Weekly Stock Review|Navigating the A-share Market Above 3600 Points with Calm

![]() 07/28 2025

07/28 2025

![]() 726

726

A weekly review of automotive stocks reveals the diverse conditions within the auto market.

This July has seen the A-share market heat up significantly.

On July 9, the Shanghai Stock Exchange Composite Index (SSE Composite Index) broke through and recovered the 3500-point mark after an eight-month hiatus. Since July 17, the index has embarked on a "four-day winning streak," starting from 3500.37 points. On Wednesday, July 23, the SSE Composite Index surged past 3600 points for the first time since last year's "September 24 market trend."

On July 24, the SSE Composite Index closed up 0.65%, reaching an intraday high of 3608.73 points and finally settling at 3605.73 points, marking a new year-to-date closing high.

Despite significant fluctuations in global capital markets due to US tariffs and geopolitical conflicts since the second quarter, Chinese assets have defied the trend, showcasing remarkable resilience.

The only slight hiccup was on Friday, when the market could not withstand closing pressure. The three major A-share indices adjusted collectively, with the SSE Composite Index dipping below 3600 points. The SSE Composite Index fell slightly by 0.33% to close at 3593.66 points, the ChiNext Index declined by 0.23% to close at 2340.06 points, and the Shenzhen Component Index dipped by 0.22%. The CSI 300 and SSE 50 also saw slight declines, while the STAR Market 50 surged more than 2% fueled by the semiconductor sector, and the Beijing Stock Exchange 50 rose slightly.

Historically, the SSE Composite Index has only effectively stabilized above 3500 points three times in the past 35 years.

The first instance was during the bull market of share reform in 2006-2007. On April 12, 2007, the SSE Composite Index first surpassed 3500 points, closing at 3531 points.

In 2008, influenced by the subprime mortgage crisis, the SSE Composite Index fell below 3500 points in March. Although there were brief fluctuations later, it was not until the "leveraged bull market" in 2015 that it truly stabilized again.

On March 17, 2015, the market not only surpassed the high point of the 2009 market trend but also stood above the 3500-point mark for the second time in history, closing at 3502 points that day. After the stock market crash in the second half of the year, it failed to recover. It was not until January 4, 2021, that the SSE Composite Index stabilized above 3500 points for the third time.

Some experts have stated that "the Shanghai Composite Index, Shenzhen Component Index, and ChiNext Index have risen for five consecutive weeks. It is expected that next week, the index will consolidate at a high level near 3600 points, completing the exchange of chips through fluctuations. After a brief pause, it is still anticipated to challenge last year's high of 3674 points." Historically, 3500 points represents not only an important psychological level for the A-share market but also a "strategic highland" carrying the expectation of a bull market.

Unlike the intensive policy introductions surrounding last year's "September 24" event, the market has strengthened recently without a significant fundamental catalyst. This uptick is more attributed to endogenous emotional recovery and growth, as well as the natural flow of funds.

In terms of sectors, the Hainan Free Trade Zone, rare earth permanent magnets, lithium mines, super hydropower, and other sectors led the gains.

Particularly noteworthy, Tianqi Lithium hit a rare daily limit on Thursday this week, its first such limit this year. On July 24, the main contract of lithium carbonate futures surged again, with an intraday increase of nearly 8%, and the price exceeded 77,000 yuan/ton, setting a new high since mid-March. Since the start of this rebound in late June, lithium carbonate futures have risen by over 30%.

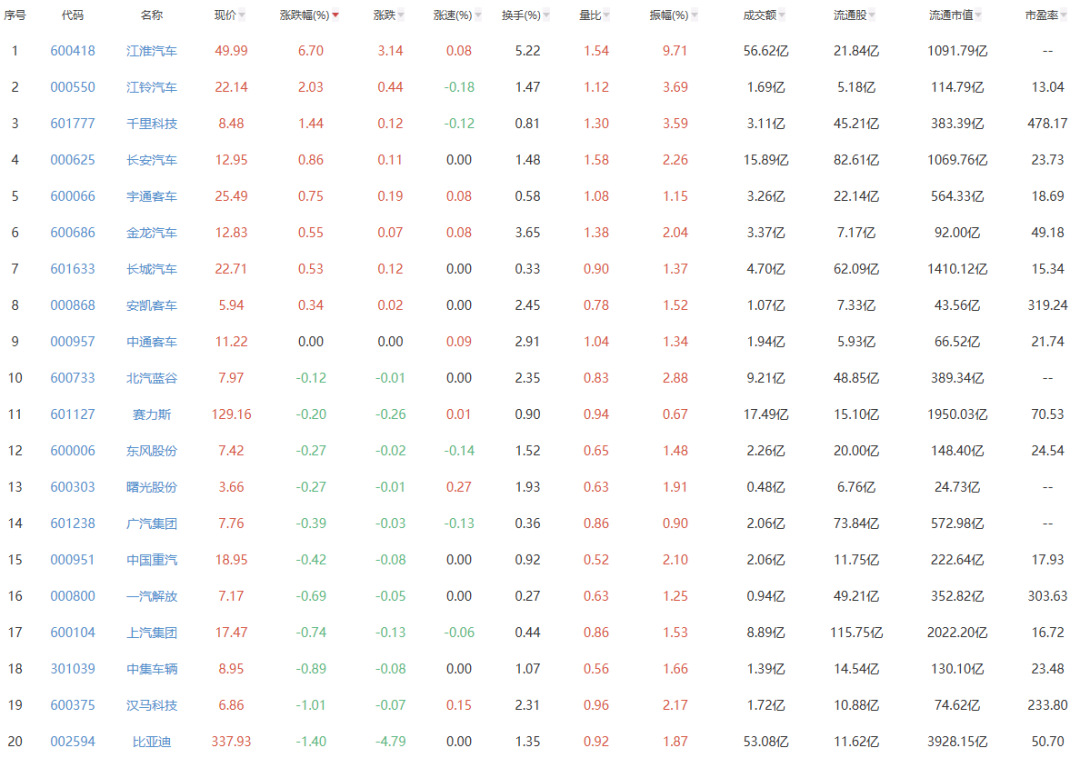

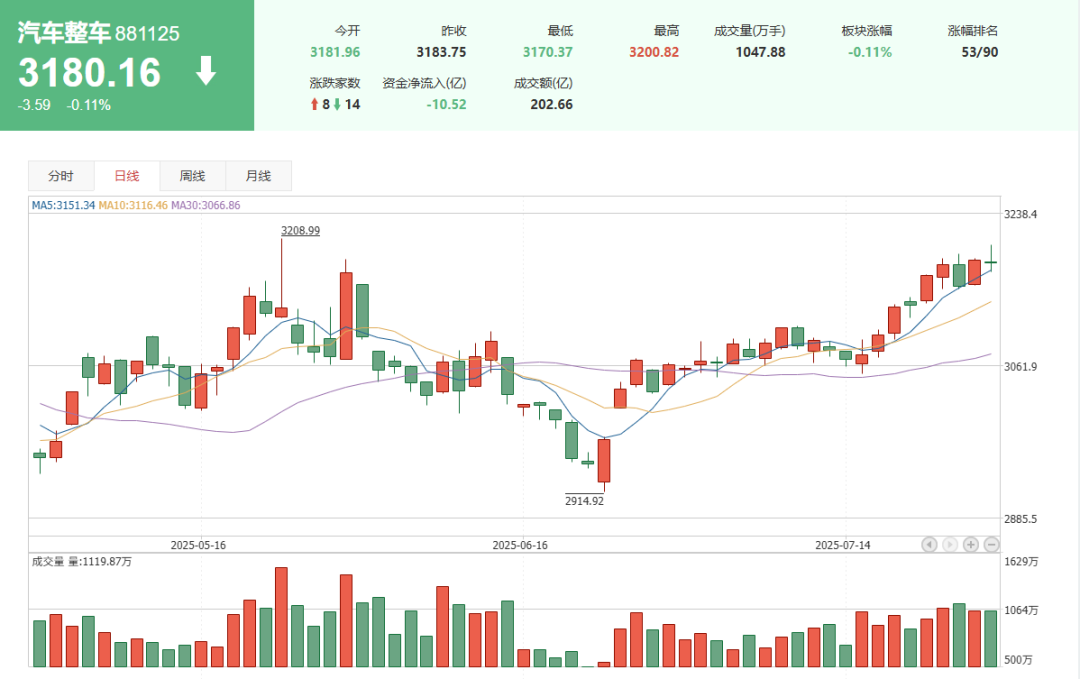

In terms of auto stocks, their performance was relatively muted, maintaining a low profile amidst this general market trend.

On July 25, JAC Motor opened at 46.63 yuan, and its share price climbed to 51.18 yuan, more than double that of the same period last year, setting a new record high. As of the close that afternoon, JAC Motor closed at 50.12 yuan, up 6.98%, and nearly 10% higher over the past five days.

In addition to JAC Motor, SAIC Motor, Thalys, BAIC BluePark, Dongfeng Motor, GAC Group, Changan Automobile, etc., all rose after the morning session on Friday. As of the close on the afternoon of July 25, the Huawei auto sector rose by 0.25%, with 44 stocks up. The sector has risen by 14.63% in the past quarter and 66.80% in the past year.

Two weeks ago, JAC Motor disclosed a 2025 first-half pre-loss announcement, forecasting a net loss attributable to shareholders of around 680 million yuan and a non-deductible net loss of around 820 million yuan, both turning from profit to loss year-on-year.

In fact, before that, JAC Motor's non-deductible net profit had been in the red for eight consecutive years, accumulating a loss of 13.805 billion yuan from 2017 to 2024.

It is worth noting that since February 2024, JAC Motor's share price has nearly quadrupled. In December 2023, JAC Motor actively embraced Huawei to develop the Zunjie project.

As the saying goes, "It's cooler under a big tree." However, a recent heated discussion on intelligent assisted driving has also propelled the Huawei system into the spotlight.

At the State Council press conference on July 23, Wang Qiang, Director of the Traffic Management Bureau of the Ministry of Public Security, pointed out that the "intelligent driving" systems currently equipped in cars sold on the market have not yet achieved the goal of "autonomous driving" and are still in the stage of assisted driving. Therefore, the driver remains the ultimate responsible entity and the first person accountable for driving safety.

He also stated that if the driver "lets go of the steering wheel and takes their eyes off the road" (i.e., removes their hands from the steering wheel and takes their eyes off the road conditions) during vehicle operation, it not only poses a serious road traffic safety risk but may also face triple legal risks, including civil compensation, administrative penalties, and criminal accountability.

The Ministry of Science and Technology also issued the "Ethical Guidelines for the Research and Development of Driving Automation Technology," establishing principles such as safety first and fairness and justice, clarifying responsible entities according to the levels of assisted driving (L0-L5), preventing ethical risks in science and technology, and emphasizing the need for realism in promoting intelligent assisted driving.

On the same day, the intelligent assisted driving test results jointly released by Dongchedi and CCTV News were also noteworthy. In the high-speed scenario simulation test, none of the 36 tested models passed all six tests, while the "castrated version" of Tesla with limited functionality unexpectedly won the championship, sparking public uproar.

The evaluation also attracted the attention of Musk, who forwarded the relevant content on the X platform, stating, "Despite not having local training data, Tesla still achieved top results in China."

CCTV News, the Ministry of Science and Technology, and the Ministry of Public Security successively expressed their views to temper the "autonomous driving" trend. On July 25, HarmonyOS Intelligent Drive, AITO Wenjie, and Zhijie Automobile all stated, "We have seen the so-called 'test' on a certain platform and will not comment on it." Behind this brief response, HarmonyOS Intelligent Drive simultaneously released the "report card" for assisted driving in the first half of 2025, showcasing the true performance of its system with actual data.

It should be emphasized that on this poster, the original wording of "intelligent assisted driving" has been changed to "assisted driving," and "intelligent parking" has been revised to "parking assistance."

This terminology has been unified across all models equipped with Huawei's Kunpeng system. While strongly responding to Dongchedi, the company has also made internal adjustments and rectifications. Recently, Yu Chengdong has repeatedly and unabashedly touted intelligent driving at Huawei product launches. This situation is also expected to improve in the future.

Currently, public opinion has polarized between Tesla and Huawei, and this heated discussion on intelligent driving safety has begun to escalate amidst criticism and condemnation from netizens.

From this perspective, Chinese users have not yet developed a calm mindset to adapt to the advent of the era of intelligent assisted driving.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for deletion.

-END-