Musk and Trump Sever Ties, Tesla Posts Disappointing Q2 Results

![]() 07/25 2025

07/25 2025

![]() 560

560

Amidst political and business setbacks, Musk's magic is gradually fading.

Written by | Xu Fengnian

Produced by | Zero Carbon Knowledge Bureau

After publicly breaking with Trump, Musk delivered a disappointing report card.

Early this morning, Tesla released its Q2 financial report, revealing revenue of $22.5 billion for the second quarter, marking a year-on-year decline of 12% and the second consecutive quarter of decline. Net profit stood at approximately $1.2 billion, a decrease of about 16% compared to the same period last year.

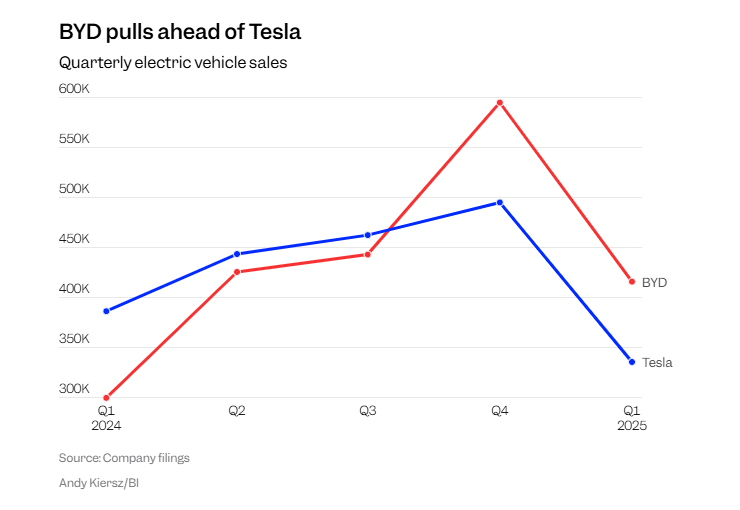

The main reason for the decline remains the automotive segment: decreased sales and average selling prices have reduced revenue to $16.6 billion, a year-on-year decrease of 16%. Quarterly deliveries amounted to only 384,000 vehicles, a decrease of 14% compared to last year.

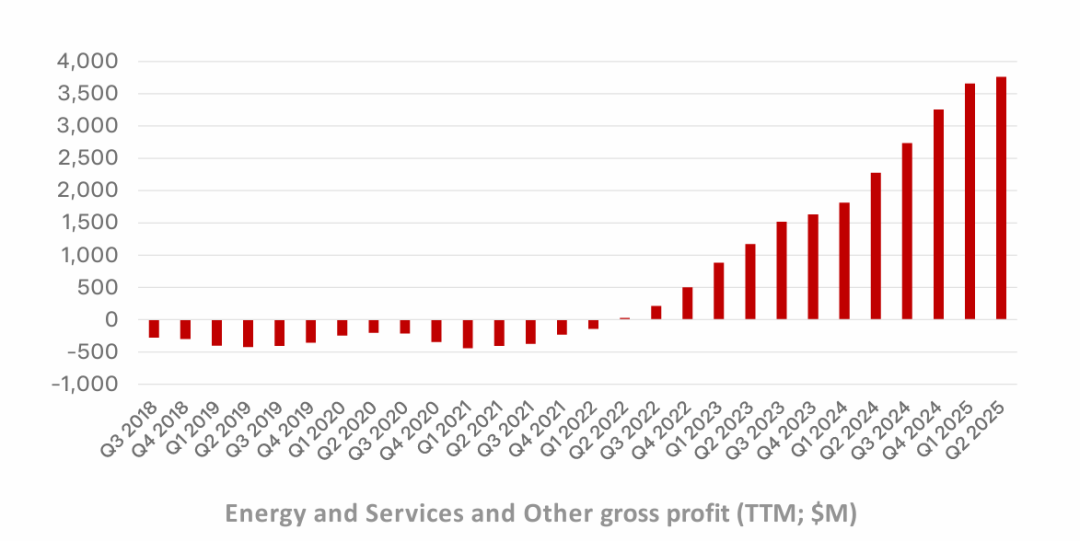

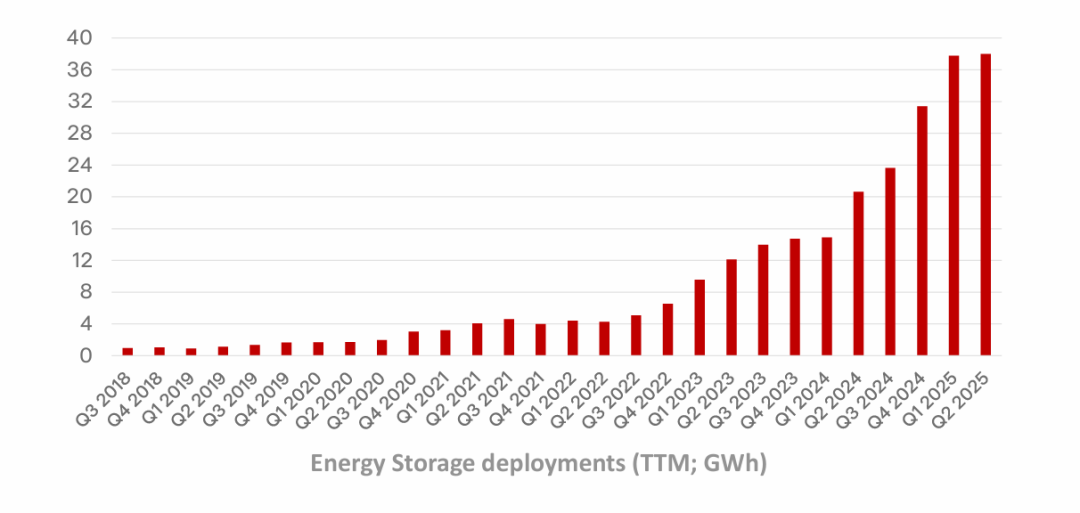

In contrast to the "stalled" automotive business, the energy production and storage segment continues to expand. This quarter recorded revenue of $2.79 billion (accounting for 12% of the group), a slight year-on-year decrease of 7%, but gross profit increased both quarter-on-quarter and year-on-year, reaching a record high of $846 million. This quarter, 9.6 GWh of energy storage products were deployed, including the first batch of Megapacks produced at the Shanghai Megafactory, which have been delivered externally.

"Despite headwinds from tariffs and supply chains, our energy business continues to expand rapidly," Musk said on the earnings call.

Musk added that MegaPack production is rapidly ramping up, and a new round of upgrades will further enhance its performance. In the second quarter, Tesla set another record for power deployments. He is convinced that batteries will become an unprecedentedly large market - many people have yet to realize the massive scale of demand. For instance, the continuous output power of the U.S. power grid is approximately 1 terawatt, but the average load is less than 0.5 terawatts; if batteries are introduced, power plants can operate at full capacity 24 hours a day, thereby doubling the annual electricity generation in the United States compared to now, and this can be achieved solely through batteries.

"This is significant and indeed a 'big deal'," Musk emphasized.

It is worth noting that Tesla's previously lucrative carbon credit revenue was only a meager $439 million, a plunge of 51%, all due to "that man."

"Tesla-Trump Split"

When Trump was first elected, Musk was still a prominent "red-capped merchant." He was invited into the president's advisory circle to offer advice and entered the Oval Office as if it were his own living room. He headed the Department of Government Efficiency (DOGE), cut redundancies and expenses, and once reached the pinnacle of his personal political power.

"I love @realdonaldtrump to the limit that a straight man can love another man," Musk posted, expressing his intense admiration for Trump during their "honeymoon phase".

※ Musk wearing a hat that reads "Whatever Trump does is right"

However, despite sharing equally eccentric personalities and a love for stirring up emotions on social media, the two had fundamental differences in economic policy. One was an extreme climate skeptic, while the other was a green technology giant making money from electric vehicles and photovoltaic storage products.

After Trump announced an increase in tariffs on automobiles and parts from China, Musk publicly disagreed with the White House, stating on Twitter that tariffs would have a "significant impact" on Tesla and demanding the reversal of his comprehensive tariff plan, but to no avail.

About a quarter of the components of the U.S.-made Model Y are not manufactured in the United States, and key links are highly dependent on the Chinese supply chain; China is also its second-largest market, accounting for about 20% of revenue. Morgan Stanley estimates that about 20% of Tesla batteries produced in the United States come directly from China, and 30% are supplied by Chinese-invested enterprises in Mexico; if Chinese batteries are taxed, the cost per vehicle will increase by about $3,000-$5,000.

No matter how clever a court jester is, he cannot compete with a willful tyrant. Relations took a sharp turn for the worse after the "One Big Beautiful Bill" was introduced, and disagreements over subsidy policies erupted between the two sides.

This bill was almost catastrophic for Tesla's business as it simultaneously cut off two key "revenue streams" for the company: the $7,500 federal EV tax credit for consumers was prematurely terminated, increasing the cost of purchasing a vehicle for consumers; the bill also reduced the CAFE fuel consumption penalty for non-compliant enterprises to "0," meaning other automakers were no longer subject to CAFE standards and no longer needed to purchase carbon credits from Tesla. This "selling air" income suffered a severe blow.

According to analysts' calculations, approximately three-quarters of Tesla's carbon credit revenue comes from CAFE standards. Within days of the new law's enactment, they reduced their estimates for Tesla's 2025 carbon credit revenue by nearly 40% to approximately $1.5 billion. They expect it to plummet to $595 million next year and dry up completely by 2027.

Carbon credits have been Tesla's "cash cow" year after year, contributing more than one-third of net profit multiple times. This revenue has risen from less than $600 million in 2019 to nearly $3 billion in 2024.

Judging from the financial report, if it were not for these credit revenues sold to internal combustion engine automakers, Tesla would have incurred a loss in the first quarter, underscoring their importance.

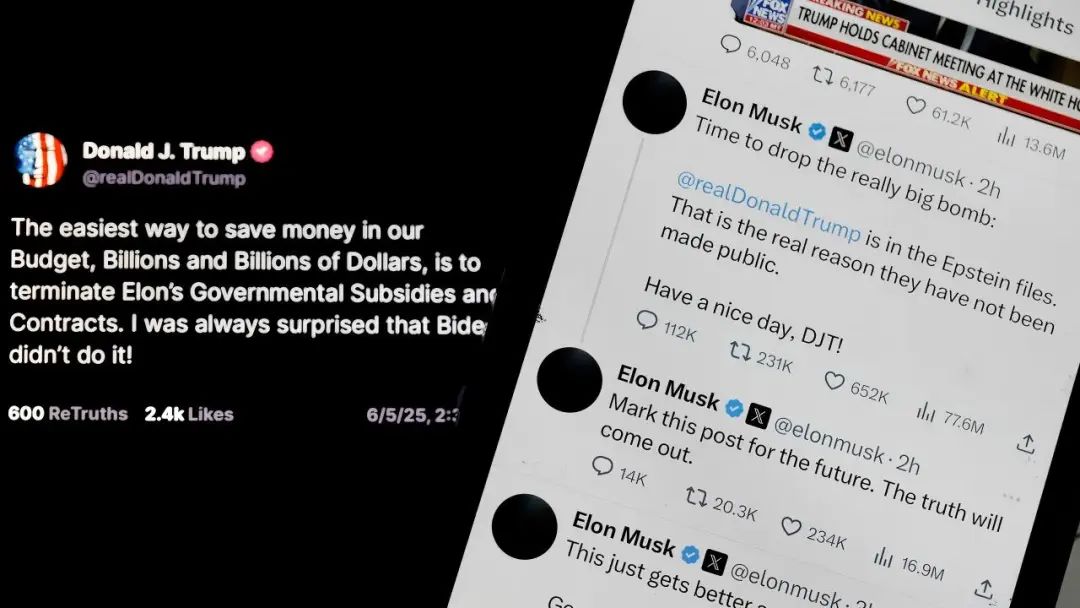

After Musk's lobbying efforts proved futile, the two sides completely tore each other apart, with the two social media influencers, each with over 100 million followers, attacking each other in an ongoing war of words.

Musk lambasted the "One Big Beautiful Bill" on Twitter as a "disgusting monster."

Trump responded at a press conference on July 1: "He's upset because he's losing his electric vehicle 'privileges'" (referring to subsidies) and threatened that "he could lose much more than that."

Musk accused Trump in a rage of being an accomplice to Jeffrey Epstein's crimes and hinted that Trump had covered it up. He also replied "yes" to a post stating that Trump should be impeached and replaced by Vice President JD Vance. Trump retaliated by threatening to cancel all SpaceX contracts.

Musk also declared: "Trump could never have been elected without me."

After resigning from the White House advisory circle, Musk refocused his attention on his own business and almost disappeared from White House media materials and news briefings of Republican lawmakers, but the outside world had changed.

Due to Musk's frequent involvement in partisan disputes and the indiscriminate actions of the current U.S. government, Musk's image as a friendly tech figure in public has been severely damaged. Tesla has become a highly politicized brand, its popularity has plummeted, and it has sparked a wave of resistance to Tesla among some Americans.

Some liberal users have turned to competitors (such as Rivian and Ford electric vehicles), while conservatives are already skeptical of EVs, and both sides are "not interested in buying," gradually falling behind BYD in global competition.

In the first quarter of this year, Tesla's automotive segment (including leasing and carbon credits) generated revenue of $13.967 billion, a year-on-year decrease of 20%; if after-sales and other services are added, total revenue was $16.605 billion, still a year-on-year decrease of 16%.

A total of 337,000 vehicles were delivered in Q1, about 51,000 fewer than the same period last year, the lowest since the second quarter of 2022. The main reason was the simultaneous line change and upgrade of the New Model Y at the four major factories, coupled with the continued "trading price for volume" strategy to lower average selling prices.

The much-hyped Cybertruck's quarterly sales were only about 5,000 vehicles, far below Musk's initial boast of 250,000-500,000 vehicles per year; the stock price has fallen by more than 30% from its post-election high, and several executives have resigned.

Although SpaceX remains the private enterprise most deeply relied upon by the U.S. aerospace industry, the White House is not stupid and will not tolerate national security risks arising from reliance on a single supplier, so it has begun to support other competitors. The profitability of Starlink in the United States is also under scrutiny.

Musk's business empire is beginning to crumble.

Still Resilient Business

The "One Big Beautiful Bill" prematurely terminated tax credits for wind and solar power, but the incentive policy framework for electrochemical energy storage was overall retained, and the validity period of tax credits was extended by 8 years, although stricter "localization" and "anti-Chinese capital" thresholds were added. It is unfortunate but fortunate.

In sharp contrast to the bleak automotive market, the energy storage business is becoming Tesla's new pillar.

From 2016 to 2024, energy storage revenue increased from 1.258 billion yuan to 72.502 billion yuan, a 56.63-fold increase in nine years; cumulative revenue reached 203.171 billion yuan, and the proportion of total revenue increased from 2.59% to 10.32%.

In 2024, Tesla deployed 31.4 GWh of energy storage systems worldwide, and the energy generation and storage segment generated approximately $10.1 billion in revenue, a year-on-year increase of 67%. At the same time, automotive sales revenue decreased by approximately $3.3 billion year-on-year, and the energy storage business offset the decline in the automotive business to a certain extent.

Entering the first quarter of 2025, energy storage shipments jumped again to 10.4 GWh, with energy generation and storage segment revenue of $2.7 billion and a gross profit margin of 28.8%, making it the most profitable business.

In 2024, Tesla ranked first in global energy storage system integrator (AC side) shipments, followed by Sungrow, CRRC Zhuzhou Institute, Fluence, and HBS.

Chinese companies, based in the Chinese market, are gradually expanding overseas. Tesla, supported by the North American market, is gradually expanding to Europe, the Middle East, Africa, and the Asia-Pacific region. The frequency and intensity of head-on confrontations between the two sides have continued to increase this year.

After coming into direct contact with CATL, BYD, and Sungrow, Tesla faces encroachment and pricing pressure from competitors. It intends to "approach" Chinese competitors on the cost side through the rapid replication of the Megafactory model.

After more than a year of ramp-up, the Lathrop factory in California has stabilized its annual production capacity at 40 GWh; in February 2025, the Lingang factory in Shanghai was completed and put into production in nine months, also with a planned capacity of 40 GWh, and shipped over 100 Megapacks in the first quarter. In March of this year, Waller County, Texas, approved a tax exemption agreement, and the third Megafactory will be located on the western outskirts of Houston, with production expected to commence in 2026 and a production capacity scale equivalent to the first two factories.

Once all three factories are fully operational, Tesla theoretically could provide about 120 GWh of energy storage systems per year, equivalent to about half of the new global grid-side installations in 2024.

In particular, the landing of the Shanghai energy storage Megafactory has given Tesla an opportunity to break the deadlock, allowing it to utilize the complete LFP industrial chain in East China to reduce manufacturing costs by more than 20% and also export to Asia-Pacific and Europe, forming a dual-base layout of "high gross margin in the United States and high turnover in China" to reduce policy and exchange rate risks.

According to Bloomberg analysis, Tesla's stock price, good relations with the U.S. government, and ability to continuously raise funds from investors were Musk's key strategies for building a business empire. However, due to political naivety and the immaturity of new technologies, these strategies are gradually losing their effectiveness.

As Isaacson, the author of "Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic Future," believes, Musk's various personality flaws are inseparable from his tremendous success in his career. Now it seems that the opposite is also true.