European Auto Market | UK July 2025: Robust Sales for MG and BYD

![]() 08/07 2025

08/07 2025

![]() 527

527

In July 2025, the UK new car market delivered a mixed performance, with 140,154 registrations marking a 5% year-on-year decline and the lowest level for the same period since 2022.

Behind these figures, the decline of traditional internal combustion engine vehicles has become increasingly evident, as gasoline cars' market share fell below 50% to 47.3%, while diesel cars shrank further to 5.7%.

Conversely, plug-in hybrids and pure electric vehicles bucked the trend, achieving year-on-year growth rates of 33% and 9.1%, respectively, collectively capturing nearly 34% of the market share. This underscores the profound transformation underway in the UK auto market.

In this shift towards new energy, Chinese brands have emerged prominently. BYD sold 3,184 vehicles in a single month, marking a fivefold increase year-to-date. Meanwhile, MG, with a strong foothold established through years of cultivation, is aggressively penetrating the high value-added market with its electrification technology.

From technology penetration to product recognition, Chinese automakers have made significant strides in both sales and brand influence in the UK.

01 Overview of the UK New Car Market: Decline in Traditional Powertrains, New Energy Driving Structural Transformation

In July 2025, UK new car registrations totaled 140,154, a 5% year-on-year decrease. This figure was not only lower than the same period in 2024 but also 10.8% down from pre-pandemic levels in 2019.

Despite short-term market pressures, cumulative sales since the beginning of the year have increased slightly by 2.4% to 1.182 million, the best result for the same period in the past five years.

From the perspective of purchase channels:

◎ The proportion of private car buyers increased slightly from 36.2% last year to 36.8%, indicating sustained consumer confidence at the retail end.

◎ Fleet sales and commercial vehicles showed divergence. Fleet sales, still dominant (59.5% market share), grew at a slower rate of 1.6%, while commercial vehicle sales increased by 10.4%, though their overall share remained low at 2.1%.

In terms of powertrain structure, traditional internal combustion engine models continued to lose ground:

◎ Gasoline car sales fell by 14.7% year-on-year, with market share dropping from 52.7% to 47.3%.

◎ Diesel car sales decreased by 7.9% year-on-year, with their share falling to 5.7%.

◎ Hybrid models also performed weakly, experiencing a year-on-year decline of 10%.

In contrast, plug-in hybrids and pure electric vehicles emerged as key growth drivers:

◎ Plug-in hybrids grew by 33% year-on-year, with market share jumping to 12.5%.

◎ Pure electric vehicles grew by 9.1%, with market share rising to 21.3%.

Since the beginning of the year, cumulative sales of plug-in hybrids have increased by 31.5%, and pure electric vehicles by 16.8%, reflecting UK consumers' continued embrace of low-carbon travel and the initial success of policy guidance and infrastructure improvements.

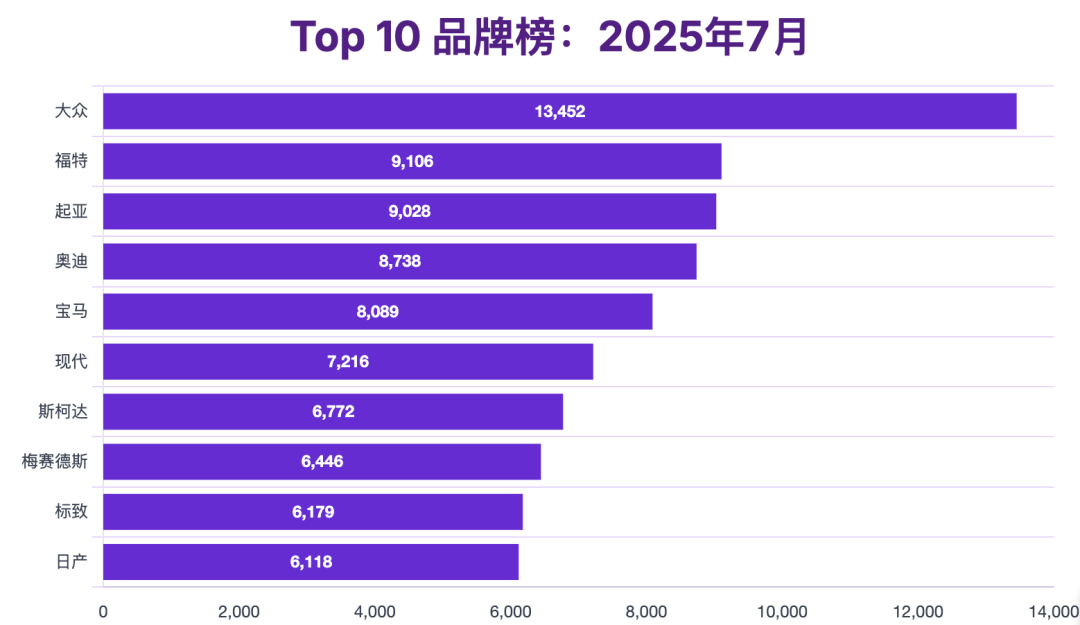

From a brand perspective:

◎ Volkswagen retained its top spot, selling 13,452 vehicles in July, with a market share of 9.6%. It was the only brand to sell over 10,000 vehicles in a single month.

◎ Ford jumped to second place with a growth rate of 16.5%, accounting for 5.9% of the market share year-to-date.

◎ Kia, Audi, and BMW ranked third to fifth but experienced varying degrees of sales declines.

◎ Brands like Skoda and Peugeot recorded growth of over 30% in July. Peugeot, in particular, has increased its market share by nearly 40% over the past year, suggesting that mid-range brands are gradually eroding the market space of German high-end brands.

◎ Meanwhile, Nissan, Toyota, and Mercedes have shown significant declines, highlighting a diversifying market competition landscape.

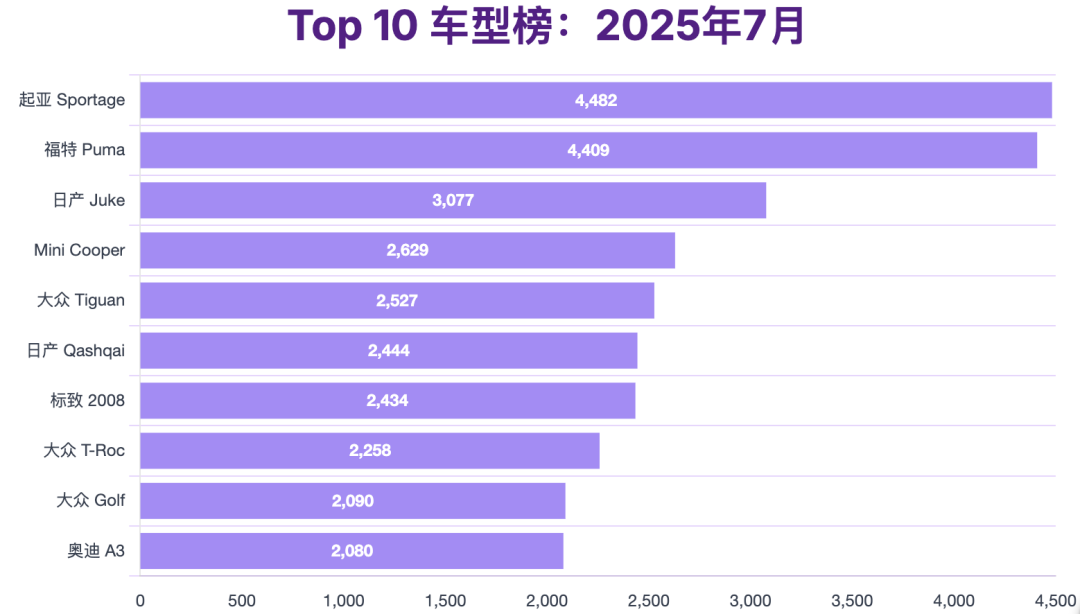

At the model level:

◎ Kia Sportage regained the monthly sales crown, ranking second in cumulative sales year-to-date, just behind Ford Puma.

◎ Nissan Juke and Mini Cooper ranked third and fourth, both recording double-digit growth.

◎ Compact SUVs such as Volkswagen Tiguan and Peugeot 2008 maintained good momentum, with Volkswagen dominating several sales charts with its Tiguan, T-Roc, and Golf models.

Overall, the UK market is accelerating its transition from traditional gasoline vehicles to new energy models. Compact and city-level SUVs remain the mainstay of consumption, while the stability of Japanese and German brands faces challenges. Mid-range European brands and individual new energy brands are gradually gaining recognition.

02 Sales Performance of Chinese Brands: Multi-point Blossoming, BYD Leading, Jetta and Dacia Rapid Rising Rapidly

◎ In July 2025, MG ranked 12th with 5,637 vehicles sold, a year-on-year decline of 9.5%, but remained the top Chinese brand in the UK market.

MG has a deep presence in the UK, offering a rich model matrix and flexible pricing. Its fuel and plug-in hybrid models, represented by the HS and ZS series, continue to be favored by consumers.

◎ The expansion of Chinese brands in the UK market continues to gather momentum. BYD ranked 19th in brand sales with 3,184 vehicles sold, a year-on-year increase of 314.6%. Its cumulative sales for the year reached 22,574 vehicles, surging more than fivefold year-on-year, with a market share of 1.9%.

As one of the earliest Chinese new energy automakers in Europe, BYD leverages its deep vertical integration capabilities in batteries and electric drive systems to strengthen its local brand recognition. Models like the ATTO 3 (Yuan Plus) and Seal are gradually gaining traction among UK consumers.

◎ Among new brands, Jaceoo and Dacia Rapid made their debut in the UK mainstream sales rankings. Jaceoo ranked 21st with 1,915 sales, while Dacia Rapid followed closely in 22nd place with 1,874 sales. Having officially entered the UK market earlier this year, they quickly achieved sales breakthroughs, thanks in part to their right-hand drive adaptations and European market compliance adjustments. UK users' acceptance of compact SUVs and pure electric coupes is continuously increasing.

◎ While ZERO Run and XPeng currently have relatively low monthly sales of 248 and 8 vehicles, respectively, such results reflect the market response during their initial exploration period in the UK.

From the perspective of model performance:

◎ MG HS ranked 13th in monthly model sales with 1,678 vehicles sold, despite a year-on-year decline of 31.4%, it remains competitive in the compact SUV segment.

◎ BYD's main sales contributors have yet to break into the mainstream Top 10 model rankings. However, considering their higher average selling prices and focus on pure electric models, they still have potential for structural growth.

Over the past few months, Chinese brands' role in the UK market has evolved beyond price competition, gradually forming differentiated value propositions:

◎ MG maintains a balanced layout across traditional and new energy models.

◎ BYD stands out in electrification technology and smart cabins.

◎ Jetta and Dacia Rapid seek breakthroughs in user experience through differentiated styling, brand culture output, and segmented product strategies.

Summary

The combined market share of nearly 34% for plug-in hybrids and pure electric vehicles is laying a solid foundation for this structural transformation.

The future of the UK auto market is no longer dominated by internal combustion engines but is being reshaped by electric drive and software-defined consumer logic. In this process, the most active and groundbreaking influence comes from China. The transformation of Chinese brands from 'price killers' to 'technology pioneers' has already gained significant traction in the UK market.