Global EV Race: China Dominates with 57% Market Share, Europe and US Face 'Range' and 'Policy' Hurdles

![]() 08/04 2025

08/04 2025

![]() 495

495

Amid the decline in internal combustion engine (ICE) sales and the steady rise of electrification alternatives, the global market share of pure electric vehicles (EVs) surged to 14.5% in the first quarter of 2025, marking a continued trend towards auto electrification. However, the pace, scale, drivers, and consumer acceptance of this transition vary significantly across continents, countries, and even regions.

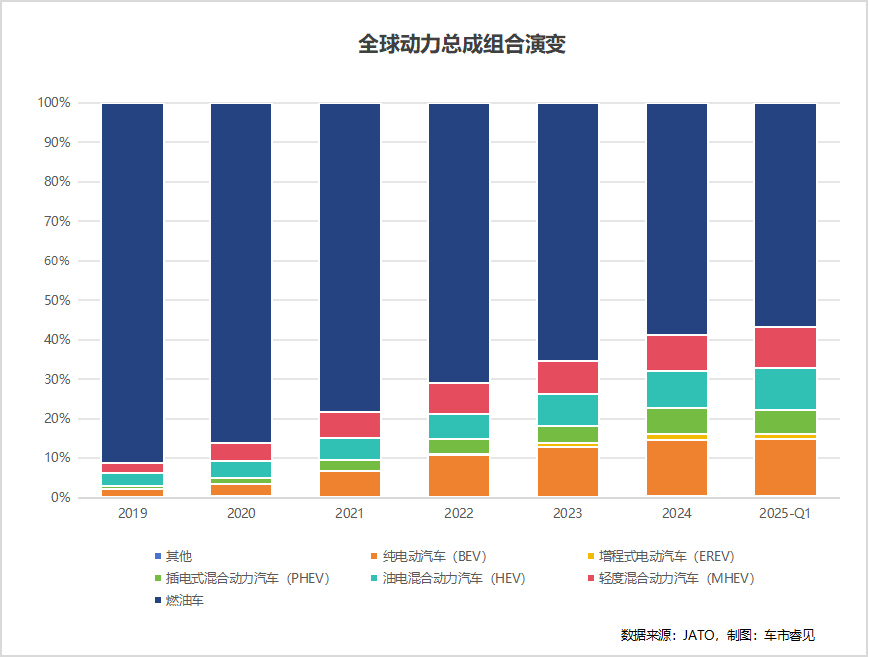

According to JATO Dynamics, a leading provider of automotive industry data and consulting services, the traditional ICE powertrain's market share has plummeted by 34.4 percentage points since 2019, being steadily replaced by new electrification technologies. Among these, pure EVs have emerged as the world's second-largest mainstream powertrain, followed by non-plug-in hybrids (including hybrid electric vehicles (HEVs) and mild hybrid electric vehicles (MHEVs)), which are gaining popularity due to alleviating range anxiety and reducing dependence on charging facilities.

Research indicates that while consumer environmental awareness continues to grow, the primary drivers behind the growth of EVs and the decline of ICE market share are stringent government regulations on traditional fuel vehicles and incentive policies for EVs (such as purchase subsidies and preferential road rights). These measures significantly enhance the attractiveness of EVs to consumers and accelerate the electrification process.

▍Regional Disparity: China Leads, Followed by Europe and the US

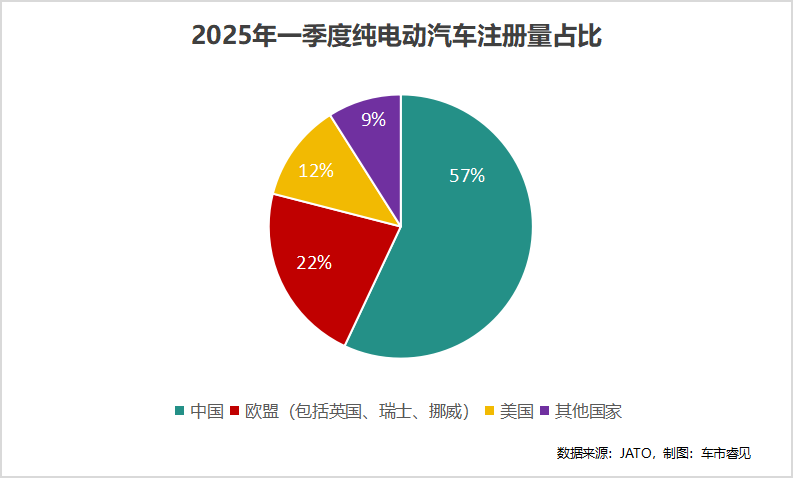

Global EV registration data clearly highlights imbalances in national development. In the first quarter, China accounted for 57% of global pure EV registrations, occupying an overwhelming lead; Europe followed with 22%, and the US ranked third with 12%. Other countries, such as India (1.7%), South Korea (1.2%), and Turkey (1.1%), registered relatively low volumes, all below 2%.

▍Key Differentiating Factors: Pricing and Technological Routes

While political and social dynamics contribute to the imbalanced development, from a purely automotive industry perspective, significant regional differences in EV pricing are a key point of differentiation. China stands out with its price advantage; over the past six years, the price gap between pure EVs and ICE vehicles has narrowed by 15%, making pure EVs more price-competitive. In contrast, in Germany (Europe's largest automotive market), prices for both pure EVs and ICE vehicles have risen by approximately 21% during the same period, maintaining a relatively stable price gap. In the US, while the premium for pure EVs has declined from a global high of 44% in 2019 to around 31%, it remains high.

China's rapid growth in pure EV penetration is directly linked to their more affordable and competitive market prices, attributed to the widespread use of low-cost lithium iron phosphate (LFP) batteries. As of 2024, 75% of pure EVs registered in China were equipped with LFP batteries.

▍Range and Charging: Divergent Technological Paths

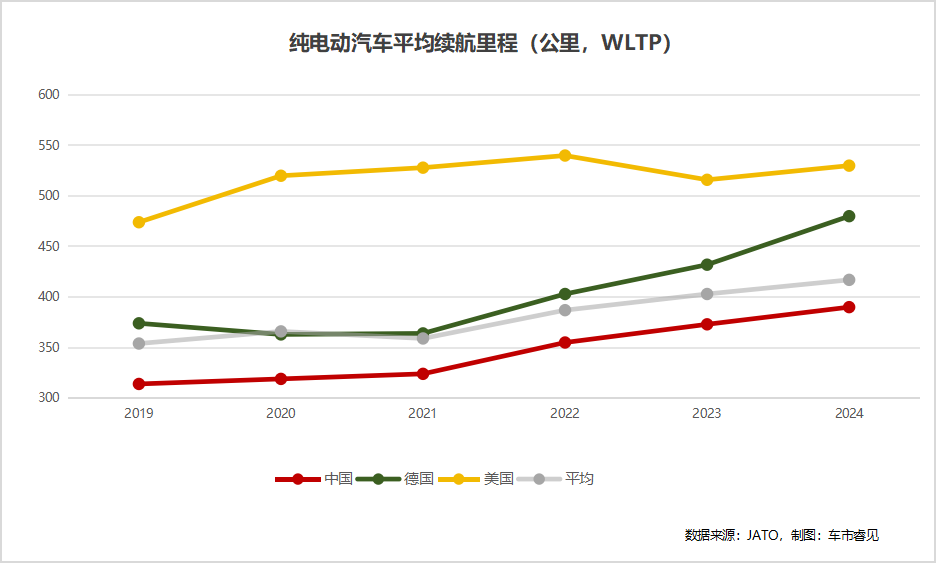

Regional differences are also apparent in battery technology and charging capacity. While LFP batteries effectively reduce production costs, their lower energy density limits driving range improvements. To address range anxiety and charging convenience, the US and German markets are increasingly focusing on models with longer driving ranges. However, achieving long ranges in compact cars, where space and weight are constrained, requires higher energy density battery technologies (like ternary lithium batteries), directly impacting vehicle average selling prices.

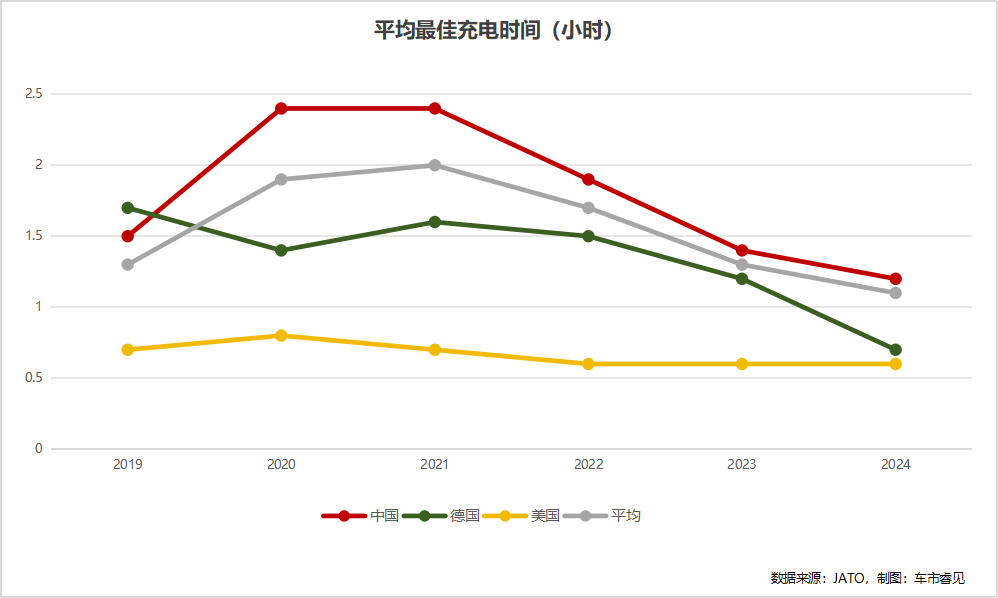

In terms of charging speed, although China, Europe, and the US share similar trends in reducing charging times, their specific goals differ. In the US and Germany, the proportion of registered pure EVs with charging times below one hour continues to rise; in China, the average charging time still exceeds this threshold.

In summary, the transition to pure EVs remains the most dynamic and transformative process in the global automotive industry. While the direction of development is clear, the pace and strategies vary significantly across regions.

As a cost-driven leader, China has firmly established itself as a global frontrunner, leveraging efficient pricing strategies, robust industrial policy support, and large-scale application of cost-effective technologies like LFP batteries. This enables Chinese automakers to rapidly expand their scale and offer highly price-competitive pure EV products.

In contrast, the US is undergoing a period of strategic adjustment. Despite occupying a significant share of the global pure EV market, the US is still grappling with challenges posed by insufficient charging infrastructure and shifting policy directions.

Meanwhile, Europe finds itself at a 'crossroads.' While long a staunch supporter of electrification, recent debates surrounding the feasibility and timeline of the 2035 ICE sales ban reflect deep concerns about affordability, industrial competitiveness, and energy infrastructure readiness. The outcomes of these discussions will profoundly impact the development trajectory of the European pure EV market over the next decade.

Regardless of regional differences and evolving policy environments, one fact remains indisputable: pure EVs have become the second-largest powertrain in global sales. China leads the trend through economies of scale and cost advantages; Western markets, on the other hand, focus more on performance enhancements, range breakthroughs, and technological advancements. The popularization of EVs is inevitable, with the core uncertainty lying in the speed and manner in which different regions will complete this transition.

Typeset by Zheng Li

Source: JATO Dynamics