Asian Auto Market | Japan's July Sales Growth Turns Negative for the First Time, with 390,500 Vehicles Sold

![]() 08/11 2025

08/11 2025

![]() 630

630

In July 2025, the Japanese new car market ended its streak of consecutive monthly sales growth, which had been fueled by the 'low base effect' from the previous year.

Amid the combined effects of a high base from the full production recovery in the same period last year and a slight slowdown in demand, sales fell 3.6% year-on-year, marking the first negative growth for the year. The total volume dropped to 390,500 vehicles. Nevertheless, due to the cumulative advantage from the beginning of the year, overall growth for the first seven months remained at 8%.

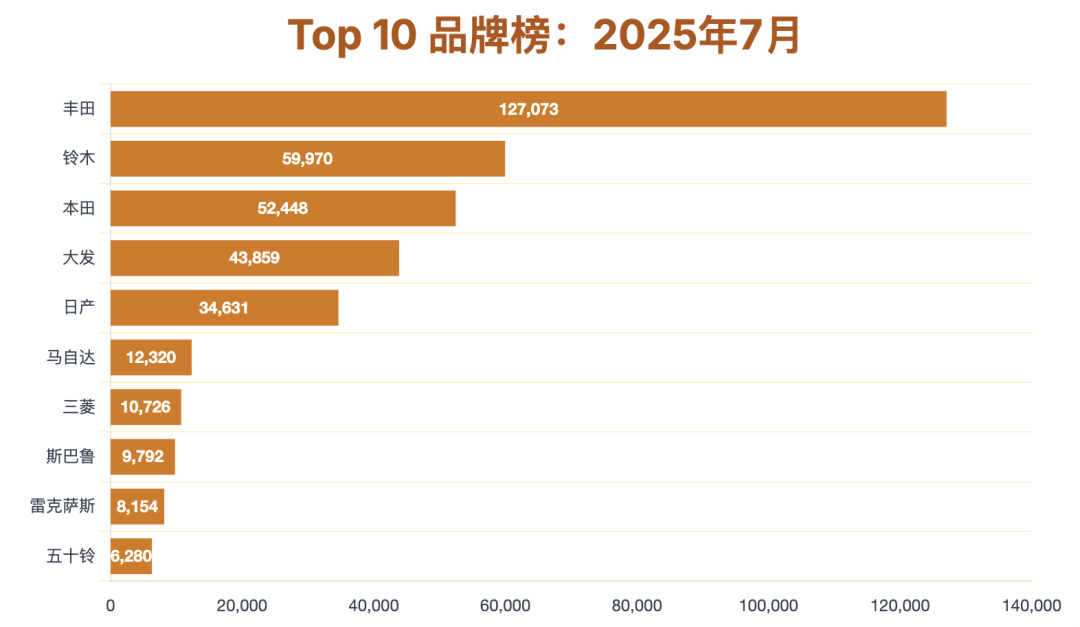

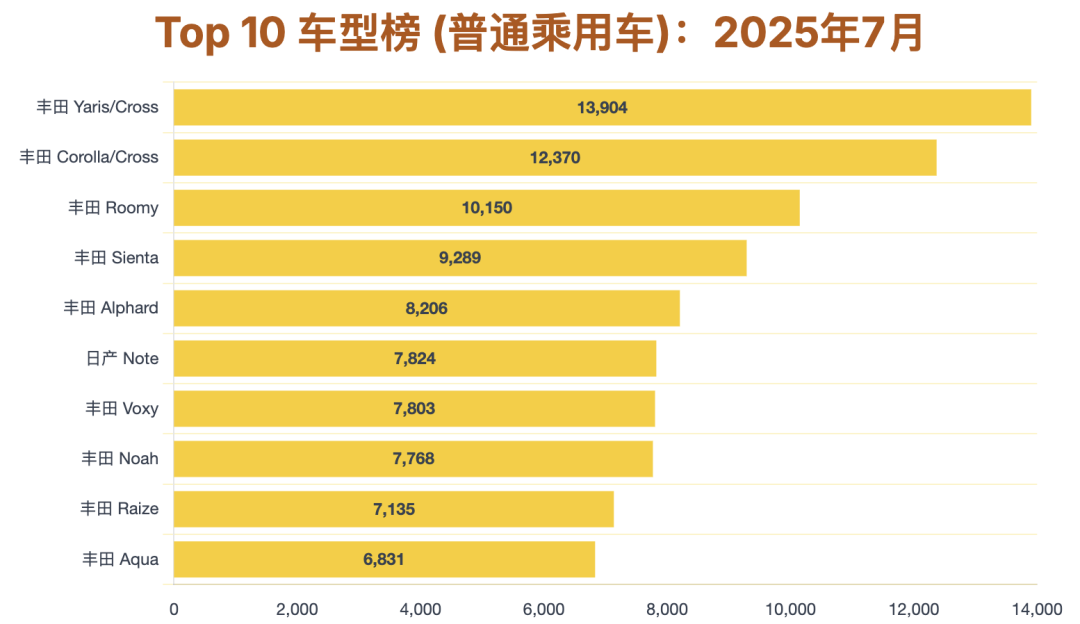

◎ In terms of brand performance, Toyota's leading position widened further. Its market share rose to 32.5% in July, and it even swept the top five spots in the regular car rankings. The Roomy overtook the Yaris/Cross and Corolla/Cross with a slight increase to become the new monthly sales champion. This compact and affordable small multi-purpose vehicle continues Toyota's appeal in the household segment market.

◎ In the kei car segment, Honda's N-BOX remained firmly in first place, but Suzuki's Spacia overtook Daihatsu's Move, bringing subtle changes to the rankings. Overall, while the Japanese auto market showed signs of cooling in July, it created new suspense in segment markets and model rankings.

01 Market Overview and Brand Performance

In July 2025, the Japanese new car market bid farewell to the 'low base effect' of production disruptions in the same period last year. Under the combined effects of a high base and slowing demand, it experienced its first decline of the year, falling 3.6% year-on-year to 390,500 vehicles sold.

However, thanks to the robust performance in the first half of the year, cumulative sales for the first seven months still increased by 8% year-on-year, reaching 2,532,700 vehicles.

From the perspective of brand performance:

◎ Toyota retained its top spot, with its market share increasing from 30.9% in the first half of the year to 32.5% in July. Although it fell slightly by 3.8% year-on-year, it remained far ahead of its competitors.

◎ Suzuki held onto second place with a slight increase, accounting for 15.4% of the market.

◎ Honda, despite a year-on-year decline of more than 10%, regained third place, pushing Daihatsu to fourth.

◎ Daihatsu continued its high growth trend since the beginning of the year, with a year-on-year increase of 4.3% in July and a cumulative surge of 87.9% for the first seven months, benefiting from new products and the recovery of the kei car market.

◎ Nissan performed poorly, with a year-on-year decline of nearly 20%, ranking fifth.

◎ In the midstream segment, Mitsubishi, Mazda, and Isuzu all achieved positive growth, with Mitsubishi's growth exceeding 10%.

For imported brands:

◎ Mercedes-Benz continued to lead in imported car sales, while Volkswagen saw the most significant increase among BMW, Audi, and Volkswagen, surging 71.7% year-on-year.

◎ Peugeot and Land Rover also recorded significant growth, with year-on-year increases of 94.5% and 43.5%, respectively.

Overall, while imported brands struggled to enter the top ten, some models remained competitive in segment markets.

02 Segment Markets and Model Trends

In the regular car market, Toyota's dominance reached new heights.

◎ The Yaris/Cross combination saw a year-on-year sales increase of 19.7%, but it was overtaken by the Roomy this month. The Roomy topped the charts with a slight increase of 1.5% and sales of 10,150 vehicles. This small multi-purpose vehicle, which emphasizes spaciousness and cost-effectiveness, maintains its stable appeal among household users.

◎ The Corolla/Cross combination fell 15.4% year-on-year, ranking third.

◎ All five top-selling models were from Toyota, including the aforementioned three models, as well as the Sienta and Alphard, which ranked fourth and fifth, respectively.

◎ Toyota Raize emerged as the biggest dark horse, with a year-on-year surge of 150.5%, indicating the potential for continued growth in the small SUV market.

◎ Models such as the Voxy, Noah, and Aqua also continued to grow steadily.

If the Yaris and Yaris Cross are considered separately, the ranking of individual models will decline, reflecting shifts in market demand between crossover and hatchback versions.

In the kei car market:

◎ Honda's N-BOX remained unchallenged at the top.

◎ Suzuki's Spacia overtook Daihatsu's Move with a 12.1% increase, while Move, despite a massive year-on-year surge of 122.3%, fell to third place.

◎ Daihatsu's Tanto experienced a significant decline, decreasing by 38.1% year-on-year.

◎ Mitsubishi's Delica Mini and Daihatsu's Mira were among the few models on the list that still maintained double-digit growth, indicating that in the kei car segment, products with unique features or differentiated positioning still have market space.

Summary

The decline in July was a result of the combined effects of a high base and demand fluctuations, but it does not signify a loss of market vitality.

The regular car market has entered a 'dominance period' under Toyota's multi-point layout. The Roomy's ascent to the top is not a one-month fluke but a microcosm of the shift in consumer demand towards multi-functional and compact models. Changes in the kei car segment rankings remind us that market competition is far from settled – differentiated positioning and precise entry into segment markets can still open up growth opportunities.