South American Auto Market | BYD Claims Uruguay's Sales Crown in July 2025

![]() 08/14 2025

08/14 2025

![]() 562

562

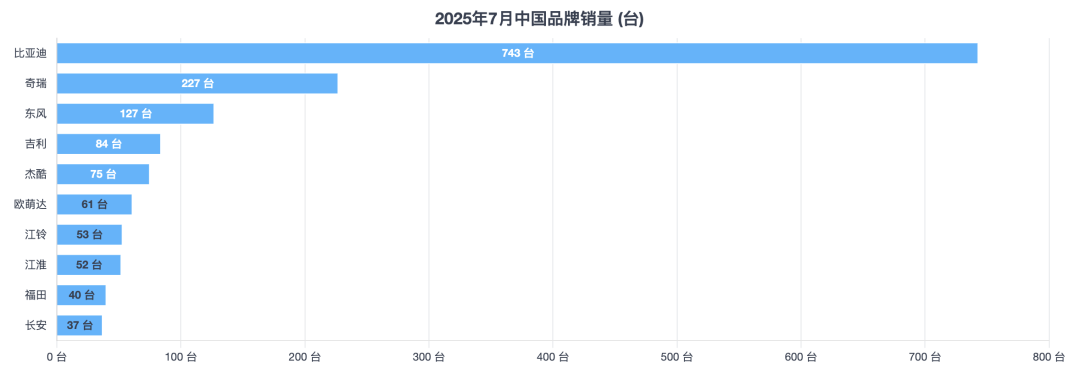

July 2025 marked a pivotal moment in the Uruguayan automotive industry as BYD ascended to the throne of monthly sales champions for the first time, tallying 743 vehicles sold and capturing a 12.6% market share. This milestone not only represented BYD's maiden title in South America but also signaled the first instance where Chinese automakers collectively surpassed 30% market share in Uruguay, doubling the figure from the previous year and reshaping the traditional dominance of brands like Fiat and Chevrolet.

Cumulative sales of new light vehicles in Uruguay surged 9.8% year-on-year in the first seven months of 2025, with a quiet but steady rise in the penetration of new energy vehicles. The surge in Chinese brands across all segments has been the most notable development.

BYD's Dolphin and Song PLUS DM-i models hit the sweet spot for urban consumers in terms of price and range. Chery and Jetour have cemented their positions in the SUV market, while Dongfeng and Auman have launched aggressive campaigns in the commercial vehicle sector. Emerging players like NIO and XPeng have also begun to establish brand recognition in this market of fewer than 4 million people.

Uruguay, a bastion in the high-value South American market, has emerged as the first significant challenge for Chinese automakers, and they have now made a crucial breakthrough.

01 Overview of the Uruguayan Market

In July 2025, bolstered by improved consumer confidence and a flurry of new model launches, the Uruguayan auto market witnessed a 21.4% year-on-year increase in sales, totaling 5,908 vehicles. Cumulative sales for the year reached 36,678 vehicles, up 9.8% year-on-year, outperforming several neighboring South American countries.

The substantial growth of BYD and the entry of new energy brands like NIO and XPeng indicate a rapidly increasing acceptance of pure electric and plug-in hybrid vehicles in Uruguay, particularly among urban users, where electric vehicles are no longer a niche option.

Brand Landscape

◎ BYD sold 743 vehicles in July, soaring 271.5% year-on-year to capture a 12.6% market share, overtaking Fiat (710 vehicles, 12.0%) for the first time to become the monthly sales leader in Uruguay.

◎ Suzuki ranked third with 679 vehicles and an 11.5% share.

◎ Volkswagen came in fourth with 505 vehicles.

◎ Chevrolet, despite ranking fifth with 470 vehicles, saw a 33.9% year-on-year decline, signaling heightened competition for traditional American brands in the local market.

◎ Renault, Hyundai, and other brands maintained steady performance but grew at a slower pace than the overall market.

In terms of growth, Chinese brands like Dongfeng witnessed a staggering increase of 4133.3%, Auman 1933.3%, Chery 183.8%, and Jetour 63%. This remarkable growth underscores the advantages of Chinese automakers in product pricing, configuration, and new energy vehicle layouts, particularly in the pickup truck, light commercial vehicle, and entry-level SUV markets.

Regarding models, while specific rankings for individual models are unavailable for this month, based on past trends, Fiat's compact sedans and microcars continue to enjoy high sales, while BYD's Dolphin and Song PLUS DM-i models stand out in the new energy segment. Volkswagen's Polo and T-Cross remain popular choices among urban users.

The Uruguayan market is transitioning from a landscape dominated by single-fuel vehicles to one where fuel and new energy vehicles coexist, with Chinese brands emerging as the most dynamic force driving this transformation.

02 Performance and Opportunities of Chinese Brands in Uruguay

In July 2025, the overall market share of Chinese cars in Uruguay reached 30.7%, doubling from 14.1% in the same period last year.

This historic breakthrough for Chinese automakers in Uruguay is fueled by several key factors:

◎ BYD's Comprehensive Breakthrough: BYD boasts a formidable advantage in the new energy sector while also offering competitive pricing and configurations in the fuel and hybrid markets. Monthly sales of 743 vehicles have propelled it to the top spot, an unprecedented achievement in a market previously dominated by Fiat, Chevrolet, and Renault. Models like the Dolphin and Song PLUS DM-i cater to local consumers' dual demands for low operating costs and high practicality.

◎ Dual Growth of Chery and Jetour: Chery ranked eighth with 227 vehicles, up 183.8% year-on-year, while Jetour sold 75 vehicles, up 63%. Both focus on the SUV segment with moderate sizes and prices tailored to the middle class, outperforming European and American models in the same price range in terms of configuration, thus winning the favor of family users and tourist rental companies.

◎ Dongfeng sold 127 vehicles, marking a staggering increase of 4133.3%.

◎ Brands such as JMC, JAC, and Foton all achieved severalfold growth in July.

◎ New energy players like NIO and XPeng, despite modest sales volumes (ranging from single digits to more than ten vehicles), have established brand recognition in the market. This strategy of starting small and gradually expanding sales and service networks lays the groundwork for medium- and long-term expansion.

Historically, the Uruguayan market was segmented among Italian, American, Japanese, and European brands, with Chinese brands occupying only the low-end market. However, the successful breakthroughs of BYD and Chery have not only elevated the overall image of Chinese brands but also introduced consumers to the advanced technology and quality of Chinese automakers.

Summary

BYD's ascent to the top is merely the beginning. Behind the rapid expansion of Chinese brands in Uruguay lies a concerted effort in advancing new energy technology, pricing strategies, channel development, and after-sales systems.

Once a stronghold of European and American brands, the competitive landscape is now being disrupted. In the next two to three years, as more plug-in hybrid and pure electric vehicles enter the market, there is ample opportunity for Chinese automakers to further increase their share. The Uruguayan market is witnessing a clear shift: Chinese cars are transforming from "foreign guests" to "victorious forces".