European Auto Market | Portugal Auto Market Sales Highlights for July 2025

![]() 08/19 2025

08/19 2025

![]() 570

570

The Portuguese auto market is undergoing rapid transformation. In July 2025, car sales in this southwestern European nation surged 20.6% year-on-year to 17,549 units, sustaining upward momentum for several consecutive months.

Behind these figures lies a confluence of factors: recovering demand and the shift towards new energy vehicles. Peugeot and Mercedes retain the top two spots, albeit with slowed growth rates. Conversely, Volkswagen and Citroen have witnessed explosive growth, bolstered by new product launches and pricing strategies.

Notably, Chinese brands are accelerating their penetration. BYD and MG have firmly established their presence in Portugal, with sales steadily rising. Additionally, XPeng and Leapro made their market debut in July.

At the model level, the Peugeot 2008 remains the champion, albeit with a 20% year-on-year sales decline. The surge in sales of the Dacia Duster and the Citroen C3 hints at a new market order emerging.

01

Overall Performance of the Portuguese Market

In July 2025, Portuguese auto sales reached 17,549 units, marking a significant 20.6% year-on-year increase. Cumulatively, sales for the first seven months of the year stood at 141,575 units, up 8.1% year-on-year, indicating a robust market expansion.

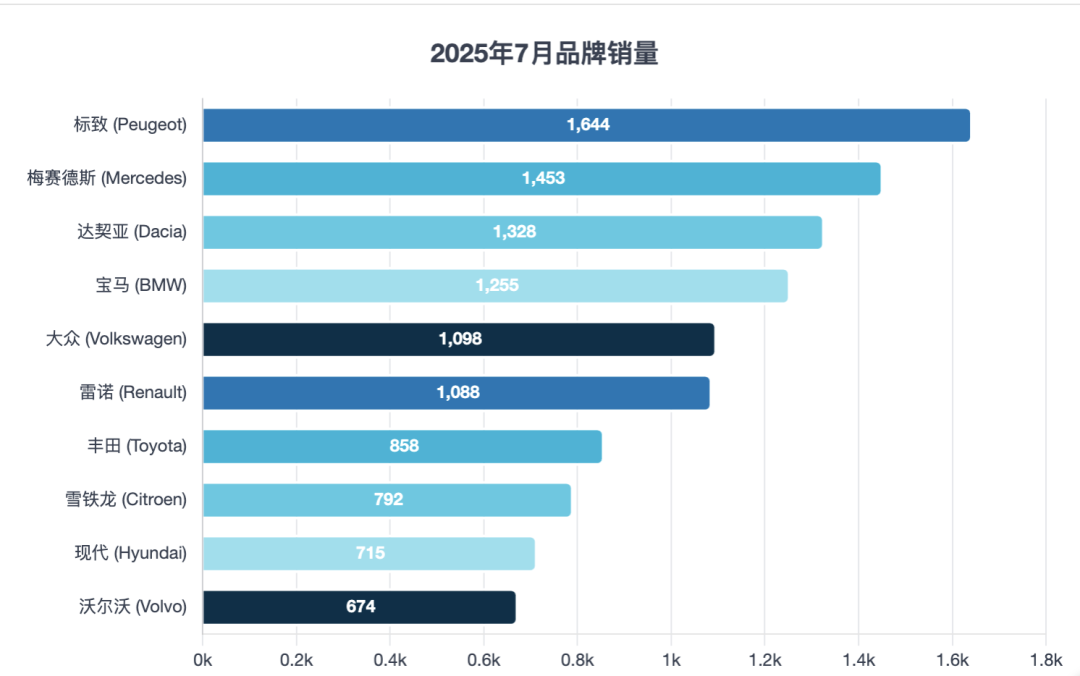

Brand Rankings

◎ Peugeot retained its top spot with 1,644 units sold, but its sales increased by a modest 1.2% year-on-year, accounting for a 9.4% market share, notably lower than the overall market growth rate.

◎ Mercedes-Benz ranked second with 1,453 units sold, up 3.4% year-on-year, also reflecting low-speed growth.

◎ Dacia continued its ascent with 1,328 units sold, a substantial 33.1% year-on-year increase, capturing a 7.6% market share and emerging as a key driver of market growth.

◎ BMW ranked fourth with 1,255 units sold, up 14.6% year-on-year.

◎ Volkswagen achieved robust growth of 74% with 1,098 units sold, reasserting its position in the mainstream market.

Second Tier Brands

◎ Renault ranked sixth with 1,088 units sold, up 13.2% year-on-year.

◎ Toyota sold 858 units, up 2.3% year-on-year.

◎ Citroen shone with 792 units sold, a remarkable 118.2% year-on-year increase, solidifying its market position.

◎ Hyundai also recorded growth of 33.9%, selling 715 units.

◎ Volvo ranked tenth with 674 units sold, up 3.9% year-on-year.

Smaller and Medium Brands

◎ Skoda experienced a substantial 115.6% year-on-year increase.

◎ MG saw robust growth of 97.5%.

◎ Nissan grew by 60.3%.

◎ BYD achieved 52% growth.

All these brands exhibited a rapid upward trend.

◎ In contrast, Tesla bucked the trend with a decline of 48.5%, selling only 284 units and gradually losing ground in the new energy market.

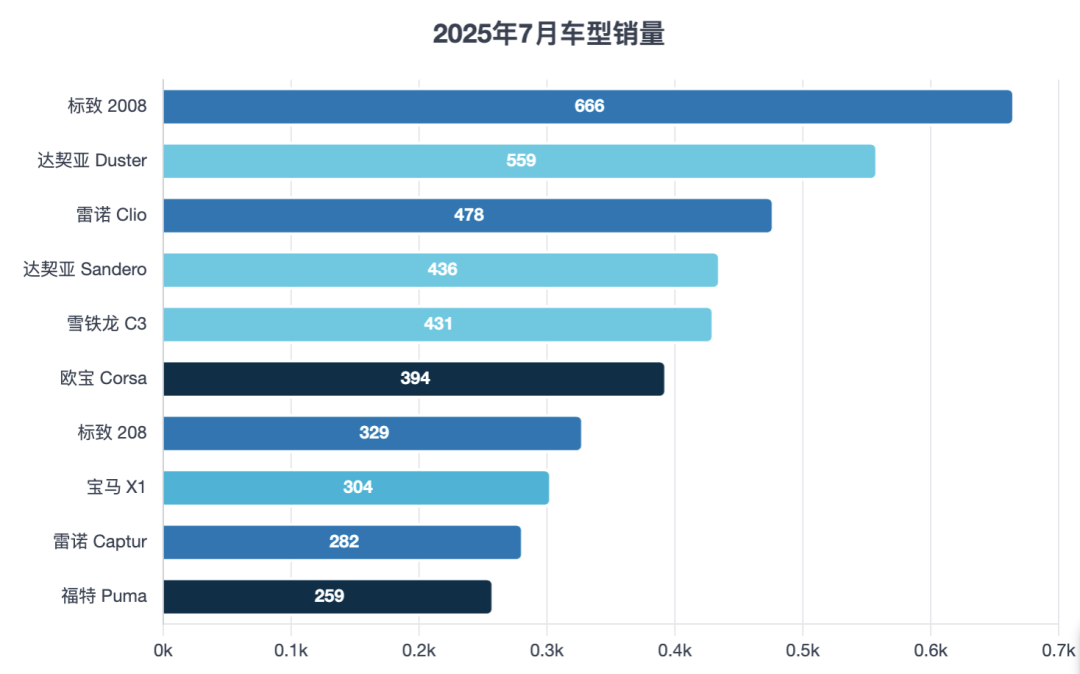

Model Rankings

◎ The Peugeot 2008 remained the top-selling model, but with 666 units sold, its sales declined by 20% year-on-year, indicating eroding market leadership.

◎ The Dacia Duster sold 559 units, up 124.5% year-on-year, ranking second.

◎ The Renault Clio ranked third with 478 units sold, down 8.3% year-on-year.

◎ The Dacia Sandero sold 436 units, down 20.1% year-on-year, ranking fourth.

◎ The Citroen C3 experienced explosive growth, up 193.2% year-on-year, with sales reaching 431 units, pushing it into fifth place.

Other notable models include:

◎ Opel Corsa (394 units, up 38.7% year-on-year)

◎ BMW X1 (304 units, up 50.5% year-on-year)

◎ Renault Captur (282 units, up 29.4% year-on-year)

◎ Ford Puma (259 units, up 72.7% year-on-year)

◎ Nissan Juke (259 units, up 69.3% year-on-year)

Market Competition

◎ French brands maintain a strong overall advantage in Portugal, with Peugeot, Renault, and Citroen firmly holding significant market shares.

◎ German brands, represented by Mercedes-Benz, BMW, and Volkswagen, achieve stable growth through their premium and diversified product offerings.

◎ Romania's Dacia continues to strengthen its position in the mid-to-low-end market.

◎ Additionally, as electric vehicle demand evolves, Chinese brands and emerging players are gradually becoming significant variables in the market.

02

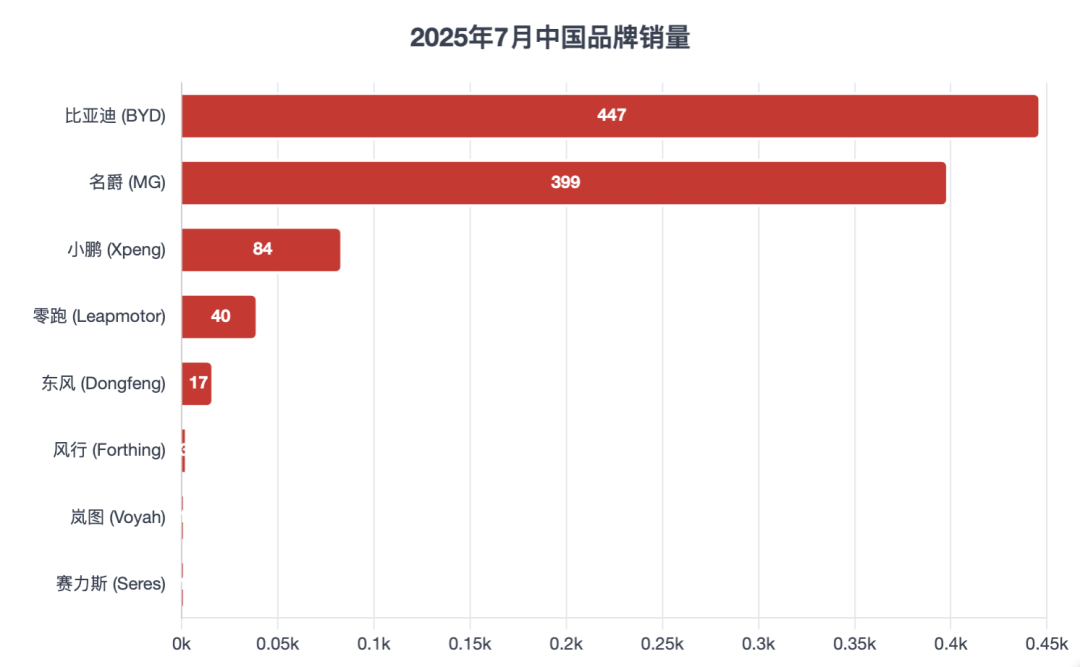

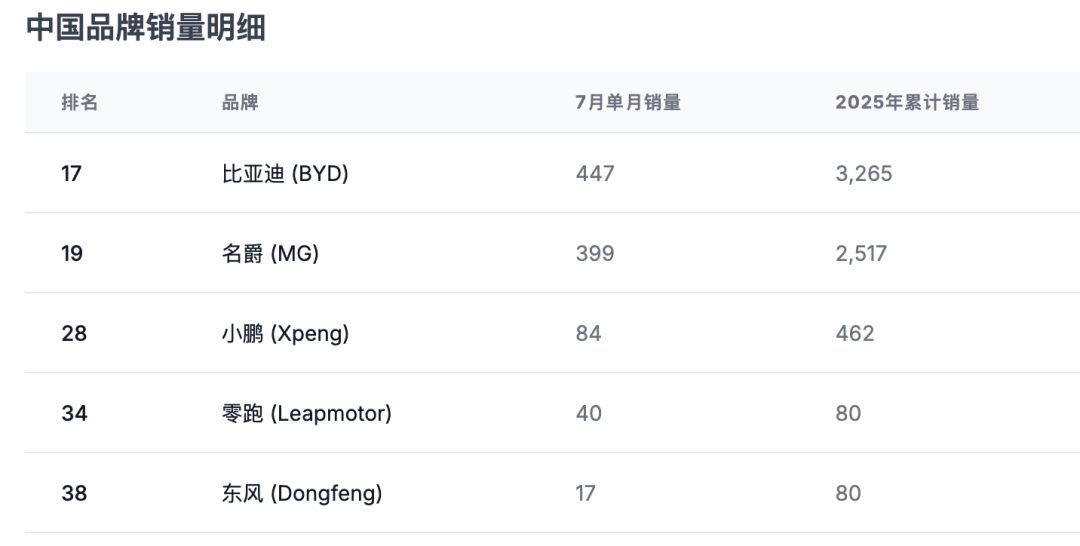

Performance of Chinese Brands in Portugal

In July 2025, Chinese brands continued to demonstrate growth momentum in the Portuguese market, with BYD, MG, XPeng, Leapro, and Dongfeng making the list.

◎ BYD sold 447 units, up 52% year-on-year, accounting for a 2.5% market share and further solidifying its influence in the European market.

◎ MG also performed impressively, selling 399 units, up 97.5% year-on-year, gradually expanding its market presence with popular models like the MG ZS and MG HS.

◎ XPeng entered the list for the first time with 84 units sold, representing a new force. Although the scale is limited, it marks the official beginning of its presence in the Portuguese market.

◎ Leapro entered with 40 units sold, while Dongfeng recorded 17 units. Hovo and Thalys also achieved single-digit deliveries, indicating that Chinese brands' penetration in the European market is spreading from point to area.

Model-Specific Performance

◎ The MG ZS sold 160 units in July, up 471.4% year-on-year, jumping to 30th place on the model list and becoming the cornerstone of MG's success in Portugal.

◎ The MG HS ranked 46th. Although its sales volume is modest, as a newly launched model, it has already demonstrated market acceptance.

◎ BYD's key model is the Dolphin, ranking 71st. As a medium to large electric vehicle, its performance in the European market warrants attention.

◎ In contrast, Tesla's Model Y sold 182 units in Portugal, down 26.3% year-on-year, ranking 22nd. It has been surpassed by several new Chinese models in terms of market popularity.

MG and BYD are gradually building a stable customer base with their competitive pricing, configurations, and new energy attributes. While XPeng and Leapro are starting from a smaller base, with increasing brand recognition, they have the potential to expand their market share in the future.

Chinese brands are no longer marginal players in the Portuguese market. BYD and MG have solidified their positions in the mainstream, while XPeng and Leapro are completing their market introduction phases.

In the coming years, as more new energy vehicles enter Portugal, Chinese automakers are expected to further boost their sales and directly compete with traditional European manufacturers in the mid-to-low-end electric vehicle segment.

Summary

In the Portuguese auto market, traditional French and German automakers still hold a strong position, but their growth momentum is being challenged by emerging brands with more competitive pricing and advanced technology. BYD and MG have achieved stable sales, while XPeng and Leapro have successfully entered the market. For Chinese automakers, Portugal may just be the starting point, as European consumers increasingly embrace new brands from the East.