Mitsubishi Motors Completely Exits China

![]() 07/25 2025

07/25 2025

![]() 702

702

Termination of Engine Business in China

Author | Wang Lei

Editor | Qin Zhangyong

An era has come to an end.

On July 22, Mitsubishi Motors announced the termination of its joint venture partnership and engine business operations with Shenyang Aerospace Mitsubishi Automobile Engine Manufacturing Co., Ltd. Citing the rapid shift towards electric vehicles in China's automotive industry, Mitsubishi decided to reassess its strategy and exit the joint venture.

It is noteworthy that although Mitsubishi Motors ceased vehicle production and sales in China in 2023, it continued to produce and supply engines to other domestic original equipment manufacturers (OEMs). With this move, Mitsubishi's production footprint in China has been completely eradicated.

01 The Godfather of Domestic Engines

This joint venture has a significant background. If you owned a joint venture or independent model over a decade ago, there's a high likelihood that its engine was produced by this company.

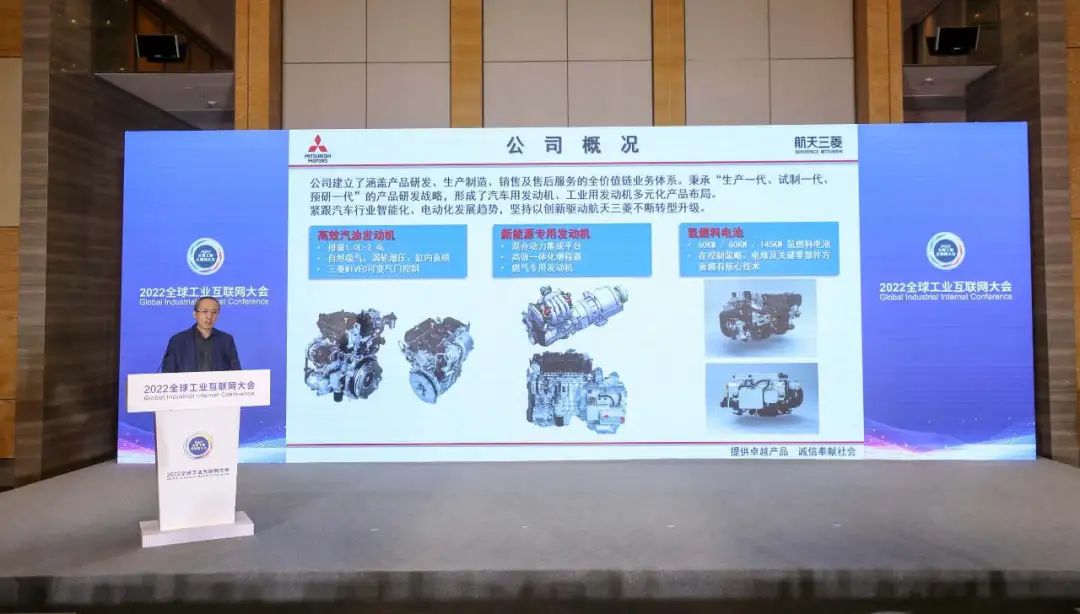

Shenyang Aerospace Mitsubishi Automobile Engine Manufacturing Co., Ltd. was jointly established by China Aerospace Automobile and Mitsubishi Motors in 1997. The shareholding structure at the time was as follows: China Aerospace Automobile Holdings accounted for 30%, Mitsubishi Motors Corporation accounted for 25%, Shenyang Jianhua Automobile Engine Co., Ltd. accounted for 21%, Ma Zhong Investment Holding Co., Ltd. accounted for 14.7%, and Mitsubishi Corporation accounted for 9.3%.

Since 1998, this joint venture has been responsible for supplying engines to Mitsubishi Motors and numerous domestic Chinese automakers.

Not only Mitsubishi Motors but also many domestic manufacturers sought expertise from Mitsubishi during that period.

Also in 1998, Mitsubishi established its second engine company, Dong'an Mitsubishi, in Harbin, now known as Dong'an Power. However, Mitsubishi sold its shares in Harbin Dong'an as early as 2019 and exited, after which Dong'an Power was incorporated into China Changan Automobile Group.

In the 1990s, independent brands were still in their infancy, facing severe technology blockades and lacking a solid foundation. It was the engines from these two factories that supported over 90% of independent brands. Almost every brand you can name has used Mitsubishi engines.

Take Shenyang Aerospace Mitsubishi as an example. It has launched many classic engines, including the 4G6 MIVEC series, 4G6 MPI series, 4A9 turbocharged series, 4A9 MIVEC series, and 4K series engines. These engines were not only installed in Mitsubishi vehicles but also in products from domestic brands such as Soueast, JAC, Chery, Landwind, Brilliance, Haval, BYD, and Leopaard.

In particular, the 4G6 series engines became the cornerstone on which most domestic automakers relied for survival. Since many domestic vehicles used Mitsubishi powertrains, some people joked at the time that "Mitsubishi single-handedly supported half of the domestic auto industry".

It once occupied 30% of the engine market share in domestic vehicles. According to official data, as of December 2024, more than 7 million domestic vehicles were equipped with engines produced by Shenyang Aerospace Mitsubishi.

Even today, many low- to mid-range pickup trucks and SUVs still use Mitsubishi engines. However, the supply volume has seen a significant decline, and the drop in demand has been directly reflected in its financial performance.

According to Shenyang Aerospace Mitsubishi's audit data for 2024, the company's revenue was 1.339 billion yuan, with a net loss of 62.5272 million yuan. Financial statements for the first quarter of 2025 show a revenue of 301 million yuan and a net loss of 23.6751 million yuan.

With Shenyang Aerospace Mitsubishi struggling to sustain its operations, Mitsubishi's exit seemed inevitable.

On July 2, the National Enterprise Credit Information Publicity System revealed that the original Shenyang Aerospace Mitsubishi Automobile Engine Manufacturing Co., Ltd. quietly changed its name to "Shenyang Guoqing Power Technology Co., Ltd." At the same time, Mitsubishi Corporation and Mitsubishi Motors Corporation withdrew from the list of shareholders, and Beijing Saimu Technology Co., Ltd. was added as a new shareholder.

Moreover, it wasn't only Mitsubishi that wanted to exit this enterprise. Earlier, China Aerospace Automobile Holdings listed the transfer of its 30% stake in Shenyang Aerospace Mitsubishi Automobile Engine Manufacturing Co., Ltd. in April, with a listing price of 516 million yuan. Then, in June, it was listed again with a price reduction of over 10%, to only 460 million yuan.

02 Complete Defeat in the Chinese Market

Before withdrawing from engine production, Mitsubishi Motors was already a name in name only in China.

As early as 2021, there was a change in the shareholding of Southeast Motor, in which Mitsubishi held a 25% stake. Mitsubishi Motors exited, transferring its shares to Fuzhou Communications Construction Investment Group Co., Ltd. Southeast Motor's shareholding no longer included Mitsubishi, and now Southeast Motor has been fully acquired by Chery and renamed Soueast, primarily targeting the overseas market.

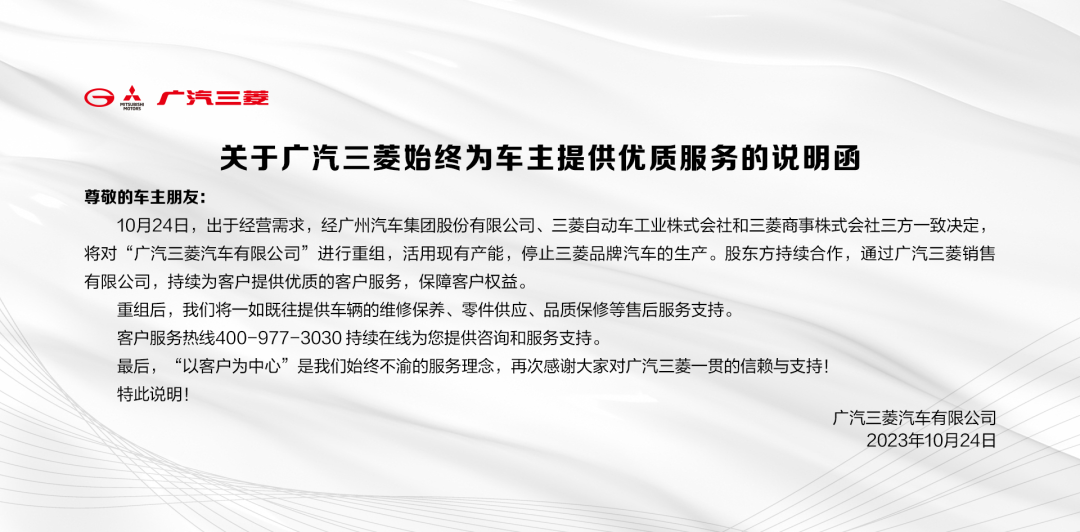

In 2023, Mitsubishi ended its cooperation with GAC Group, officially shut down its vehicle plant in Changsha, Hunan, and stopped selling new vehicles in China. Subsequently, GAC Aion took over the Changsha plant for a symbolic price of 1 yuan.

This marked a crucial turning point in Mitsubishi's retreat from the Chinese market.

However, Mitsubishi Motors did not completely exit the Chinese market at that time. It was not until the end of February last year that GAC Mitsubishi completed a series of industrial and commercial changes, with the original shareholders Mitsubishi Corporation and Mitsubishi Motors Corporation fully exiting. The only remaining shareholder was GAC Group, and the company's name was changed from GAC Mitsubishi to Hunan Zhixiang Automobile Management Co., Ltd.

At that time, Shenyang Aerospace Mitsubishi was still producing and supplying engines to domestic automakers and continued to provide after-sales service for sold vehicles.

Mitsubishi Motors' history in China began with engine technology cooperation. With the eventual exit from the first two factories it established, Mitsubishi Motors no longer has any ties to the automotive industry in China, marking the end of an era.

Looking back at Mitsubishi Motors' development in China, its journey has been complex with numerous partners but has also experienced moments of glory.

It can be traced back to 1973 when Mitsubishi Motors first entered China as an importer, primarily with medium-sized truck products. In 1983, it started cooperating with Beijing Automotive Industry Corporation to produce and sell automobiles in China and established its first joint venture enterprise, Beijing Jeep Automobile Co., Ltd., to produce Jeep sedans and off-road vehicles.

There were also Dongfeng Mitsubishi and Nanjing Mitsubishi in the 1990s, but neither lasted long. The cooperation with Changfeng Motor on the Leopaard SUV began to gradually make Mitsubishi known to the public in China.

Later came Southeast Mitsubishi and GAC Mitsubishi, marking a period of stable development for Mitsubishi in China. In particular, the joint venture between GAC and Mitsubishi pushed Mitsubishi Motors' performance in China to new heights.

In May 2012, GAC Mitsubishi was officially established, successively launching models such as ASX and Eclipse Cross. Sales were average until the third-generation Outlander was introduced for domestic production in 2016, when GAC Mitsubishi's sales improved. In 2018, GAC Mitsubishi sold 144,000 vehicles, marking Mitsubishi's sales peak since entering China.

However, since then, it was also the beginning of the rise of domestic independent brands and new energy vehicle makers. Coupled with Mitsubishi's lagging product updates, sales began to decline gradually from 2019. From 2019 to 2022, GAC Mitsubishi's sales fell from 133,000 to 33,000 vehicles, a drop of 80%.

By 2023, everyone knows the story: vehicle production was paused, the vehicle business was exited, and GAC Mitsubishi was dismantled.

Mitsubishi is not doing well in China and is also facing pressure from Chinese brands in other overseas markets. Southeast Asia has always been a key market for Mitsubishi Motors, accounting for up to 30% of its global sales. However, in recent years, Chinese automakers have begun to collectively expand in Southeast Asia, leading to a decline in Mitsubishi's market share.

Chinese automotive brands such as Geely, Great Wall, and BYD, which once relied on Mitsubishi, now not only possess complete engine research and development technology but have also embarked on their own paths through the transformation towards electrification.

When the once-renowned "Mitsubishi engine" is no longer a marketing gimmick used by manufacturers, Chinese automobiles have achieved overtaking.

And Mitsubishi, the once-dominant player, has to face the reality of its twilight years.