Can Joint Venture Automakers Regain Their Footing?

![]() 08/04 2025

08/04 2025

![]() 474

474

Lead

In the heyday of fuel vehicles, joint venture automakers shone brightly; yet, in the era of new energy vehicles, they stumbled due to their sluggish transformation. Despite widespread pessimism, mainstream domestic joint venture automakers exhibited signs of sales stabilization in the first half of 2025.

Produced by | Heyan Yueche Studio

Written by | Zhang Dachuan

Edited by | He Zi

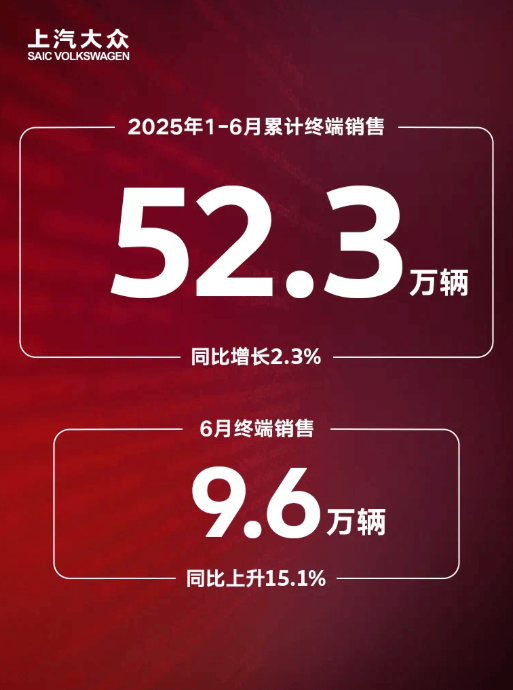

Excluding a handful of automakers like Honda, mainstream joint venture automakers fared reasonably well in the first half of 2025. FAW-Volkswagen, SAIC Volkswagen, FAW Toyota, GAC Toyota, and SAIC-GM all halted their declines. Even the Korean automakers, which had fallen out of favor, showed improvement. Yueda Kia recorded a year-on-year increase of over 10%, while Beijing Hyundai sold a total of 100,016 vehicles in the first half, with June sales alone reaching 21,713, a monthly growth of 66%, indicating a significant rebound. Even Dongfeng Nissan, whose sales still declined year-on-year, launched the eye-catching N7, which is expected to propel Dongfeng Nissan's sales turnaround in the second half of the year.

△Volkswagen-led joint venture automakers performed well in domestic sales in the first half of the year

What Stabilized Joint Venture Automakers' Sales?

The stabilization of joint venture automakers' sales in the first half of this year was primarily driven by their performance in the fuel vehicle segment. In the first half, SAIC Volkswagen's fuel vehicle lineup, including Lavida, Passat, and Tiguan, contributed 137,000, 117,000, and 91,000 vehicles respectively. SAIC-GM's Buick Envision Plus brand witnessed a cumulative sales increase of nearly 200% in the first half. Additionally, sales of GAC Toyota's Camry and Highlander increased by 30% year-on-year.

△Fuel vehicles emerged as the key factor in stabilizing joint venture automakers' sales in the first half of the year

Currently, joint venture automakers have introduced marketing strategies such as "one-price deals" for their fuel vehicles, continuously emphasizing their cost-effectiveness. Furthermore, over the past two years, joint venture automakers have implemented intelligent transformations on their fuel vehicles. Whether it's driving assistance or smart cabins, many joint venture fuel vehicles have caught up with independent brands, gradually bridging the previous gap. SAIC Volkswagen has introduced DJI and launched the Pro versions of the Passat and Tiguan, ushering in an intelligence-focused product upgrade. It is undeniable that giants like Volkswagen, Toyota, and GM still hold a certain brand appeal among domestic consumers due to their richer automaking experience and more mature system capabilities. Consequently, after addressing their shortcomings, they naturally attract numerous consumers.

△The intelligence of joint venture automakers' fuel vehicles has significantly improved

How to Overcome the Weaknesses in New Energy Vehicles?

In the realm of new energy vehicles, joint venture automakers remain largely on the defensive. According to data released by the China Passenger Car Association in June, the penetration rate of new energy vehicles for mainstream joint venture brands was only 5.3%, with the overall market declining by 1 percentage point year-on-year to 3.1%. In contrast, the penetration rate for independent brands reached 75.4%.

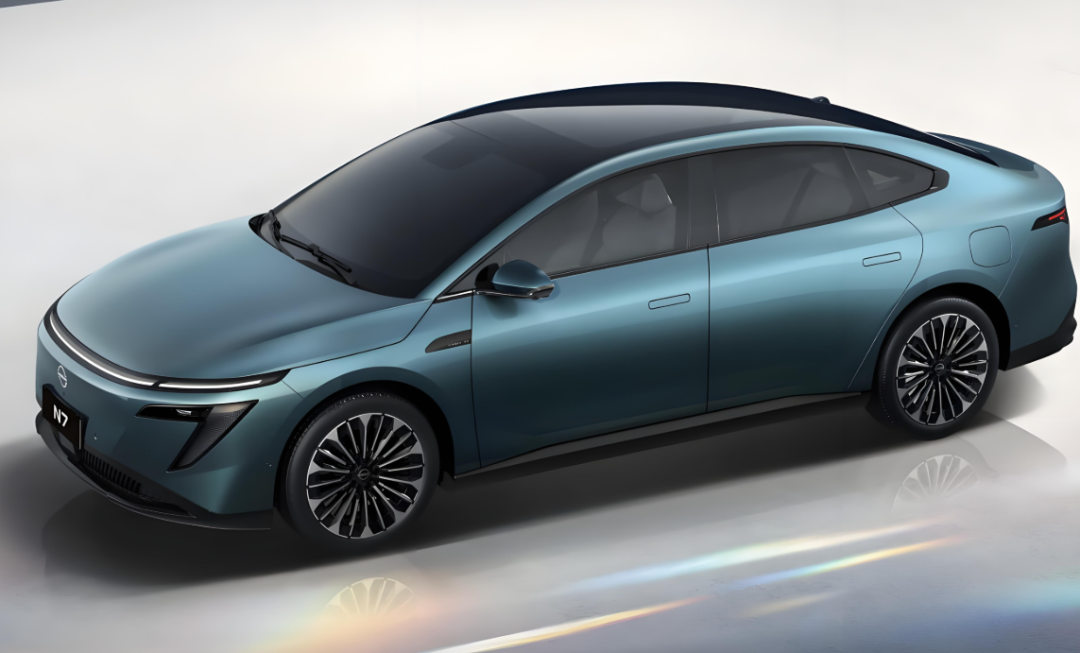

△Dongfeng Nissan's N7 made a stunning comeback for joint venture automakers' electric vehicles

While joint venture automakers struggle in the new energy vehicle market, crises often spawn new opportunities.

High cost-effectiveness models are stirring up the new energy vehicle market. For instance, Dongfeng Nissan's N7, focusing on high cost-effectiveness, sold 6,189 vehicles in June, with cumulative deliveries since its launch on May 15 exceeding 10,000 units by June 30. This significantly diverted sales from Xpeng's MONA M03, a pillar of Xpeng's sales accounting for half of its total. If Xpeng fails to take effective measures, it will face significant challenges in maintaining continuous sales growth. Similarly, GAC Toyota's Bzz 3X delivered 6,030 units in June, with cumulative orders exceeding 30,000 and cumulative deliveries topping 20,000 in just over three months since its launch, recognizing its high cost-effectiveness across the market.

△GAC Toyota's Bzz 3X recorded cumulative orders exceeding 30,000 in just over three months since its launch

The extended-range market is no longer exclusive to independent brands. On the foundation of consolidating their fuel vehicle market, more joint venture automakers are entering the plug-in hybrid and extended-range market. The Volvo XC70 has been unveiled, targeting the extended-range SUV market above the 300,000 yuan level dominated by Li Auto and AITO. The Zhijing L7, the first model launched by SAIC-GM Buick's new brand Zhijing, is an extended-range mid-to-large sedan poised to become a formidable force in the new energy sedan segment.

△Buick's new brand Zhijing's first model, the Zhijing L7, is an extended-range mid-to-large sedan

Leveraging New Chinese Technologies to Benefit the Global Market

For multinational automakers, the fierce competition in the Chinese market poses challenges to their joint venture operations. However, every coin has two sides.

The intelligence capabilities of joint venture automakers are expected to reciprocally benefit the global markets of multinational automakers. While multinational automakers invest heavily in independent R&D for new energy and intelligent connectivity technologies at their global headquarters, they can also consider introducing the technologies and platforms of their domestic joint ventures into global vehicle projects. In the domestic market, leading intelligent connectivity enterprises such as Huawei, Momenta, DJI, Ecarx, and Horizon Robotics have entered the supplier lists of joint venture automakers. This not only enhances the intelligence of joint venture automakers' fuel vehicles but also generates greater benefits for multinational automakers if they apply these suppliers' technologies in the global market.

△The intelligence capabilities of joint venture automakers are anticipated to benefit the global markets of multinational automakers in return

Moreover, multinational automakers can consider utilizing China's production capacity to support their global markets. Simultaneously, these automakers are gradually increasing their procurement of domestic components. Taking Volkswagen as an example, most components for its ID. series electric vehicles produced in Germany are sourced from China. Tesla even requires its parts suppliers supporting its Shanghai Gigafactory to establish factories near its Mexico Gigafactory. Both the stable quality of domestic vehicle assembly and the cost-effective component supply chain can become pivotal factors for multinational automakers to enhance their overall performance.

△Tesla has a particular preference for Chinese component suppliers

Commentary

With the stabilization of joint venture automakers' sales, the pressure is gradually shifting to independent brands. Previously, domestic independent automakers and new forces capitalized on the time difference to build their advantages, which are now gradually being reclaimed by joint venture automakers. However, independent brands' advantages in fuel vehicles are not as pronounced as those in new energy vehicles. In the future, joint venture automakers are expected to gradually regain some of the market share previously captured by independent brands. Independent brands must prepare for a protracted battle, as joint venture automakers are resilient and may even launch a strong counterattack.

(This article is original content of "Heyan Yueche" and may not be reproduced without authorization)