Mitsubishi Motors' Exit from China: An Era Ends and a Reflection on Industrial Transformation

![]() 07/28 2025

07/28 2025

![]() 750

750

On July 22, 2025, Mitsubishi Motors Corporation (MMC) announced the termination of its joint venture operations with Shenyang Aerospace Mitsubishi Automobile Engine Manufacturing Co., Ltd. (SAME) and its withdrawal from the partnership. The official statement attributed this move to the "rapid transformation of China's automotive industry" and MMC's reassessment of its regional strategy. Following its withdrawal from GAC Mitsubishi's vehicle production in 2023, this decision marks the complete withdrawal of the Japanese brand, which has been operating in the Chinese market for over half a century.

Mitsubishi's departure is not an isolated incident; it mirrors the profound changes being experienced by the world's largest auto market. These changes include the unstoppable rise of new energy vehicles, the severe challenges faced by traditional fuel vehicle giants, and the unprecedented growth of Chinese local brands. This is not just a strategic shift for one company but a pivotal moment for an era. The closure of the former 'heart': The glory and end of Shenyang Aerospace Mitsubishi.

MMC's ties with China date back to the 1970s, but its true integration into China's auto industry began with the export of engine technology. In August 1997, MMC established SAME in a joint venture with China Aerospace Automobile and other enterprises, officially commencing production in 1998. During the nascent period of China's independent auto brands, the engines produced by this factory, particularly the technologically mature and affordable 4G series, became the 'heart' of numerous domestic vehicles.

Many early independent brands, including Great Wall, BYD, Geely, and Chery, overcame their most difficult technical accumulation phases by procuring or referencing Mitsubishi engines. At its peak, nearly 30% of China's independent brand models were equipped with Mitsubishi engines, earning it the moniker 'godfather of domestic vehicles'. By May 2017, SAME's cumulative production had surpassed 5 million units, witnessing the golden era of China's auto market.

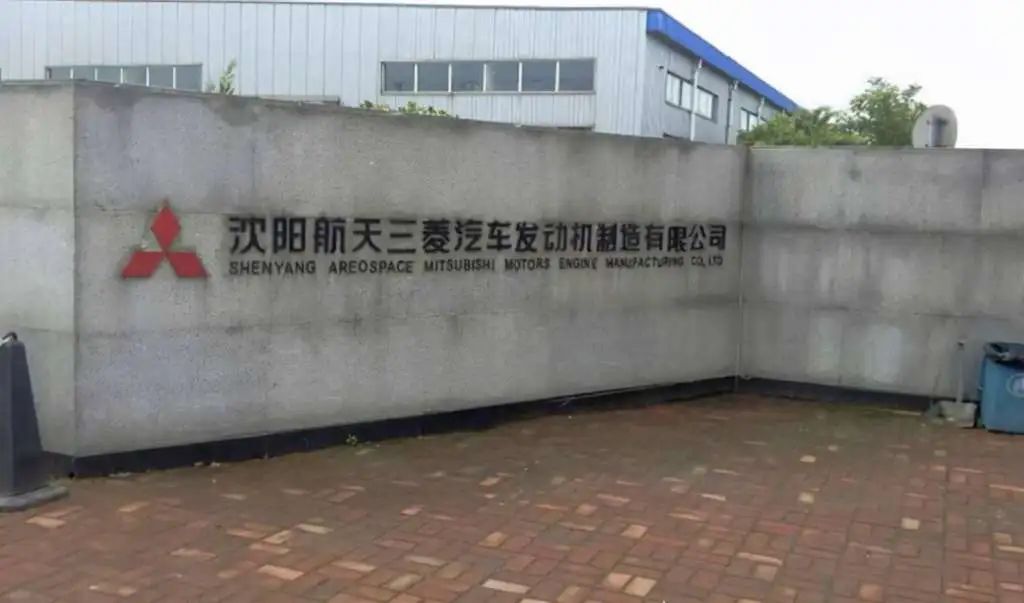

Factory plaque of Shenyang Aerospace Mitsubishi Automobile Engine Manufacturing Co., Ltd.

However, with the rapid advancement of Chinese automakers' independent R&D capabilities and the full opening of the new energy sector, Mitsubishi engines' technological advantages gradually diminished. Following Mitsubishi's withdrawal, this 27-year-old joint venture factory has also changed its name. Corporate information shows that SAME was renamed "Shenyang Guoqing Power Technology Co., Ltd." in July 2025, with all Mitsubishi shareholders exiting and being replaced by a new shareholder, "Beijing Saimu Technology Co., Ltd."

Why is Mitsubishi retreating from the Chinese market?

From withdrawing from vehicle to engine business, Mitsubishi's failure in China is the result of multiple intertwined factors, primarily its inability to adjust its course amid the wave of industrial transformation.

'Incompatibility' Amidst the Electrification Wave

Mitsubishi officials attributed the withdrawal to the "rapid transformation of China's automotive industry," directly pointing to the disruptive impact of new energy vehicles. The development of China's new energy vehicle market far exceeded expectations, with penetration rates soaring. According to the International Energy Agency (IEA), in 2024, sales of new energy vehicles in China accounted for nearly two-thirds of the global total, and their sales share in the domestic market has steadily exceeded 50% since the second half of 2024.

In this unprecedented transformation, Mitsubishi's response was sluggish. It wasn't until the end of 2022 that GAC Mitsubishi launched its first and only pure electric model, "Artuko," which was essentially a rebadged version of GAC Aion V, lacking core competitiveness and receiving a lukewarm market response, with monthly sales hovering in the double digits. While Chinese brands were making significant strides in electrification, Mitsubishi almost missed the entire game.

Prior Collapse of the Vehicle Business

The termination of the engine business was the final straw, but prior to that, its joint venture vehicle company, GAC Mitsubishi, had already been struggling with long-standing issues. Established in 2012, GAC Mitsubishi reached its sales peak of 144,000 units in 2018 with models like the locally produced Outlander. However, it then took a sharp downturn.

Data shows that GAC Mitsubishi's sales fell from 133,000 units in 2019 to 33,600 units in 2022. Entering 2023, the downturn became irreversible, ultimately leading to the suspension of production in March and the official announcement of withdrawal in October. Its factory in Changsha was eventually taken over by GAC Aion for a symbolic price of 1 yuan to expand new energy vehicle production capacity.

The Mitsubishi Outlander was once the sales mainstay of GAC Mitsubishi.

Apart from misjudging the electrification transformation, Mitsubishi also faced serious issues with its own products and strategies. Since 2019, Mitsubishi has not launched any truly new models in the Chinese market for several years, resulting in an aging product line and severely insufficient competitiveness. In the Chinese market, where consumer demand rapidly evolves and new models emerge endlessly, such a strategy of "living off past glories" is tantamount to self-destruction.

Moreover, its once-proud engine technology advantage has also vanished with the breakthroughs made by Chinese independent brands in powertrain technology. As its former 'students' have all graduated and even achieved 'lane-changing overtakes' in the new energy field, Mitsubishi, the 'old master,' has been left far behind.

Mitsubishi's classic engines like the 4G63T.

A Microcosm Under the Wave of Times: Collective Challenges Faced by Foreign Brands

Mitsubishi's exit is a microcosm of the difficulties faced by foreign brands in the Chinese market in recent years. With the strong rise of Chinese local brands, especially in the new energy field, many international brands that once flourished have felt unprecedented pressure. Brands like Jeep and Acura have successively ceased local production in China, while other Japanese, Korean, and French brands are also facing the dilemma of shrinking market share.

According to data from the China Passenger Car Association, the market share of Japanese brands in China has fallen from 14.3% a year ago to 12% in June 2025. Behind this shift is the changing preference of Chinese consumers: they are no longer blindly obsessed with the 'joint venture' halo but pay more attention to technological innovation, intelligent experience, and product cost-effectiveness. Led by BYD, Chinese new energy automakers have successfully reshaped the competitive landscape with their strong technological integration capabilities, rapid product iteration, and deep understanding of the local market.

Farewell and Turnaround: Where Does Mitsubishi's Future Lie?

After completely exiting production operations in China, Mitsubishi Motors has shifted its strategic focus to its traditional advantage market - Southeast Asia (ASEAN). According to its mid-term business plan, 'Challenge 2025,' Mitsubishi will concentrate resources to deepen its presence in the ASEAN market and plans to launch a series of new models, including hybrids and plug-in hybrids, in the region, aiming to consolidate and expand its market share.

In recent years, Mitsubishi has announced plans to increase investments or establish factories in the Philippines, Vietnam, and other locations, demonstrating its determination for strategic transfer. For the approximately one million Mitsubishi owners remaining in the Chinese market, GAC Mitsubishi has promised to continue retaining the sales company to ensure the supply of spare parts and after-sales service needs of car owners.

Mitsubishi Motors' China story, from a glorious beginning of technology export to a bleak ending, spans half a century. Its experience serves as a wake-up call for all multinational automakers in an era of transformation: in a rapidly changing market, any hesitation and conservatism can lead to elimination. For China's auto industry, this is not only a powerful testament to independent rise and technological confidence but also a spur to continuous innovation and forward progress amidst global competition.

References:

- Mitsubishi Motors has terminated all vehicle production operations in China

- Mitsubishi Motors Completely Exits the Chinese Market: The End of an Era and a Mirror of Industrial Transformation

- The 'Twilight' of Japanese Brands? Following Suzuki, Another Brand Operating in China for Over Half a Century Exits

- China's Auto Market Completely Bids Farewell to 'Mitsubishi Power'

- Terminating Engine Business in China, Mitsubishi Motors Completely Exits the Chinese Market

- Struggling Mitsubishi Chased Out Of China By Local Brands

- Mitsubishi Motors at a Glance

-END-