Global Auto Market | Chinese Brands Achieve New Milestone in Australian Market in July 2025

![]() 08/08 2025

08/08 2025

![]() 516

516

In July 2025, Australia's new car sales reached 104,244 units, marking a 2% year-on-year increase.

Chinese automakers continued to expand their influence in the local market, with total sales of 19,997 units, up 33.1% year-on-year. They now rank third among import sources, trailing only Japan and Thailand, and are closing in on the second position.

This upward trajectory is not a short-term fluctuation but a sustained trend. Chinese automakers' market performance in Australia has evolved from a focus on cost-effectiveness to a comprehensive competitive landscape featuring multiple brands and product capabilities.

Great Wall and BYD maintained stable growth, while Chery made a significant breakthrough by entering the top ten in monthly sales for the first time with the Tiggo 4 Pro, jumping to 11th place in the brand ranking—its highest result since entering the Australian market. In contrast, MG, which had long held a leading position, saw a notable decline with sales falling nearly 30% year-on-year.

Meanwhile, emerging brands such as Geely, MG ZS EV, and Zeekr are also accelerating their market entry, starting small but gradually establishing a multi-point presence. Overall, Chinese brands' market share in Australia is transitioning from marginal to firmly established positions.

01 Overview of the Australian Market and Evolution of Mainstream Trends

In July 2025, the Australian passenger car market reached a record high of 104,244 units, up 2% year-on-year. Despite a slight 0.9% decrease in cumulative sales since the beginning of the year, the market still maintained the second-highest level in history (728,374 units), second only to the same period last year.

Power Structure:

◎ Gasoline car sales were 39,991 units, down 4.8% year-on-year.

◎ Diesel car sales bucked the trend with an 8% increase to 31,611 units.

◎ Plug-in hybrid sales surged 81.7% year-on-year to 4,031 units.

◎ Pure electric vehicles also maintained moderate growth of 7.1%, with sales of 7,219 units, and their market share increased from 6.6% to 6.9%.

This indicates that new energy vehicles are gaining endogenous momentum for stable growth in the Australian market.

Usage Scenarios:

◎ Private car purchases increased by 6.1%.

◎ The leasing market also grew by 20.8%.

◎ Government procurement, however, fell by 23.2%.

Performance varied significantly across states, with the Northern Territory experiencing the strongest growth (+10.6%), followed by major states such as Queensland, New South Wales, and Victoria.

The model structure continued to concentrate on SUVs:

◎ SUV sales were 63,723 units, accounting for 61.1% of the overall market, an increase of over 4 percentage points compared to the same period last year.

◎ The share of light commercial vehicles also steadily rose to 21.5%, while traditional passenger cars accounted for only 13.9%, indicating a growing preference for multifunctional, high-clearance models.

Brand Competition Landscape:

◎ Japan remains Australia's primary import source, with sales of 30,874 units in July.

◎ China, with sales of 19,997 units, surged 33.1% year-on-year, ranking third and closing in on second-placed Thai models (20,596 units).

◎ Notably, models manufactured in Germany and South Korea saw limited growth, while the continued strength of Chinese-made models has become a prominent trend.

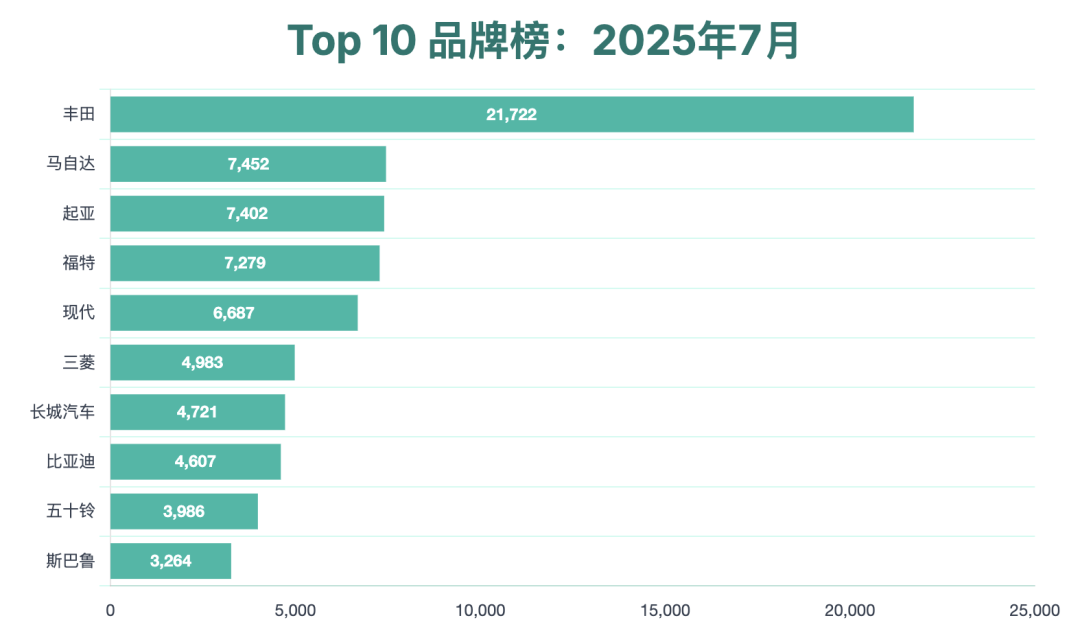

Brand-Level Performance:

◎ Toyota, despite a year-on-year decline of 4.3%, still ranked first in the market with sales of 21,722 units, accounting for 20.8%—almost equal to the combined total of the second to fourth places.

◎ Mazda returned to second place after several months.

◎ Kia and Hyundai followed closely with double-digit growth.

◎ Ford ranked fifth.

◎ Mitsubishi fell to sixth place.

Chinese brands shone particularly brightly:

◎ Great Wall Motor firmly held seventh place, with a year-on-year increase of 42.2%.

◎ BYD, although dropping from its historical high to eighth place, still achieved double-digit year-on-year growth.

◎ Chery experienced a major breakthrough, surging 267% year-on-year to 11th place, achieving its highest ranking since entering Australia.

◎ In contrast, MG experienced a 27.9% decline, becoming the weakest performer among the top four Chinese brands.

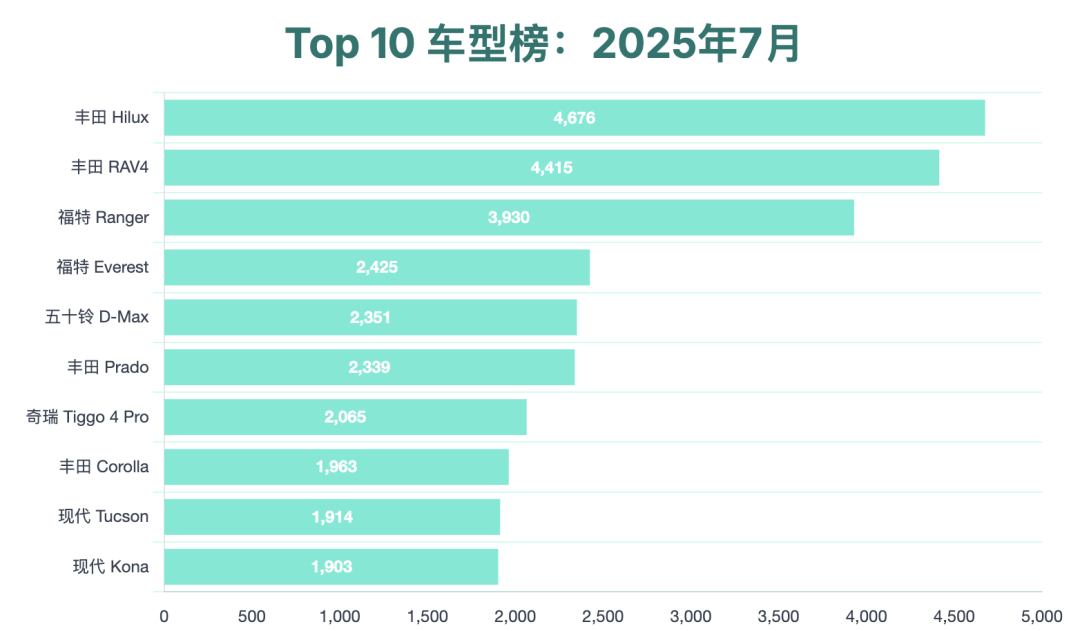

Model Rankings:

◎ Toyota Hilux, RAV4, and Ford Ranger still occupied the top three positions.

◎ Chery Tiggo 4 Pro surged to seventh place with sales of 2,065 units, breaking into the top ten for the first time—a milestone performance for Chinese brands in the Australian market.

◎ Great Wall Haval Jolion also entered the top twenty in sales (13th place), with cumulative sales of 10,716 units this year, up nearly 30% year-on-year.

◎ BYD models such as the Sealion 7 and Shark also maintained stable sales.

02 Comprehensive Acceleration of Chinese Brands and Rapid Increase in Local Acceptance

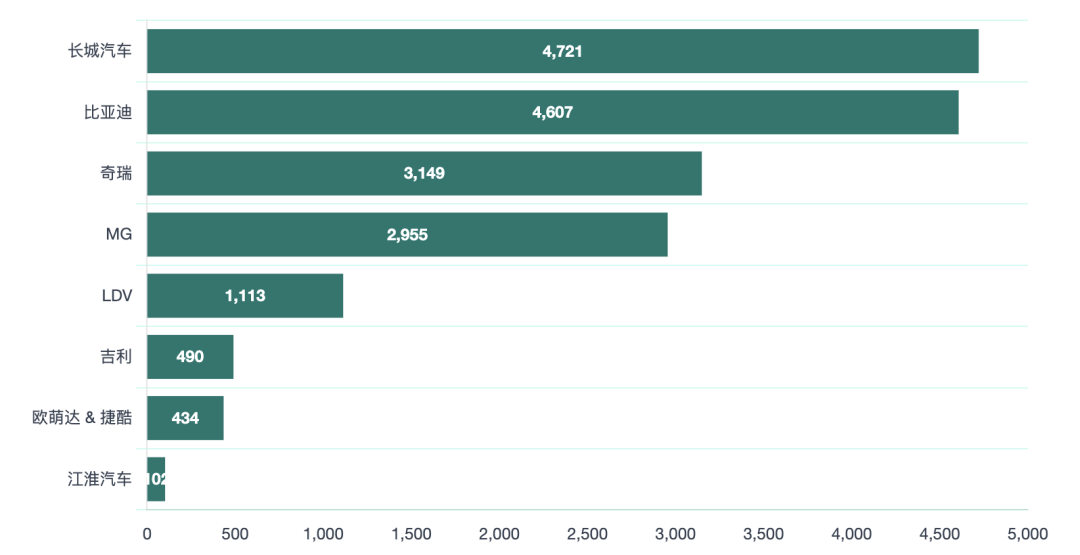

◎ Among Chinese brands, Great Wall Motor was the most stable performer. Its sales in July reached 4,721 units, a year-on-year increase of 42.2%, ranking seventh among overall brands in Australia and being the most popular Chinese automotive brand.

Among its models, Haval Jolion sales reached 1,687 units, up more than 50% year-on-year, making it the core model. The Tank series and Cannon series also began to show improvement in the light commercial vehicle market, helping Great Wall Motor to continuously consolidate its position.

◎ BYD followed closely with 4,607 units, a year-on-year surge of 158%. Although it fell back compared to June, it still demonstrated astonishing growth momentum.

Its models such as the Sealion 7 continued to sell well. Although the Shark slipped to 24th place in July, its cumulative sales for the year have already entered the top thirteen, indicating that its appeal to Australian users has not diminished.

◎ Chery's explosive growth was the biggest highlight of the month. Its sales in July reached 3,149 units, surging 267% year-on-year, and its brand ranking jumped to 11th place.

The main model, Tiggo 4 Pro, performed particularly impressively, surpassing 2,000 units for the first time and ranking seventh in the market, becoming the only Chinese model to enter the top ten. This not only represents the local market's recognition of Chery's product capabilities but also reflects the initial success of its channel and brand building in Australia.

◎ MG showed a different trend, with sales of 2,955 units in July, down 27.9% year-on-year, and its brand ranking falling to 12th place. As one of the earliest Chinese brands to enter the Australian market, MG faces significant challenges amidst increasing competition.

◎ Emerging brands such as Geely and MG ZS EV have also begun to test the waters in the Australian market. Geely sold 490 units in July, a small volume but impressive for a newcomer; MG ZS EV also started in the Australian market, selling 434 units in July, demonstrating the appeal of independent brand operation and young design language to local users.

◎ Zeekr, IM Motors, Nezha, Deepal, and Zero Running have also successively launched their layouts in Australia. Although their current monthly sales are still within 100 units, they are gradually establishing brand recognition and channels, paving the way for future development.

Chinese brands have formed a pattern of "four powers competing + multi-point penetration" in the Australian market.

◎ Great Wall, BYD, Chery, and MG constitute the main tier, each with representative models and relatively stable sales networks.

◎ Geely, MG ZS EV, Zeekr, etc., as up-and-coming brands, are accelerating breakthroughs with technological innovation and brand differentiation.

Summary:

While Chinese brands have not yet dominated the Australian market in terms of market share, their growth rate and structural changes are sufficient to reshape the market order. Driven by factors such as the slowdown in growth of traditionally dominant brands, the adjustment of local demand structure, and the increasing penetration of new energy vehicles, Chinese brands have gradually found a path to enter the mainstream.