Qualcomm: Samsung's "blood transfusion" fails to sustain momentum, Apple's "sabotage" conceals hidden risks

![]() 05/07 2025

05/07 2025

![]() 595

595

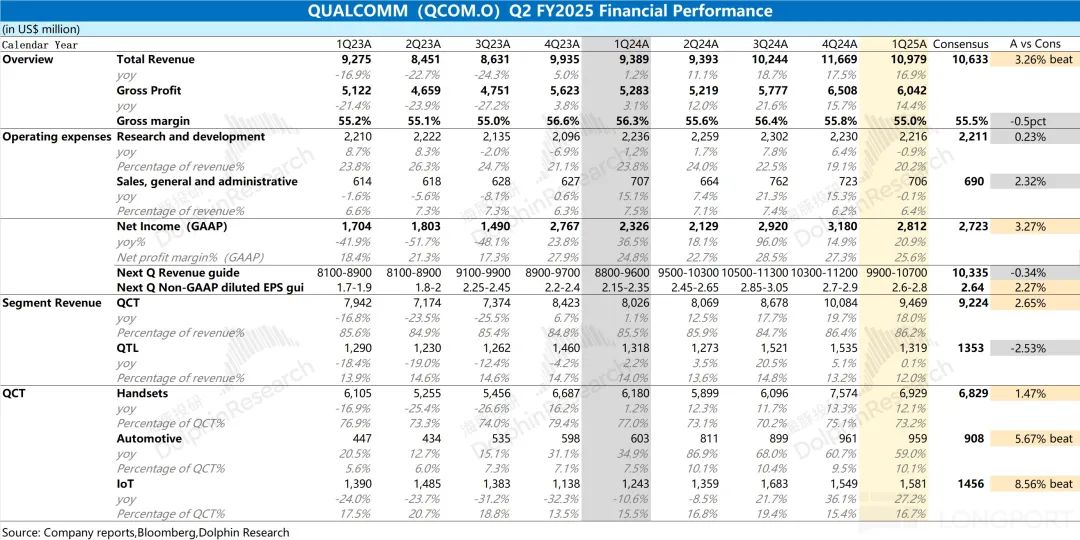

Qualcomm (QCOM.O) released its fiscal second-quarter 2025 financial report (ending March 2025) after the US market closed on the morning of May 1, 2025, Beijing time. The key points are as follows:

1. Overall performance: Revenue still grew, but gross margin remained low. Qualcomm reported revenue of $10.98 billion in the second quarter of fiscal 2025 (i.e., 25Q1), a year-on-year increase of 16.9%, exceeding market expectations ($10.63 billion). The company's revenue growth rate continued to increase this quarter, primarily benefiting from the growth of mobile phone, automotive, and IoT businesses within the QCT (semiconductor chip business); Qualcomm achieved a net profit of $2.81 billion this quarter, a year-on-year increase of 20.9%, exceeding market expectations ($2.72 billion), with growth mainly coming from revenue growth and cost control.

2. Business segments: Core business demand was relatively low. The mobile phone business remains the company's core business, accounting for over 60% of revenue. Considering the industry, even with the promotion of China's subsidy policies, global shipments of Android mobile phones were basically flat year-on-year. The growth of the company's mobile phone business this quarter mainly came from the increase in the company's share in Samsung's S25. In addition, the unexpected growth in automotive and IoT businesses was mainly driven by increased demand for smart cockpits, industrial products, and AI PCs.

3. Qualcomm's guidance: Expected revenue for the third quarter of fiscal 2025 (i.e., 25Q2) is $9.9-10.7 billion (market expectations of $10.33 billion) and adjusted earnings per share of $2.60 to $2.80 (market expectations of $2.64).

Dolphin's overall view: The financial report data is decent, but the guidance is relatively average.

Qualcomm's revenue growth this quarter was primarily driven by the growth of its QCT business. Among them, the company's mobile phone, automotive, and IoT businesses all showed varying degrees of growth this quarter, while the QTL business (technology licensing) remained basically flat year-on-year due to the impact of mobile phone sales in emerging regions.

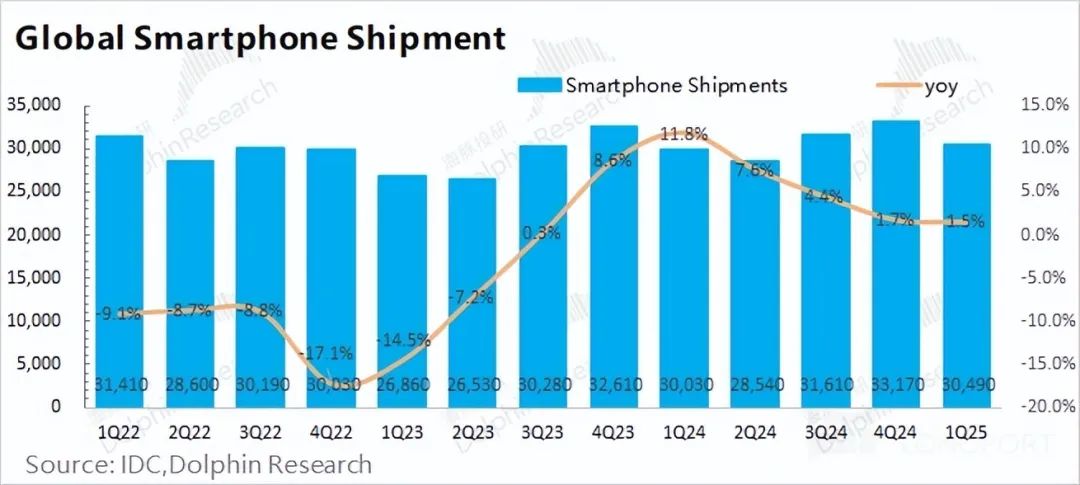

Specifically, the company's core mobile phone business, although it grew by double digits this quarter, mainly came from an increase in share in Samsung's S25 (from 70% to 100%). From an industry perspective, global mobile phone shipments only grew by 1.5% this quarter, while overall shipments of Android mobile phones were basically flat year-on-year. Even with the promotion of China's subsidy policies, shipments of Xiaomi, OV, and others did not show significant improvements in the first quarter, and overall demand in the mobile phone market remained low.

Compared to this quarter's data, the company's guidance for the next quarter is even more average. The company expects revenue of $9.9-10.7 billion in the next quarter, continuing to decline quarter-on-quarter. Although affected by seasonal factors, the company has failed to provide above-expectation guidance even with the promotion of subsidies in China.

Considering the company's guidance, the market remains concerned about the company's operational performance:

1) Apple's in-house 5G baseband chip: Apple launched the iPhone 16e this quarter, equipped with its in-house 5G baseband chip for the first time. This "test run" of Apple's in-house chip poses a risk of decline in Qualcomm's stable revenue from Apple in the future;

2) Chinese customer (HW): Qualcomm's agreement with its Chinese customer (HW) for QTL (technology licensing) has expired, and renewal negotiations are ongoing. Affected by Sino-US frictions, this may also impact the company's related revenue;

3) Mobile phone market demand: Although Qualcomm's increased share in Samsung's S25 has driven performance, overall demand in the mobile phone industry remains low. With little growth in the overall market, it will be difficult for the company to achieve above-expectation performance.

Overall, Qualcomm's financial report this time is not satisfactory and fails to eliminate market concerns about the company. With the mobile phone industry continuing to be sluggish, AI PCs have not yet achieved significant growth, and coupled with the risk of losing customers, the company's current operational performance will still face pressure. Specifically, the growth rate of the mobile phone business is expected to continue to fall to around 10% in the next quarter. The automotive business appears to still have a high growth rate, but this quarter has already shown negative quarter-on-quarter growth. Under such circumstances, if AI PCs do not take off in the second half of the year, the company's revenue growth rate may fall to single digits again.

From a short-term perspective, considering Qualcomm's current market capitalization of $164.2 billion, although the company's PE (for fiscal 2025) has fallen to around 15 times, if the company falls into single-digit growth again, such a valuation cannot be considered cheap. From a medium to long-term perspective, the market's main focus on the company lies in the recovery of the mobile phone business and the growth of AI PCs, with the latter bringing growth potential. If AI PCs fail to achieve significant growth and the mobile phone market slumps again, the company will struggle to inspire confidence in the market.

Below is a detailed analysis

I. Overall performance: Revenue still grew, but gross margin remained low

1.1 Revenue

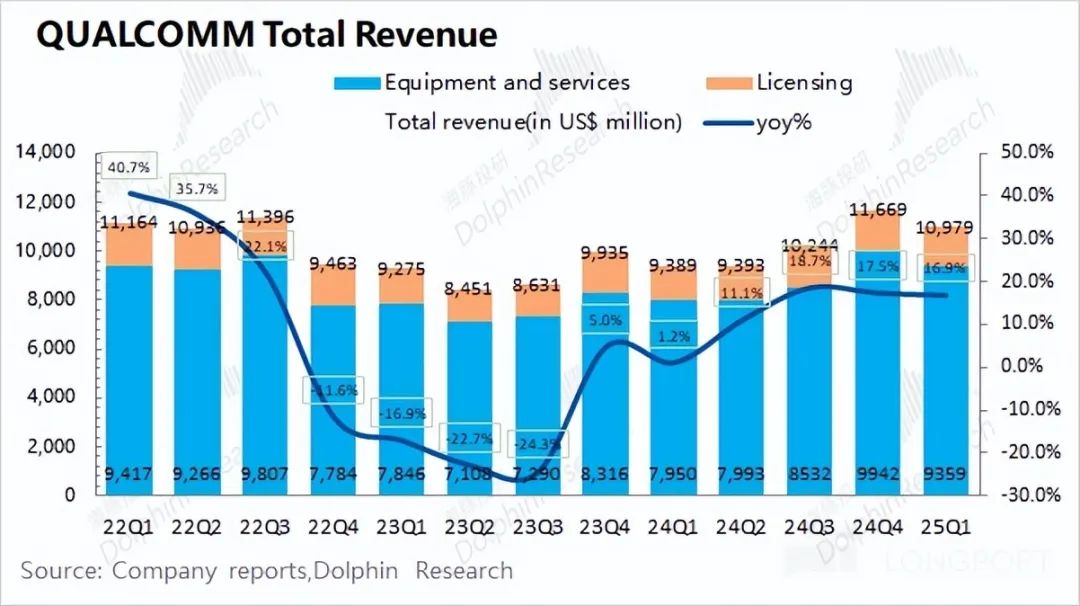

Qualcomm reported revenue of $10.98 billion in the second quarter of fiscal 2025 (i.e., 25Q1), a year-on-year increase of 16.9%, exceeding market expectations ($10.63 billion). The growth in the company's revenue this quarter was primarily driven by the growth of smartphone, automotive, and IoT businesses within the QCT (semiconductor chip business), while the QTL (technology licensing business) remained basically flat year-on-year.

For the next quarter, the company expects to achieve revenue of $9.9-10.7 billion, with growth primarily coming from the growth of Android mobile phones. Even with the promotion of China's subsidy policies, the company still faces a quarter-on-quarter decline in the next quarter, indicating that downstream demand remains relatively weak.

1.2 Gross margin

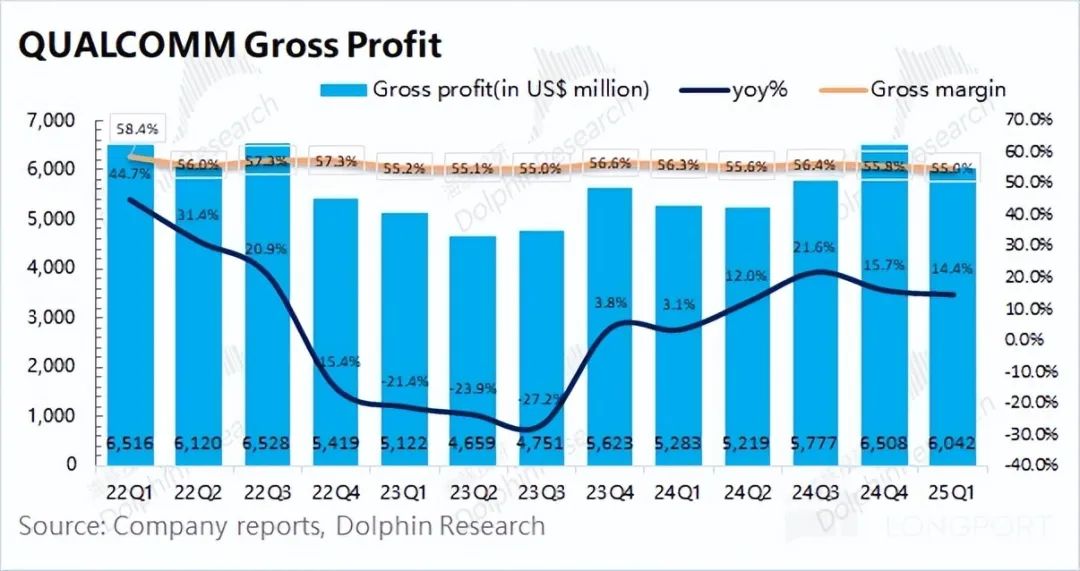

Qualcomm achieved a gross profit of $6.048 billion in the second quarter of fiscal 2025 (i.e., 25Q1), a year-on-year increase of 14.4%.

The company's gross margin this quarter was 55%, a year-on-year decline of 1.3 percentage points, below market expectations (55.5%). Affected by weak downstream demand for mobile phones, the company's current gross margin remains relatively low.

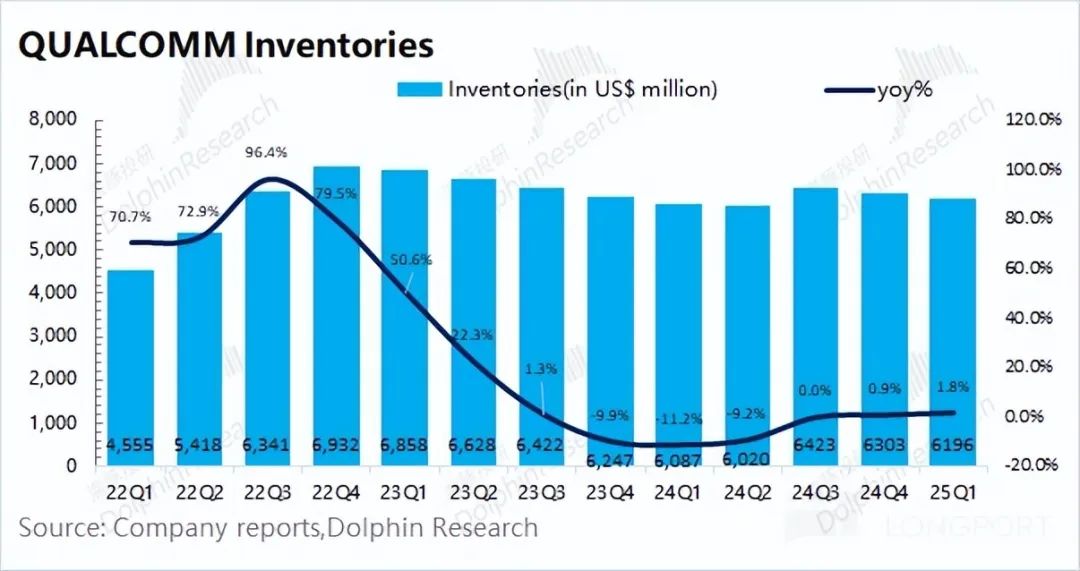

Qualcomm's inventory was $6.2 billion in the second quarter of fiscal 2025 (i.e., 25Q1), a slight year-on-year increase of 1.8%. The second half of the year is often a high point for the company's inventory preparation, and as downstream customers release new products, the company's inventory begins to be digested. Considering past data, Dolphin believes that the company's current inventory situation is relatively stable.

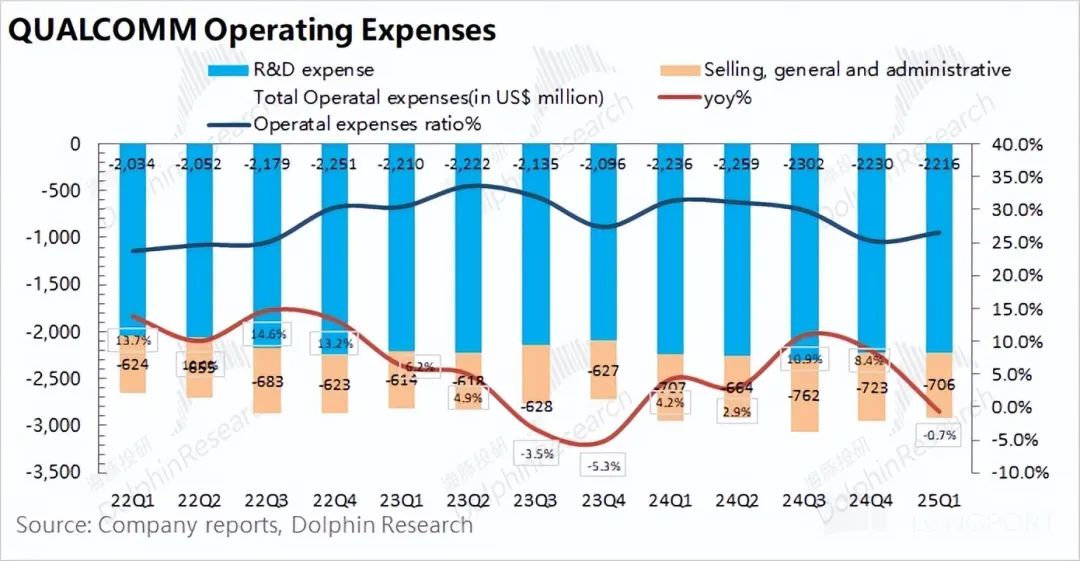

1.3 Operating expenses

Qualcomm's operating expenses were $2.92 billion in the second quarter of fiscal 2025 (i.e., 25Q1), a year-on-year decrease of 0.7%. With revenue growth, the reduction in expenses allowed the company to control its operating expense ratio at 26.6% this quarter.

Specifically, regarding expenses, the breakdown is as follows:

1) R&D expenses: The company's R&D expenses this quarter were $2.22 billion, a year-on-year decrease of 0.9%. Although R&D expenses remain the largest item of the company's investment, the company has controlled the R&D expense ratio at around 20%;

2) Sales and administrative expenses: The company's sales and administrative expenses this quarter were $710 million, a year-on-year decrease of 0.1%. Sales and other expenses are somewhat correlated with revenue, and the company still controlled related expenditures this quarter.

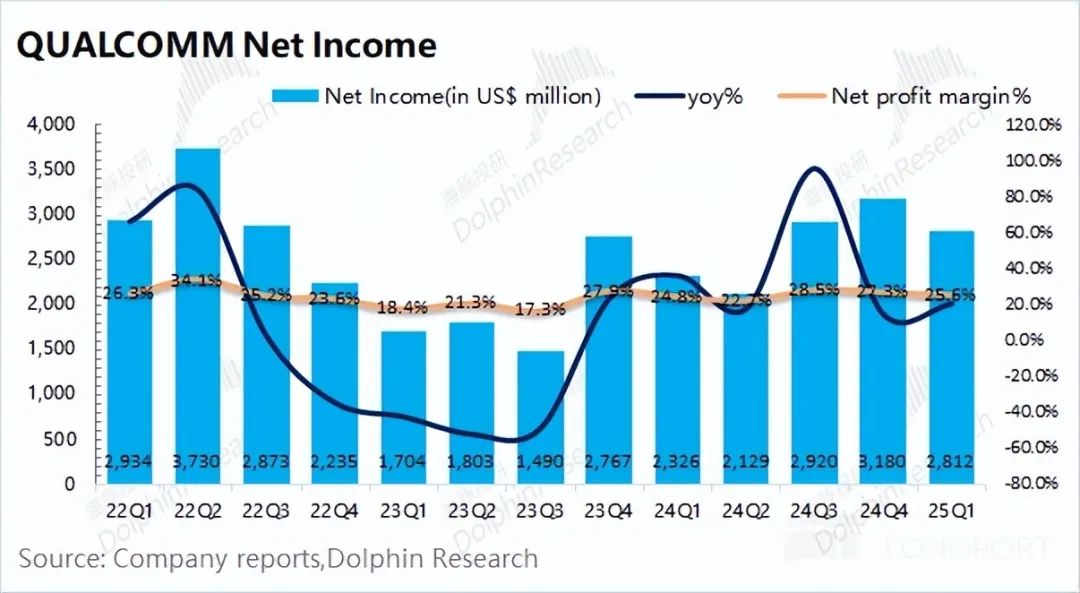

1.4 Net profit

Qualcomm achieved a net profit of $2.81 billion in the second quarter of fiscal 2025 (i.e., 25Q1), a year-on-year increase of 20.9%, exceeding market expectations ($2.72 billion). The net profit margin for this quarter was 25.6%.

After excluding the impact of non-operating factors such as investment income, the company's operating profit for this quarter was $3.12 billion, a year-on-year increase of 33%, mainly coming from revenue growth and cost control.

II. Business segments: Core business demand is relatively low

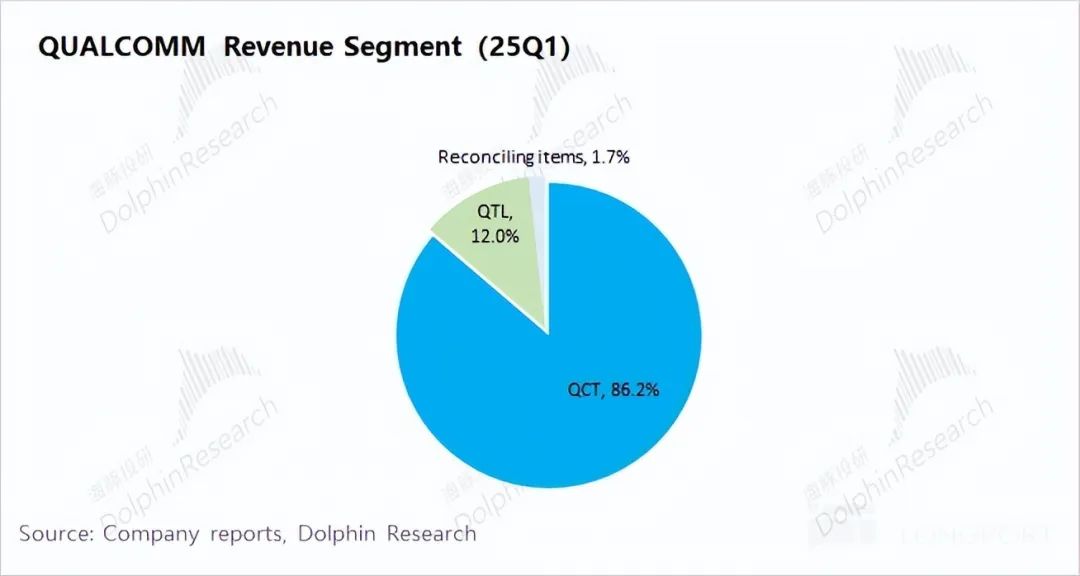

From Qualcomm's business segment perspective, QCT (CDMA business) remained the company's largest source of revenue this quarter, accounting for 86.2%, mainly including revenue from chip semiconductors; the rest of the revenue mainly came from the QTL (technology licensing) business, accounting for around 12%.

Qualcomm's main growth this quarter still came from the QCT business, with varying degrees of growth in mobile phone, automotive, and IoT businesses. The revenue of the QTL business this quarter remained basically flat year-on-year.

The QCT business is the most important part of the company. Specifically, the breakdown is as follows:

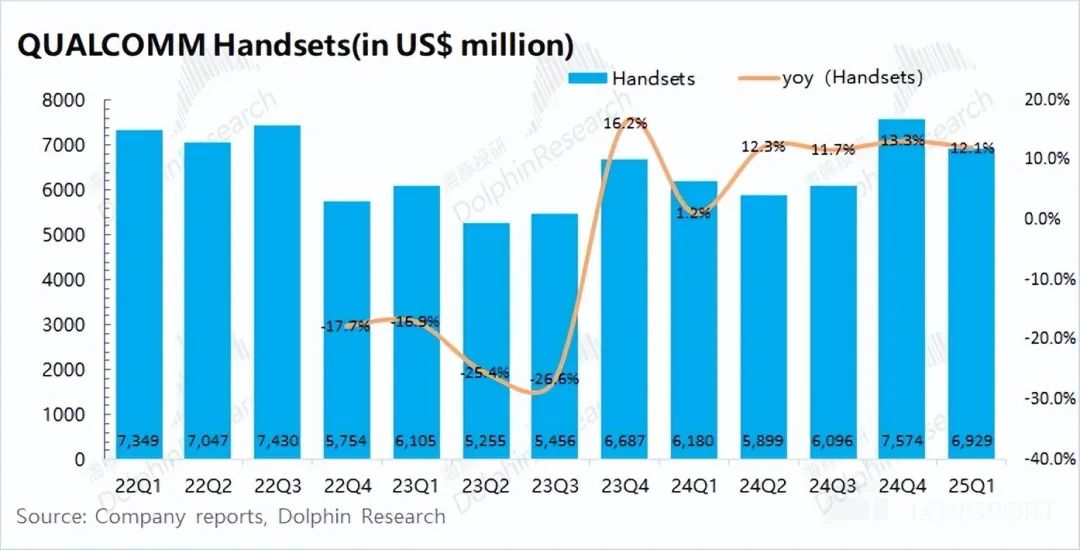

2.1 Mobile phone business

Qualcomm's mobile phone business achieved revenue of $6.93 billion in the second quarter of fiscal 2025 (i.e., 25Q1), a year-on-year increase of 12.1%, slightly exceeding market expectations ($6.83 billion). The growth this quarter mainly came from the increase in shipments of high-end Android mobile phones.

Although Apple was affected by seasonal factors, Samsung provided the main increment this quarter. Samsung's entire S25 series adopted Snapdragon chips, while Qualcomm's share in the S24 was approximately 70%. The increase in this share was the main source of growth for the company's mobile phone business this quarter.

Considering industry data, global smartphone shipments in the first quarter of 2025 were 305 million units, a year-on-year increase of 1.5%. Industry growth rates continued to maintain low single digits, and even with the promotion of China's subsidy policies, global demand for mobile phones remained relatively low.

Specifically, Apple's mobile phone shipments increased by 10% this quarter, while overall Android shipments were basically flat year-on-year. Among them, VIVO captured some market share from OPPO, while Xiaomi and Samsung both showed slight year-on-year growth. Since the company's customers are mainly from the Android ecosystem, and the overall performance of the Android ecosystem was average this quarter, the growth in the company's mobile phone revenue mainly came from an increase in share.

2.2 Automotive business

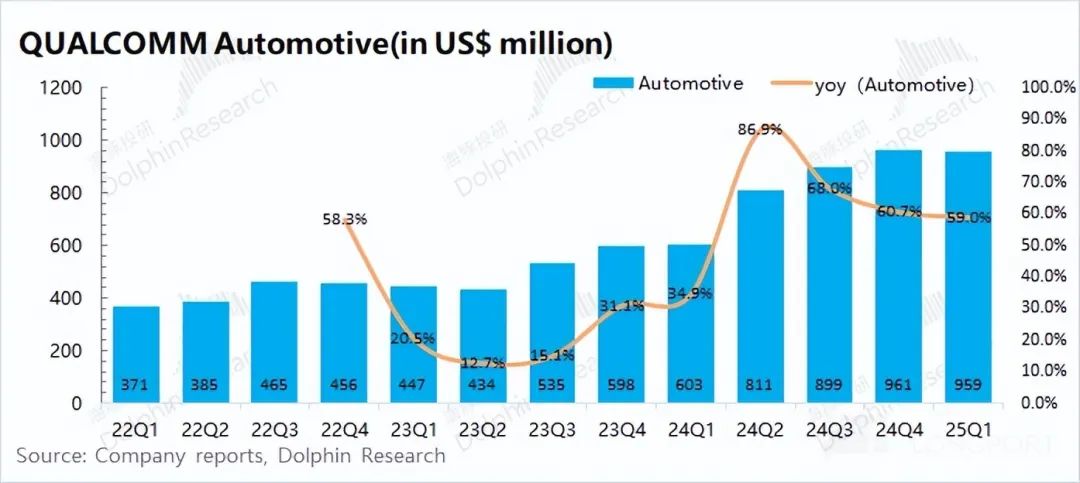

Qualcomm's automotive business achieved revenue of $960 million in the second quarter of fiscal 2025 (i.e., 25Q1), a year-on-year increase of 59%, exceeding market expectations ($910 million). The automotive business remains the fastest-growing business segment of the company, setting a new high for the seventh consecutive quarter. As automakers adopt the company's high-performance, low-power computing and connectivity chips, digital cockpits in newly launched vehicles drove growth this quarter.

Driven by downstream demand for products such as digital cockpits, the company maintains its revenue target of $8 billion for the fiscal year 2029 for the automotive business. In this quarter, the company secured 30 new design orders, including five advanced driver assistance systems (ADAS) projects and projects from Chinese automakers (such as NIO, ZEEKR, Great Wall, Dongfeng, etc.).

Driven by demand for automotive intelligence and other factors, the company expects the automotive business to grow at a year-on-year rate of 20% in the next quarter.

2.3 IoT business

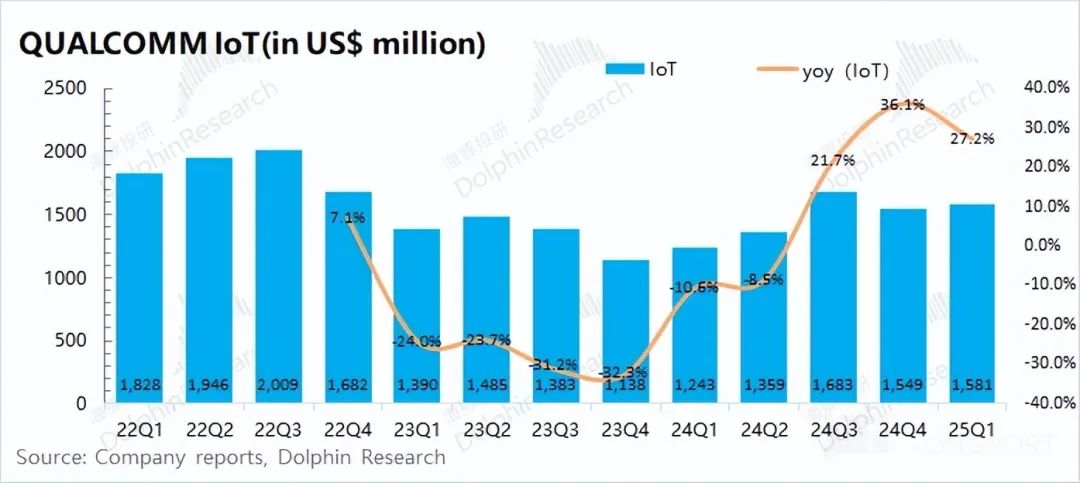

Qualcomm's IoT business achieved revenue of $1.58 billion in the second quarter of fiscal 2025 (i.e., 25Q1), a year-on-year increase of 27.2%, exceeding market expectations ($1.46 billion). After experiencing a trough, the company's IoT business maintained double-digit growth.

In Qualcomm's IoT business, it mainly includes consumer electronics, edge network products, and industrial products. The IoT business rebounded this quarter, with growth across all three major segments, with the industrial sector being the largest source of growth for the quarter.

For the AI PC segment, which is also a major focus of the market on IoT business, the company still maintains its target of achieving $4 billion in fiscal year 2029 revenue. Since the launch of the first Snapdragon X-series PC device in mid-2024, over 85 designs have been put into production or development, with plans to commercialize over 100 models by 2026. Combined with market data, the company's products accounted for approximately 9% of the US retail market and the $600+ Windows laptop market in the top five European countries in the PC market this quarter.

Driven by the recovery in demand for industrial products and the growth of AI PCs, the company expects IoT business to achieve 15% growth in the next quarter.

- END -