North American Auto Market | July 2025: U.S. Eases Off the Accelerator; Canada Maintains Steady Course

![]() 08/14 2025

08/14 2025

![]() 660

660

In July's North American auto market, both the U.S. and Canada exhibited growth, yet their paths diverged significantly.

The U.S. auto market continued to expand, albeit with a shift in momentum. Sales of high-margin SUVs and pickup trucks remained robust, and electric vehicle purchases surged ahead of the expiration of tax incentives.

However, a confluence of rising prices, dwindling incentives, and tariff pressures signaled a deceleration in growth. The average retail price of new vehicles in the U.S. climbed to $45,063, a year-over-year increase of nearly $1,000, with incentives accounting for only 6.1% of the selling price, a decrease from earlier in the year. Inventory levels surged 28% year-over-year to 2.19 million vehicles, equivalent to a 60-day supply, offering short-term delivery assurance but potentially leading to promotional and profit margin pressures should demand weaken.

In contrast, the Canadian market maintained a steady pace. New vehicle sales in July rose 6.9% year-over-year, marking the best performance for that period since 2019. With continued digestion of pre-tariff inventory and a resurgence in demand, price pressures have yet to materialize. Toyota and Hyundai spearheaded growth, with hybrids and SUVs serving as the primary drivers.

One market is adjusting its speed amidst deceleration, while the other is accelerating its momentum. The U.S. and Canadian auto markets stood at different inflection points in July.

01 Analysis of the U.S. Auto Market

In July 2025, the U.S. light vehicle market continued its upward trajectory, influenced by multiple factors, yet the growth engines were evolving.

Sales forecasts varied widely among institutions, with JD Power-GlobalData predicting a 7.4% year-over-year increase and Cox Automotive estimating just 1.2%. Seasonally Adjusted Annual Rate (SAAR) projections also differed significantly, with the former forecasting 16.4 million vehicles, higher than the previous year, and the latter anticipating a drop to 15.6 million vehicles.

This disparity underscores market uncertainty: the imposition of tariffs, leading to price hikes for certain products and a slowdown in incentives, has begun to dampen potential demand.

The average retail price of new vehicles in July hit $45,063, a year-over-year increase of nearly $1,000, with incentives comprising only 6.1% of the selling price, a decline from previous levels.

Regarding inventory, the U.S. light vehicle inventory surged 28% year-over-year to 2.19 million vehicles, equivalent to a 60-day supply, compared to just 0.49 million vehicles in the same period last year. This inventory rebound offers brands short-term delivery security, but if demand wanes under price pressure, it could translate into promotional and profit margin challenges.

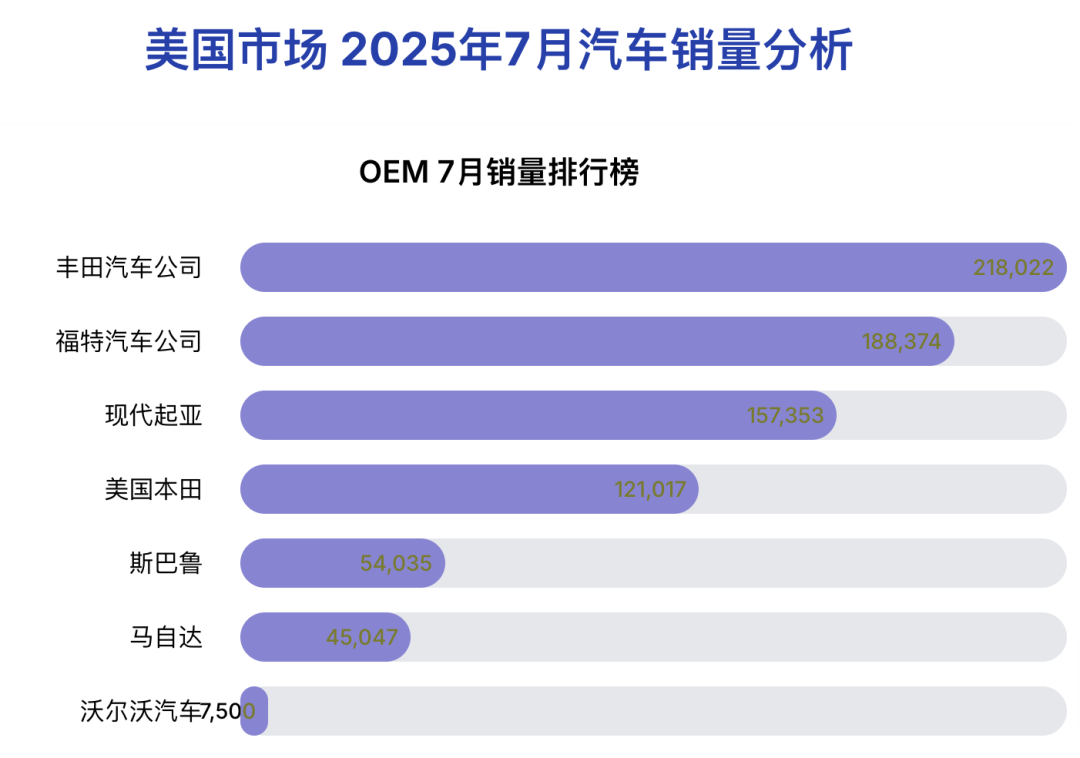

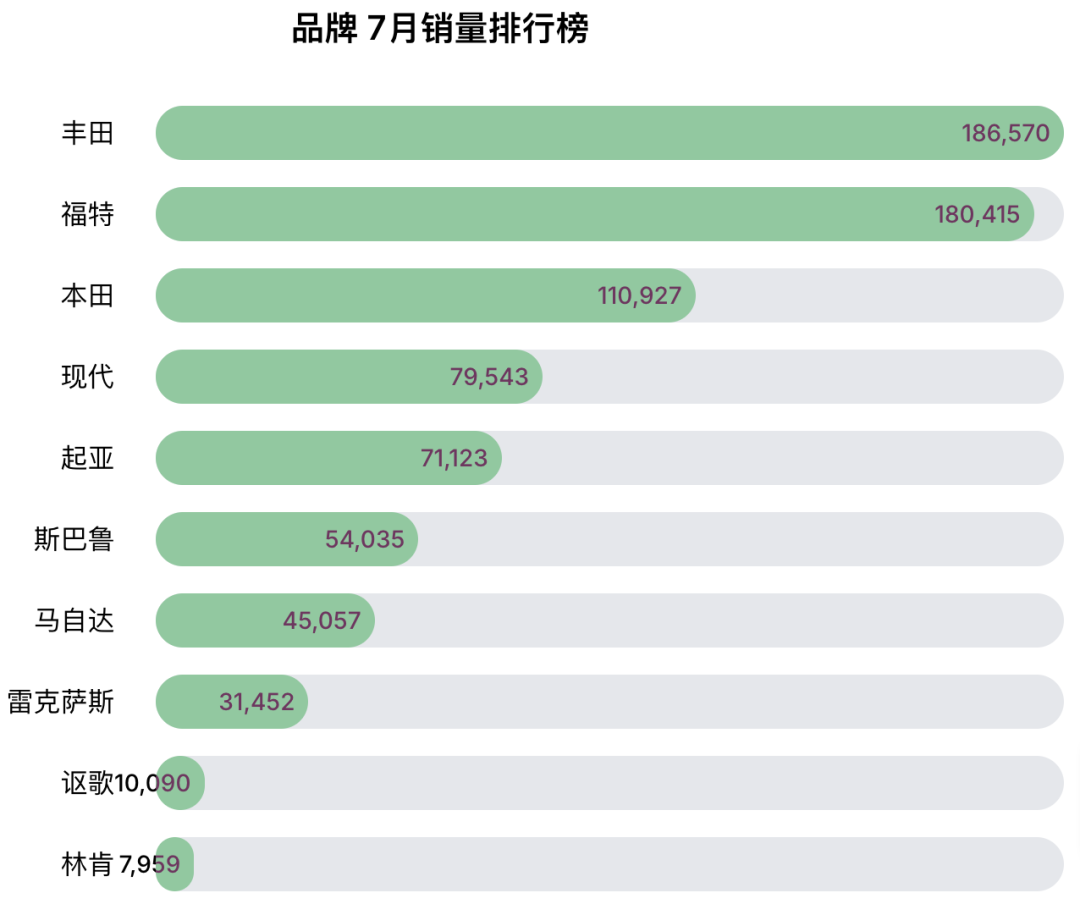

In terms of specific brand performance:

◎ Toyota led with a 21.9% year-over-year increase, fueled by strong demand for SUV and pickup truck models like the 4Runner and Tacoma.

◎ The Hyundai-Kia group grew by 13.2%, with several models setting new July sales records.

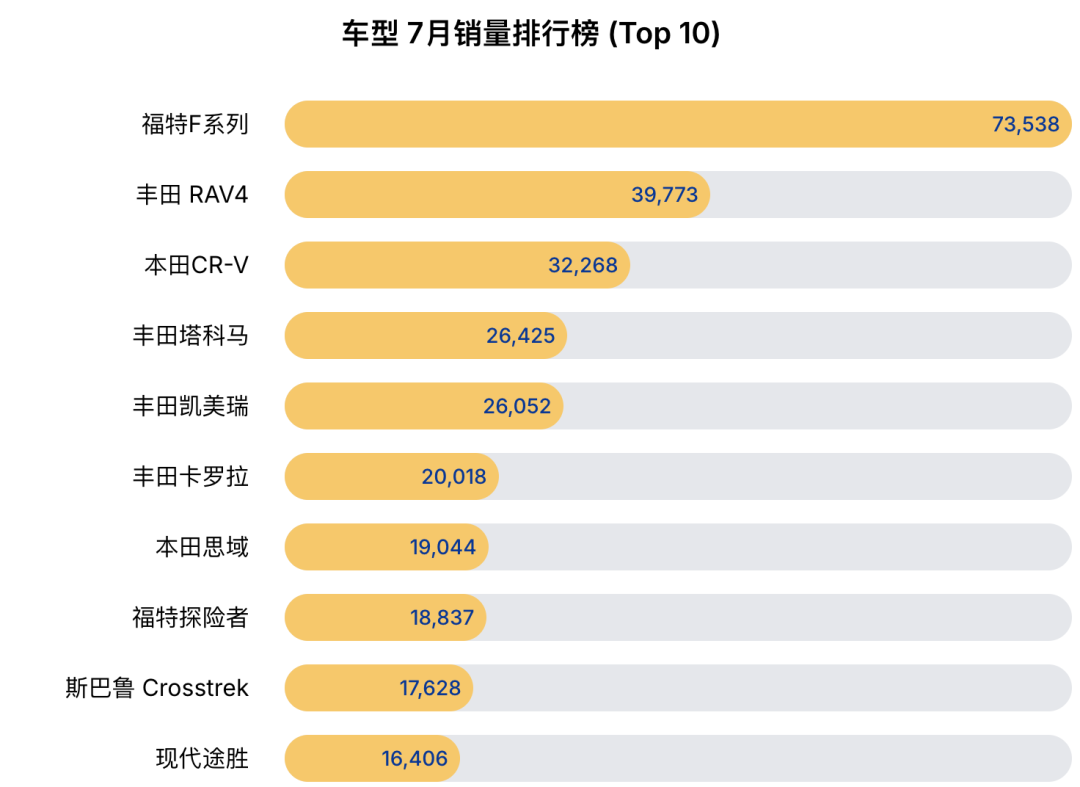

◎ Ford expanded by 9.4%, with F-Series pickup truck deliveries exceeding 73,000 units, a 6.6% year-over-year increase.

◎ Honda's overall performance was stable, with a modest 0.2% increase, but certain models like the CR-V and Civic saw slight declines.

◎ Among luxury brands, Lexus grew by 9%, while Acura and Volvo declined by 9.8% and 21.9%, respectively, reflecting intensified competition in the premium segment.

The electric vehicle segment witnessed a surge in purchases due to the impending expiration of the $7,500 federal electric vehicle tax credit at the end of September, pushing the proportion of electric vehicles in new vehicle sales to 10.9% in July, surpassing the 10% threshold for the first time in 2025.

In terms of models, in addition to traditionally popular pickup trucks, SUVs and crossovers such as the Toyota 4Runner, Hyundai Santa Fe, Ford Explorer, Toyota Tacoma, and Mazda CX-5 recorded double-digit or even up to 90% year-over-year growth. The dominance of SUVs and pickup trucks remained steadfast, while the sedan market generally struggled with growth.

The U.S. market can still rely on higher-priced models and SUV demand to sustain growth in the short term, but the triple pressures of tariffs, price hikes, and reduced incentives may slow growth in the second half of the year, particularly after the expiration of electric vehicle tax incentives, which could rapidly cool electric vehicle sales enthusiasm.

02 Analysis of the Canadian Auto Market

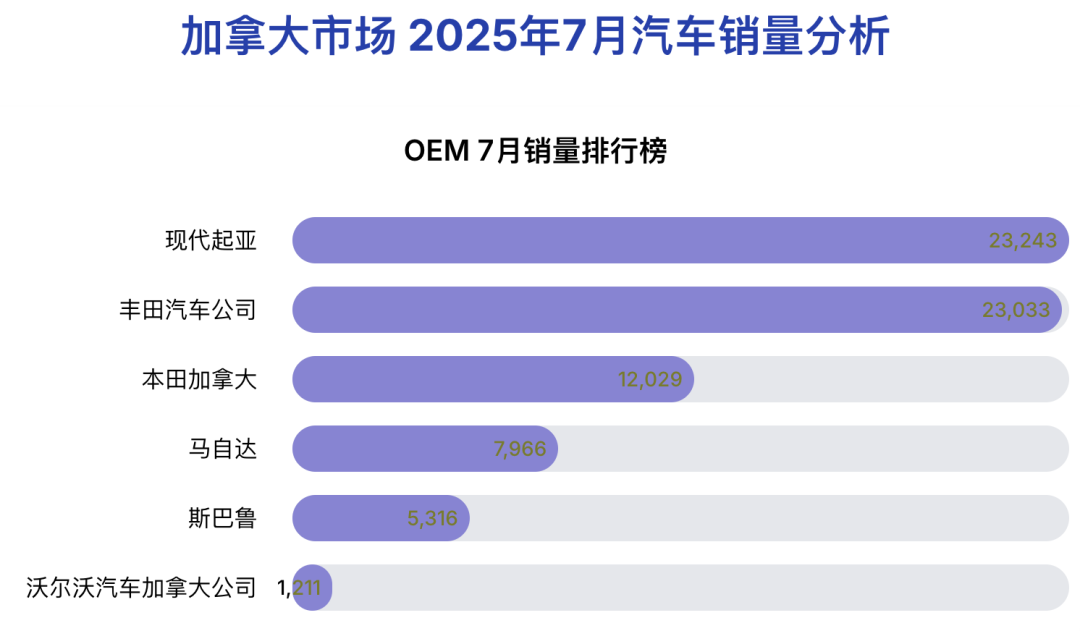

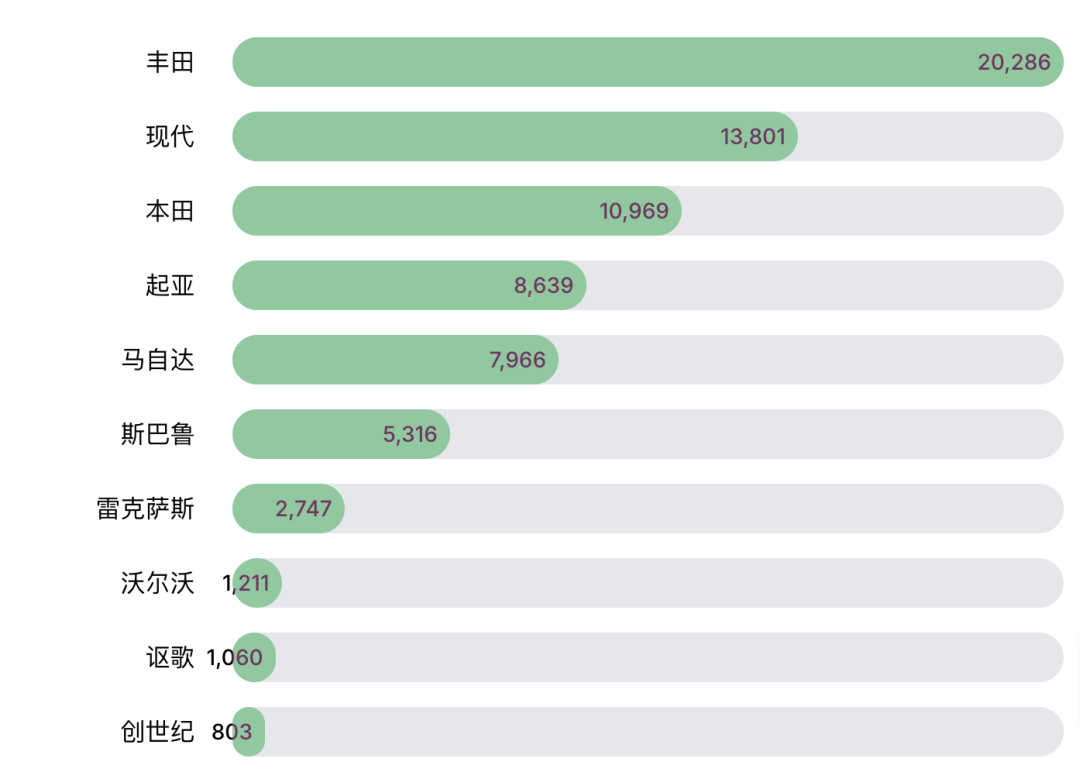

The Canadian market shone in July 2025, with new light vehicle sales increasing 6.9% year-over-year to 172,000 units, marking the best performance for that period since July 2019.

Benefiting from the continued digestion of pre-tariff inventory, the market has yet to feel the tariff's price impact, and consumer willingness to purchase vehicles remains strong.

The Seasonally Adjusted Annual Rate of sales reached 1.89 million vehicles, higher than the 1.77 million vehicles in the same period last year and the 1.81 million vehicles in the preceding month.

◎ Toyota's year-over-year growth in the Canadian market soared to 29.5%, primarily driven by the popularity of SUV and hybrid models.

◎ Hyundai grew by 22.1%, with Tucson sales surging 123.4% year-over-year, becoming the highlight of the month.

◎ Kia also maintained double-digit growth, further solidifying the market share of Korean brands in Canada.

In contrast to the price pressures and signs of slowing growth in the U.S. market, the Canadian market's momentum is more fueled by inventory releases and demand recovery, with consumer reactions to price increases not yet evident. This relatively steady growth may shift after pre-tariff inventory is depleted, but positive growth is still anticipated in the short term.

Summary

While both the U.S. and Canadian auto markets experienced growth in July, their drivers differed. The U.S. relied on high-margin models and policy-driven electric vehicle sales surges, but the burden of rising prices and tariffs is mounting, and electric vehicle sales could cool rapidly post-tax incentive expiration.

Canada, benefiting from inventory releases and demand recovery, remains within a moderate growth range, but once this advantage wanes, it too will face the challenge of restructuring its pricing system.

In the coming months, the North American auto market will transition from "growth in numbers" to "competition in quality," and global automakers must navigate how to stabilize sales and profits amidst the cross-pressures of pricing, product mix, and policy shifts.