Revelry in the Pure Electric Vehicle Market: Is There No Room for "Boutique Pure Electric Compact Cars"?

![]() 08/15 2025

08/15 2025

![]() 820

820

Introduction

Achieving "exceptional value" is the key to high sales, yet few brands can truly deliver on this promise.

In July, despite the so-called off-season, the retail penetration rate of new energy vehicles soared to an impressive 54%. Among these, the pure electric segment exhibited robust growth, increasing by a full 24.5% compared to the same period last year. From January to July, it saw an even more significant increase of 35.2%, far surpassing many expectations.

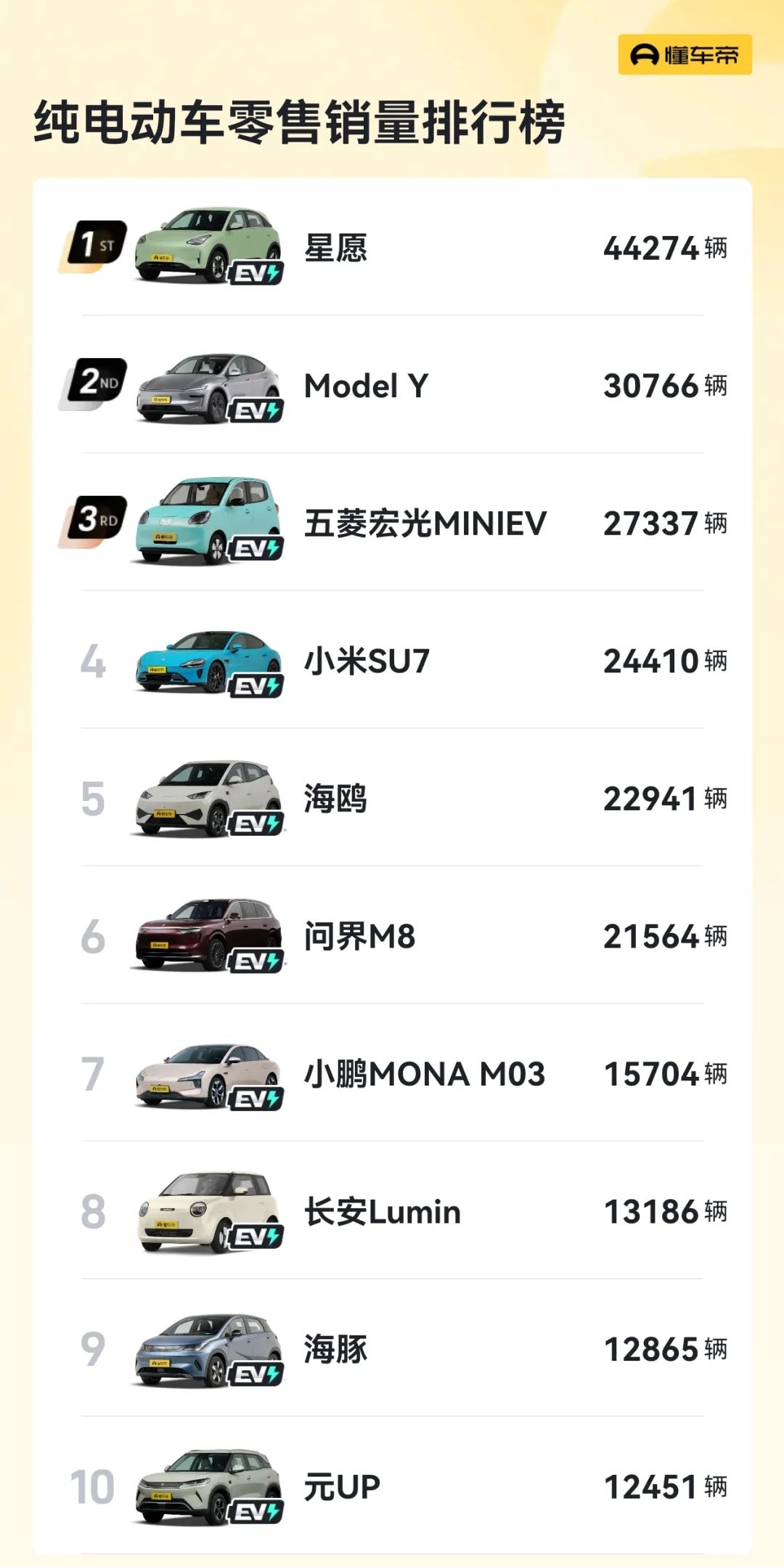

Analyzing the sales rankings of specific models reveals that, among the top ten, with the exception of Xiaomi SU7, Tesla Model Y, and AITO M8, the rest are primarily "pure electric compact cars." Expanding the scope further reveals an increasing number of similar models on the list, which explains the major surge in the pure electric segment this year.

It is no exaggeration to state that as long as a product falls into this category, is priced competitively, and does not have significant shortcomings in configuration, it can achieve relatively good sales results. However, in the vast Chinese automotive market, there are also counterexamples, and the focus of today's article is on boutique pure electric compact cars.

In contrast to the lively sales of their lower-priced counterparts, most boutique pure electric compact cars have performed lukewarmly. For instance, models like the LYNK & CO Z20, Geely Zeekr X, Smart #1, and the highly anticipated electric MINI COOPER have failed to break through the 2,000-unit monthly sales mark, with the best-performing model struggling to reach this milestone.

The reason behind this ultimately boils down to a small market size. Most domestic consumers inherently prefer larger vehicles, and even when opting for a smaller car, the primary reason is for commuting and cost savings.

In contrast, the boutique pure electric compact cars discussed today, due to their higher prices and compact sizes, find themselves in an awkward middle ground, resulting in limited terminal demand. As the saying goes, "It's not that boutique pure electric compact cars are not good enough, but rather that the survival environment is too harsh." Despite efforts, the results may still be limited.

However, in July, two outstanding examples emerged, prompting new thinking. The first is FENGBIAO Ti3, which sold 8,513 new vehicles. Perhaps, in the eyes of many readers, it does not meet the criteria for inclusion. But with a length of 4.6 meters and a top-of-the-line model priced close to 200,000 yuan, in an era when boutique models of the same class often exceed 5 meters in length, it undoubtedly qualifies as a boutique pure electric compact car.

Recently, I had the opportunity to communicate with Xiong Tianbo, CEO of FENGBIAO, at BYD's headquarters. Regarding Ti3, she candidly stated, "Over the past year, our brand positioning has been adjusted, so we launched such a product accordingly. In fact, from the moment it was unveiled, it did not receive any resources from the group; we did everything ourselves behind closed doors. We were surprised by the positive sales feedback, and most of the sold units were mid-to-high configurations."

Indeed, when Ti3 was first launched, almost the entire industry was not optimistic about it, even viewing it as a "cannon fodder." However, the results proved this judgment wrong. So, what made Ti3 defy skeptics? The answer lies in providing users with a sense of "exceptional value." Never underestimate these simple two words; most boutique pure electric compact cars fail to achieve this.

Ti3's tough exterior design, superior interior texture, abundant power performance, coupled with rare configurations such as an electric front trunk, and the brand image of FENGBIAO itself, which has a certain long-term appeal, all became its strengths. Ultimately, when matched with a sincere terminal price, it is not surprising that it became a bestseller. For FENGBIAO as a whole, it is precisely because of Ti3's "timely rain" assistance that it can take a deep breath in the fiercely competitive Chinese automotive market.

Coincidentally, this also leads me to introduce the second outstanding example – NIO Firefly.

As the only product under this new force's third brand, after its debut at last year's NIO Day, this boutique pure electric compact car faced what seemed like an incredibly difficult start. "Everyone says it's ugly, everyone plays jokes about it, everyone hopes it will be redesigned." Despite the enormous pressure, Firefly still chose to launch as scheduled in April this year. Fortunately, this underdog has unleashed unexpected energy.

In terms of sales, it recently surpassed the cumulative delivery of 10,000 units. In July, it surpassed the industry benchmark set by the electric MINI COOPER. According to official sources, with the completion of production line adjustments, the ongoing month of August will once again set a new record, with a guess that it will approach or even surpass the 5,000-unit mark. If this becomes a reality, it will fulfill the previous promise, "equivalent to the sum of Smart #1 and electric MINI COOPER."

So, what is the key to Firefly's popularity? After inquiring about feedback from several real car owners, "exceptional value" undoubtedly appears most frequently. Firstly, in terms of appearance, the actual car is much more decent and personalized than the photos; the interior, both in design and materials, maintains the high standards of NIO. Coupled with the ability to swap batteries, the handling and ride quality of the chassis are also recognized strengths.

In contrast, what Firefly has received the most praise for from users is its safety. In terms of sheer specifications, with 9 airbags throughout the vehicle, there is no second model in the same class. Moreover, in the latest collision test conducted by the China Insurance Research Institute (CIRI), Firefly achieved an all-excellent rating.

Among them, it received a G rating for crashworthiness and repair economy index, a G+ rating for occupant safety index, a G+ rating for pedestrian safety index, and a G+ rating for vehicle assistance safety systems, becoming one of only three models in history to achieve such performance. The other two are the Ledao L60 and AITO M9. As a compact car with a length of just over 4 meters, obtaining an all-excellent rating is actually the most difficult among the three due to the very limited available crush zone area. Fortunately, Firefly has made no compromises on safety.

Behind its popularity, there is undoubtedly a connection to price and brand. Since the early launch of the BaaS (Battery as a Service) vehicle-battery separation solution in June, shedding the "burden" of the power battery, the minimum price of 79,800 yuan has allowed Firefly to stand on equal footing with the top-selling models in the retail rankings mentioned earlier. As the "third prince" of NIO, displayed in NIO Houses, and enjoying the same service system as NIO, the experience is indeed superior in the minds of many potential customers. Firefly's rebound from the bottom is more like a matter of course.

With Ti3 and Firefly as support, at the end of the article, I would like to put forth a viewpoint: "In the Chinese automotive market, boutique pure electric cars are not absolutely without a future. The key to high sales is how to make consumers feel exceptional value." However, these seemingly simple two words are rarely achieved by OEMs.

Therefore, I can't help but offer another piece of advice: "Don't touch boutique pure electric compact cars unless you're ready." Entering this market segment can easily result in wasted human, material, and financial resources. Rather than exerting effort for little reward and spending money to suffer, it is better to honestly follow the low-price route and sell pure electric compact cars. Although profits are slim, at least sales volumes can be maintained...

Editor-in-Charge: Cui Liwen | Editor: He Zengrong

THE END