Asian Auto Market | South Korea in July: Tesla Climbs to Top Four

![]() 08/18 2025

08/18 2025

![]() 491

491

South Korea's auto market recorded a modest 3.4% year-on-year increase in July, totaling 138,100 units.

Upon closer inspection, a divergence emerges between local and foreign brands: Hyundai and Kia saw slight adjustments in sales, with local brands declining by 0.5%, whereas foreign brands surged by 23.2%, nearly accounting for all new market growth.

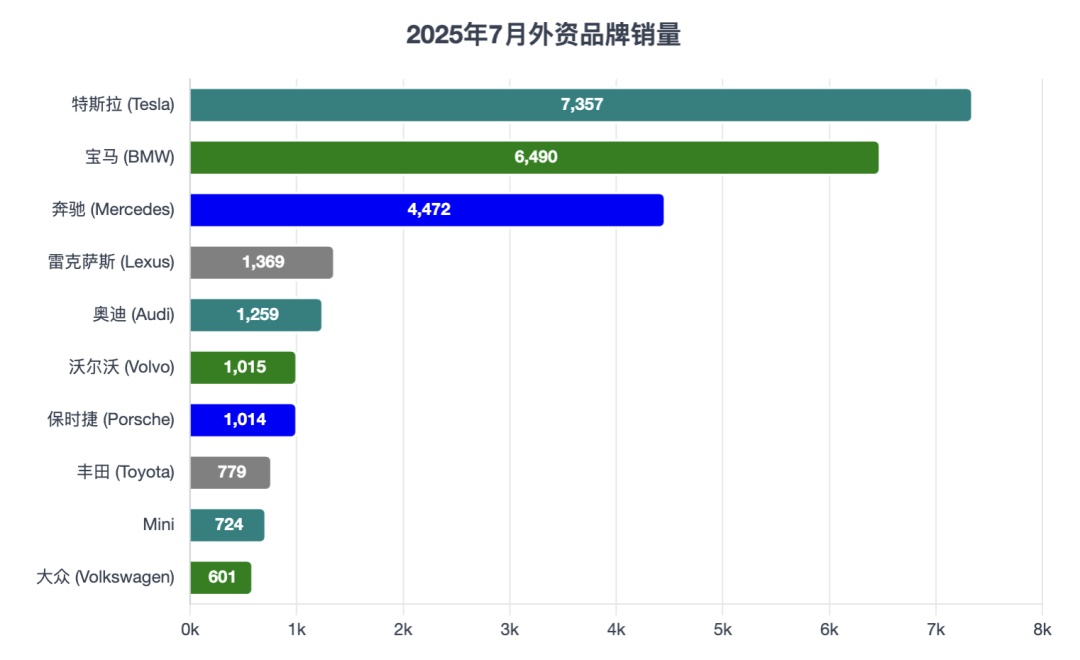

Tesla stood out as the game-changer, not only dominating the imported car rankings but also leaping to fourth place in the overall market, trailing only Kia and Hyundai's flagship models.

This signifies that in South Korea's mid-to-high-end electric vehicle segment, local brands are facing encroachment from foreign EVs. BMW, Mercedes-Benz, Polestar, and others maintain strongholds in their respective niches, leveraging a combination of luxury SUVs and high-end electric vehicles to capture the market.

01 Overall Market Performance and Structural Changes

In July 2025, South Korea's new light vehicle market grew 3.4% year-on-year, reaching 138,100 units sold. Foreign brands witnessed a remarkable 23.2% surge to 27,100 units, capturing nearly 20% of the market, while local brands dipped slightly by 0.5% to 111,000 units, highlighting the growing influence of foreign brands.

For the first seven months, the overall market expanded 3.5% year-on-year to 962,400 units. Local manufacturers still dominated with over 80% market share but grew at a slower rate of 2%, whereas foreign brands achieved faster growth of 11.8%.

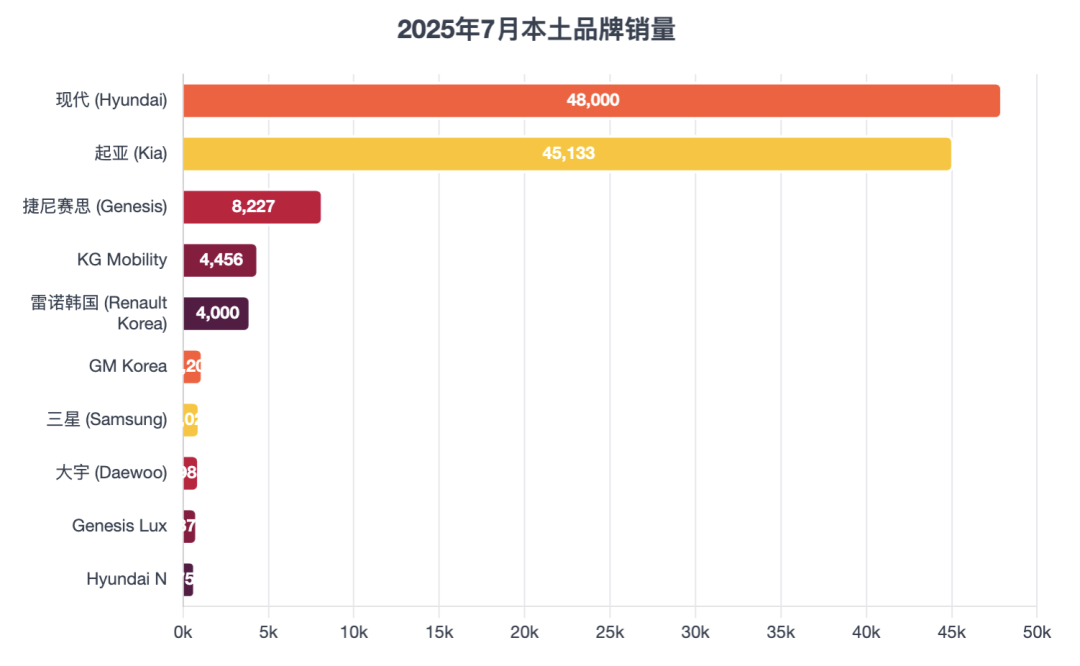

Brand Landscape

◎ Hyundai retained the top spot with 48,000 units sold, marking a 5.9% increase.

◎ Kia ranked second with 45,100 units but saw a 2.4% year-on-year decline, indicating heightened competition.

◎ The premium brand Genesis held onto third place but fell 23.1% year-on-year.

◎ Tesla emerged as the breakout star, surging 174.5% year-on-year to fourth place, rapidly expanding its footprint in the luxury and new energy markets.

◎ BMW and Mercedes-Benz showed steady growth and maintained their leading positions.

◎ KG Mobility and Renault Korea both recorded growth, with Renault Korea skyrocketing 172.3% year-on-year, demonstrating the impact of product updates.

◎ Additionally, Polestar, Audi, Mini, and others showed notable growth in their segments, with Polestar soaring nearly fivefold year-on-year.

02 Model Rankings and Segment Highlights

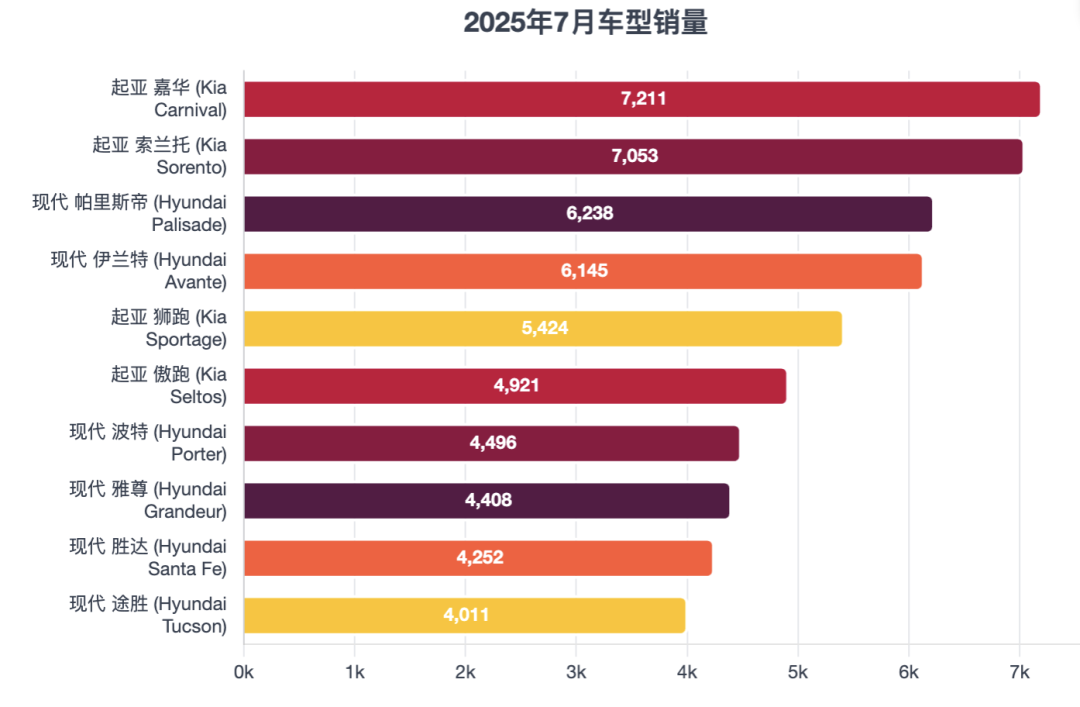

In local models:

◎ The Kia Carnival claimed the monthly sales crown with 7,211 units, marking its fourth time at the top.

◎ The Kia Sorento ended its 10-month winning streak, slipping to second place with a 7.1% year-on-year decline.

◎ The Hyundai Palisade, fueled by the launch of its new generation, surged 374% year-on-year to third place.

◎ The Hyundai Avante grew by over 50% to take fourth place.

◎ The Kia Sportage, though still in the top five, declined 13% year-on-year.

◎ The Hyundai Tucson and Kia K8 exhibited impressive growth, with the latter increasing 81.1% year-on-year.

◎ Among new models, the Kia EV4 emerged as the best-selling newcomer, ranking 25th and outpacing recently launched models like the KGM Musso EV, Kia Tasman, KGM Actyon, and Hyundai Ioniq 9.

Foreign models performed even more impressively:

◎ The Tesla Model Y's sales soared 304.1% year-on-year, topping the imported car segment with 6,559 units and ranking third overall, trailing only two local models.

◎ The BMW 5 Series reclaimed second place among imported cars, surpassing the Mercedes-Benz E-Class.

◎ The Mercedes-Benz GLC maintained its fourth-place ranking.

◎ The BMW X3 grew more than sixfold year-on-year.

◎ The Mercedes-Benz S-Class and Volvo XC90 also showed significant improvements.

This underscores the rapid surge in demand for luxury SUVs and high-end electric vehicles among South Korean consumers.

From a segment perspective, new energy vehicle models continue to penetrate, driven primarily by foreign brands.

Tesla's strong performance not only compresses local manufacturers' space in the mid-to-high-end pure electric vehicle market but also spurs other luxury brands to accelerate their electrification strategies. Luxury SUVs remain popular, with sales of mid-to-high-end models like the Mercedes-Benz GLC and BMW X3 continuing to climb.

Summary

In July's South Korean auto market, beneath the growth figures lies a structural transformation—local manufacturers have stabilized the market, but foreign brands have captured nearly all incremental growth and buzz. The Tesla Model Y's sales surge has left local electric vehicles struggling in the mid-to-high-end segment, while BMW, Mercedes-Benz, Polestar, and others continue to solidify their dual strengths in luxury and electrification.