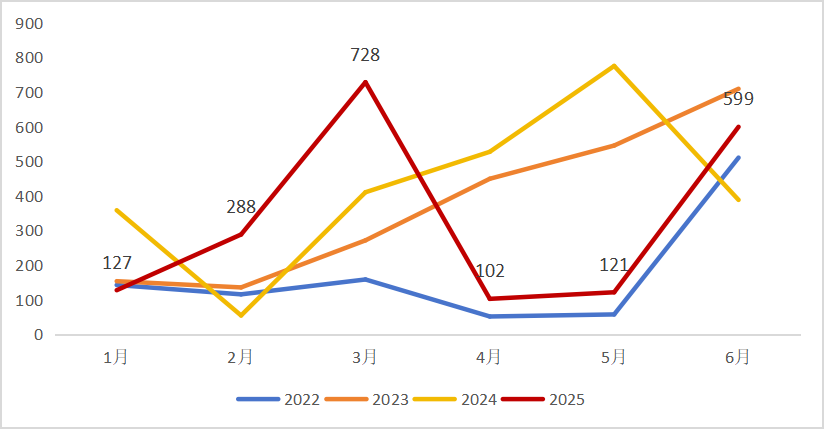

From a monthly perspective in 2025, hydrogen vehicle sales plummeted in January but showed strong momentum from February to March. In March, sales reached 728 units, the highest level for the same period in history and for the first half of this year. First-quarter sales totaled 1,143 units, a 39.1% year-on-year increase, performing well during the traditional off-season. Sales were sluggish in April and May but picked up momentum in June.

Figure 2: Sales and Growth Rate of China's Fuel Cell Vehicles from January to June 2025 (units, %)

Data Source: Orange Hydrogen Energy Database

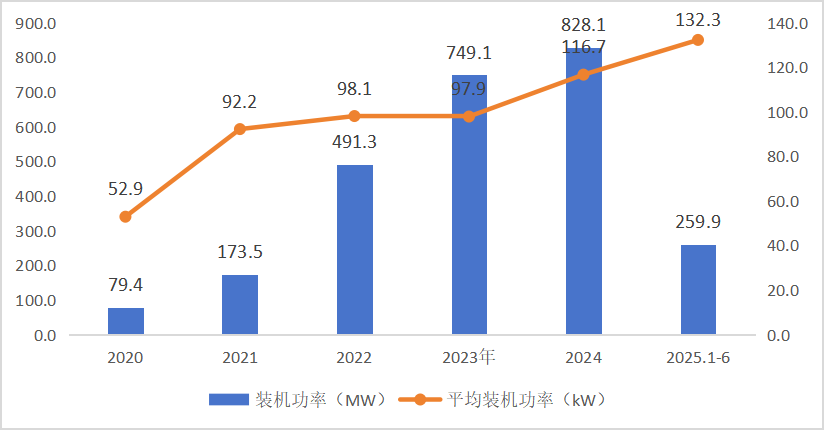

The installed power per vehicle has continued to climb. In the past five years, the installed power of fuel cell vehicle systems increased from 79.4MW to 828.1MW in 2024, with a compound annual growth rate of 79.7%. The installed power in the first half of 2025 was 259.9MW. The average installed power per fuel cell vehicle increased from 52.9kW in 2020 to 116.7kW in 2024, reaching 132.3kW in the first half of 2025, a year-on-year increase of 22.4%.

Figure 3: Installed Power and Average Installed Power of Fuel Cell Systems from 2020 to June 2025

Data Source: Orange Hydrogen Energy Database

2

Vehicle Model Structure Analysis

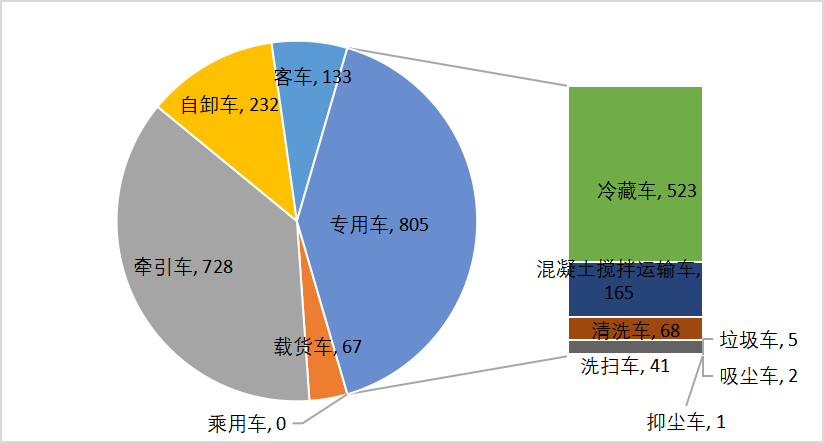

Special vehicles and tractors dominate sales. In the first half of 2025, sales of fuel cell tractors reached 728 units, a year-on-year decrease of 30.7%, accounting for 37% of total sales. Sales of fuel cell special vehicles were 805 units, a year-on-year increase of 5%, accounting for 41%. Sales of fuel cell dump trucks were 232 units, a year-on-year increase of 60%, accounting for 11.8%.

Among special vehicles, refrigerated trucks had the best sales at 523 units, but this was still a decrease of 17.8% compared to last year. Concrete mixer trucks were the second best-selling model with 165 units, approximately 40 times the sales volume of the same period last year.

Figure 4: Distribution of Specific Fuel Cell Vehicle Models from January to June 2025

Data Source: Orange Hydrogen Energy Database

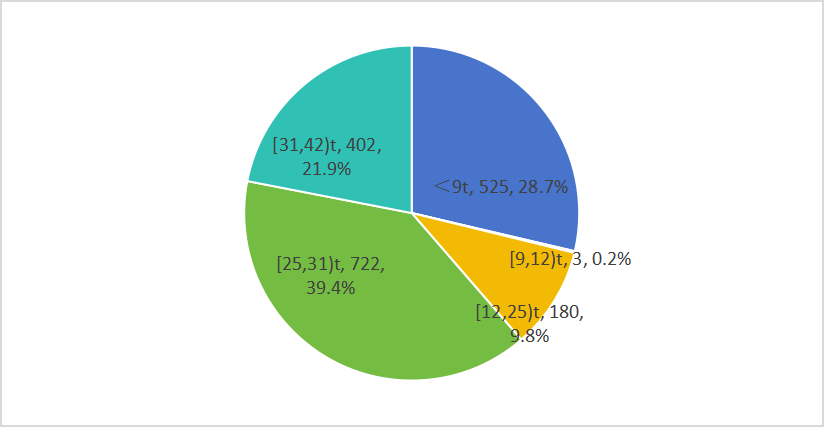

Heavy trucks are the primary focus of fuel cell vehicle development. In the first half of 2025, sales of trucks with a gross vehicle weight of 25 tons or more accounted for 61.4% of total truck sales, amounting to 1,124 units. Among them, trucks weighing 25-31 tons accounted for 39.4% (722 units), and trucks weighing 31 tons or more accounted for 21.9% (402 units). Trucks weighing less than 9 tons accounted for 28.7% (525 units).

Figure 5: Gross Vehicle Weight Distribution of Fuel Cell Trucks from January to June 2025

Data Source: Orange Hydrogen Energy Database. Note: Fuel cell trucks here include all models except fuel cell passenger vehicles and buses.

3

Sales of Complete Vehicles and System Enterprises

In the first half of 2025, the market concentration of fuel cell vehicles further increased, and the market landscape changed.

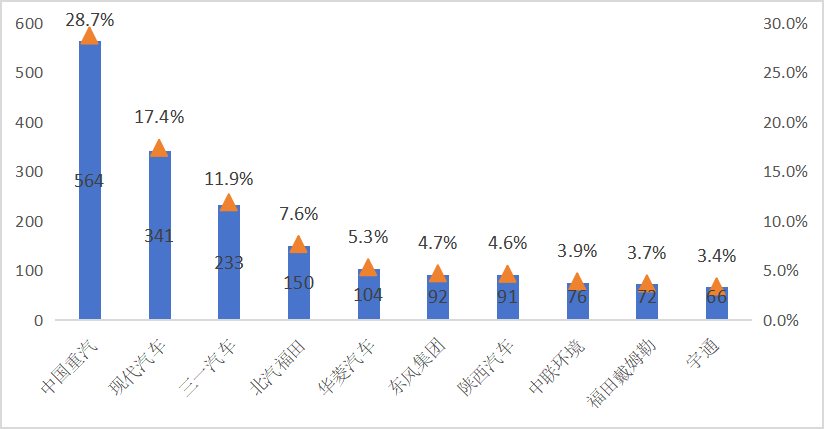

Regarding complete vehicles: Approximately 30 fuel cell vehicle manufacturers shipped vehicles in the first half of 2025, a decrease of about 7 compared to the first half of 2024. The top 10 automakers sold a total of 1,789 units, accounting for 91% of total sales, an increase of 9.6% compared to the same period last year. The top 5 automakers sold 1,392 units, accounting for 70.8%, an increase of 14.3% compared to the same period last year. The top three enterprises were China National Heavy Duty Truck with 564 hydrogen vehicles sold (28.7% market share), Hyundai Commercial Vehicles with 341 units (17.4% market share), and Sany Automobile with 233 units (11.9% market share).

In the first half of 2024, the top three enterprises in terms of hydrogen vehicle sales were Meijin New Energy with 445 units, Suzhou Kinglong with 286 units, and FAW Group with 241 units.

Figure 6: Sales and Market Share of Top 10 Fuel Cell Vehicle Manufacturers in the First Half of 2025

Data Source: Orange Hydrogen Energy Database

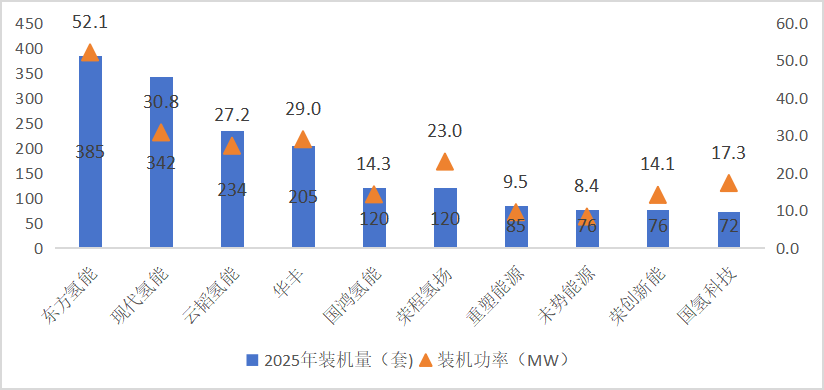

Regarding systems: Approximately 35 fuel cell vehicle manufacturers shipped systems in the first half of 2025, a decrease of 8 compared to the first half of 2024. The top 10 system enterprises had a cumulative installed capacity of 1,715 units, accounting for 87.3% of the total installed capacity, an increase of 6.7% compared to the same period last year. Their cumulative installed power was approximately 225.6MW, accounting for 86.8% of the total installed power, an increase of 5.9% compared to the same period last year.

The top 5 system enterprises had 1,286 units, accounting for 65.4%, an increase of 3.7% compared to the same period last year. Their cumulative installed power was approximately 153.3MW, accounting for 59% of the total installed power, a decrease of 4.1% compared to the same period last year.

The top three enterprises were Dongfang Hydrogen with 385 units installed (19.6% market share) and an installed power of approximately 52.1MW (20% market share), Hyundai Hydrogen with 342 units (17.4% market share) and an installed power of approximately 30.8MW (11.8% market share), and Yuntao Hydrogen with 234 units (11.9% market share) and an installed power of approximately 27.2MW (10.5% market share).

In the first half of 2024, the top three system supporting enterprises were Sinohytec with 652 units and an installed power of approximately 60.3MW, Shanghai RePower with 388 units and an installed power of approximately 50.1MW, and GuoHong Hydrogen with 257 units and an installed power of approximately 30.8MW.

Figure 7: Installed Capacity and Cumulative Installed Power of Top 10 Fuel Cell System Enterprises in the First Half of 2025

Data Source: Orange Hydrogen Energy Database

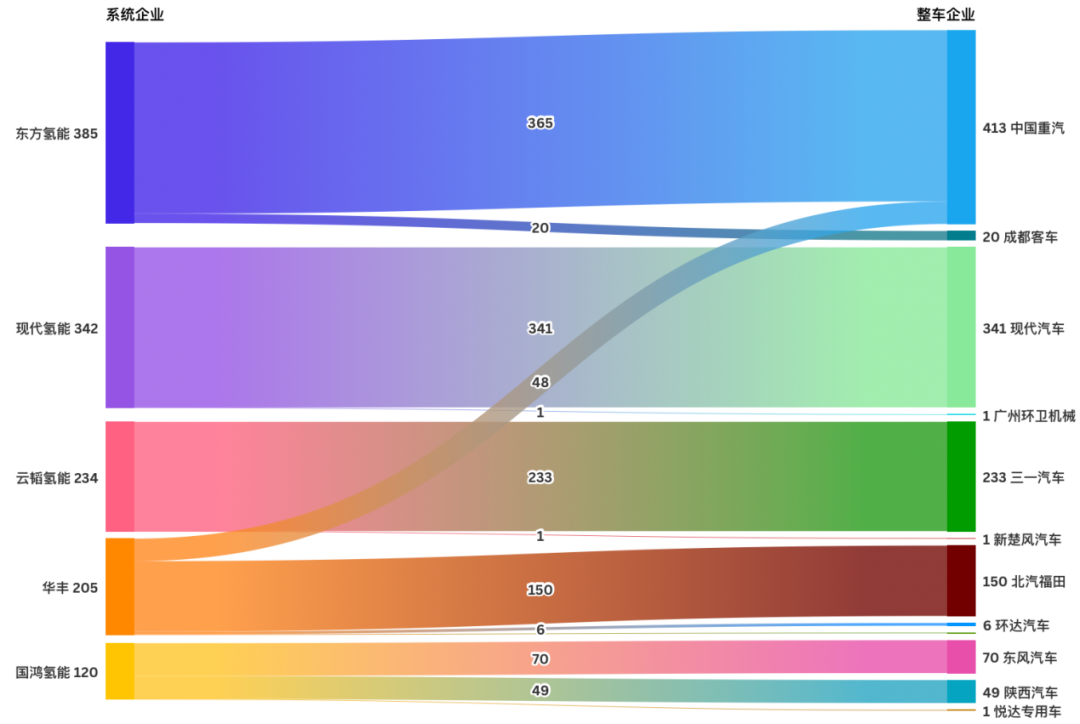

Regarding system enterprises supporting complete vehicle enterprises: Dongfang Hydrogen supports China National Heavy Duty Truck and Chengdu Bus. In the first half of 2025, Dongfang Hydrogen supplied 365 systems to China National Heavy Duty Truck, with a cumulative installed power of approximately 50.7MW, and 20 systems to Chengdu Bus, with a cumulative installed power of approximately 1.4MW.

Hyundai Hydrogen supports Hyundai Motor and Guangzhou Environmental Sanitation Machinery. In the first half of 2025, Hyundai Hydrogen supplied 341 systems to Hyundai Motor, with a cumulative installed power of approximately 30.7MW, and 1 system to Guangzhou Environmental Sanitation Machinery, with a cumulative installed power of 90kW.

Yuntao Hydrogen supports Sany Automobile and Xinchufeng Automobile. In the first half of 2025, Yuntao Hydrogen supplied 233 systems to Sany Automobile, with a cumulative installed power of approximately 27.1MW, and 1 system to Xinchufeng Automobile, with a cumulative installed power of 80kW.

Figure 8: Supporting Situations of Top 5 System Enterprises and Complete Vehicle Enterprises in the First Half of 2025

Data Source: Orange Hydrogen Energy Database

4

Regional Sales

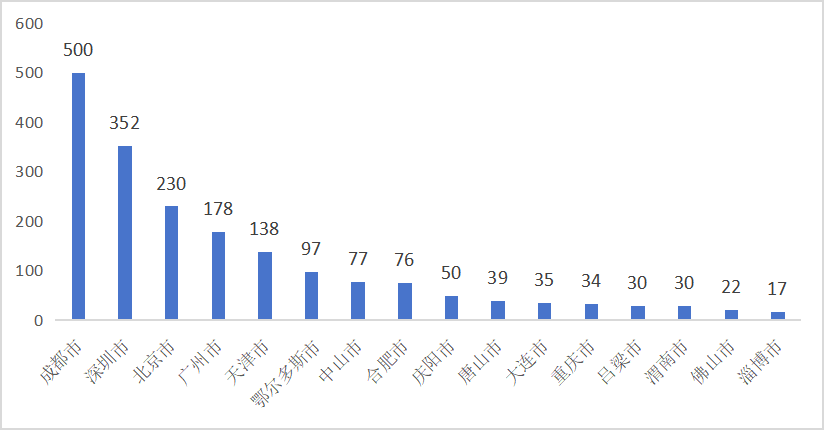

In terms of sales regions, fuel cell vehicles were sold in 33 cities in China in the first half of 2025. Chengdu led with 500 units sold, accounting for 25.4% of total sales, primarily due to listing and leading projects in 2024. Guangdong's early hydrogen vehicle demonstration tasks were not ideally completed, so it accelerated its promotion pace this year, with Shenzhen selling 352 hydrogen vehicles (ranking second) and Guangzhou selling 178 units (ranking fourth). Beijing sold 230 units, ranking third.

Figure 9: Top 15 Cities in Hydrogen Vehicle Sales in the First Half of 2025

Data Source: Orange Hydrogen Energy Database

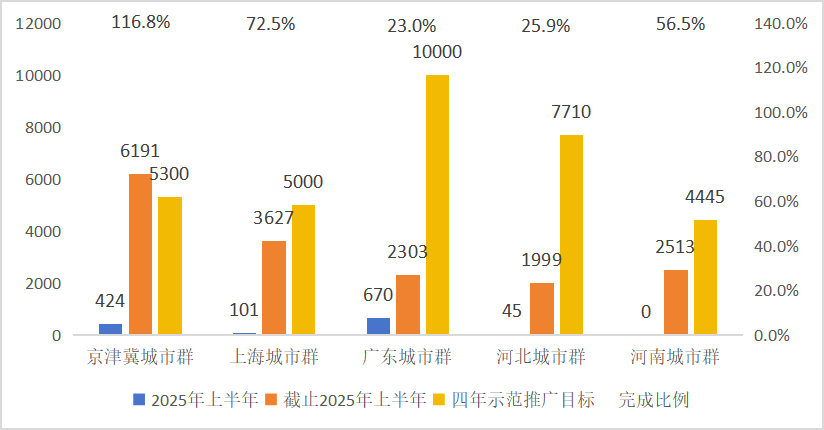

In the first half of 2025, sales in cities outside the fuel cell vehicle demonstration clusters amounted to 764 units, accounting for 38.9% of total sales. Among the demonstration clusters, the five major city clusters jointly promoted 1,201 units in the first half of 2025, with the Guangdong city cluster promoting the most at 670 units, followed by the Beijing-Tianjin-Hebei city cluster with 424 units.

As of the first half of 2025, the five major demonstration city clusters had jointly promoted 16,633 units, completing 51.2% of the four-year demonstration task. Among them, the Beijing-Tianjin-Hebei city cluster had promoted 6,191 units, exceeding its task. The Shanghai city cluster had promoted 3,627 units, completing 72.5% of its demonstration task, and the Henan city cluster had promoted 2,513 units, completing 56.5% of its demonstration task.

Figure 10: Number of Fuel Cell Vehicles Promoted, Targets, and Completion Ratios in Fuel Cell Vehicle Demonstration City Clusters

Data Source: Orange Hydrogen Energy Database