Asian Auto Market | Indonesia July 2025: Demand Declines, Chinese Brands Accelerate

![]() 08/18 2025

08/18 2025

![]() 458

458

The Indonesian auto market is undergoing a transformation. In July 2025, new car sales declined by 18.3% year-on-year, and retail sales dropped by 17%, continuing the sluggish trend observed over the past two years.

It is widely acknowledged that overall demand is weakening, yet the market's focus is subtly shifting. Japanese brands still maintain a dominant market share but have generally experienced double-digit declines, including Toyota's flagship models, the Kijang Innova and Avanza, which have not escaped the downturn. Daihatsu, Mitsubishi, Honda, and other traditional powerhouses are similarly under pressure.

In contrast, Chinese automakers are performing impressively, seemingly against the odds. BYD has firmly established itself in the new energy SUV segment, Chery has rapidly gained market presence with double-digit growth, and Wuling continues to maintain its foundation with a dual-track strategy of low prices and new energy vehicles.

More remarkably, new players such as Tenzing, Aion, Geely, and Zeekr are gradually entering the market. Although their sales volumes are currently small, they signify that Chinese automakers are no longer marginalized "supplements" but are forming an encircling trend.

The transformation of the Indonesian market extends beyond mere numerical fluctuations. The increasing penetration of new energy vehicles not only alters the energy structure but also disrupts a market order long dominated by Japanese brands.

01 Overall Performance and Competitive Landscape of the Indonesian Auto Market in July

In July 2025, new car sales in Indonesia totaled only 60,552 units, a year-on-year decrease of 18.3%. Cumulative sales for the year reached 435,390 units, a decrease of 10.1% compared to the same period last year.

Retail sales data was equally sluggish, with 62,770 units sold in the month, a year-on-year decline of 17%, and cumulative sales of 453,278 units, down 10.8%. This indicates that both dealer-level digestion capacity and end-consumer purchasing demand are in a state of sluggishness.

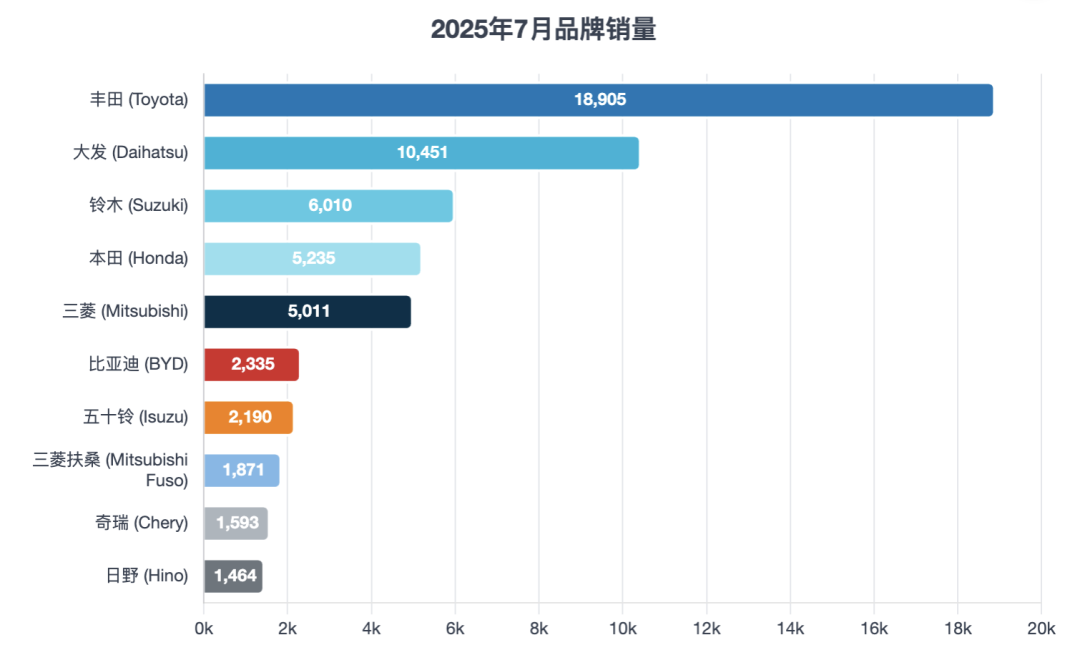

At the brand level:

Toyota remains the absolute leader in the Indonesian market, with July wholesale sales of 18,905 units and a market share of 31.2%. However, year-on-year sales declined by a staggering 30.3%.

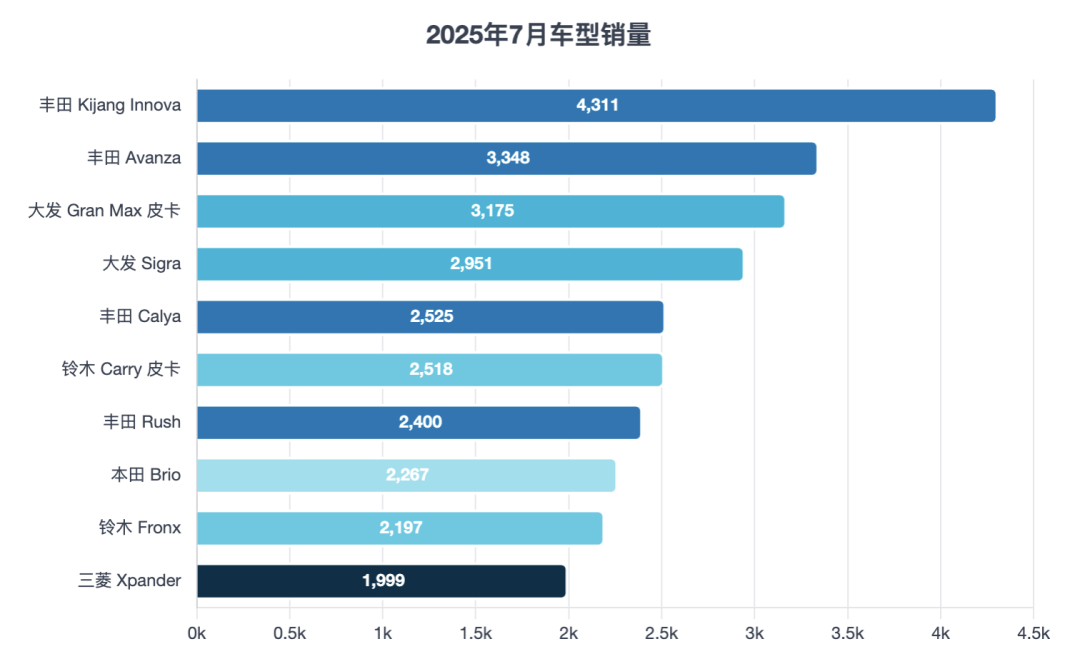

Toyota's Kijang Innova maintained its position as the monthly sales champion for seven consecutive months, with 4,311 units sold, but sales fell by 37.4% year-on-year, revealing the fatigue of its main models.

The other best-selling model, Avanza, ranked second with 3,348 units, down 20.1% year-on-year. Additionally, main models such as Rush, Calya, and Agya all experienced significant declines.

It is evident that although Toyota still has a solid market foundation, the downward trend of its products is difficult to reverse amid weak demand.

Daihatsu still ranks second but has also seen a significant decline in sales. July wholesale sales were 10,451 units, down 24.9% year-on-year. Main models such as the Gran Max pickup truck and Sigra saw declines of 32.8% and 39.1%, respectively, weakening their market competitiveness.

Notably, Suzuki performed prominently with July wholesale sales of 6,010 units, up 11.1% year-on-year, bucking the trend to rank among the top three and successfully surpassing Honda and Mitsubishi.

The newly launched Fronx sold 2,197 units in July, just two months after its launch, accounting for 3.6% of the market and becoming a remarkable new product. Meanwhile, the Carry pickup truck remained stable with 2,518 units sold, up 1.8% year-on-year. Suzuki achieved rare positive growth in the market thanks to the benign interaction between its old and new product mix.

Honda and Mitsubishi are in a relatively difficult situation. Honda sold 5,235 units in July, down 16.2% year-on-year. Its small car Brio fell by 33.8%, but the HR-V saw a remarkable increase of 117%. Mitsubishi ranked fifth with 5,011 units sold, down 10% year-on-year. Its main model, Xpander, remained in the top ten but experienced a decline of over 20%.

In the overall sluggish environment, besides Suzuki, the Chinese forces also stood out.

BYD ranked sixth with 2,335 units sold, up 21.3% year-on-year, becoming a representative of new energy penetration.

Chery saw a year-on-year increase of 104.2%, ranking among the top ten with 1,593 units sold.

Although Wuling declined by 17.7%, it still ranked high.

At the same time, newly entered brands such as Tenzing, Aion, and Geely also began to achieve sales, reaching 523 units, 421 units, and 249 units, respectively. Although the scale is not large, it marks the accelerating layout of Chinese brands.

At the model level, besides the main models of Toyota and Daihatsu, Suzuki's Fronx was the most eye-catching performer. Its immediate popularity upon launch shows a high acceptance of new products in the Indonesian market. Meanwhile, active performances by models such as Honda HR-V and Daihatsu Terios also indicate that SUVs and crossovers still have growth potential.

The Indonesian auto market continued its downward trend in July, with traditional Japanese brands under overall pressure. However, Suzuki broke through with new products, and Chinese brands are gradually rising under the impetus of new energy vehicles, shaping a diversified market competition pattern.

02 Sales Performance of Chinese Auto Brands in Indonesia

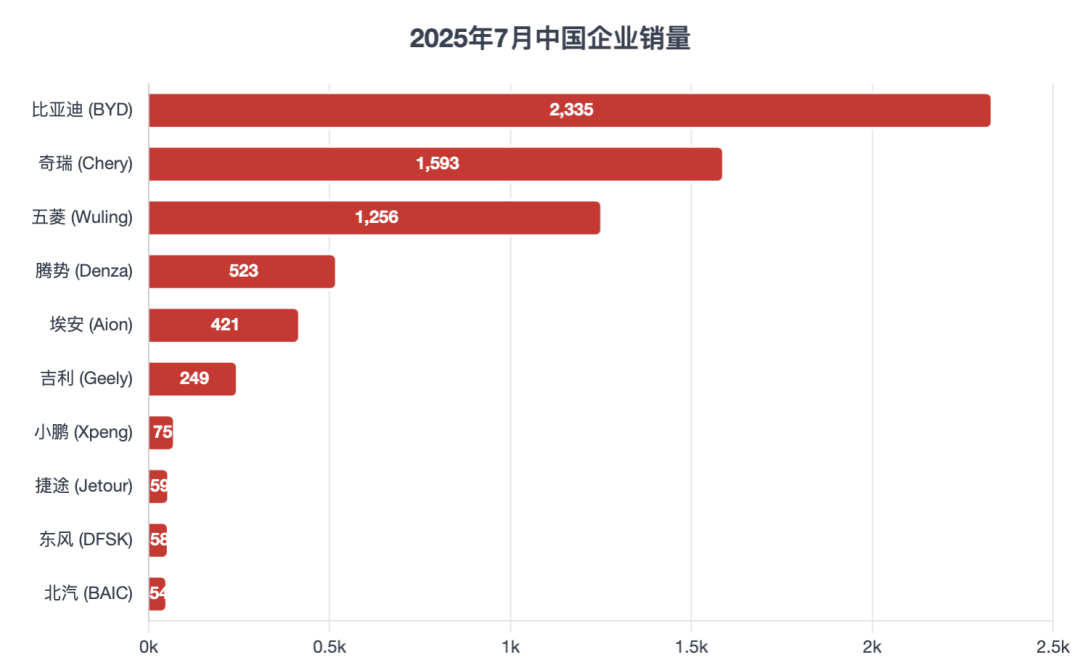

The performance of Chinese auto brands in the Indonesian market was a highlight in July. Against the backdrop of shrinking overall market demand, Chinese automakers not only achieved countercyclical growth but also demonstrated a diversified pattern.

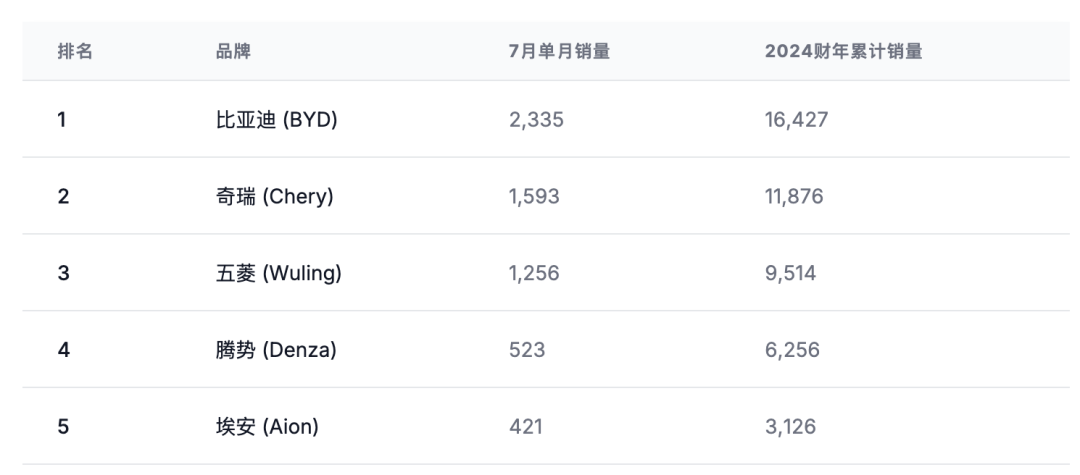

BYD ranked sixth with wholesale sales of 2,335 units, up 21.3% year-on-year, and retail sales reached 2,827 units, a significant increase of 38.1% year-on-year. This continuously enhances BYD's presence in the new energy market.

In particular, the Sealion 7 sold 939 units in July, ranking among the top models overall, demonstrating its strong competitiveness in the SUV new energy segment. With a relatively complete product line and brand effect, BYD has formed a leading advantage in the Indonesian new energy vehicle market.

Chery performed even more prominently, with wholesale sales of 1,593 units in July, more than doubling year-on-year, and retail sales significantly increasing by 138.8% to 1,705 units.

Chery's product mix focuses on the SUV segment, meeting the Indonesian market's demand for space and versatility. Amidst fierce competition, Chery quickly established its reputation with high cost-effectiveness and fresh product designs.

Wuling is in an adjustment phase, with wholesale sales of 1,256 units in July, down 17.7% year-on-year, and retail sales also declining by 23.8%.

Nevertheless, Wuling's brand foundation in Indonesia remains solid. As one of the earliest Chinese automakers to deeply enter the local market, its MPV and electric vehicle products have a certain reputation in the low-end and new energy markets, and it still has potential for recovery growth in the future.

Newly entered Chinese brands are also worth noting. Tenzing achieved sales of 523 units in July, Aion reached 421 units, and Geely's wholesale sales were 249 units with retail sales of 213 units. New brands such as Zeekr and JETOUR have also entered the market.

Although the sales volumes of these brands are still small, they reflect the high importance Chinese automakers attach to the Indonesian market and their strategic deployment. Notably, Xpeng achieved retail sales of 56 units in July, a limited number but a sign that Chinese smart electric vehicle brands have begun to test the waters.

Great Wall Motors, Beijing Automotive Group, and others also recorded sporadic sales. Although their overall share is not significant, they have formed a pattern of Chinese brands "grouping" to enter Indonesia.

Overall, the combined sales volume of Chinese brands in the Indonesian market in July approached 7,000 units, accounting for more than 10% of the market, with new energy models making significant contributions.

Chinese brands are gradually shifting from the exploration stage of a single brand to the collective breakthrough stage of multiple brands and market segments.

BYD's steady growth has laid the foundation for the new energy market.

Chery has opened up a situation with SUV products.

Wuling remains an important participant in the mass market.

While newcomers such as Tenzing, Aion, and Geely complement the high-end and diversified dimensions.

As the product line continues to improve, the competitiveness of Chinese brands in the Indonesian market is gradually increasing.

Summary

The Indonesian auto market began to show significant changes in 2025. BYD, Chery, and Wuling have secured their positions on the sales chart, while new entrants such as Tenzing, Aion, and Geely are testing the market's acceptance. Their common advantages lie in their leadership in new energy, flexible costs, and precise targeting of Indonesian consumer segments. This forms a sharp contrast with Japanese brands, which are struggling with tariffs, costs, and aging products.

Indonesia is the largest automotive market in Southeast Asia. Whoever takes the lead in the new energy transition may rewrite the competitive landscape of the entire region in the next decade. Judging from July's data, Chinese brands have already opened the door, while Japanese automakers find themselves at a crossroads, requiring new strategies to stay competitive.