Applovin: Short Sellers Rotate, Yet Fail to Match Robust Performance

![]() 05/08 2025

05/08 2025

![]() 487

487

After the U.S. market closed on May 7, Eastern Time, Applovin unveiled its Q1 2025 financial report. Amidst the pressure of five bearish reports, Applovin robustly countered short sellers with an "anticipated yet surprising" outstanding performance.

Specifically:

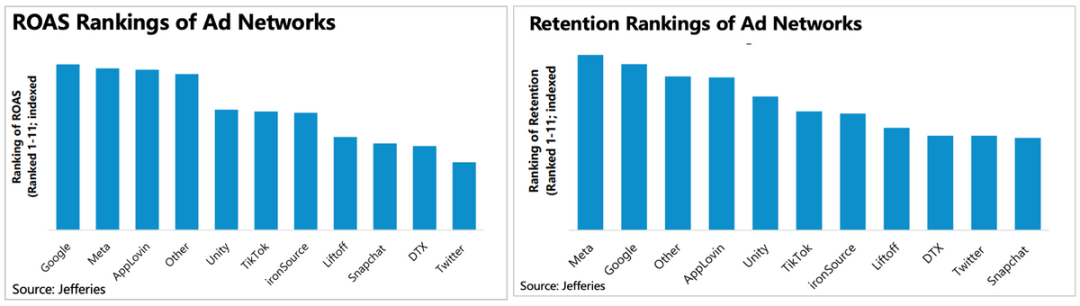

1. Robust Guidance and E-commerce Growth Against the Trend: For Dolphin Insights, our primary focus is on Applovin's guidance. Despite the deluge of bearish reports, their impact on actual performance may not be substantial. For customers, it's all about their Return on Advertising Spend (ROAS).

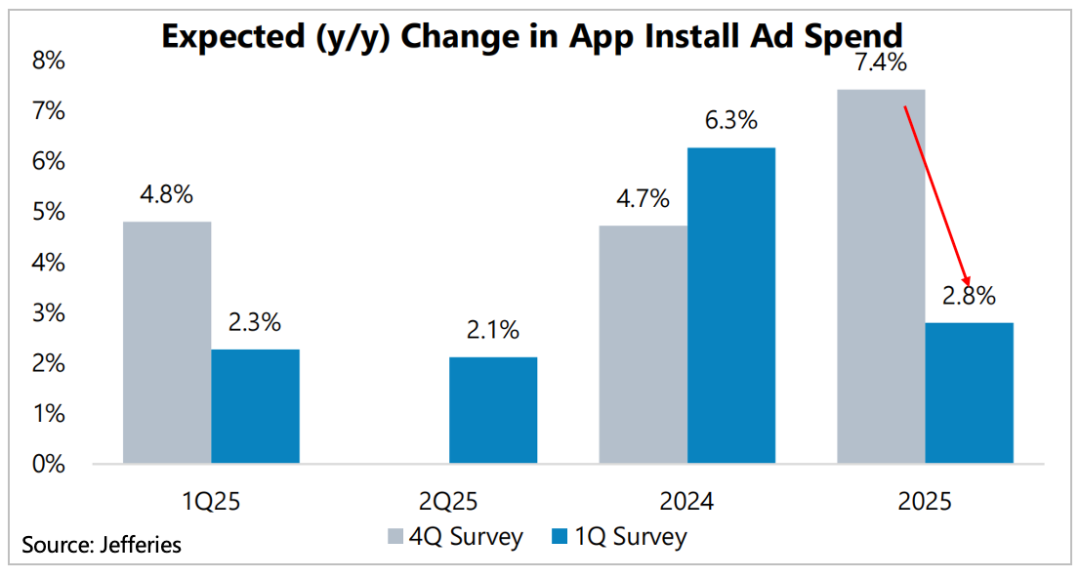

Since the start of the year, there have been shifts in the industry and macroeconomic environment. In gaming, developers still prefer in-app purchases over advertising monetization; macroeconomic factors are mainly constrained by tariffs, which isn't favorable for Applovin, which is emphasizing its e-commerce narrative this year.

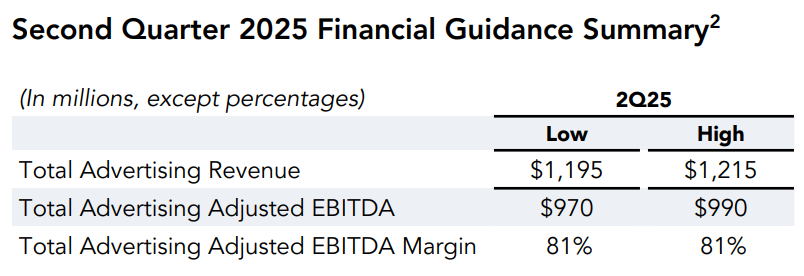

However, the company's revenue guidance for Q2 (excluding sold proprietary apps, only including prior "software services revenue," i.e., advertising revenue) implies a growth rate in the range of 68-71%, showing minimal slowdown from Q1.

Combining market expectations and Dolphin Insights' own estimates (for reference only):

(1) It is estimated that Q1 e-commerce advertising revenue surpassed $200 million, with nearly 200% quarter-over-quarter growth, indicating smooth progress. Other advertising revenue, primarily from gaming, increased by 37% year-over-year. Compared to the single-digit growth in the industry, where peers are under pressure (Meta mentioned a significant slowdown in Q1 gaming advertising revenue; Unity Grow's revenue in this segment declined by 4% despite incremental contributions from Vector), Applovin continues to maintain an absolute advantage.

(2) It is estimated that Q2 e-commerce revenue will approach $300 million, representing another 30-50% quarter-over-quarter growth, with other advertising revenue, mainly from gaming, growing at a rate close to 30%. Needless to say, Applovin remains the industry leader.

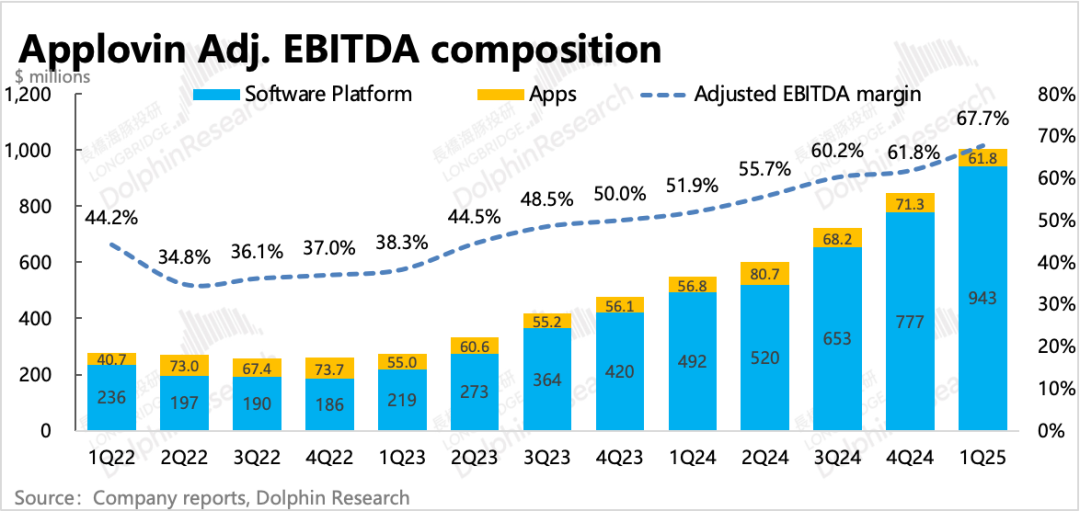

2. Profitability Surpasses Expectations: Revisiting the current quarter's performance, revenue exceeded consensus expectations by nearly $100 million, driven by advertising. EBITDA margin improved to 68%, a 7 percentage point increase quarter-over-quarter.

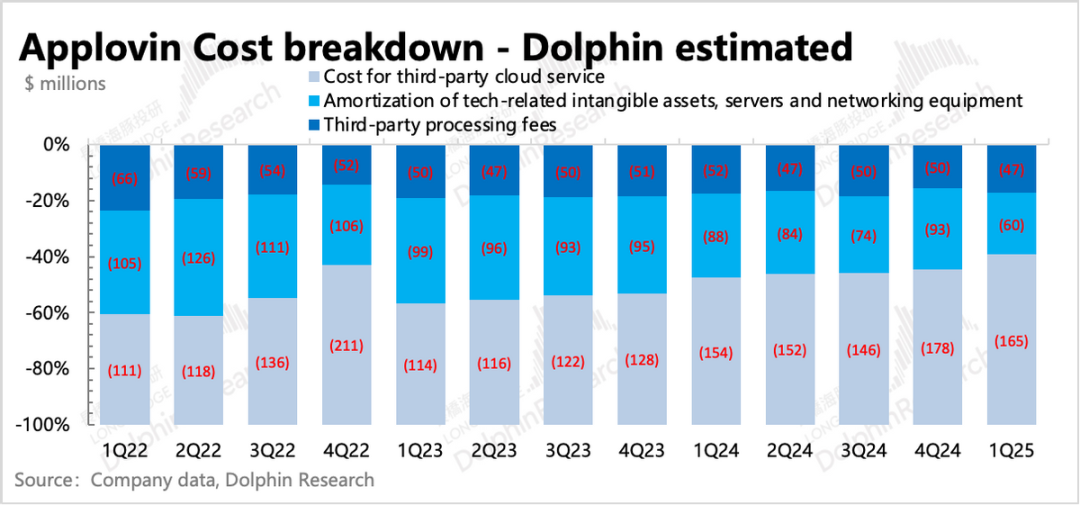

The increase in profitability is primarily due to the business structure leading to a gross margin closer to that of advertising, coupled with a significant reduction in operating expenses. The expense optimization may primarily stem from personnel optimization (restructuring costs such as severance compensation of $6.6 million) in the proprietary app business (1P game studio) and lower server bandwidth costs (a nearly 40% quarter-over-quarter decrease).

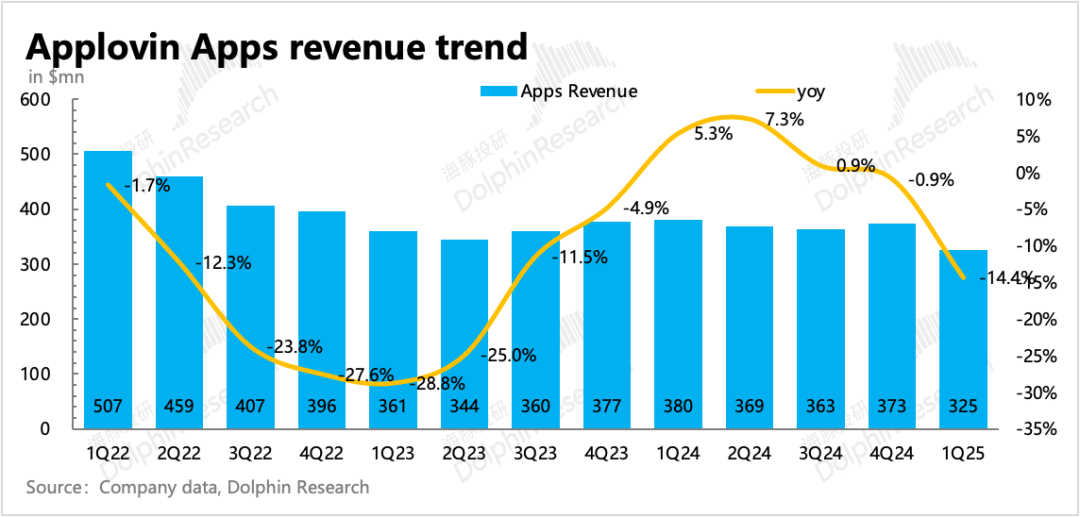

In early May, the proprietary app business (1P games) was sold to Tripledot Studios (a casual mobile game company focusing on card, puzzle, match-3, and other genres) for $400 million in cash and the purchase of a 20% stake in Tripledot. With Tripledot reportedly valued at approximately $1.4 billion USD, this transaction implies a consideration close to $700 million, a discount from the $900 million valuation given in the previous quarter. This transaction involves an impairment of goodwill of nearly $190 million.

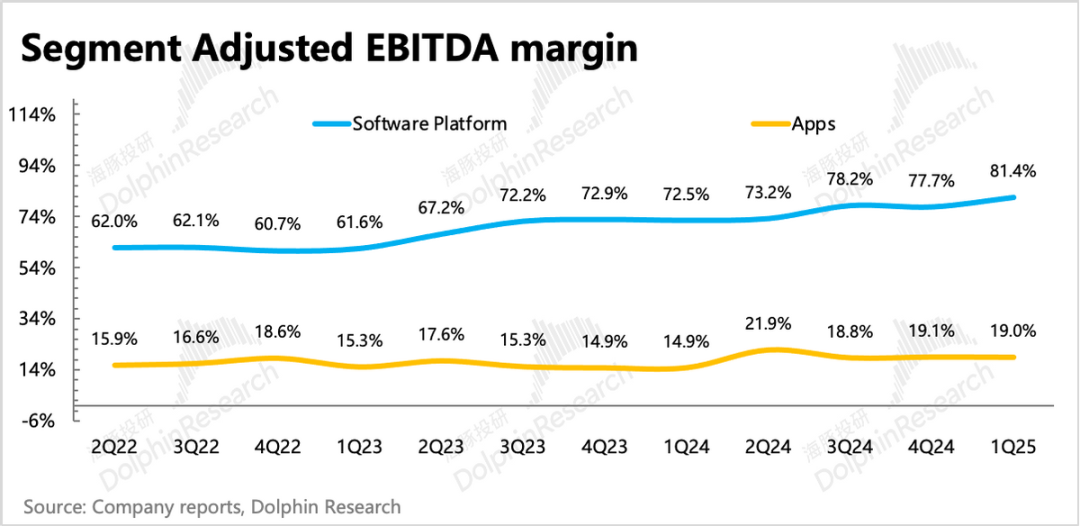

According to the Q2 guidance, after the successful divestiture of the proprietary app business in May, overall profitability will primarily reflect the advertising business. Compared to Q1, the EBITDA margin for the advertising business remains at 81%. This margin is already high, making further improvement challenging.

Therefore, subsequent profit growth will largely depend on business expansion.

3. Increased Share Repurchases to Support Stock Price: During the period when the stock price plummeted due to bearish attacks, the company was not idle but increased funds for share repurchases. In Q1, $1.2 billion USD (including fees and withholding taxes) was spent on repurchases, equivalent to 40% of last year's total, with a total of 3.4 million shares repurchased and cancelled. As of the end of Q1, the total number of shares was 338 million, slightly down from the end of last year.

Judging from the company's net cash and free cash flow, assuming that the repurchase amount this year synchronizes with profit growth, i.e., approaching $4 billion USD in repurchases, the shareholder return rate for the current market capitalization would be 3.8%. For a company still growing at a high speed, this is very rare.

Dolphin Insights believes that, compared to using funds for shareholder returns, we would prefer Applovin to invest in business operations to sustain growth. After all, the current valuation is primarily supported by the high-growth narrative.

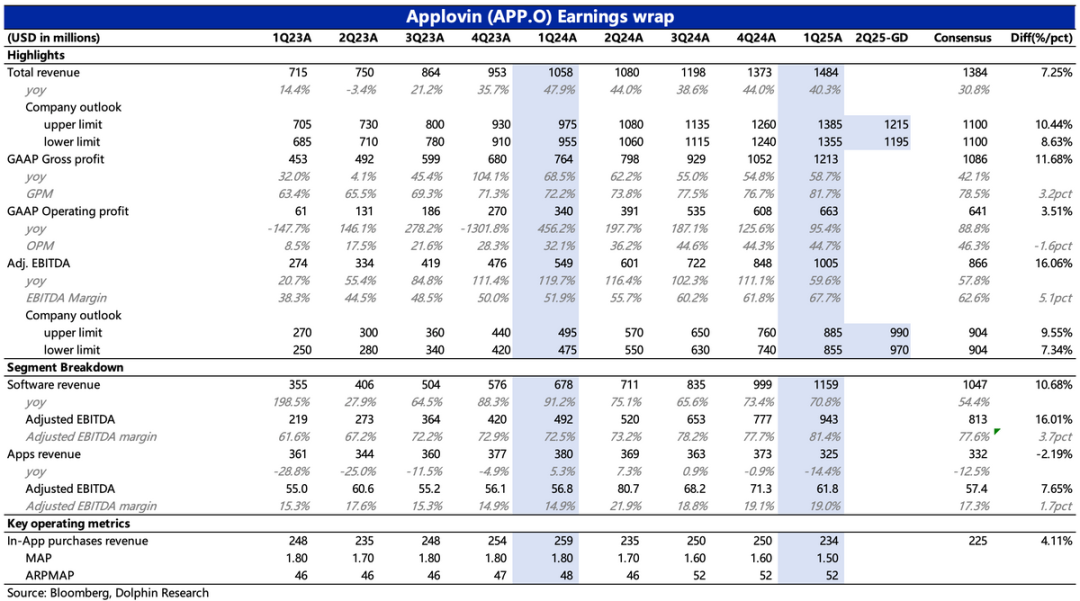

4. Overview of Key Financial Indicators

Dolphin Insights' Perspective

This is a report card that is both anticipated and surprising.

Saying it's "anticipated" means that due to "stable gaming advertising position + aggressive e-commerce advertising," Dolphin Insights did not doubt that Applovin would have impressive performance in Q1, essentially unaffected by bearish reports.

Saying it's "surprising" means that we did not anticipate such robust actual performance, not only in terms of advertising revenue but also in terms of a significant improvement in profitability. Additionally, the Q2 advertising revenue guidance also exceeded our expectations, with growth rates showing minimal slowdown. This is undoubtedly very resilient in the current macroeconomic environment. Comparing it to Unity, it's evident that happiness and sorrow cannot coexist.

However, the "shadow" of being shorted still lingers. Although business activities, as long as they are not illegal, are market-based choices regardless of whether customers approve or competitors snipe, funds have somewhat lost their fascination with Applovin's high ROAS after the technical black box was exposed by short sellers, especially the AI attribute bonus, which has become a key stumbling block preventing Applovin from reaching the "mythical" valuation of Palantir.

Before the financial report, although Applovin had recovered a market capitalization of $100 billion, the strong performance announcement only led to a 14% increase after-hours, which is significantly weaker than the market feedback following previous earnings beats. This indicates that Applovin has been somewhat weakened by several rounds of bearish reports; otherwise, a 20% increase in valuation before the financial report (implying a 2025 Non-GAAP EV/EBITDA of 20x) would not have been exaggerated.

Regarding the growth trend reflected in Q1, Dolphin Insights expects e-commerce advertising revenue to approach $1 billion USD this year. If other traditional advertising continues to grow at an endogenous rate of 20-25%, then total advertising revenue is expected to be $4.8-5.1 billion USD for the year. By analogy, advertising revenue is expected to reach $6.2 billion USD in 2026, assuming an Adj. EBITDA margin of 80%, i.e., approximately $5 billion USD in EBITDA profit. The after-hours increase to $116 billion USD corresponds to a 2026 EV/EBITDA of 23x. Although compared horizontally, Applovin's valuation is higher than most advertising peers, it is still on the low side when matched with short-term growth rates (three-year CAGR of 25%-30%).

Detailed Analysis Below

I. Ignoring Short Sellers' Pressure, E-commerce Progress Exceeds Expectations

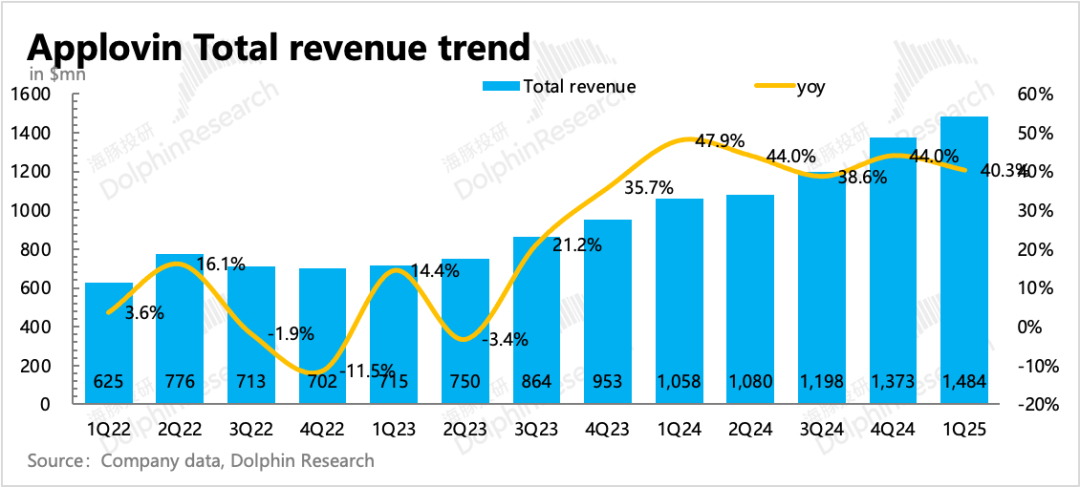

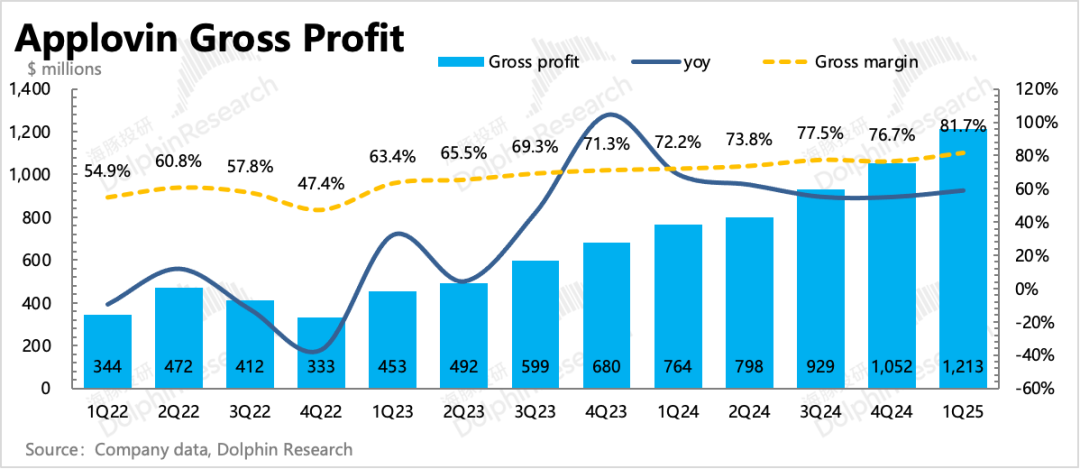

In Q1, Applovin achieved total revenue of $1.48 billion USD, a year-over-year increase of 40%, with growth slightly slowing down from the previous quarter due to a high base. Market expectations were in line with the guidance upper limit of $1.385 billion USD, so the actual performance undoubtedly beat expectations.

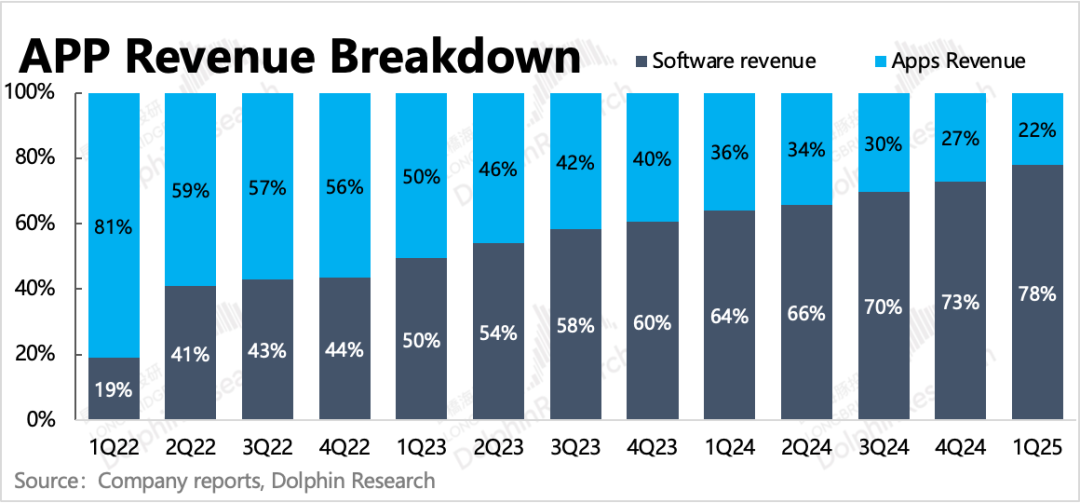

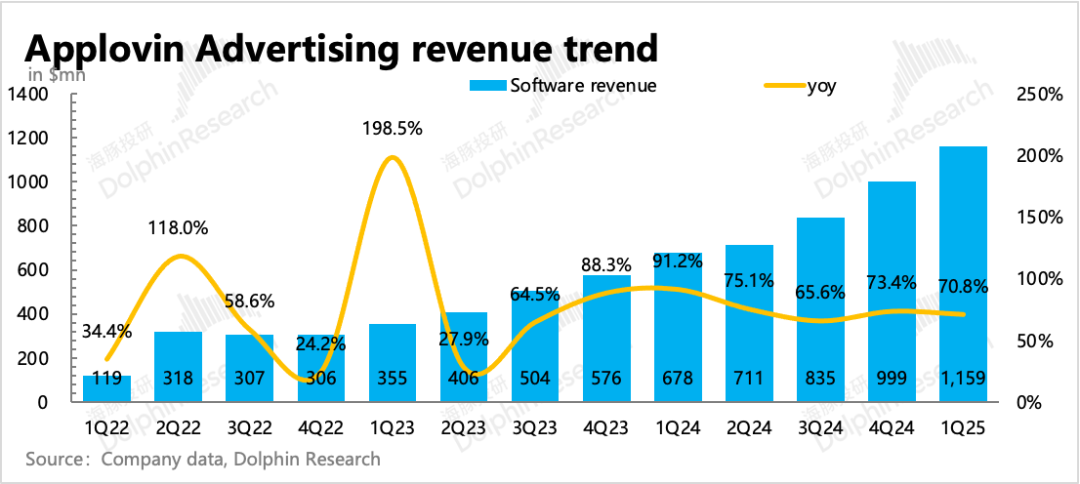

Among them, advertising revenue (formerly software services revenue), which accounts for the majority, continued to grow at a rate of 71%, achieving revenue of $1.16 billion USD, which was also the main area exceeding expectations. Proprietary app revenue was lower than expected, but it was already divested in May, so the current period was mainly focused on proactive contraction.

Despite the addition of e-commerce, 90% of advertising revenue still comes from gaming, general software, etc. However, the gaming market has experienced low growth for a long time, and since the second half of last year, as advertising CPMs have been raised by thriving industries such as e-commerce, affecting ROI, gaming companies have shifted their focus from advertising to paid in-app purchases.

The marginal weakness in consumer spending in Q1 exacerbated advertisers' expectations adjustments. According to institutional research, compared to the end of last year, game developers' budget increases for acquiring customers through advertising this year have declined significantly, shifting again from high single-digit growth to low single-digit growth.

Peers' performance seems to align more closely with industry trends. For example, Unity mentioned that although Vector brought incremental growth, the traditional segment still declined. Meta also stated in its Q1 earnings call that the trend of gaming advertising spending has slowed down significantly. The April tariff confrontation, in addition to making the macroeconomic environment increasingly uncertain and further affecting gaming advertisers' expectations, also directly impacted the realization of Applovin's e-commerce story, which it began telling this year.

However, Applovin seems to be living in another world, where not only is the progress of e-commerce relatively smooth, but the growth rates of traditional businesses such as gaming are also significantly higher than those of peers. Dolphin Insights estimates based on market and our own expectations:

(1) It is estimated that Q1 e-commerce advertising revenue surpassed $200 million, with nearly 200% quarter-over-quarter growth, indicating smooth progress. Other advertising revenue, primarily from gaming, increased by 37% year-over-year, solidly outperforming the competition.

(2) It is estimated that Q2 e-commerce revenue will approach $300 million, representing another 30-50% quarter-over-quarter growth, with other advertising revenue, mainly from gaming, growing at a rate close to 30%. Needless to say, Applovin remains the industry leader.

II. Sale of 1P Games, Officially Transforming into an Advertising Platform That "Earns Easy Money"

In Q1, the company achieved an overall EBITDA margin of 67.7%, exceeding market expectations. The main difference from expectations came from Applovin's aggressive efficiency enhancement measures before the final sale of the 1P game business, making the company's overall profit margin level increasingly close to that of advertising.

For example, from the financial data, it can be seen that in Q1, there was personnel optimization in the proprietary app business (1P game studio) (restructuring costs such as severance compensation of $6.6 million USD) and lower server bandwidth costs (a nearly 40% quarter-over-quarter decrease) after closing some 1P games.

In early May, the proprietary app business (1P games) was sold to Tripledot Studios (a casual mobile game company focusing on card, puzzle, match-3, and other genres) for $400 million in cash and the purchase of a 20% stake in Tripledot. With Tripledot reportedly valued at approximately $1.4 billion USD, this transaction implies a consideration close to $700 million, a discount from the $900 million valuation given in the previous quarter. This transaction involves an impairment of goodwill of nearly $190 million.

Looking solely at the profitability of the advertising segment, it is still improving quarter-over-quarter. However, according to the Q2 guidance, the advertising EBITDA margin remains at the Q1 level, i.e., 81%, which is already relatively high, leaving little room for further improvement.

- END -