State-owned Enterprises Accelerate Joint Creation of Vehicles: Will Huawei Fully Enter the Sub-180,000 Yuan Market?

![]() 08/06 2025

08/06 2025

![]() 508

508

The partnership between automakers and Huawei is giving rise to a new model of collaboration.

This shift became evident in 2024. Initially, Huawei had three primary modes of deep cooperation in the automotive industry: component mode, HI mode, and HarmonyOS Intelligent Driving mode, also known as the Five-Boundary mode. However, in 2024, this landscape evolved to include a fourth possibility.

The fourth mode is HI PLUS. In December 2024, news emerged that AITO had reached a comprehensive and deepened strategic cooperation agreement with Huawei, entering the HI PLUS mode. However, subsequent news about new collaborations led to misunderstandings about the HI PLUS mode.

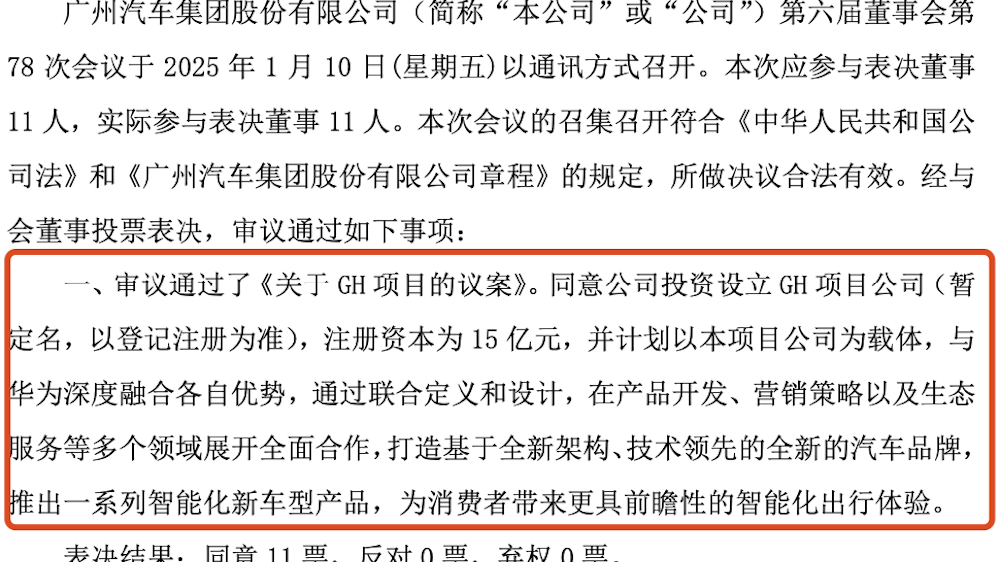

For instance, in March 2025, GAC and Huawei jointly established HuaWang Automobile with a registered capital of 1.5 billion yuan. In terms of equity, GAC Group holds 100% of the shares, while Huawei has yet to take a stake. Additionally, in 2024, YinWang was established to expand independent third-party technology businesses.

As Huawei deepens its integration into the automotive industry, proving its profitability and sales capabilities, both the public and the automotive industry find it challenging to distinguish the types of new collaborations. Recently, with two state-owned enterprises making official announcements at the end of July, AITO announced the upcoming launch of a model co-created with Huawei, followed by Dongfeng's Yapai Technology announcing a new model co-created with Huawei for 2026.

This landscape is poised for further change.

How different is the joint creation model?

The joint creation model can be understood as an extension of the HI PLUS mode, with even more possibilities. Here's a summary of the currently known official news:

1. Chen Zhuo, President of AITO Technology, revealed that AITO is promoting the HI PLUS mode with Huawei. A joint team has been stationed at AITO's headquarters, and the first co-created product will be unveiled in the second half of next year. Simultaneously, AITO is also promoting the N Plus cooperation mode with CATL, engaging in in-depth cooperation from battery supply to brand output.

2. Dongfeng's Yapai Technology's latest news revolves around the "Yapai Upward, Aeolus Renewal" dual-track strategy. Yapai integrates the Nano brand to focus on the mid-to-high-end market and jointly develops high-end smart product series with Huawei. The "Smart Boutique Series" co-created with Huawei (the first high-end smart full-size SUV will be launched in 2026, equipped with Huawei's Kunlun Intelligent Driving ADS 4.0 and HarmonyOS Cabin 5.0).

In other words, products of Huawei's deep cooperation with Dongfeng and Changan will enter the market in 2026. Currently, there are increasing numbers of Huawei-empowered models. If the product selling point strategy from 2024 to 2025 continues, it will be challenging to create differentiation and stand out. The current strategy highlights Huawei's latest technology as a strong point and leverages its own advantages to create 1-2 product selling points. For example, Lantu's FREE+ and Dreamer emphasize safety and ease of driving in addition to intelligence. Another example is Deepal's slogan, "Super Extended Range on the Left, Huawei Kunlun on the Right."

However, the reality is clear. As Huawei's technology transitions from being an exclusive asset of a few automakers to a standard configuration for more automakers, the cost of explaining this to consumers will rise indefinitely, leading to internal friction.

Therefore, what exactly is the joint creation model, and how does it differ from the industry-recognized HI PLUS mode? This is a crucial question. Similarly, previous official announcements provide clues to the answer.

The summary of official announcements is as follows:

1. On January 22, 2025, Dongfeng's Yapai and Huawei signed a strategic cooperation agreement on smart cars at Huawei's headquarters in Shenzhen. Leveraging their respective strengths, the two parties will deepen cooperation in smart car product development, marketing, and ecological services, jointly creating a series of mid-to-high-end intelligent car models and providing users with a tailored smart travel experience.

2. On December 12, 2024, AITO and Huawei signed a comprehensive and deepened strategic cooperation agreement at Huawei's headquarters in Shenzhen. The two parties will cooperate deeply in product development, marketing, and ecological services to support AITO in creating the next generation of series models and jointly providing users with leading smart travel and lifestyle experiences.

The similarities between the two are that their cooperation with Huawei involves three areas: product development, marketing, and ecological services. The difference lies in that the cooperation with AITO is aimed at creating AITO's next-generation models, while the cooperation with Yapai Technology focuses on creating mid-to-high-end intelligent car models. The above two also differ significantly from Huawei's cooperation with GAC.

In March 2025, the official announcement of HuaWang Automobile featured keywords such as an independent high-end automobile brand, with new models equipped with Huawei's intelligent driving software, intelligent cabin, intelligent vehicle control, and other solutions.

In summary, Huawei's cooperation with GAC Group involves the technical level, while GAC still dominates the product definition, sales, and research and development of the car models. For Dongfeng and Changan, their new round of cooperation with Huawei involves Huawei's participation in product definition, including deep involvement in technology, marketing selling points, and Huawei ecological empowerment.

In other words, the only core difference from the Five-Boundary mode is that Huawei does not officially intervene in specific sales, after-sales, and other processes. However, as the news and progress of ShangJie and ZhiJie independently building channels continue to advance, the differences among automakers deeply cooperating with Huawei are becoming less obvious.

Will Huawei fully enter the sub-150,000 yuan market?

Currently, most automakers have begun participating in the battle for Huawei's cooperation. Competing for cooperation rights is just the first step, followed by the depth of cooperation.

It's worth noting that 2026 could mark a turning point in Huawei's cooperation mode with automakers, as the current joint creation mode may surpass the current Smart Selection mode, also known as HarmonyOS Intelligent Driving, in many aspects.

The reason lies in the key details of previously announced terms. At the event where AITO invested 11.5 billion yuan in YinWang and took a 10% stake in August 2024, several key points were highlighted. These include priority in core technology deployment, priority in component supply, most-favored-nation treatment in pricing, and joint creation in intelligent experience, intelligent cabin application ecological experience, intelligent driving application experience, and vehicle platform.

In other words, Huawei's latest technology will be applied to AITO in the future, and priority in component supply ensures rapid production capacity increases, which is crucial. When the AITO M7 experienced a surge in orders, it was precisely because of Huawei's Vehicle BU's full support in components that it set a record for the ramp-up speed of new cars in the Chinese automotive industry.

There are also counterexamples, such as the disappointment after a small number of pre-orders exploded but delivery was far off. An important aspect of intelligent perception is that due to joint creation in four areas, especially the vehicle platform, automakers can implement new technologies while minimizing costs, which is known as technology democratization.

In the automotive industry, there's an iron law: cost reduction for automakers isn't simply about downgrading suspension, chassis, or certain aspects, as those savings are minimal. Substantial cost reduction primarily involves three points: maximizing scale to amortize production line investment, high commonality of components among models, and efficient team management.

Currently, AITO's new car in 2026 is likely to be a price killer. This is due to the joint creation with Huawei and technological iteration by automakers. It's certain that the models co-created with Huawei in 2026, including many next-generation AITO models, will use Changan's SDA 2.0 architecture. Therefore, data throughput capacity, computing platform, and compatibility will be superior. Coupled with early joint creation and cooperation with Huawei, the cost of intelligent technology will decrease. Moreover, the SDA 2.0 architecture itself fully considers component commonality, which will be used across the entire Changan Group, leading to significant cost reductions.

How significant is this? With a larger scale, achieving a 50% cost reduction is feasible, making vehicle pricing very competitive. For example, Tesla's Shanghai factory produced over 750,000 units in 2023, ultimately reducing the manufacturing cost of the Model 3 by 50% compared to its initial launch. Similar cases abound in the industry. Since the launch of MQB, Volkswagen has seen cost reductions of over 20% and a manufacturing time increase of over 30%.

Yapai Technology's latest joint creation logic is similar but expected to be less deep in cooperation than AITO. This is because Yapai Technology did not directly take a stake in YinWang but in Thalys, and Dongfeng has a stake in Thalys, creating a state of multiple intersections.

In summary, the benefits of joint creation with Huawei extend beyond the obvious. If readers manage projects, they will quickly understand the following: When leading companies from both sides sign a deep agreement, it's far more effective than the traditional mode where automakers are the Party B and Huawei is the Party A. This is because the Party A and Party B model only involves a procurement relationship, where Party B makes demands and considers prices, while Party A looks at stock allocation. If it doesn't work out, they can negotiate later. But now, with thousands of people involved in the team, results must be delivered.

The overall logic of joint research and development and large-scale cost reduction is similar. Additionally, it's worth noting that the joint creation plans announced by both parties now target the same or similar markets. Yapai Technology's first model co-created with Huawei will be a full-size SUV, and AITO's model co-created with Huawei will be AITO's next-generation model. In other words, both are primarily aimed at the market above 200,000 yuan.

However, the fact that such co-creation models target markets above 200,000 yuan doesn't mean Huawei's fully capable models won't see price reductions in the market. As competition intensifies and prices become more transparent, the principle of prioritizing cost-effectiveness remains unchanged in the mass consumer market. Therefore, to compete for sales, more automakers deeply cooperating with Huawei will undergo new changes.

By 2025, Huawei's full-capacity models have firmly established their position within the RMB 200,000 price bracket. The entry-level Lantu FREE+ starts at just RMB 219,900, and the upcoming Lantu Zhiyin, also equipped with Huawei's full-capacity system, has a current starting price of RMB 196,900. Notably, while the fifth-generation HarmonyOS Intelligence model, Shangjie H5, may not feature Huawei's full-capacity system within the RMB 200,000 range, it is confirmed that its mid-to-high configurations will incorporate Huawei's Kunlun ADS4.

Reflecting this trend, within a year, Huawei's full-capacity models have seen their prices drop from nearly RMB 300,000 (for the AITO M7) to within RMB 220,000 (for the Lantu FREE+) in the mid-to-large SUV market, and from RMB 240,000 (for the AITO M5 with optional features) to an anticipated price within RMB 200,000 (for the Lantu Zhiyin) in the mid-size SUV segment.

Further price reductions remain a possibility.

Final Thoughts

2026 is poised to be a transformative year, backed by compelling evidence.

For instance, under the co-creation model, the proportion of tangible Huawei technologies will continue to rise, with intangible technologies likely to be phased out. Many HarmonyOS Intelligence models have already achieved deep hardware integration with Huawei. Their electric motors, produced by Huawei Digital/Huawei Technologies, may not be a prominent selling point, but their relatively high cost presents an area for optimization.

For automotive companies, adopting motors of similar or superior specifications across the entire group could lead to significant cost savings.

The competitive landscape has evolved from securing cooperation rights with Huawei to racing for first-mover advantage and securing larger supply volumes of Huawei's technologies. The next frontier will be the depth of cooperation; the closer the partnership, the more pronounced the cost advantages and negotiating power will be.