China's Auto Market Bids Farewell to "Mitsubishi Power"

![]() 07/25 2025

07/25 2025

![]() 456

456

Introduction

Mitsubishi has definitively severed ties with the Chinese market, a development for which it alone bears responsibility.

What marks the end of an era in China's auto market? With numerous foreign brands exiting and joint ventures collapsing, the rise of Chinese independent brands offers clear answers.

In this era of technological innovation, some argue that past technology imports and joint ventures were merely timely strategies to capitalize on the times. However, during China's automotive infancy, we cannot overlook the significant influence of overseas automakers like Volkswagen, Toyota, and Mitsubishi on China's automotive enlightenment and industrial infrastructure.

From Changfeng Liebao, Hafei Automobile, Beijing DaimlerChrysler to Southeast Mitsubishi, GAC Mitsubishi, and Dongan Mitsubishi to Shenyang Aerospace Mitsubishi, despite Mitsubishi's seemingly promiscuous relationships with many Chinese enterprises, every collaboration, regardless of Mitsubishi's performance vis-à-vis Volkswagen or Toyota, injected vitality into China's automotive development through model and engine introductions.

Particularly in engines, since entering China through technological cooperation in the 1980s, Mitsubishi engines became the "nurse" for nearly all Chinese automakers, guiding them from nothing to something.

While the establishment of the joint venture engine plant was partly due to Mitsubishi's survival crisis, perhaps this serendipitous opportunity shaped the past of Mitsubishi and domestic manufacturers. However, it was also Mitsubishi's own issues that led to its current situation.

Mitsubishi Motors' announcement of terminating its joint venture cooperation and engine business operations with Shenyang Aerospace Mitsubishi Automobile Engine Manufacturing Co., Ltd. signifies its complete exit from China's auto-related production. However, given China's auto industry's progress over the past 20 years, Mitsubishi's name will only remain in history.

01 A Glorious Past That Ultimately Turned into a Bubble

Today, affected by China's industrial transformation, the new energy industry is increasingly reducing its engine reliance, and weak Chinese automakers have gone bankrupt. As foreign suppliers, they have struggled. Given this context, it was only a matter of time before Mitsubishi fully exited the Chinese market. However, the termination of engine business cooperation still came as a surprise compared to the comprehensive collapse of its entire vehicle business.

At the turn of the century, leveraging its early China cooperation and cultivation, Mitsubishi saw the Chinese market's huge potential and invested in establishing Shenyang Aerospace Mitsubishi Automobile Engine Manufacturing Co., Ltd. and Harbin Dongan Automobile Engine Manufacturing Co., Ltd. in 1997 and 1998, respectively.

Despite these investments contradicting the then-popular automaker collaborations, given the industrial ecology, Mitsubishi's foresight in focusing on engines—core automotive components—proved beneficial.

Around 2000, Mitsubishi faced a survival crisis akin to later overseas emissions scandals and the Pajero brake scandal in China. What could Mitsubishi rely on during this severe weakening?

The engine businesses of Dongan Mitsubishi and Shenyang Aerospace Mitsubishi became Mitsubishi's turning point in China. With its brand tarnished and sales declining, being a supplier seemed viable.

Over 20 years ago, what decent engine technology did Chinese automakers possess? Besides crude imitation, there was little to show. Thus, regardless of the engines' age, Mitsubishi's durability, reliability, large quantities, and low prices met major automakers' needs. Can you name a Chinese automaker that wasn't a major Mitsubishi engine customer?

From Dongan's 4G13, 4G15, 4G18, and 4G93 to Shenyang Aerospace's 4G63 and 4G64, with displacements ranging from 1.3L to 2.4L, they perfectly suited various manufacturers' existing models.

Despite Mitsubishi stipulating that only Shenyang Aerospace engines could carry the Mitsubishi logo, given China's nascent auto market, Mitsubishi engines' utility made them irresistible.

By 2017, when the 5 millionth engine, a 4K2, rolled off Aerospace Mitsubishi's production line, this milestone propelled Mitsubishi's engine business in China to new heights.

However, as the saying goes, "All good things must come to an end." Who would have thought Chinese automakers would persist in self-researching engines? As companies developed their own engine technology and received positive market feedback, Mitsubishi engines suddenly had no place, not because they were bad, but because demand decreased.

In the short term, Mitsubishi engines could still supply Southeast, Landwind, and Zotye, which hadn't yet gone bankrupt. But as time passed and these weaker automakers gradually fell, there was no more room for Mitsubishi engines.

On September 20, 2020, Harbin Dongan Automobile Power Co., Ltd. announced a major asset reorganization by purchasing a 19.64% stake in Dongan Automotive Engine held by Mitsubishi Motors Corporation, Mitsubishi Corporation, and Malaysia-China Investment Holdings Co., Ltd. to leverage synergies, achieve economies of scale, and avoid duplicate investments.

Frankly, from that moment, Shenyang Aerospace Mitsubishi's fate was sealed. Five years later, Mitsubishi Motors' choice to withdraw from the joint venture is the ultimate proof that Mitsubishi power has no place, presumably ending the legendary chapter of Mitsubishi engines in China.

02 Failure to Change Means Being Abandoned by the Times

Over the past two decades, China's auto industry's development has been evident. Engine technology research and development have always been vibrant. In other words, as long as Chinese automakers are willing to change, they don't need Mitsubishi; Mitsubishi power will eventually be discarded.

Looking back, mainstream Chinese automakers like Geely, BYD, Great Wall, Changan, and Chery have shown no lag in engine research and development.

When Li Shufu proposed that "a car is just four wheels and two sofas," did Geely truly continue building cars with that mindset?

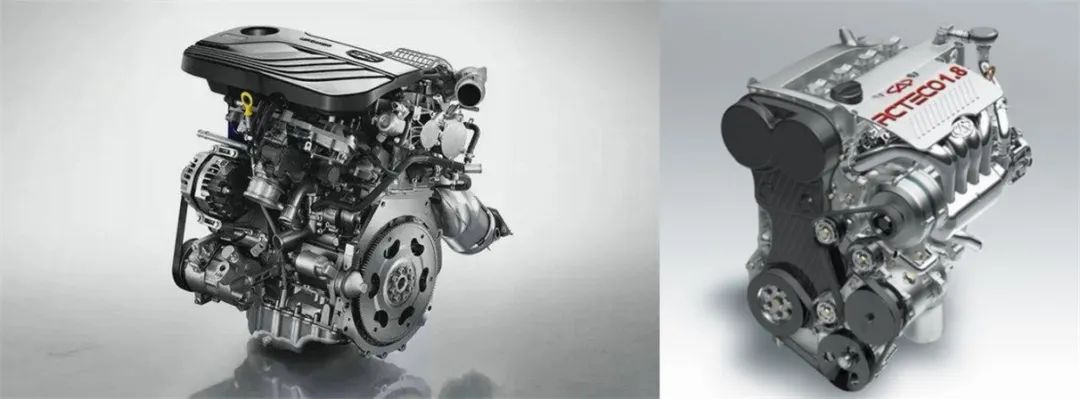

In Geely's early stages, although it adopted the Toyota 8A engine in many models, and subsequent Mr series engines were improved based on external technology, by 2006, Geely officially launched its new 4G series engines. The GL4G18 engine, as China's first equipped with CVVT technology, laid the foundation for Geely's industrial base.

Then, with Geely's acquisition of Volvo, leaning on Volvo's engine technology, creating engines with stronger performance and better market adaptability became almost effortless.

Meanwhile, from successfully igniting its first engine in 1999 to launching the fully independent intellectual property ACTECO series in 2005, while purchasing mature powertrains, Chery was also engaged in real independent research and development, hoping to break the technological blockade.

Around 2011, the 4T15B series 1.5T engine directly increased thermal efficiency to 37.1%, surpassing Volkswagen's EA211 engine of the same period. Later, with Kunpeng power's emergence, Chery's engine technology accumulation is undeniably deep.

I've always believed the market favors the prepared. Geely and Chery are just some representatives. From the ignorant stage to growth and maturity, every Chinese automaker striving for greatness has acquired a set of skills in this process.

Today, although the new energy industry's progress has rewritten traditional technological paths, it's undeniable that Mitsubishi power's disappearance isn't solely due to supply-side issues. With plug-in hybrid and extended-range vehicles' sudden rise, who can say researching engine technology will be useless?

From an outsider's perspective, Mitsubishi's withdrawal from the engine joint venture business is due to deteriorating profitability, making it unable to hold on. But ultimately, I prefer to view Mitsubishi as a casualty of the times. If Mitsubishi Motors had invested more in engines and studied Chinese automakers' needs, outcomes might have been different.

Ironically, as one of Mitsubishi's former engine joint venture main entities, Dongan Power has not only reversed its past decline in recent years but has also shone brightly in new fields.

As early as 2022, by capturing the extended-range power engine market, Dongan Power's sales soared to 613,400 units, with revenue reaching 5.767 billion yuan and net profit exceeding 100 million yuan. By 2023, it had secured the top market share among domestic independent gasoline engine enterprises, becoming a leading supplier to emerging enterprises. This year, facing the future, Dongan Power has even shouted the slogan, "Challenge 1 million engine sales by 2026 and 10 billion yuan revenue by 2027."

As China's auto industry accelerates its electrification transition, it's understandable for Mitsubishi Motors to reassess its regional strategy and ultimately decide to completely withdraw from Shenyang Aerospace Mitsubishi's operations. Business records show the joint venture was renamed Shenyang Guoqing Power Technology Co., Ltd. on July 2, with all former Mitsubishi shareholders having exited and the new shareholder being Beijing Saimu Technology Co., Ltd. Everything is now settled.

But throughout this process, as we marvel at China's auto industry's rise, recalling the past 30 years' industrial changes, some enterprises' arrivals and departures are mostly due to their own reasons. All we can say is, goodbye, Mitsubishi power.

Chief Editor: Shi Jie

Editor: He Zengrong

THE END