Tesla's Six-Seater Model Y L Disrupts China's New Energy Vehicle Market

![]() 07/23 2025

07/23 2025

![]() 570

570

The launch of Tesla's Model Y L is more of an injection of fresh energy into the domestic family car market than a mere "threat."

Original Tech News by New Energy Vehicle Team

Without fanfare or lengthy announcements, Tesla simply confirmed the upcoming launch of a new model tailored for the Chinese market with a brief statement: "Model Y L, autumn arrival."  Photo/Weibo

Photo/Weibo

As Tesla's Model Y L enters the market with six seats and an extended wheelbase, it's perceived by many as a "dimensional attack" on domestic new energy vehicles. However, a closer look at China's family car market reveals that local brands like NIO, Li Auto, AITO, and Denza have already fortified themselves against this "late entrant." This seemingly fierce rivalry is more like a validation of the domestic new energy vehicles' home-field advantage. The automotive market in the second half of this year is poised to witness intense competition among mid-to-large SUV brands. So, what is Tesla's strategy with the Model Y L? Are domestic brands really panicking? How will the domestic family car market evolve?

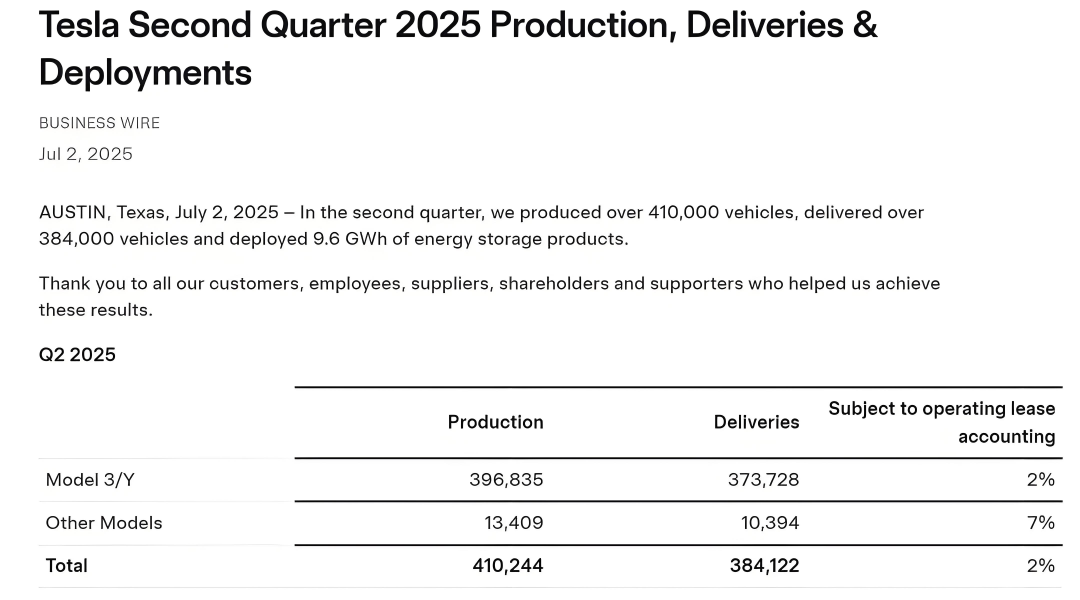

01 Tesla "Catches Up" with Six-Seater SUVs

To understand the impact of Tesla's Model Y L on the family car market, it's essential to grasp its background and product capabilities. Since the launch of the Model 3 in 2019 and the Model Y in 2021, Tesla has been relatively quiet on the new product front, with only minor updates. Coupled with the rise of domestic new energy vehicle companies, Tesla's sales in China have declined. Last year, Tesla delivered 1.789 million new vehicles, a commendable achievement but still a 1.1% decrease from 2023. In the second quarter of this year, Tesla delivered 384,100 vehicles, a 13.5% drop compared to the same period last year.

Amidst this downturn, Tesla urgently needs a new model to boost sales. In the domestic market, large-space new energy SUVs have always been popular among consumers, making the China-specific Model Y L a highly anticipated "trump card." Based on current leaks and information from the Ministry of Industry and Information Technology, this Model Y L is not merely an elongated version of the Model Y or the seven-seater introduced in North America. Tesla's engineers have performed a "major overhaul." Public data shows that the Model Y L measures 4976mm in length, 179mm longer than the Model Y, with a wheelbase of 3040mm, an increase of 150mm, surpassing even the Model X. Additionally, the vehicle's height has increased by 44mm to 1668mm, while the width remains unchanged. This significantly enhances the interior space, particularly the third row, finally shedding the label of being a "temporary bench" and catering to adults' short-distance riding needs. The numerical changes may not seem significant, but the side-by-side comparison reveals a more evident difference, especially in the rear half of the vehicle. Firstly, almost all the extension of the Model Y L is concentrated behind the B-pillar, with significantly enlarged rear doors. Secondly, the C-pillar is notably moved backward. Unlike the compact and dynamic fastback stance of the original Model Y, the Model Y L's roofline declines more gently, presenting a more elongated and stable form.

This means that the Model Y L's introduction is not just a speculative elongation or a cosmetic upgrade but a necessary adjustment to the body structure. It's a systematic product solution designed after thoroughly understanding domestic market demand and ready to compete in the real market. The core upgrade of the Tesla Model Y L is essentially a response to the "space anxiety" among Chinese family users. However, domestic automakers have already taken this step. Tesla is no longer the pioneer facing peers but an attacker trying to carve out a share.

02 "Defensive Battle" of Domestic New Energy Vehicles

As early as three years ago, domestic new energy vehicle brands represented by Li Auto began to strengthen their presence in the large six-seater market. In the past two years, a series of products like Li Auto L9, AITO M9, Denza N9, and Lynk & Co 900, as well as the dark horse Leapmotor C16, have undergone iterative updates, integrating family scene needs into every detail. It could even be said that they have transformed "large six-seaters" into "mobile three-bedroom, one-living room" vehicles. In terms of space, the 200,000-yuan-level Leapmotor C16 offers an actual usable space of 3301mm. The third row, with a flip-up electric drive design, allows passengers up to 1.8 meters tall to sit comfortably. In terms of ecology, Li Auto L9's "Little Master Mode" creates a dedicated ecosystem for children, while AITO M9's HarmonyOS cabin realizes "family-wide intelligent equality." These are based on years of experience in the Chinese family car market.  Photo/Leapmotor

Photo/Leapmotor

In the past, domestic new energy vehicle brands catered to consumers, while Tesla played the role of educating users, evident in details like screen shifting, door handle design, and single-pedal mode. The Model Y L may introduce new modes and concepts, but they might not resonate with current Chinese consumers. For users in family car scenarios, being understood is often more crucial than being educated. Moreover, pricing strategy is pivotal for a product's ultimate success. Although Li Xiang, the founder of Li Auto, predicted that the Model Y L would be priced in the highly competitive range of 200,000 to 300,000 yuan, from a product and business logic perspective, the Model Y L's technical blueprint is based on the current long-range version of the Model Y priced at 313,500 yuan.

On this basis, the elongated body structure, added third-row seats, and potential interior upgrades will collectively increase the cost and value by at least 30,000 to 50,000 yuan. This means that a final selling price within the range of 335,000 to 365,000 yuan is the most commercially logical, i.e., the 350,000-yuan level. However, regardless of the pricing, it cannot be ignored that domestic new energy vehicle brands' product lines cover almost all price segments, from the 200,000-yuan-level Leapmotor C16 to the 500,000-yuan-level AITO M9, with several strong products in each segment, forming a "full-price surround." This layout makes it challenging for the Tesla Model Y L to find a price breakthrough.  Photo/AITO M9

Photo/AITO M9

However, for products priced between 300,000 and 400,000 yuan, such as NIO Ledao L90, Denza N8, AITO M8, and Li Auto i8, the pricing of the Model Y L may bring pressure. Last year, almost all best-selling six-seater SUVs in China adopted hybrid technology, but this year, several pure electric six-seater SUVs have been launched. It's undeniable that Tesla's choice of a pure electric route to enter the family market will undoubtedly expand the market for pure electric six-seater SUVs, but it will also make other domestic brands feel concerned. Nevertheless, some domestic models' localized innovations have already outpaced Tesla. However, it must be recognized that as the global leader in electric vehicles, Tesla remains a formidable competitor that cannot be underestimated.

03 "Family Battleground" Enters a White-Hot Stage

The entry of Tesla's Model Y L is more of an injection of fresh energy into the family car market than a mere "threat." In the past two years, this niche segment has undergone tremendous changes. Three-row, six-seater large SUVs have not only become the new darlings of the market but are also considered a strategic choice by many brands to simultaneously meet family car needs, enhance brand image, and increase gross profit margins amidst fierce competition. This transformation did not happen overnight. The success of AITO M9 and Li Auto L9 undoubtedly sparked this change. With their outstanding product capabilities and precise market positioning, these two models quickly opened up the market gap for full-size SUVs. According to J.D. Power's research, more than half of consumers' primary consideration when purchasing a car in 2024 has become the space factor, and full-size SUVs are the perfect answer to this demand. The push from the demand side has made three-row, six-seater hybrid large SUVs the preferred choice for family users when adding or replacing cars.

The third row in the car is precisely the core embodiment of this "new reason to buy." However, users' novelty will quickly fade. After the first wave of family users have driven, sat in, and complained, the third row will no longer be a differentiating factor between automakers but will become a criterion for judging whether it is good enough. In the next stage, the third row must offer sustained value, i.e., how to transform a seat from emotional attraction to rational retention. In this game of the family car market, the entry of Tesla's Model Y L is both a challenge and a catalyst for industry upgrades. As market competition shifts from "whether there is a third row" to "whether the third row is good to use," the deep integration of technological innovation and user needs will be the deciding factor. Regardless of the final product capabilities and pricing of the Model Y L, its mere existence is enough to force all six- and seven-seater SUVs priced above 300,000 yuan to re-examine their pricing, configurations, and market strategies to cope with this powerful competitor with a brand halo and cost advantage. The outcome of this "family war" may not be about who defeats whom but rather about all players collectively raising the standards of six-seater SUVs to a new height.

In terms of safety, vehicles' collision protection capabilities and active safety systems will continue to be upgraded to safeguard family members' travel. In terms of comfort, the material and enveloping nature of the seats will be further optimized, and the car's sound insulation and air-conditioning systems will also be more outstanding. In terms of intelligence, autonomous driving, smart connectivity, and other technologies will become more mature, making family travel easier and more convenient. However, during this process, market competition will gradually intensify, and automakers that do not adapt or actively respond may be phased out. As consumers' requirements for family cars become increasingly high, only automakers that can continuously meet user needs and keep up with market trends will survive the fierce competition. For domestic new energy vehicle brands, the advantage lies in their deep cultivation of localized innovations, a profound understanding of changes in Chinese family needs, and the continuous launch of products that better meet market demand. At the same time, the disadvantage is also evident, which is the need to strengthen brand building, enhance brand influence and reputation, shed the "cost-effective" label, and march towards the high-end market. Tesla needs to further adapt to the characteristics of the Chinese market and make more localized improvements in product design and services. Only by truly understanding the needs of Chinese family users can they secure a place in this huge market.

In the past, the competition in the markets for minicars and mid-to-large SUVs was extremely fierce, constantly squeezing profit margins, and brands urgently needed to find new growth points. The full-size SUV market, relatively untouched and challenging in terms of product development, has become a new blue ocean in the eyes of brands. However, with the arrival of the Tesla Model Y L, it can be said that the competition in China's family car market has entered a white-hot stage. Whether it's new forces like Li Auto, AITO, NIO, and Leapmotor, or the "second-generation" automakers like Deepal Blue and Blue Mountain, whoever can find unique value in this historical evolution of market demand and technological progress will be able to continuously lead in the six-seat segment.

Reference Materials:

Tesla China Official Product Information

Li Auto, HarmonyOS Smart Drive, NIO, Leapmotor Official Product Information

Dongchehui

Tesla Model Y L Enters China's "Family War" with Six Seats Dongchehui

Three-Row Six-Seat Hybrid Large SUV: The "Answer to the Version" in China's Auto Market in 2025

- The end -