Auto Market in the Americas | Mexico July 2025: Chinese Automakers Strengthen Their Presence

![]() 08/15 2025

08/15 2025

![]() 561

561

Mexico's auto market demonstrated remarkable resilience in July, with sales totaling 124,482 vehicles, a minimal decline of 0.4% year-on-year, maintaining historically high levels.

However, beneath this apparent stability, subtle shifts are reshaping the brand landscape.

Nissan continues to reign supreme in this market, which could aptly be termed its "second home turf," with monthly sales of 23,600 vehicles, capturing nearly one-fifth of the market share, leaving second-place Chevrolet trailing far behind.

Volkswagen and Toyota felt the pinch of intensifying competition, whereas Mazda bucked the trend, recording growth, propelled by popular models such as the CX-30.

Concurrently, Chinese brands are making their mark more prominently.

Changan soared to the 16th position, experiencing a nearly threefold increase year-on-year. Brands like Great Wall and JAC are also progressing steadily, transcending their 'price killer' image to achieve targeted breakthroughs in niche markets, such as SUVs and pickups.

Following a facelift, the MG 5 surged to fifth place in the overall market, revitalizing the local influence of Chinese brands.

The steady demand in Mexico's auto market offers an inviting entry point for new players, with Chinese brands swiftly accelerating onto this fast track.

01 Overall Market Structure and Model Performance in Mexico

In July 2025, Mexico's new car sales remained virtually unchanged from the previous year, dipping marginally by 0.4%. Excluding unannounced sales by Chery Group, the actual market size could be even larger. This marked the third-highest July sales volume in Mexico's auto market history, following 2024's 125,000 vehicles and 2016's 131,800 vehicles.

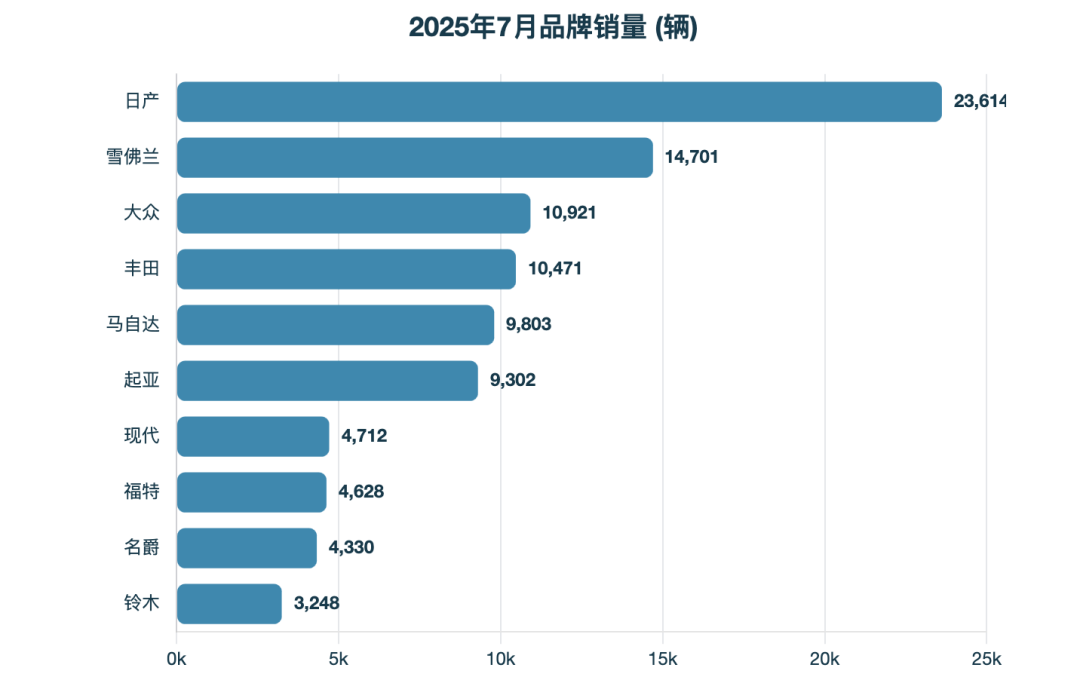

From a brand perspective:

Nissan retained its top spot with monthly sales of 23,614 vehicles, up 13.3% year-on-year, and a market share of 19%, significantly ahead of second-place Chevrolet with 11.8%.

Volkswagen and Toyota occupied the third and fourth positions with shares of 8.8% and 8.4%, respectively, but both witnessed declines.

Mazda shined, with a year-on-year increase of 17.1%. Bolstered by popular models like the CX-30, its market share rose to 7.9%, surpassing Kia to secure fifth place.

Kia and Hyundai both maintained slight growth, while Ford, Suzuki, Honda, and other brands experienced notable sales declines.

In terms of growth rate:

Changan emerged as the biggest dark horse, experiencing a year-on-year increase of 296.6%, ranking 16th.

Dodge and Mercedes-Benz suffered significant declines due to product cycles and market competition pressures.

Notably, Chinese brands such as Great Wall and JAC also featured in the top 20, with modest volumes but a consistent growth trajectory.

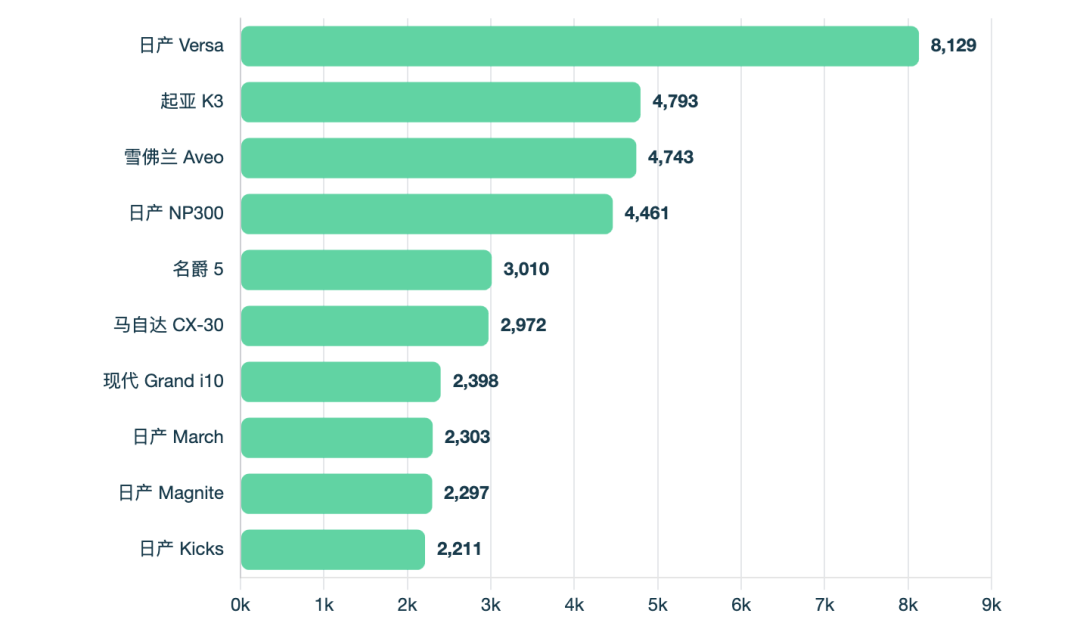

In the model category:

The Nissan Versa continued to lead with sales of 8,129 vehicles, accounting for a 6.5% market share, nearly double that of the second-place Kia K3.

Chevrolet Aveo ranked third with 4,743 vehicles.

Nissan NP300 pickup truck came in fourth with 4,461 vehicles.

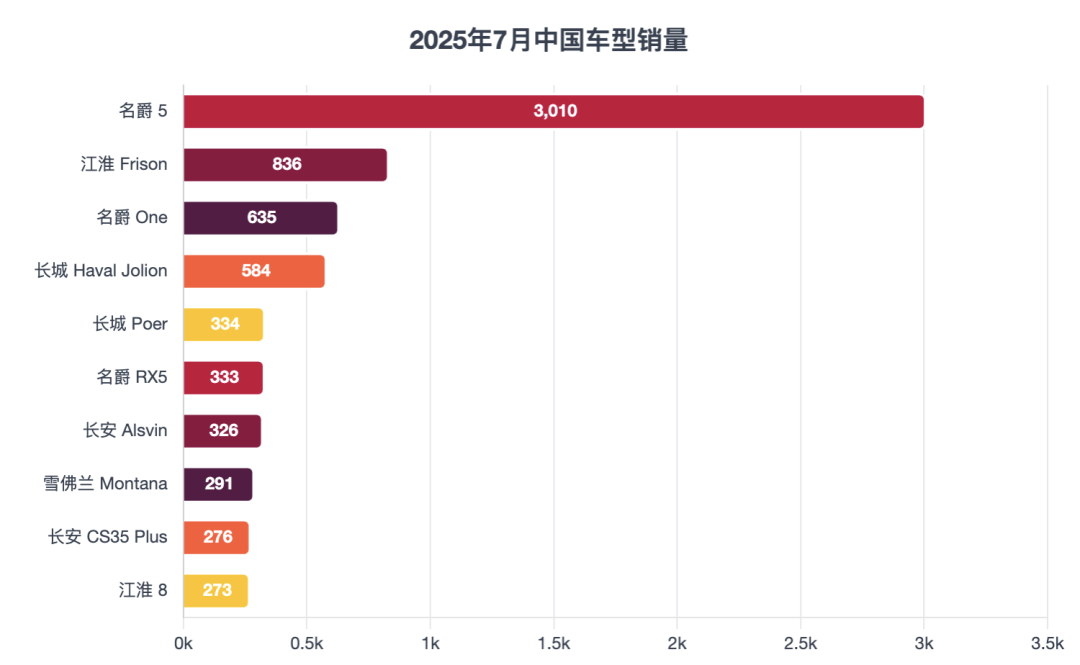

Boosted by a facelift, the MG 5 surged to fifth place with monthly sales of 3,010 vehicles, a year-on-year increase of 28.9%.

Mazda CX-30 and Hyundai Grand i10 both witnessed increases exceeding 50%, highlighting the popularity of compact SUVs and entry-level cars in the Mexican market.

Nissan Magnite debuted in the top 10, becoming a new growth driver for the brand, while the consistent performance of Kicks ensured that Nissan held five spots in the top 10 models.

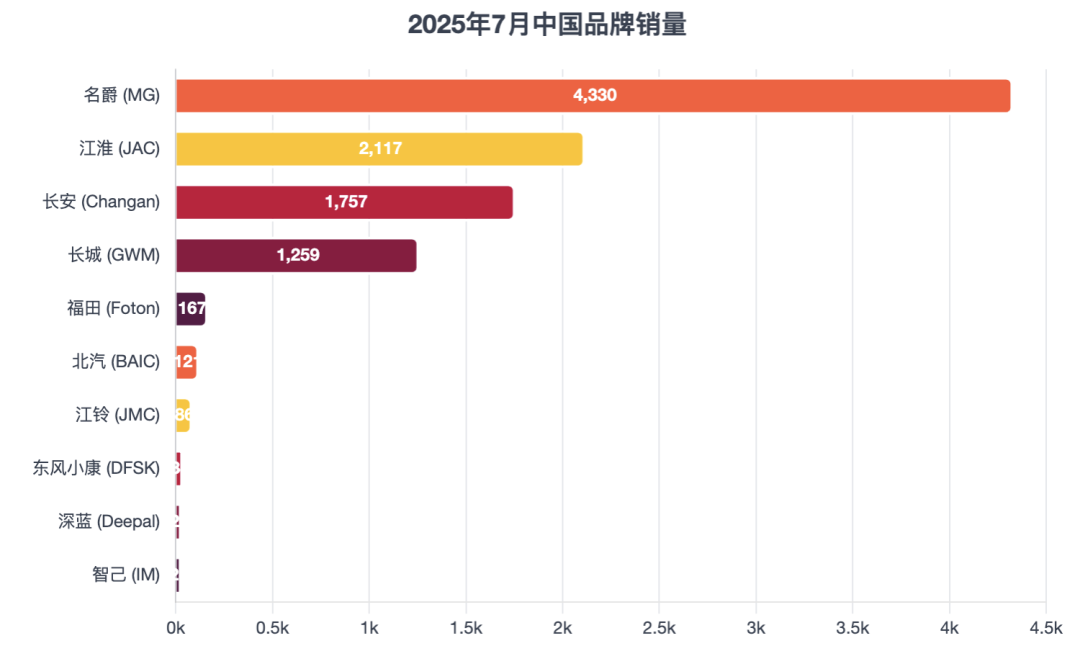

02 Market Performance of Chinese Brands in Mexico

The penetration of Chinese brands in the Mexican market is evidently accelerating.

Changan sold 1,757 vehicles in July, surging nearly threefold year-on-year, thanks to its improved market alignment for SUV and small car models.

Great Wall, despite a slight year-on-year decline of 0.5%, still sold 1,259 vehicles in a single month, attributed to its solid performance in pickups and compact SUVs, maintaining its position in the top 20.

JAC maintained stability, with sales of 2,117 vehicles, enabling it to continue its presence in Mexico's low- to mid-range passenger car market.

In terms of individual model performance:

The MG 5 is undeniably the flagship product of Chinese brands, ranking fifth in the overall market in July with sales of 3,010 vehicles, attributed to its high configuration levels and competitive pricing.

This achievement not only solidified MG's brand image in Mexico but also instilled market confidence in other Chinese brand models to follow suit.

Although Chery Group did not disclose specific data, its sub-brands Tiggo and Jetour series cannot be overlooked in terms of local sales, based on their past performance.

The product mix of Chinese brands is evolving.

Previously, the Mexican market for Chinese brands was dominated by compact sedans, but now, the proportion of SUVs, crossovers, and even pickups has surged, enhancing the brands' competitiveness across all segments.

As consumers' awareness of the quality and after-sales systems of Chinese brands improves, these brands are poised to capture a larger market share within the next two to three years.

Summary

Mexico's auto market in July showcased a blend of established automakers holding firm and new forces making breakthroughs. While Nissan remains an unwavering benchmark, Chinese brands like Changan and MG have demonstrated that they can compete on price while also establishing advantages in product diversity and niche markets.

In the next two to three years, the growth potential for Chinese brands in Mexico remains substantial, especially as new energy vehicle models enter the fray and the after-sales network improves, transforming them from an 'option' to a 'preferred choice' for consumers.