Chinese Automobiles: Striving for One-Third of the Global Market Amidst Dual Challenges

![]() 07/25 2025

07/25 2025

![]() 585

585

Introduction

If issues of productivity and price wars can be effectively addressed, the aspiration of Chinese automobile brands to capture one-third of the global market will gain substantial traction.

"Japanese cars account for one-quarter of the global market share," a source of pride for Japanese manufacturing. As China shifts gears, what heights can its automobile brands attain?

Recently, both statistical agencies and overseas media have projected that "by 2030, Chinese automobile production will account for nearly one-third of the global total." This is generally interpreted as the rise of the Chinese automobile industry, but some voices also echo the "China manufacturing threat theory."

Meanwhile, insiders in the domestic automobile industry are acutely aware of the pressure stemming from price wars and internal competition, pressures that are also recognized internationally.

In summary, while Chinese automobiles are poised to capture one-third of the global market, they must first overcome two significant hurdles. Addressing productivity and price wars will substantiate the "one-third global market share" aspiration of Chinese automobile brands.

01 Chinese Brands: Aiming for One-Third of the Global Market

"China's annual automobile production and sales volume is 30 million units, and the global annual production and sales volume is 90 million units. Isn't that already one-third of the market share?"

In fact, what AlixPartners, Bloomberg, and other foreign media are referring to is that Chinese automobile brands will account for 30% of the global automobile market share, which is still a far cry from the level of "one-third of the world."

That is to say, of the domestic annual total production and sales volume of 30 million automobiles, about 40% of joint venture brand automobiles need to be subtracted, but about 5 to 6 million exported Chinese brand automobiles need to be added, totaling around 20 million units.

According to statistics from companies such as JATO and AlixPartners, in 2024, the total domestic and international sales volume of Chinese automobile brands surpassed American brands for the first time, reaching 20~21%, second only to Japanese cars at 24~25%. These institutions often focus on passenger cars or light vehicles. According to data from the China Association of Automobile Manufacturers, in 2024, Chinese brand passenger cars sold a total of 17.97 million units. The global sales volume of light vehicles counted by overseas institutions was 89 million units. After adding a small number of light commercial vehicles to the sales of self-owned passenger cars, the proportion is indeed around 20~21%.

Reports released by AlixPartners last year and this year both predict that Chinese automakers are expected to account for 30% of global automobile sales by 2030, up from 21% in 2024. Among them, emerging markets such as Southeast Asia, the Middle East, Africa, and South America are expected to experience the most significant growth.

This means that by then, Chinese automobile brands will surpass Japanese cars in global market share, truly positioning the automobile branch of the national industry at the top of the global market.

In 2023, China achieved automobile exports of 4.91 million units, surpassing Japan to become the world's leading automobile exporter. Since then, the overseas market has become a critical direction for Chinese automobiles.

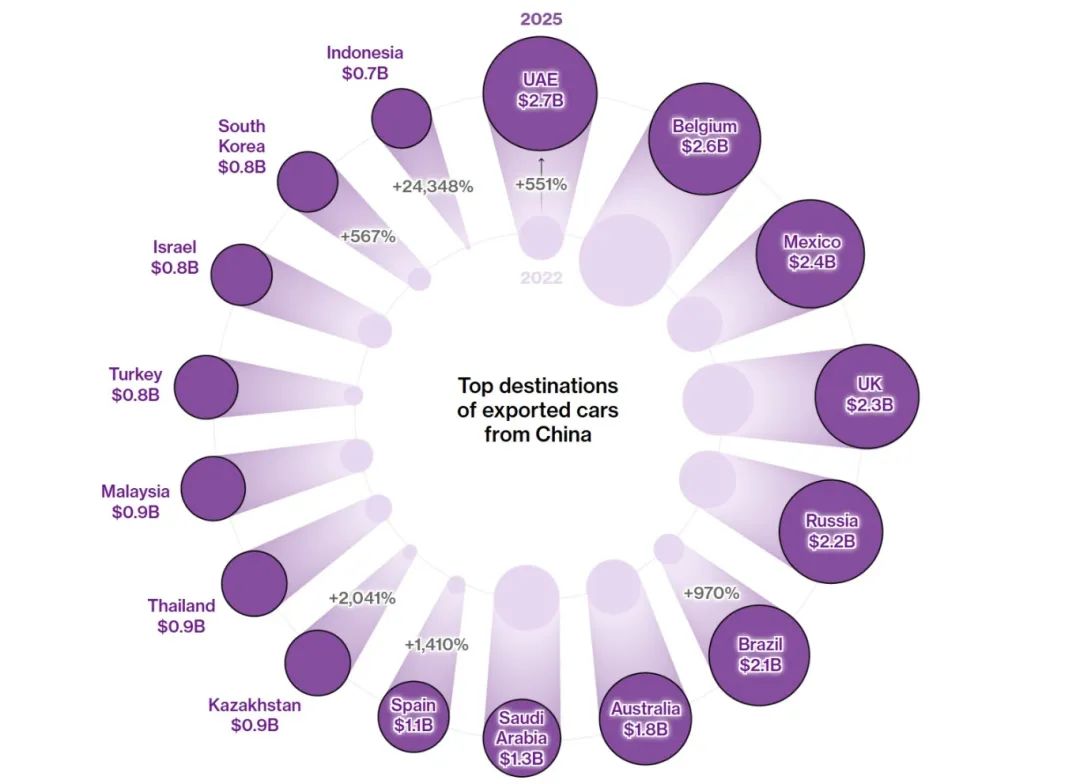

Currently, among the major regions of the world, the United States is difficult to become the preferred export market due to tariff and political factors. Southeast Asia, the Middle East, Latin America, and Europe are all flooded with a large number of Chinese automobiles.

According to the institutions, the surge in Chinese automobile exports is reshaping the global automobile market. A flood of affordable automobiles is entering various countries, triggering a price war that has impacted automobile showrooms from Mexico to Malaysia.

Chinese-made automobiles are dominating the streets in some parts of South America, while electric vehicles produced by automakers such as BYD, which are inexpensive but of high quality, are winning the favor of thousands of consumers in Europe.

In addition to the Gulf region, many countries have fueled China's export boom. Mexico, an important player in the North American automobile market, imported cars worth $2.4 billion, while Russia, despite geopolitical complexities, remains an important market with imports of $2.2 billion.

Analysts believe that Chinese automakers are focusing on higher profit margins overseas. Regional markets will be impacted, but price competition may not be as intense as it is in China. However, established automakers are concerned about the impact of Chinese automobile exports on their revenue streams. The pressure to protect local employment, profit structures, and budgets will grow increasingly intense.

Recent trade data vividly illustrates the extent of this export surge. In the first five months of 2025, China's automobile exports reached a new peak, with the total export value nearly tripling from 2022 to reach $37.3 billion; exports to the United Arab Emirates alone reached $2.7 billion, a 551% increase from 2022, highlighting the growing demand for Chinese automobiles in the Middle East.

02 Navigating Capacity and Price Dynamics

The rapid development of China's automobile industry, of course, cannot avoid "byproducts," including overcapacity and price wars. The country is currently also advocating for rational development of the industry and opposing internal competition.

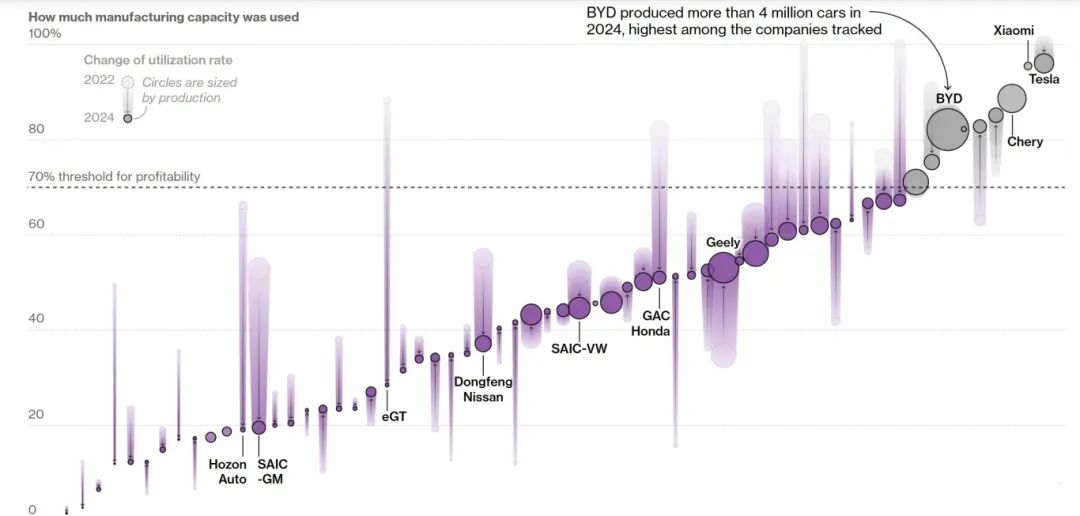

The previous wave of "working hard and fast" allowed China to rapidly establish a huge production capacity scale, far exceeding the demand of China as the world's largest automobile market. According to the experience of mature markets, factory capacity utilization/operating rates need to exceed 70% to achieve profitability and sustainable development.

According to agency statistics, among the 70 active automakers in China in 2024, only about 15% of factories met the minimum viable standard of 70% capacity utilization for profitability.

In contrast, the capacity utilization rates of leading automakers are relatively good. Taking BYD as an example, its production and sales continued to climb from 2022 to 2024, with factory capacity utilization rates maintained between 80% and 85%.

The automaker with the highest factory capacity utilization rate is Tesla. In addition to its continuously rising domestic sales, the Shanghai factory produces the Model 3 sedan and Model Y SUV, which are also exported to other Asian markets and Europe, resulting in a capacity utilization rate as high as 96%. Popular automotive brands such as Thalys AITO and Xiaomi also have high capacity utilization rates. However, Xiaomi has long stated that it is difficult to deliver cars quickly due to insufficient capacity, but data shows that Xiaomi's factory capacity utilization rate is lower than Tesla's 96%.

Some joint venture automakers and declining new forces at the tail end of the industry have the lowest factory capacity utilization rates, with Hezhong Auto/Nezha Auto at the bottom.

Price wars and internal competition are another major dilemma facing China's automobile industry.

According to statistics from the China Passenger Car Association, the average price per passenger car in the Chinese market reached a peak of 183,000 yuan in 2023, nearly 20% higher than the 151,000 yuan in 2019. However, it fell to 177,000 yuan in 2024, even with the entry of a large number of high-priced vehicles such as the AITO M9 into the market. In the first half of 2025, the average price per passenger car was 171,000 yuan, slightly lower than the level in 2022.

However, by closely observing the changing curve of 170,000 yuan in January 2025, 173,000 yuan in March, and 174,000 yuan in June, it can be found that prices are slowly recovering. On the one hand, sales of high-priced vehicles such as the AITO M8 are increasing, and on the other hand, the state is also preventing further damage to the industrial atmosphere caused by internal price wars.

For now, analysts at HSBC Holdings believe that in months with higher temperatures, the price war is unlikely to ease immediately. This is because summer is usually a sales off-season. Considering the lukewarm overall demand and consumer downgrading, HSBC expects the pricing environment to continue to face pressure; the automobile industry is currently in the process of deep integration and has not yet reached a turning point.

03 The Strong Will Thrive, and Differentiation Will Intensify

In a sense, the acceleration of automobile exports is related to domestic automobile overcapacity and intensifying internal competition.

Amid slowing domestic economic growth and intensifying competition, many Chinese automobile exporters are actively turning to export markets and selling automobiles globally.

However, analysts point out that overseas markets are not always a reliable fallback option. Geopolitical factors and the upfront costs of establishing overseas sales channels may hinder weaker enterprises from exporting, meaning that "only stronger companies can achieve this," said Stephen Dyer, managing director of AlixPartners in Shanghai.

He noted that the average capacity utilization rate of China's top five exporters in 2024 was 57%, higher than the overall industry level.

A team led by Eunice Lee, an analyst at Sanford C. Bernstein, said that BYD is able to significantly reduce prices without excessively impacting its finances due to its extensive vertical integration—BYD produces batteries and chips on its own, thus avoiding many supply chain issues, which is a powerful advantage.

In addition, BYD sold 4.24 million units last year, becoming the domestic automaker with the highest sales volume, and economies of scale have also strengthened its competitiveness.

Competitors trying to emulate BYD will "face a long and costly process." Eunice Lee said, "While technically BYD has the ability to achieve higher short-term profit margins, management has chosen a more strategic approach, seeking a balance between short-term profits and expansion."

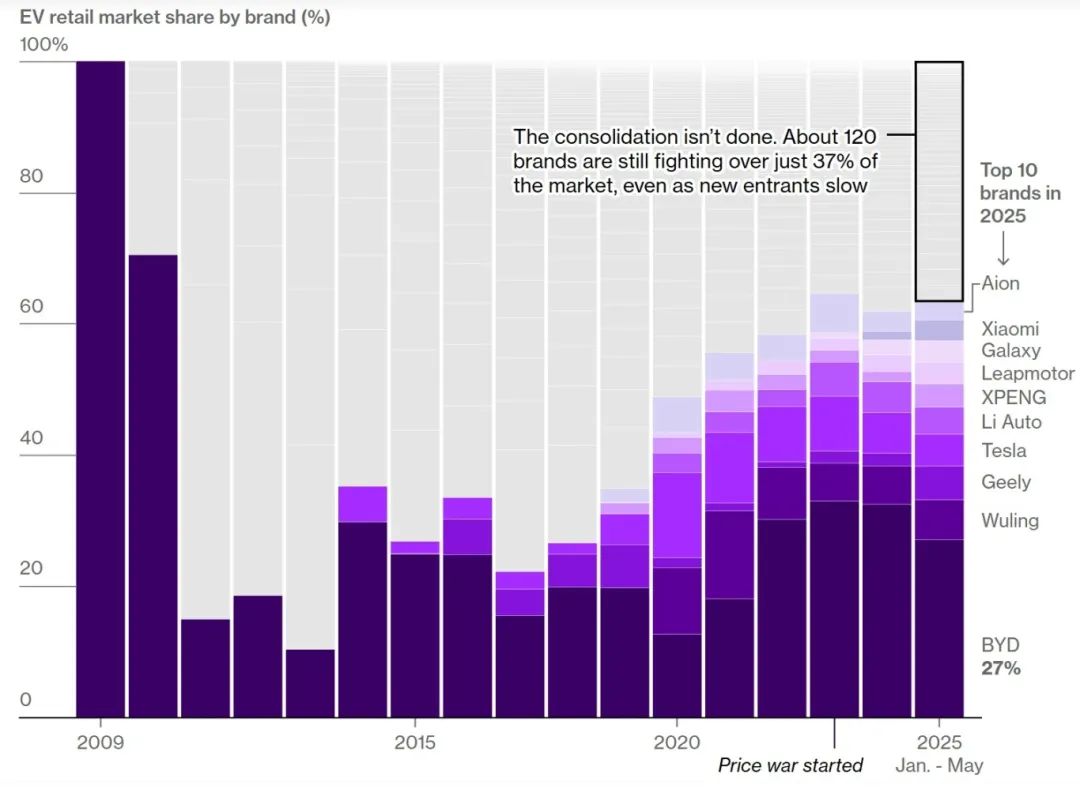

Many startup new forces in the automobile industry have closed down in the past few years, and the cancellation of government subsidies in 2018 further suppressed the influx of new entrants. However, despite these adverse factors, new participants continue to emerge, indicating that the expected consolidation in the market is far from complete.

The Matthew Effect has led to a polarization in the performance of Chinese automobile companies, with the strong continuing to thrive and the weak being eliminated. As of May this year, BYD accounted for about 27% of China's electric vehicle retail market, but there are still about 120 other brands competing for a 37% market share.

And the ultimate reshuffling may take longer in China. On the one hand, local governments will be involved, and they often extend the operating time of some automakers, even though these enterprises may have very low production efficiency, because these companies receive direct or indirect support from the government.

Stephen Dyer said, "Consolidation has not really begun yet." Local automakers' impact on employment and the supply network of automobile parts are important channels for economic growth. "Ultimately, it will slowly consolidate because automobile manufacturing is a business that really burns money. We expect that only a dozen enterprises may survive."

Such data recalls the predictions made by Marchionne and Li Shufu years ago, "In the future, there will only be five/ten automakers left." The number is not the key; who can secure one of the limited final seats is the ultimate mystery that is both troubling and fascinating.

Chief Editor: Shi Jie, Editor: He Zengrong