Fuel Cell Vehicle Prices Plummet, Signaling Economic Viability

![]() 07/25 2025

07/25 2025

![]() 476

476

Concerted efforts in procurement, hydrogen refueling infrastructure, and policy support have steadily lowered the operational costs of fuel cell vehicles.

In recent years, the domestic fuel cell vehicle industry has witnessed remarkable growth, with technological advancements catching up to and even surpassing international standards. Enhanced supply chain efficiency has led to a continuous decline in manufacturing costs.

According to Nengjing Research, domestic fuel cell vehicle prices continue to trend downwards. Coupled with the development of hydrogen corridors and the reduction in hydrogen refueling costs, the economic viability of fuel cell vehicles is becoming increasingly evident.

01

Declining Manufacturing Costs of Domestic Fuel Cell Vehicles

Component costs have universally declined.

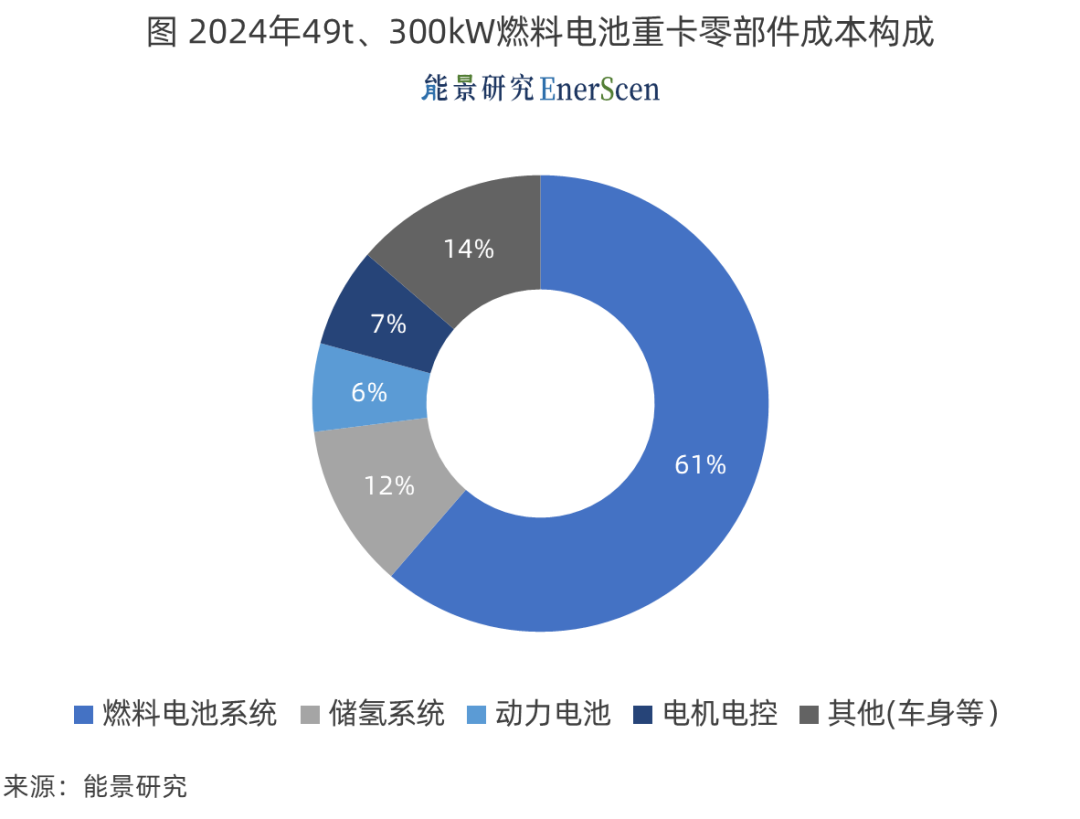

A fuel cell vehicle typically comprises five key components: the fuel cell system, hydrogen storage system, traction battery, electric drive and control system, and the vehicle body.

Driven by market competition, iterative design improvements, and other factors, the market prices of all fuel cell vehicle components have steadily decreased in recent years.

In 2024, the production cost of domestic fuel cell systems was approximately RMB 2,500 per kW, marking a 24% decrease from 2023.

This has fueled continuous breakthroughs in overall vehicle costs.

For instance, based on material cost estimates for each component, the material cost of domestic 49-ton fuel cell heavy-duty trucks fell below RMB 1 million per vehicle for the first time in 2024. Some models even saw their material costs drop to RMB 900,000 per vehicle.

02

Market Prices of Fuel Cell Heavy-Duty Trucks Approaching RMB 1 Million

Currently, freight heavy-duty trucks represent the primary development focus for domestic fuel cell vehicles.

In 2024, sales of fuel cell heavy-duty trucks in China surpassed 3,400 units, marking a year-on-year increase of approximately 13%. These sales accounted for roughly 63% of total fuel cell vehicle sales, an increase of about 11 percentage points compared to 2023. Among heavy-duty truck sales, tractors suitable for logistics transportation dominated, comprising 76% of fuel cell heavy-duty trucks registered in 2024.

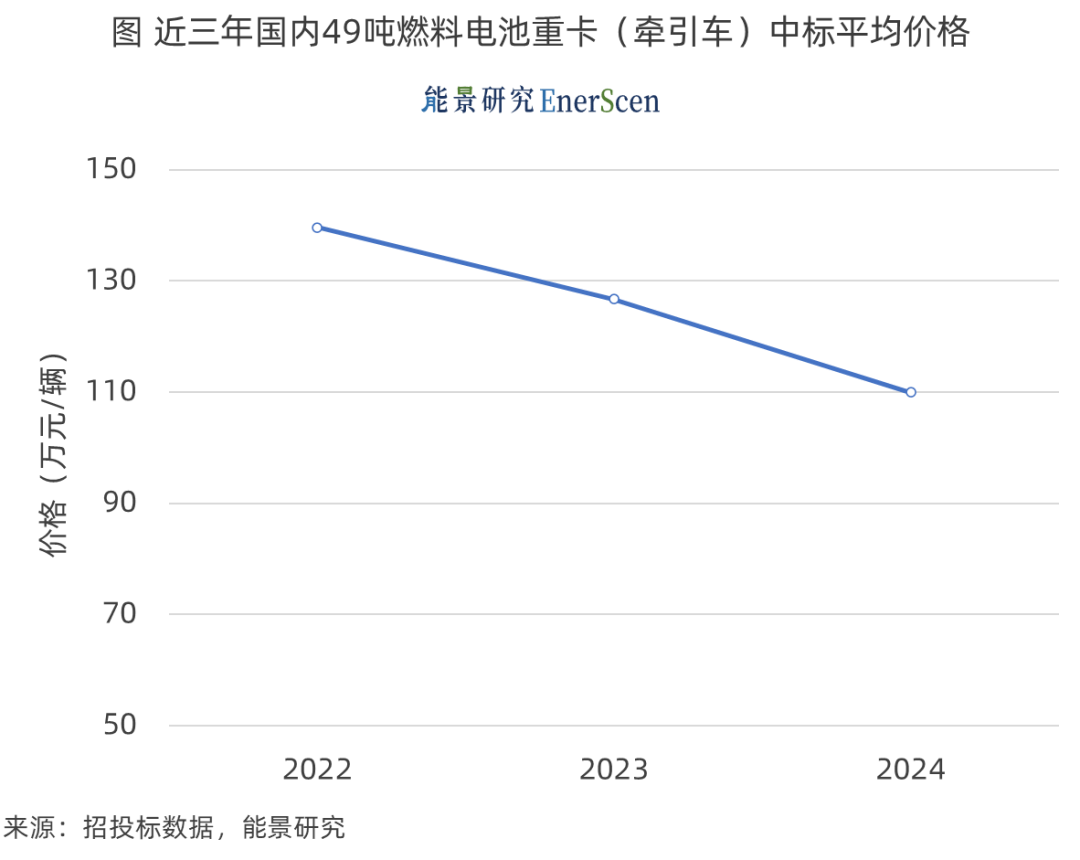

Domestic fuel cell vehicle market prices have consistently declined in recent years.

Taking the bidding price of 49-ton fuel cell heavy-duty trucks as an example, the average domestic winning bid price in 2022 was approximately RMB 1.4 million per vehicle, with some lower prices still reaching about RMB 1.3 million per vehicle.

In 2024, the average winning bid price for domestic 49-ton fuel cell heavy-duty trucks was approximately RMB 1.1 million per vehicle, a year-on-year decrease of about 13.2%. Notably, in some cases in 2024, the winning bid price for 49-ton fuel cell heavy-duty trucks dropped to approximately RMB 1.04 million per vehicle.

03

Emergence of Economic Feasibility for Fuel Cell Vehicles

For freight heavy-duty truck applications, operating costs primarily encompass purchase costs, fuel costs, road and bridge fees, operation and maintenance costs (staff, maintenance, and operations), among others.

Without additional support policies, the operating costs of fuel cell vehicles at the current stage are still higher than those of diesel vehicles.

Using a 49-ton heavy-duty truck as an example, the operating cost of domestic 49-ton diesel heavy-duty trucks is approximately RMB 4.5-5 per kilometer. In contrast, for fuel cell vehicles, without purchase subsidies, hydrogen price subsidies, road and bridge fee reductions, etc., the operating cost can reach RMB 8 per kilometer.

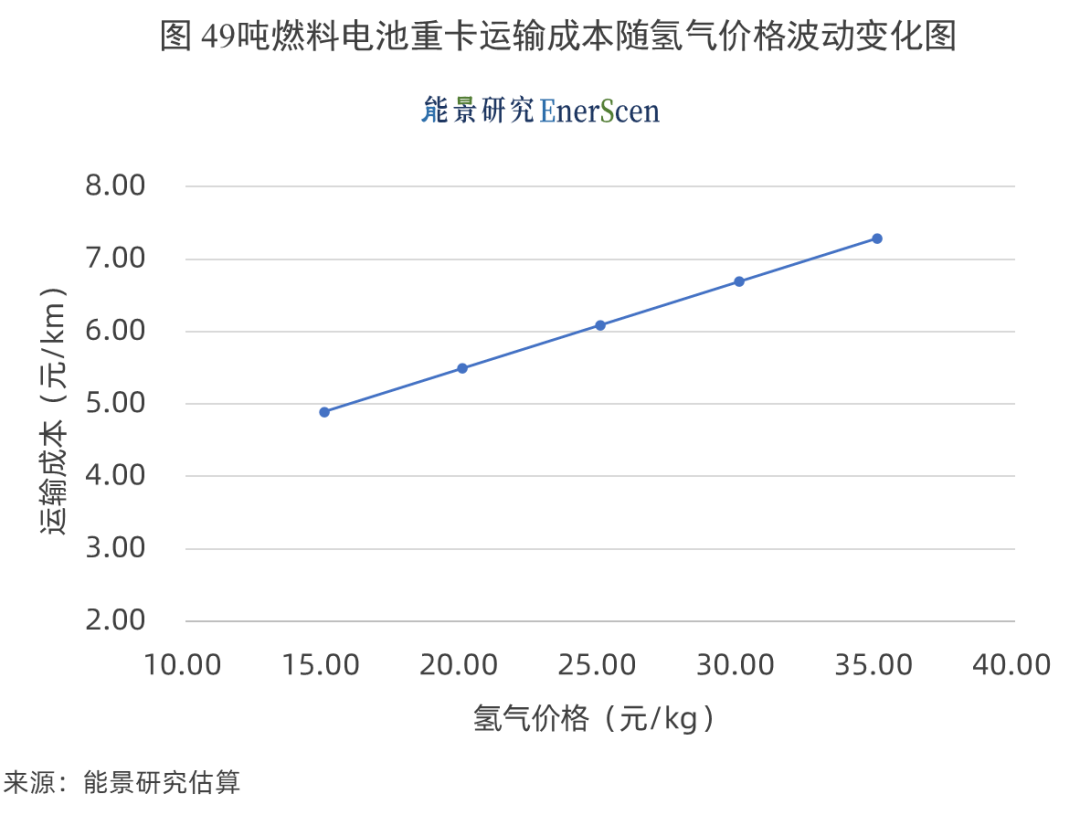

Decreases in vehicle prices and hydrogen prices are enhancing the economic feasibility of fuel cell vehicles.

In 2024, with the average purchase price of 49-ton fuel cell heavy-duty trucks falling to approximately RMB 1.1 million per vehicle and the hydrogen refueling price at some stations dropping to RMB 30 per kilogram, the operating cost of 49-ton fuel cell heavy-duty trucks can be reduced to RMB 6-7 per kilometer.

With increased subsidy support, parity with lithium-ion batteries and diesel is within reach.

Thanks to national subsidies and the reduction or exemption of road and bridge fees in some provinces, the operating cost of 49-ton fuel cell heavy-duty trucks in 2024 can be reduced to RMB 5 per kilometer, gradually converging with the cost of diesel heavy-duty trucks.

Source: Nengjing Research

END