Geely Zeekr Exits NYSE, Joins Geely: New Energy Integration Reaches Critical Phase

![]() 07/18 2025

07/18 2025

![]() 635

635

On July 15, Geely Automobile and Zeekr Intelligence Technology finalized a merger agreement, leading to Zeekr's delisting from the New York Stock Exchange (NYSE) and becoming a wholly-owned subsidiary of Geely Automobile. This two-year-long capital integration not only marks the full implementation of Geely Holding Group's "Taizhou Declaration" strategy but also signifies that the in-depth integration of China's new energy automotive industry has entered a crucial stage.

As the new energy sector shifts from "rampant growth" to "stock market competition," the reorganization of resources and strategic collaborations among enterprises have become vital for breaking stalemates. Through equity restructuring, organizational realignment, and resource coordination, Geely aims to establish more efficient competitiveness in technology, branding, and globalization under the banner of "One Geely."

▍The "Two Horizons" Layout Overcomes Brand Overlap Challenges

The merger between Geely and Zeekr is a comprehensive project encompassing equity structure adjustments and governance system optimizations. Earlier this year, Zeekr and Lynk & Co. merged to form Zeekr Technology Co., Ltd., and now Geely is merging with Zeekr Technology. Before the merger, Geely Automobile already held a 65.7% stake in Zeekr. This time, it achieved 100% ownership through a combination of cash and equity swaps, with a total valuation of approximately RMB 17.2 billion. The cash component of $2.687 per share plus 1.23 new Geely shares for each share swapped represents an 18.9% premium over Zeekr's closing price on the last trading day of the non-binding offer letter and a 25.6% premium over the volume-weighted average price for the 30 trading days preceding that date.

Geely Group stated that this design balances cash flow pressure with shareholder equity: The cash component ensures immediate returns for Zeekr's original shareholders, while the equity swap strengthens Geely Automobile's equity concentration, facilitating the direct incorporation of Zeekr's financial data into the listed company's reports. This further increases the proportion of new energy business in overall revenue and injects new momentum into the restructuring of Hong Kong stock valuation.

Post-merger, Geely's passenger vehicle segment swiftly reconstructed the "Two Horizons" framework: The "Geely Automobile Group" integrates brands such as Geely, Yinhe, and Radar, focusing on the mainstream market of RMB 100,000-200,000; the "Zeekr Technology Group" oversees Zeekr and Lynk & Co., targeting the high-end luxury new energy market above RMB 300,000.

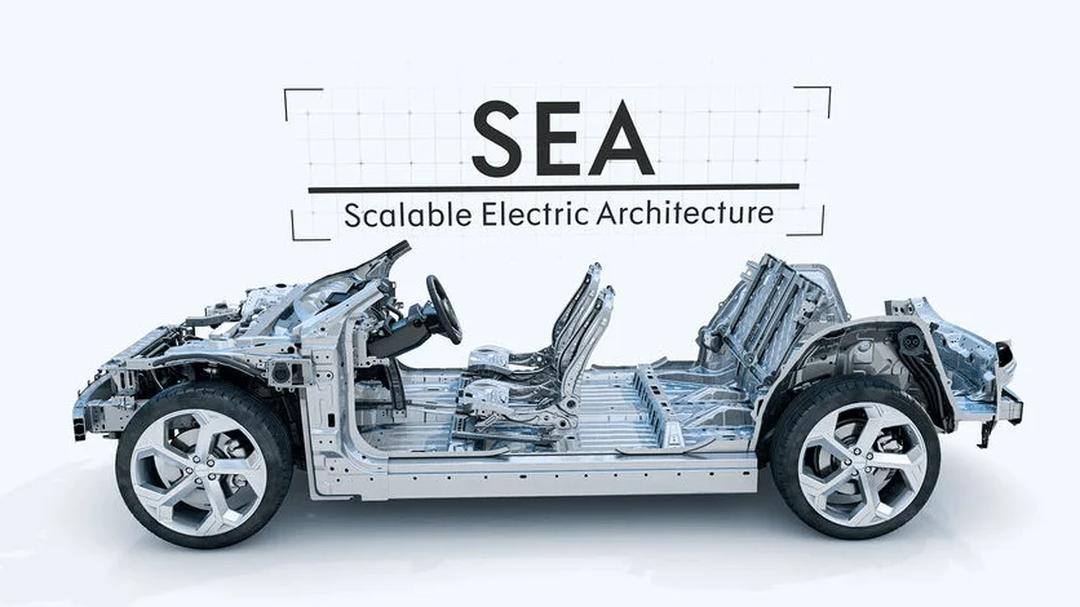

This "Two Horizons" layout forms a complementary relationship through brand positioning. Zeekr emphasizes the intelligent pure electric high-end market with its SEA boundless architecture as the core; Lynk & Co. caters to young and personalized demands above RMB 200,000, relying on the CMA architecture and hybrid technology; Geely Yinhe consolidates its cost-performance advantage in the mainstream market with its Leishen hybrid and intelligent cockpit technology. Together, they form a comprehensive product matrix spanning the price range of RMB 100,000-800,000, resolving the issues of positioning overlap and internal resource consumption caused by independent brand operations in the past.

At the organizational level, Geely simultaneously promotes centralized management of technological resources and supply chains. The Group has established a unified technology research institute to coordinate research and development in core areas such as intelligent driving, infotainment systems, and EV technologies, avoiding redundant investments across brands. Simultaneously, it has set up a supply chain company to integrate procurement needs for batteries, chips, raw materials, etc., reducing costs through large-scale bargaining.

Data shows that after the merger of Zeekr and Lynk & Co., R&D costs decreased by 10%-20%, and supply chain costs fell by 5%-8%. This synergistic effect translated into rapid product iterations in the first half of 2025 – for instance, the development cycle of Geely Yinhe L7, based on the SEA architecture, was shortened by 30%, costs were reduced by 15%, and sales exceeded 20,000 units in the first month of launch.

▍Strategic Transformation Driven by the "Taizhou Declaration"

The "Taizhou Declaration," released in September 2024, is the cornerstone of Geely's current integration efforts. This document, with the keywords "strategic focus, integration, and collaboration," directly points to the survival rules for Chinese automakers in the second half of the new energy era. As the industry shifts from "policy-driven" to "market-driven" and from "incremental competition" to "stock market competition," enterprises must bid farewell to the extensive model of "having more children to fight better" and turn to refined competition characterized by "precise force and ecological win-win."

The first core of the "Taizhou Declaration" is "strategic focus" – bidding farewell to the "blooming everywhere" brand strategy of the past decade, concentrating resources on the development of intelligent electric technology, and returning to "One Geely." In the past, Geely captured niche markets by nurturing multiple sub-brands such as Zeekr, Lynk & Co., Geometry, and Efin, but this also led to resource dispersion. Zeekr focused on pure electric high-end products, Lynk & Co. delved into hybrid technology for younger consumers, Geometry targeted the RMB 100,000 market, and Efin deployed in the MPV sector. While seemingly comprehensive, internal competition was fierce.

In November 2024, Zeekr completed the acquisition of a 51% stake in Lynk & Co., ending parallel competition between the two high-end brands; in January 2025, brands such as Efin and Radar were integrated into Geely Yinhe, forming a full-category matrix of "sedans, SUVs, MPVs, and pickup trucks." This "contraction-focused" approach has achieved initial results: In the first half of 2025, Geely's new energy penetration rate increased from 52% in 2024 to 73%, with sales growing by 73% year-on-year, exceeding the industry's average growth rate.

If "strategic focus" resolves the problem of resource dispersion, "technological collaboration" builds a deeper competitive barrier. Technologies such as Zeekr's SEA boundless architecture, Kirin battery, and intelligent cockpit system are no longer limited to a single brand but have become a shared resource pool for the entire Geely lineup.

Taking the SEA architecture as an example, this platform was originally exclusive to Zeekr. After integration, Geely Yinhe series models developed based on the SEA architecture can directly reuse the EV powertrain, chassis technology, and electronic and electrical architecture, shortening the development cycle by 30% and reducing costs by 15%. At the supply chain level, Geely has unified its Golden Brick battery and Shield short-blade battery businesses under the "Shield Golden Brick Battery" brand, reducing raw material costs through large-scale procurement while deepening cooperation with CATL to strengthen upstream bargaining power.

The construction of this technological ecosystem enabled Geely to launch the "Thousand Miles Boundless" all-domain intelligent driving solution in the first half of 2025, covering models priced from RMB 100,000 to 800,000, realizing "technology feeding back to all brands."

'Global Breakthrough' is the third pillar of the "Taizhou Declaration." Zeekr's delisting and integration imply adjustments to Geely's globalization strategy: Previously, Zeekr's listing in the US faced dual pressures of regulatory risks for Chinese stocks and low valuation. After delisting, its resources can be more flexibly invested in overseas markets such as Europe and the Middle East.

Post-merger, Geely plans to combine Zeekr's overseas channels with local manufacturing capabilities, aiming to enter 50 countries by 2025 and establish localized production bases in Europe. Simultaneously, by integrating overseas resources from brands such as Volvo and Polestar, Geely attempts to build a closed loop of "Chinese R&D, global manufacturing, and local services" – Zeekr 009's pricing strategy in the European market will be optimized by Volvo's local team; Lynk & Co.'s channel network in the Middle East will be shared with Geely Yinhe's new energy models. This global layout not only enhances Geely's overseas market share but also gradually establishes its discourse power in the global new energy industrial chain through technology exports and brand cooperation.

▍The Costs and Games of Integration

The success or failure of enterprise integration ultimately hinges on whether it can be translated into sustainable competitiveness. Judging from the half-year market performance, the merger between Geely and Zeekr has shown positive signals in terms of innovation efficiency, profitability, and organizational resilience, but the challenges in deep waters cannot be ignored.

Firstly, there is the dilemma of balancing brand positioning: Zeekr's high-end image may be diluted as its technology trickles down to Geely Yinhe – for instance, when Yinhe L7 is equipped with the same EV powertrain as Zeekr 001, some consumers may question the rationality of Zeekr's "premium pricing."

Secondly, there are obstacles to organizational cultural integration: The Zeekr team, which has operated independently for many years, differs from Geely's traditional system in management philosophy – Zeekr emphasizes "internet-style" rapid iteration, while Geely focuses more on "manufacturing-style" robust processes. This difference has led to disagreements between the two sides in product definition and supply chain decisions.

Finally, there is the sustainability of profitability under the pressure of price wars: In the first half of 2025, the average price of new energy vehicles has fallen by 12%, and Geely needs to find a new balance between cost control and product strength – if it relies too heavily on economies of scale to reduce costs, it may weaken technological R&D investment; if it pursues high-end positioning excessively, it may lose mainstream market share.

Through capital integration, technological collaboration, and global layout, the merger between Geely and Zeekr attempts to build a "technology-driven, ecological win-win" new energy circle. As Li Shufu said, "There is no retreat, only the path to victory." In the second half of the new energy race, whether Geely can translate the strategic potential of "One Geely" into market momentum and find the optimal solution in balancing brand positioning, integrating organizational cultures, and innovating profit models will be the most crucial questions.

Editor: Yang Guo

Intern: Jia Ruiyang

Typesetting: Yang Shuo

Image Source: Geely Automobile