European Auto Market | Germany July 2025: Pure Electric Market Revitalizes Post-Subsidy Phase-out

![]() 08/11 2025

08/11 2025

![]() 581

581

The German automotive market exhibited a long-awaited surge in July, with 264,800 new car sales, marking an 11.1% increase from the same period last year. This uptick drove the pure electric market to its first significant rebound since subsidies were phased out, with its share reclaiming 18.4% of the market.

Volkswagen returned to growth, led by models like the T-Roc and Golf, which topped monthly sales charts, reaffirming the strong local dominance of German brands.

Amidst established names, Chinese automakers are making their mark. BYD outpaced Tesla with a 389.6% year-on-year increase, while ZERO Run and Xpeng debuted on German sales charts. Despite their less than 1% market share, they've carved out niches in pure electric and plug-in hybrid segments.

This growth isn't coincidental; it reflects the resurgence of German consumer confidence in new energy vehicles and the differentiated strategies of Chinese automakers in pricing, configuration, and intelligence.

01 Overview and Competitive Landscape of the German Auto Market

In July 2025, Germany sold 264,800 new cars, a 11.1% year-on-year increase but still about 20% below 2019 levels, indicating market recovery but not yet pre-pandemic strength. Cumulative sales for the first seven months were 1,667,600 units, down 2.5% year-on-year.

Pure electric vehicle sales surged to 48,600 units, a 58% year-on-year jump, with market share rising from 12.9% in 2024 to 18.4% in 2025, though still slightly below 2023's 20%. The rebound this year is pronounced, following the sharp decline caused by subsidy cancellations in 2024. Cumulative sales for the year reached 297,300 units, accounting for 17.8% of the market.

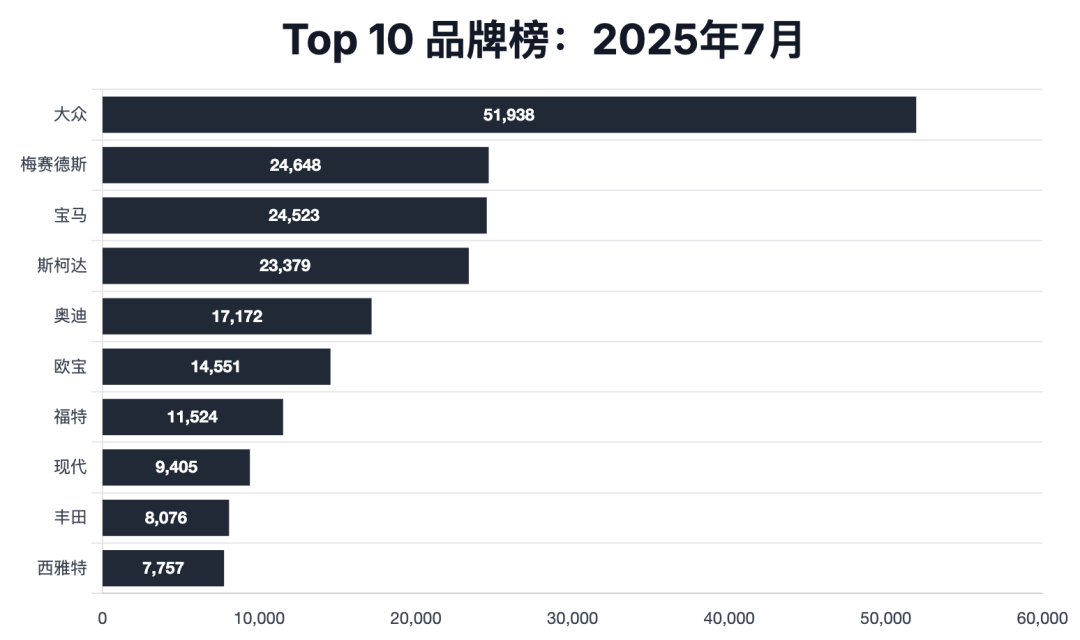

Brand Perspective

● Volkswagen sold 51,900 units in July, a 25.5% year-on-year increase. While its 19.6% share is slightly lower than the yearly average, it bounced back from June's decline.

● Mercedes-Benz sold 24,600 units, up 7.1% year-on-year, with a growth rate below the market average.

● BMW sold 24,500 units, a 15.8% increase, with its share rising to 9.3%.

● Skoda sold 23,400 units, a 23.7% year-on-year increase, performing impressively.

● Audi fell 11.6% to 17,200 units, dropping to fifth place.

● Opel (14,600 units, +17.5%) and Ford (11,500 units, +29.2%) both performed outstandingly.

● Second-tier brands like Renault, Cupra, and Mini saw significant growth rates of 47.5%, 46.7%, and 54%, respectively.

● Japanese brands like Toyota and Hyundai saw limited growth, while Seat continued to decline.

● BYD surged nearly 390% year-on-year, surpassing Tesla with a 0.4% share, while Tesla fell by 55.1%.

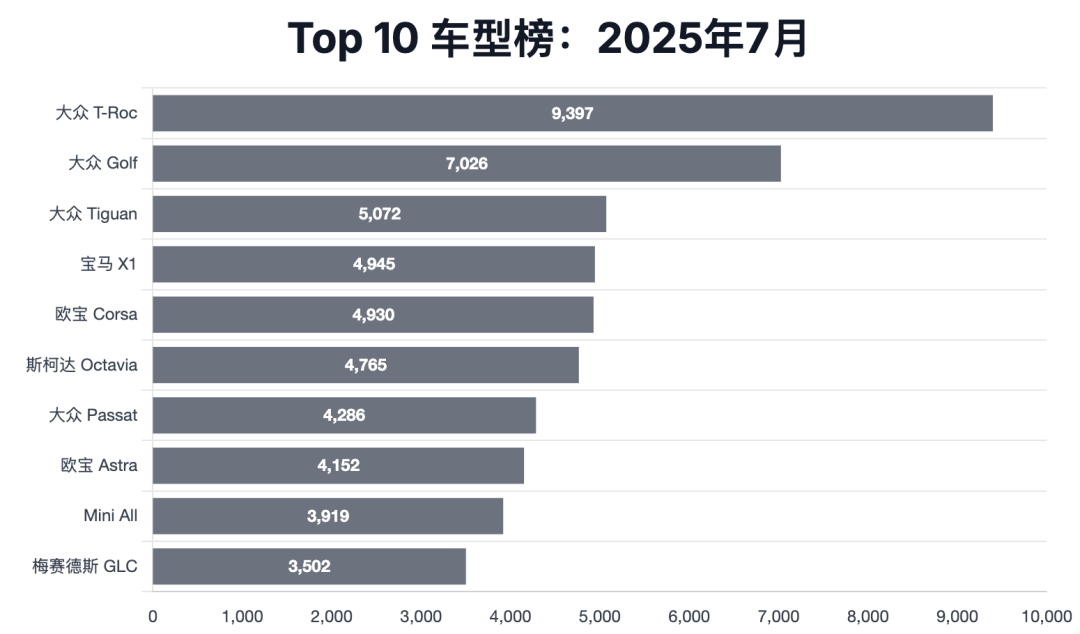

Model Perspective

● The Volkswagen T-Roc led sales with 9,397 units, a 19.6% year-on-year increase and the highest monthly sales since June 2024, outpacing the second-placed Volkswagen Golf by nearly 2,500 units.

● The Golf returned to growth with 7,026 units sold, up 39.8% year-on-year.

● Following closely were the Volkswagen Tiguan (5,072 units, +15.4%) and BMW X1 (4,945 units, +44%), with the Opel Corsa (4,930 units, +23.1%) ranking fifth.

● Models like the Skoda Octavia, Volkswagen Passat, Opel Astra, and Mercedes-Benz GLC were all in the top ten, demonstrating German brands' strong local dominance.

● Among new models, the Volkswagen Taos ranked 19th, the Skoda Elroq 30th, and the Dacia Bigster surged to 35th, becoming the brand's sales leader in Germany.

02 Performance of Chinese Brands in Germany

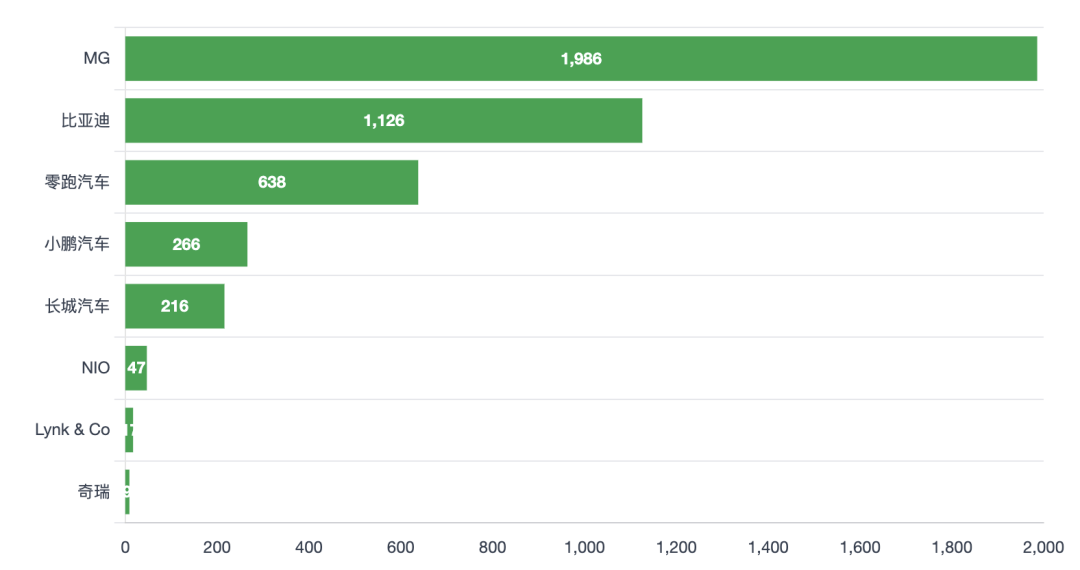

Chinese brands' share in the German market remains limited, but their growth rates are substantial.

● BYD sold 1,126 units in July, a massive 389.6% year-on-year increase, solidifying its presence in the new energy vehicle segment and surpassing Tesla.

● ZERO Run debuted on the sales chart with 638 units and a 0.2% share, demonstrating potential in the European market.

● Xpeng recorded 266 units, a 1,562.5% year-on-year increase, with cumulative growth for the year reaching 2,731.9%. While the scale is small, the growth momentum is robust.

● MG sold 1,986 units, an 8.5% year-on-year increase, continuing to attract consumers with price competitiveness and practicality.

● Great Wall sold 216 units, a 20% year-on-year decrease, mainly hindered by model adaptability and localization pace.

● NIO sold 47 units in July, a 46.9% year-on-year increase, but it remains niche, targeting the high-end pure electric segment.

● Lynk & Co. sold 17 units, an 183.3% year-on-year increase. Though the volume is small, the growth rate is remarkable, indicating recognition of plug-in hybrids and design styles among certain consumer groups.

● Chery registered 9 units in July, signaling its tentative entry into the German market.

From a model competition perspective, Chinese brands in Germany focus on pure electric and plug-in hybrid markets, particularly complementing entry-level and mid-to-high-end new energy segments.

● BYD's Seal, Yuan PLUS, and other models dominate its local sales mix.

● ZERO Run and Xpeng leverage intelligent selling points to break into the competitive German and Tesla-dominated market.

As German consumers' acceptance of new energy vehicles grows, Chinese brands are expected to steadily expand their influence in niche markets.

Summary

July's German auto market saw a dual recovery: German brands rebounded strongly in mainstream segments, while Chinese new energy brands accelerated their local market penetration. For BYD, Xpeng, ZERO Run, and others, current market shares don't directly reflect market position, but the changes in user structure behind their growth rates indicate they're being included in more German consumers' shopping lists. As local new energy subsidy policies fade, true competition will revert to product strength and brand trust. Each sales breakthrough by Chinese automakers here is a formal introduction to the mainstream European automotive ecosystem.