Sales Avalanche: Is Musk's 'Pie' Still Delicious?

![]() 07/28 2025

07/28 2025

![]() 731

731

Can Musk, having turned over a new leaf, steer Tesla back on track?

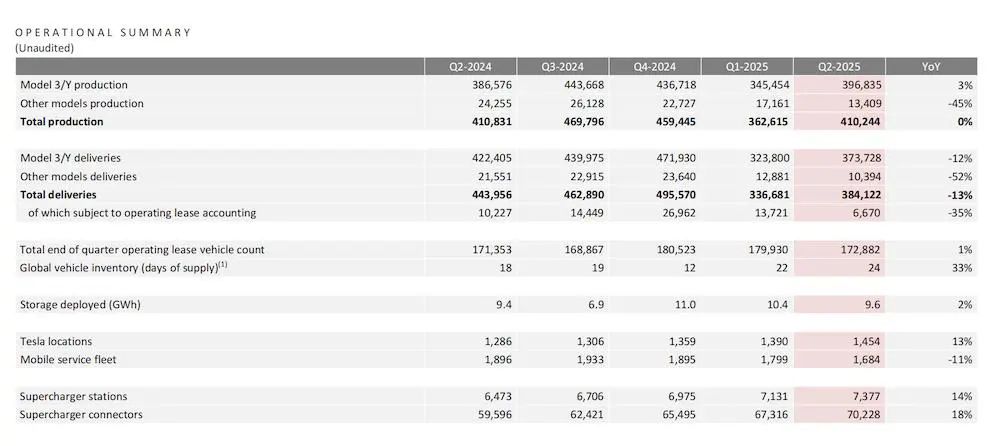

Three months ago, Tesla delivered its worst-ever first-quarter report, with both revenue and profit declining. Net profit fell to just $409 million, the first time in five years it had dropped to a single-digit figure. Global deliveries decreased by 13% year-on-year to 336,700 units, marking the lowest quarterly delivery since the second quarter of 2022.

Since then, Musk has gradually retreated from political controversies. After bidding farewell to the White House, Musk once again took up residence in the workshop, personally overseeing the FSD and Robotaxi projects, aiming to reignite Tesla's imagination space through AI.

Recently, Tesla released its second-quarter 2025 financial report. As anticipated, Tesla once again witnessed a double decline in revenue and profit, realizing revenue of $22.5 billion, a year-on-year decrease of 12%. Net profit was $1.172 billion, a year-on-year decrease of 16%, marking the largest revenue decline in nearly a decade.

However, Tesla's deliveries in the second quarter of this year reached 384,100 units. While the year-on-year decline from the previous quarter persisted, there was a 14% increase quarter-on-quarter. Nonetheless, from a longer-term perspective, Tesla's overall deliveries could not arrest the downward trend.

Tesla, once a trendsetter, seems to have been suddenly surrounded by competitors. Musk's 'political dream' and 'technological dream' ultimately must yield to performance realities.

1. Tesla is 'Not Selling Well'

"Tesla's moat is crumbling," a financial analyst bluntly stated after the quarterly report was released. In the first half of this year, sales of the 'sales twins' Model 3 and Model Y in the Chinese market declined by 11.32% and 16.71%, respectively.

Not only in the Chinese market, but according to preliminary sales data from Data Force, Tesla's sales in the EU market also witnessed a significant decline in the first half of this year, falling 33% year-on-year.

It was not until June of this year, driven by the delivery of the new version of the Model Y, that Tesla's sales began to show signs of rebound. In the second quarter of this year, Tesla's profit margin improved, and the price increase of the renewed Model Y also contributed significantly.

However, the month-on-month recovery could not conceal Tesla's deep-seated concerns. For years, the Model 3 and Model Y have borne the brunt of sales, and Tesla's product matrix has remained largely stagnant. Meanwhile, new Chinese players have launched new models at a rate of one per month, significantly eroding Tesla's market share.

Counterpoint Research predicts that Tesla's global market share will fall to 13% in 2025, with the Chinese and European markets declining to 7.6% and 0.9%, respectively. For reference, Tesla's market share in China reached 15% in 2020.

However, Tesla's sales crisis stems from more than just the saturation of the new energy vehicle market. Musk's political gambits have also backfired. According to surveys by various institutions, 62% of potential buyers believe that Musk's political stance has affected brand neutrality; in the second quarter of this year, American consumers' recognition of Tesla fell to 32%.

Tesla's brand value is plummeting at an unprecedented speed in automotive history. In the past two months, Musk has begun to lay low, first withdrawing from political disputes and then making peace with Trump, but it remains unclear whether he will shift his focus back to the automotive business.

The answer may be no. In the first quarter of this year, Tesla delivered its 'worst financial report ever', but during the subsequent press conference, Musk did not focus on improving the automotive business; instead, he elaborated extensively on autonomous driving and robotics projects.

Almost simultaneously, foreign media reported that Musk had personally decided to terminate the Model 2 project, a new mass-market model eagerly anticipated by the outside world with an estimated price of $25,000 (approximately RMB 178,000). During the Q3 2024 financial report meeting, Musk also mentioned that Model 2 would be mass-produced and launched in the first half of 2025.

The report stated that insiders at Tesla believe that Musk has lost interest in car manufacturing. Although most Tesla executives disagreed with the cancellation of the Model 2 project, Musk persisted in his belief that 'making cheap cars is meaningless; he wants to do things that change human civilization.'

This explains why Tesla's automotive business performance has become increasingly mediocre in recent years. Musk's attention to automotive R&D has gradually waned, and there are few new highlights in automotive products, which can only propel sales through price reductions and promotions.

In the first quarter of this year, Tesla's overall automotive gross margin fell to 16.2%, the lowest level in over a decade. Although Tesla's automotive gross margin recovered somewhat in the second quarter, automotive sales revenue declined 16.6% year-on-year to $16.6 billion (approximately RMB 118.9 billion).

2. Fluctuating Car Manufacturing Plans

Interestingly, despite widespread media reports on this matter, Musk has not made any statements regarding it. He has neither denied nor admitted to terminating the Model 2 project.

Recently, there was a reversal on this matter. Tesla officially stated in a report that it had launched a more affordable model for the first time in June and planned to mass-produce it in the second half of 2025.

An informed source said that Tesla's product planning has always been flexible to quickly respond to market changes. However, it should be noted that if this affordable model is the 'Model 2' mentioned by Musk, the outside world's understanding of it is limited to a few spy shots and the rumored pricing of $25,000.

Whether this new car has sufficient differentiation or is merely a 'streamlined version of the Model Y' will only be revealed upon its launch. Moreover, its launch time is six months later than Musk's promise last year, and whether it will be delayed again in the future is probably known only to Musk.

However, while the affordable model remains uncertain, Tesla officially announced that the new Model Y L would be available in the 'golden autumn'. It is reported that the Model Y L is the previously rumored six-seat Model Y, positioned as a luxury SUV suitable for all scenarios. Industry insiders estimate the price to be around RMB 400,000.

Currently, several Tesla models are already 'veterans', and consumers inevitably suffer from aesthetic fatigue. The family user group is precisely one of the core groups replacing new energy vehicles in the past two years, with married users accounting for more than 80% of the middle-class car market.

Therefore, it is natural for Tesla to address the shortcomings of family travel scenarios. After all, this field has already nurtured new energy leaders such as Li Auto and NIO, with NIO, known as the 'half-price Li Auto', even winning the sales championship in the first half of 2025.

However, referring to the positioning of the Model Y, the Model Y L will probably not adopt the strategy of a 'refrigerator, TV, and large sofa'. After all, Tesla has always emphasized performance, intelligence, and energy efficiency, which may differ from domestic family car models that emphasize 'comfort'.

But the Model Y L also has its unique characteristics. In the family car market where 'dad cars' are generally relatively bulky, it avoids competing with competitors in terms of space and comfort, potentially developing a new differentiated experience, such as allowing dad cars to speed up as well.

However, in the large SUV market, domestic new energy vehicle companies have covered all price ranges. Whether the Model Y L can eventually carve out a 'new path' in the family car market can probably only be verified in the third quarter.

Even so, the outside world still feels a sense of 'incongruity' towards Tesla's move to focus on the 'family battlefield'. In the early new energy vehicle market, Tesla always played the role of educating users, such as promoting the concept of autonomous driving, cultivating the habit of one-pedal driving, and cool door handle designs.

But now, Tesla has to adjust its pace to adapt to the mainstream demand for 'cheap and plentiful' in the domestic automotive industry, which also reflects Tesla's lack of innovation in the automotive business. This brand that believes in tech geeks is becoming a follower in the new energy vehicle market.

3. Musk Pursues the Tech Circle

From a disruptor to a remedial student, Tesla is finding a way to survive through compromise. But perhaps because of this, Musk, who yearns for adventure in his bones, is unwilling to devote more energy to the automotive business and instead focuses on building his technological empire.

Last April, Musk stated on social media that Tesla's capital expenditures in 2024 would exceed $10 billion, primarily used for joint training and reasoning artificial intelligence, which will be primarily applied in the automotive field.

This year, Musk's investment continues to grow. According to Caijing, the artificial intelligence company xAI founded by Musk is cooperating with the private equity firm Valor Equity Partners to raise up to $12 billion in a new round of funding. Additionally, Musk's space exploration technology company (SpaceX) will inject $2 billion into xAI.

Currently, xAI has launched the Grok-4 series model, known as the 'strongest AI on Earth'. It is reported that the Grok4 large model will be integrated into Tesla cars. Meanwhile, Tesla's FSD has been approved in more countries.

Musk revealed that Tesla is close to obtaining approval from Dutch regulatory authorities for supervised full self-driving (FSD) functionality. Additionally, after FSD officially entered the Chinese market in February this year, it also plans to launch FSD on a larger scale.

In June of this year, Tesla's Robotaxi officially launched pilot operations in Austin and will expand to more states in the coming months. Musk even boldly stated that 'by the end of this year, Tesla will be able to provide Robotaxi services to half of the US population.'

Furthermore, Tesla's robotics business is progressing. Musk said that the company is readjusting for Optimus 3 and hopes to increase the annual production of humanoid robots to 1 million units within five years.

However, Musk's actions of 'not minding his own business' seem highly consistent with his persona. As a recognized 'adventurer', he has never been content with mediocrity and is more eager to change the world.

In Musk's vision, xAI will become the 'brain' of his business empire, responsible for developing general intelligence that drives everything, including smart cars, robots, brain-computer interfaces, and SpaceX's satellites and starships. These intelligent terminals will also continuously generate massive amounts of real data to 'feed back' to the large model, forming a perfect closed loop.

Because of this, the market's valuation of Tesla has risen from a financial analysis level to a gaming dimension of whether Musk can rewrite the future. What investors buy now is not just Tesla stock but also an 'option' on Musk's personal vision.

Admittedly, Musk's technological empire has reached an unprecedented height in human business history. But the larger this empire becomes, the more uneasy investors become. When innovation in the automotive business gradually gives way to market compromises and resources continue to be tilted towards non-automotive areas, should Tesla become the capital that Musk uses to support his dreams?

This answer may only be given by time, but the fact that Musk has begun to vigorously save sales at least shows that, in the present, Musk's 'technological dream' is still inseparable from Tesla.