Asian Auto Market | Vietnam July 2025: VinFast Dominates Top 4 Model Rankings

![]() 08/18 2025

08/18 2025

![]() 584

584

On the surface, Vietnam's auto market in July 2025 seemed to be "stable with slight growth," with overall sales rising modestly to 46,819 units, a 4% year-on-year increase. However, beneath this apparent calm, a significant shift in the market dynamics was unfolding.

For the first time, the local brand VinFast topped the model rankings, with the VF 3, VF 5, Herio Green, and VF 6 capturing the lion's share of consumer attention.

For two decades, Vietnam's auto market has been dominated by foreign capital, with Toyota, Hyundai, Mitsubishi, and Kia being the mainstay choices, while local brands played a secondary role. However, July's sales figures suggest that local manufacturers are rewriting the narrative of Vietnam's auto market.

01 Overall Market Trend and Sales Performance

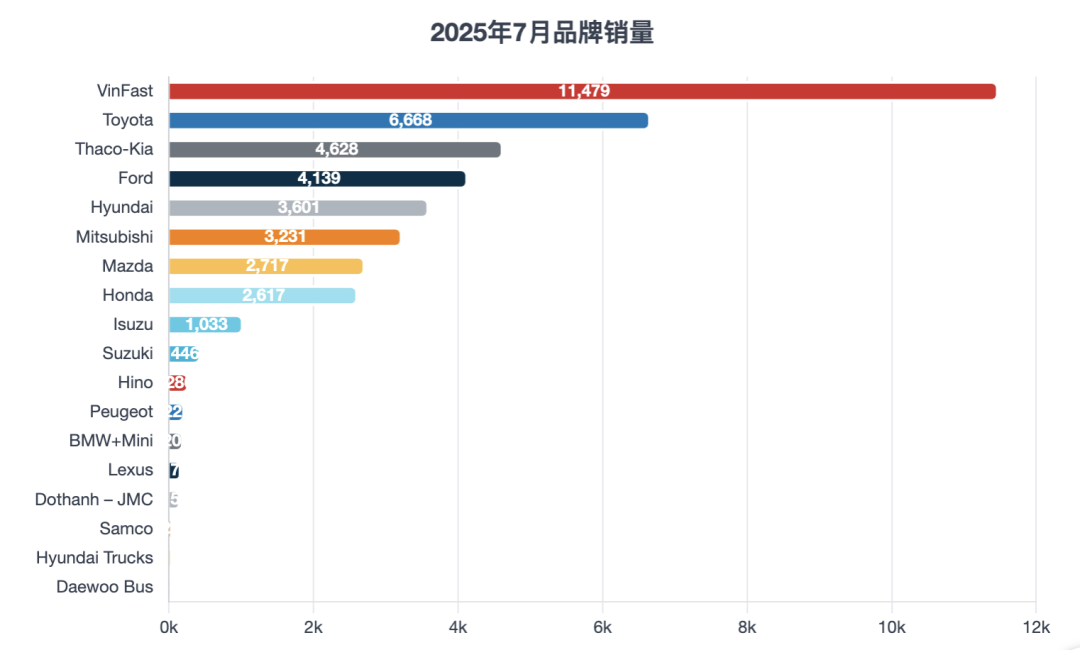

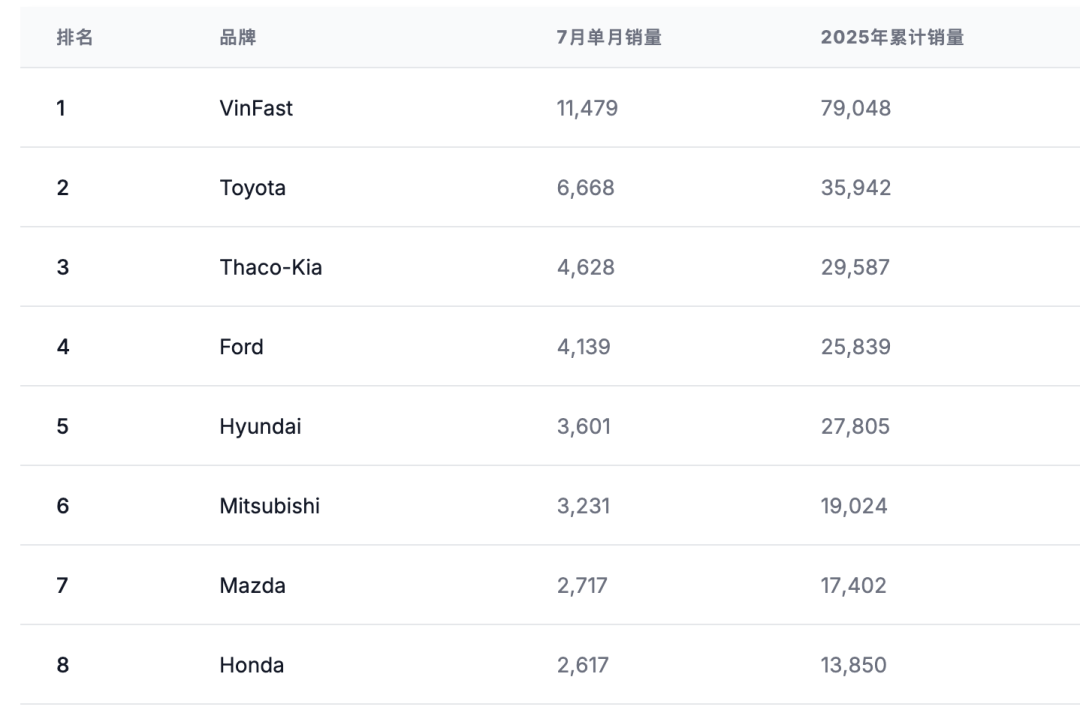

Based on data released by the local auto association and some manufacturers, Vietnam's auto market showed moderate growth in July. Overall sales reached 46,819 units, a 4% year-on-year increase, with cumulative sales climbing to 301,603 units, representing a year-to-date increase of over 15%.

This trend indicates that despite uncertainties in the regional economic environment, automotive consumer demand is gradually recovering, particularly driven by urbanization and the expansion of the middle class, demonstrating the market's resilience.

Brand Share Analysis

◎ VinFast continued to lead with a 24.5% market share, slightly down from the first-half average but still comfortably ahead of its competitors.

◎ Toyota performed steadily this month, capturing a 14.2% share, a significant increase from the beginning of the year, highlighting its product mix advantage in sedans and crossover models.

◎ Kia (produced by Vietnam's renowned THACO Group) and Ford also achieved double-digit growth, with Ford in particular experiencing a substantial 31.4% increase, fueled by its strong performance in the pickup truck and SUV markets.

◎ In contrast, Hyundai and Mitsubishi saw declines of 28.7% and 15.7%, respectively, as their main models faced intense competition and shifting consumer preferences.

Local brands are expanding rapidly, Japanese manufacturers are maintaining relative stability, and Korean brands are under pressure from weakening demand and intensified competition. Amidst consumption upgrades and brand diversification, Vietnam's auto market is forming a new equilibrium in 2025.

02 Model Landscape and Competitive Focus

While brand-level competition reveals shifts in market share, the model rankings provide a clearer picture of consumers' actual choices.

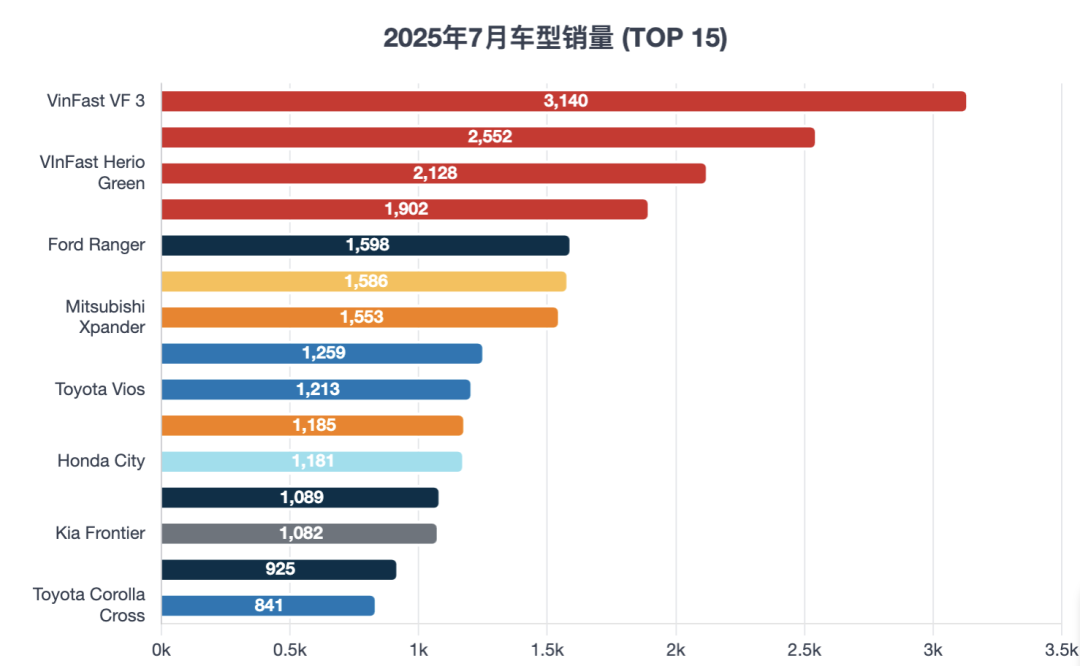

◎ In July, VinFast achieved a historic breakthrough, with the VF 3, VF 5, Herio Green, and VF 6 occupying the top four sales spots.

The small electric vehicle VF 3 led the pack with a 6.7% share, emerging as a star model in the Vietnamese market. The VF 5 closely followed, while the Herio Green, designed for the mobility service market, quickly rose to third place, showcasing the potential of customized models tailored to specific business scenarios. The VF 6 further cemented VinFast's dominance in the small and medium electric vehicle market.

◎ After local brands dominated the top four spots, Ford's Ranger became the only foreign model to break into the top five, benefiting from its established presence in Vietnam's pickup truck market.

◎ Mazda's CX-5 and Mitsubishi's Xpander followed closely, representing competitiveness in the compact SUV and multi-purpose vehicle segments, respectively.

◎ Notably, while the Toyota Yaris Cross and Vios maintained certain sales volumes, they struggled to grow and even saw noticeable declines in the face of competition from electric vehicles and emerging crossover products, indicating that traditional joint venture gasoline vehicles are gradually losing ground in the market landscape.

Local brands have established unique competitive advantages through electrification and scenario-based innovation, while foreign brands either rely on niche markets like pickup trucks and SUVs or attempt to regain demand through new products (such as Toyota's crossover models).

The core of future market competition will revolve around the popularization of electrification, the expansion of price ranges, and the broadening of consumer groups, with VinFast already leading the way in these areas.

VinFast's advantage lies not only in sales figures but also in its strategy: entering the mass market with small electric vehicles, penetrating the mobility service sector with customized models, and targeting emerging middle-income groups with affordable pricing, putting foreign brands on the defensive.

Toyota still maintains a presence in sedans and crossover models, but the decline of Korean and some Japanese brands clearly reflects a shift in market focus.

Summary

The popularization of electrification, price sensitivity, and scenario-based applications are the pillars of the current Vietnamese auto market, and VinFast is positioned right at the center of these trends. Toyota still maintains its influence with a robust product line, while Ford holds its ground in pickup trucks and SUVs. However, overall, they have lost the ability to "define the market." The decline of Korean and some Japanese brands further underscores the aggressive push by local brands.