Net Profit Slumps 23%, Musk Pushes Forward with Bold Promises: Revolutionizing Robots and Robotaxi

![]() 07/25 2025

07/25 2025

![]() 593

593

Suspense Lingers for the Coming Year

Author | Wang Lei

Editor | Qin Zhangyong

Tesla's second-quarter financial report has been released, revealing a challenging performance. Not only did profits plummet, but it also marked the largest single-quarter decline in a decade.

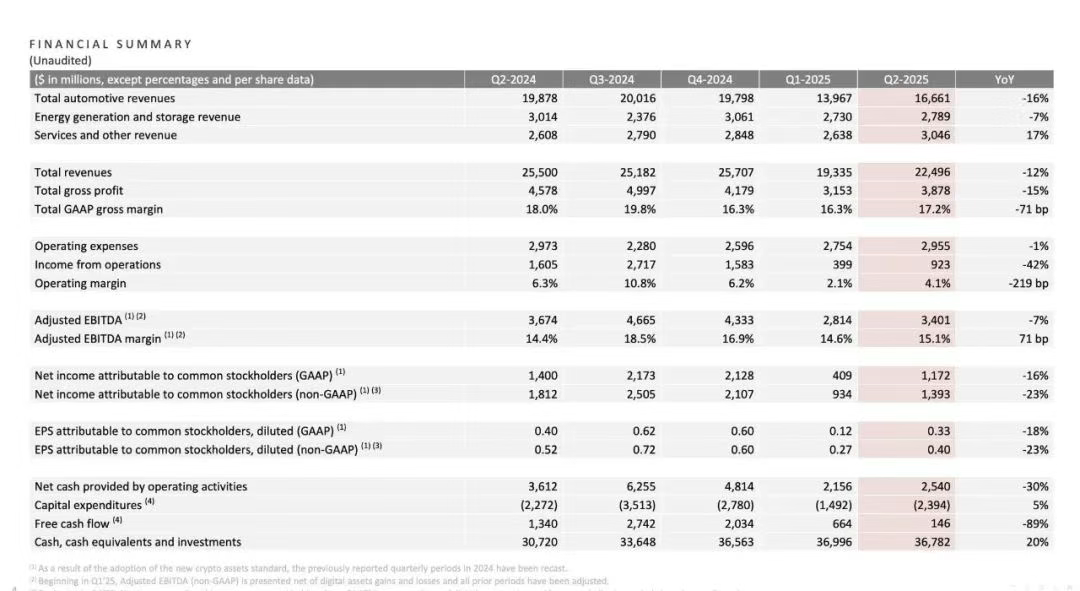

Revenue stood at $22.496 billion, down 12% year-on-year, while net profit amounted to $1.172 billion, a decrease of 20.7% year-on-year. Free cash flow plummeted by nearly 90% to just $146 million.

However, Musk remains undeterred. He even commented that Q2 2025 is a significant milestone in Tesla's history, stating, "We will transition from being a leader in the electric vehicle and renewable energy industries to a leader in AI, robotics, and related services."

He boldly asserted that Tesla is moving from a phase where "robots are rare" to one where "they are so abundant that no one even looks up," painting a vivid picture for investors in just 20 minutes that Tesla is undoubtedly poised to become the "most valuable company in the world".

Despite underwhelming results, Musk's confidence remains unshaken.

01 Severe Performance Decline

Let's start with two key data points.

Tesla's second-quarter revenue was $22.496 billion, down 12% from the same period last year, marking its largest single-quarter revenue decline since 2012 and falling short of Wall Street's expectations of $22.6 billion.

Net profit was $1.172 billion, down 16% year-on-year, while adjusted net profit was $1.393 billion, a decrease of 23% year-on-year. Adjusted earnings per share were only $0.40, not only below Wall Street's expectations of $0.42 but also a significant decline of 23% year-on-year.

Even when considering the entire first half of the year, Tesla's overall performance showed declines in both revenue and profit. Its total revenue for the first half was $41.8 billion (approximately RMB 299.5 billion), down 11% year-on-year from $46.8 billion (approximately RMB 335.1 billion) in the same period last year.

Moreover, the decline in net profit for the first half reached 30%, with net profit of $2.327 billion (approximately RMB 16.7 billion) compared to $3.348 billion (approximately RMB 24 billion) in the same period last year.

The lagging performance of core data clearly illustrates that Tesla is facing severe challenges.

Specifically, the core automotive business fell from $19.9 billion (approximately RMB 142.5 billion) in the second quarter of 2024 to $16.6 billion (approximately RMB 118.9 billion), a decline of 16.6%.

The other two segments, energy and services & other, recorded revenues of $2.79 billion and $3.05 billion, respectively, with the former down 7% year-on-year and the latter up 17% year-on-year.

The core automotive business has become a drag on performance.

The downturn in the automotive business is simply due to poor sales. In the second quarter of 2025, new vehicle deliveries amounted to 384,100 units, a decrease of approximately 60,000 units or 13.48% year-on-year. Although this figure is better than the market's pessimistic expectation of 350,000 units, it is still Tesla's largest single-quarter decline in deliveries ever.

The decline in Tesla's automotive business was anticipated by many, as in recent months, Tesla has reported varying degrees of sales declines or halving in its major sales markets.

If we extend the timeline, Tesla's cumulative deliveries for the first half of 2025 were also about 110,000 units lower than the same period last year. If Tesla fails to make up for this gap in the second half, it is highly likely that the company will experience its first annual sales decline since 2016.

Moreover, the "double decline" in sales and gross margin is forming a vicious cycle. Tesla's second-quarter gross margin was 17.2%, up from 15.8% in the first quarter but still below the level of over 18% in the same period last year.

The compression in gross margin mainly stems from various incentive measures such as price reductions to stimulate sales, leading to a decline in revenue per vehicle. In the second quarter, revenue per vehicle fell to $42,231, a decrease of $500 from the same period last year.

Additionally, Tesla disclosed a factor that directly affects profits: the further decline in regulatory credit sales revenue.

In the second quarter, as U.S. electric vehicle subsidy policies faded and carbon trading tightened, Tesla's revenue from carbon emission credits was only $439 million, a decline of over 50%. Notably, this is pure profit.

Despite its performance already at a low point in recent years, Musk still issued a warning, stating that Tesla is in an "unusual transition period." The company is likely to face "several challenging quarters" after losing electric vehicle sales incentives in the U.S.

02 Reluctance to Discuss Cheap Cars

Although Musk himself believes that the next few quarters will be "tough," he doesn't seem overly concerned.

Instead, during the earnings call, he continued to "paint a big picture," stating that the situation will significantly improve later, with breakthroughs focused on autonomous driving and robotics, with the turning point set for no later than the end of next year.

Firstly, regarding Robotaxi, Musk said that by the end of this year, about half of the U.S. population will have access to autonomous ride-hailing services.

Since the launch of the Robotaxi trial operation in June, it has operated over 7,000 miles, with positive customer feedback and "no significant safety-critical incidents to date," and the Robotaxi service area in Austin is continuously expanding.

Musk plans to significantly increase the service area within two weeks to reach a scale far exceeding that of competitors. Next, the Robotaxi service will expand to the Bay Area, Arizona, and Florida.

"I think by the end of this year, half of the U.S. population will have access to Robotaxi services." Of course, Musk added that this depends on regulatory approval, and by then, "the Tesla Robotaxi fleet is likely to grow from minuscule to massive in a very short period."

In Musk's view, his technology already meets regulatory requirements, and the safety driver in the co-pilot seat is currently only to speed up regulatory approval and is not strictly necessary.

He also said that he expects car owners to be able to add their vehicles to the Tesla fleet next year, "the specific timing is uncertain but definitely next year."

Next, costs will be further reduced, with the cost per mile dropping to $0.25-$0.30. He also mentioned the future Cybercab model, which has the potential to reduce costs to less than 30 cents. Musk stated that the design of the Cybercab aims for cost optimization.

For example, in the case of reduced speed, lower-cost tires or motors can be used, and even costs can be reduced on brakes. Musk predicts that Robotaxi will have a significant impact on Tesla's financial position by the end of next year.

However, before the Robotaxi scale becomes significant, Musk still wants more people to use FSD.

Since the launch of FSD V12, the adoption rate of FSD in North America has increased by 25%. The company's vehicle safety report shows that vehicles using FSD are 10 times safer than those not using it.

However, more than half of Tesla owners have never used FSD. To encourage these owners to use FSD, Tesla will proactively send FSD videos and demonstrate FSD functionality to them.

Moreover, in Tesla's view, FSD is the biggest demand driver for car sales. Currently, Tesla has not yet obtained approval for supervised FSD in Europe. This time, Musk revealed that approval for the supervised Full Self-Driving (FSD) feature is imminent from Dutch regulators.

"We believe that once we can provide customers in Europe with the same experience as in the U.S., our sales will improve significantly."

Additionally, Musk also stated that Tesla is making significant improvements to its FSD hardware, potentially increasing the number of model parameters by 10 times, i.e., HW5, which will achieve mass production by the end of 2026.

Compared to his talkativeness about Robotaxi, Musk seems to attach less importance to Tesla's upcoming cheap car model and even doesn't like to disclose too much information about it.

During the call, an analyst asked about the cheap car model, and Musk replied, "We'll talk about it after the car is released." Later, under continued questioning from the analyst, Musk said that the model has started production as scheduled in June and will be released in Q4.

Then, Musk remained silent...

In stark contrast, Musk spent considerable time discussing the robotics business. He stated that the third-generation robot prototype will be seen this year, with mass production next year. He even boldly declared, "If we can't produce 100,000 Optimus per month within 60 months (5 years), I will be very surprised."

He also took a dig at Google, stating that although Google excels in AI, it is not strong in real-world AI applications. Years of experience in producing and designing cars are crucial.

Finally, Musk reiterated that if Tesla executes well, it can indeed become the most valuable company in the world.