The New Energy Vehicle Market to Undergo Transformation in 2025: Plug-in Hybrids Decelerate, Pure Electrics Accelerate and Surpass!

![]() 07/25 2025

07/25 2025

![]() 494

494

According to the China Association of Automobile Manufacturers, from January to June this year, sales of plug-in hybrid models in China's automotive market totaled 2.521 million units, marking a 31.1% year-on-year increase. In contrast, the growth rates for plug-in hybrids from 2021 to 2024 were 140%, 151.6%, 84.7%, and 84.5%, respectively, indicating a notable slowdown.

Conversely, sales of pure electric models reached 4.415 million units during the same period, up 46.2% year-on-year. Prior to this, the growth rates for pure electric models were 24.9% and 15.5%, respectively, suggesting a rapid acceleration in sales.

Behind these shifts lies a transformation in China's new energy vehicle market. Experts attribute this to several key factors. Firstly, subsidy policies play a significant role. Models priced between 200,000 and 300,000 yuan receive a subsidy of 20,000 yuan, while pure electric models priced below 100,000 yuan also qualify for the same subsidy. This "one-size-fits-all" approach incentivizes consumers to opt for lower-priced models. Secondly, the rapid improvement in range for pure electric models, with many now offering 500 to 600 kilometers on a single charge, has significantly alleviated range anxiety among consumers, thereby compressing the market space for plug-in hybrids.

Demand-Driven Growth of Plug-in Hybrids

The rise of plug-in hybrids as a mainstream powertrain option in the new energy vehicle market is a recent phenomenon. Prior to this, pure electric models dominated with over 80% market share.

In 2021, domestic sales of plug-in hybrid models hit 603,000 units, up 140% year-on-year. However, despite this significant increase, their market share fell from 18.4% to 17.1%, as sales of pure electric models surged to 2.916 million units, up 161.5%. By 2024, sales of plug-in hybrids reached 5.146 million units, increasing their market share to 40%. In contrast, the growth rate for pure electric models declined to 15.5%, and their market share dropped to 60%.

From a consumer perspective, the surge in plug-in hybrid sales is attributed to product development that closely aligns with consumer needs. Plug-in hybrids offer long driving ranges, balancing the advantages of fuel vehicles and pure electrics in terms of driving experience, product performance, and driving habits, thereby gaining consumer recognition.

Take BYD and Geely as examples. BYD's fifth-generation DM-i system features a 46.06% thermal efficiency engine and an efficient electric drive unit, while Geely's 2024 Thor EM-i boasts a 1.5L naturally aspirated engine (BHE15) with a thermal efficiency of 46.5%. Both models offer a pure electric range of 200 kilometers, covering the daily commuting needs of 90% of users and reducing fuel consumption.

Furthermore, 800V high-voltage platforms significantly reduce energy loss and heat generation compared to traditional 400V systems, enabling faster charging. For instance, BYD's Seal DM-i, equipped with an 800V platform and the fifth-generation DM hybrid system, offers ultra-fast charging capabilities, achieving 300 kilometers of range with just 10 minutes of charging, enhancing the consumer driving experience.

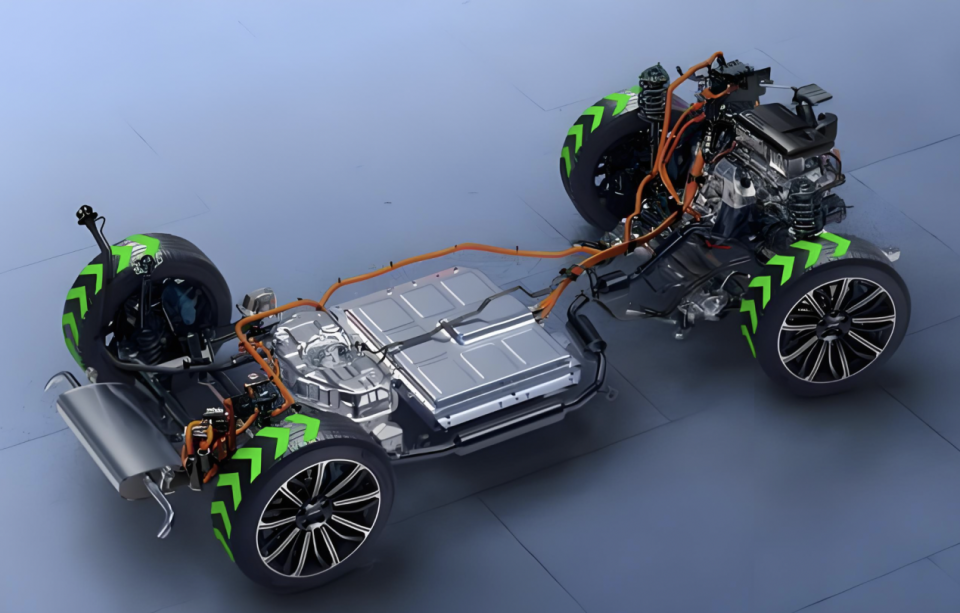

From an automaker's perspective, China is still in the early stages of new energy vehicle adoption, and most traditional automakers are slow to embrace electrification. With decades of experience in fuel vehicle technology, supply chains, and production facilities, a complete shift to pure electrics would involve significant sunk costs. Plug-in hybrid technology offers a transitional solution, avoiding the waste of resources associated with radical transformations.

Additionally, current challenges for pure electric vehicles include high battery costs, range anxiety, and inadequate charging infrastructure. Plug-in hybrids address these issues through "oil-electric synergy," offering models with comprehensive ranges of 1,200 kilometers and fuel consumption of 3 to 4 liters per 100 kilometers under depleted battery conditions.

Coupled with the uneven distribution of charging infrastructure, plug-in hybrids find opportunities in third- and fourth-tier cities and rural areas where charging pile coverage is inadequate.

Plug-in Hybrids Under Pressure, Pure Electrics Accelerate

However, the sales growth rate of plug-in hybrids declined sharply in the first half of this year, primarily due to the significant development of pure electric models.

Firstly, the pure electric vehicle market in 2025 demonstrates remarkable price competitiveness and technology popularization, with technology downscaling and price reductions across all price ranges.

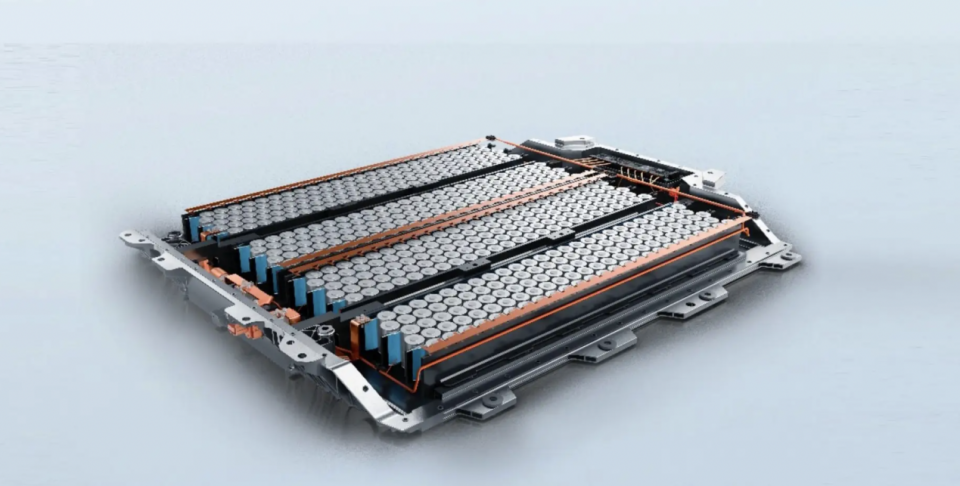

Small pure electric cars like the BYD Seagull and Geely Xingyuan have official starting prices of 69,800 yuan and 68,800 yuan, respectively, making them highly competitive in a price range where no plug-in hybrids exist. The decline in battery costs (due to the popularization of CTP technology) and large-scale production enable pure electrics to control prices, while plug-in hybrids, with their dual power systems, have limited cost compression potential.

Consider the XPeng MONA M03, which offers four versions with ranges of 515km, 502km, 600km, and 620km. The highest range version (620km) is priced at only 129,800 yuan, equipped with a lithium iron phosphate battery and CTB integration technology, achieving an energy consumption as low as 11.5kWh per 100 kilometers. The Max version comes standard with the XNGP system, supporting urban/highway NOA, automatic parking, and AI valet parking, with features comparable to models priced at 300,000 yuan. Plug-in hybrid models at the same level cannot keep pace.

Secondly, pure electric models offer longer driving ranges. In 2025, mainstream pure electric models generally have a CLTC range of 600km+ (such as the Xiaomi SU7 Max version with a range of 800km), coupled with 800V high-voltage fast charging (150km of range in 5 minutes), covering 90% of users' travel scenarios. In contrast, the pure electric range of plug-in hybrids remains concentrated at 100-200km, requiring frequent charging, which can burden the user experience.

Thirdly, policies favor pure electric models. In 2025, the trade-in policy offers higher subsidies for pure electric models (20,000 yuan for scrapping an old car and replacing it with a new energy vehicle, compared to only 15,000 yuan for a fuel vehicle or plug-in hybrid). Additionally, low-priced pure electric models below 100,000 yuan have a significant cost advantage due to the larger absolute value of subsidies, with prices dropping to the 50,000-80,000 yuan range after subsidies, directly impacting the plug-in hybrid market.

Moreover, China's total number of charging piles has exceeded 10 million, with supercharging piles accounting for over 30% and 98% coverage within 5 kilometers of highway service areas. In contrast, plug-in hybrid users need both charging and refueling, making energy replenishment more complex.

Fourthly, the maintenance of plug-in hybrid models with dual power systems is more complex and costly. Due to the higher cost of the dual system, plug-in hybrids struggle to compete with pure electrics in the low-price market. Taking the 100,000-yuan level as an example, electric models at the same price point offer ranges of over 400 kilometers and superior intelligent configurations, while plug-in hybrids fall slightly behind. Pure electric platforms are easier to integrate advanced intelligent driving (urban NOA) and full-domain OTA, while plug-in hybrids face limitations in space for intelligent upgrades due to their fuel architecture. Furthermore, plug-in hybrids require maintenance of both the engine (oil, spark plugs, etc.) and the electric drive system (battery, motor), inevitably leading to higher maintenance costs compared to pure electrics, which do not require engine maintenance.

Therefore, the decline in the growth rate of plug-in hybrids is the result of a combination of factors, including market saturation, shifting consumer demand, and technological substitution by pure electric models.

Ordinary People's Car Reviews

The next two years may mark a turning point for plug-in hybrids and pure electrics. The short-term challenges faced by plug-in hybrids stem from the market transitioning from "demand-driven" to "technology-driven," while the rapid growth of pure electrics signals the accelerated arrival of the final competitive landscape. For automakers, striking a balance between the "transitional dividends" of plug-in hybrids and the "long-termism" of pure electrics will be crucial in their strategic layout.