Asian Auto Market | Turkey July 2025: Tesla and BYD Witness Unprecedented Growth

![]() 08/20 2025

08/20 2025

![]() 472

472

Turkey's automotive landscape is undergoing a remarkable transformation.

In July 2025, overall sales surged by 14.5% year-on-year, marking the second-highest July sales figure ever recorded. Yet, it's not the sheer numbers that are remarkable; it's the shifting dynamics within the market.

Renault capitalized on the popularity of its locally produced Megane Sedan, achieving a year-on-year growth of over 133%, and dethroning Fiat Egea from its long-held top spot.

Fiat's decline is evident, with the Egea series witnessing a nearly 20% drop in July, while its sibling model, the Clio, is on the rise, pointing to a shift in consumer preferences towards younger and more diverse offerings.

Tesla and BYD have left the market in awe with their explosive growth. Tesla Model Y skyrocketed by 1020% in July, leaping directly to second place, while BYD, with the introduction of the Seal U, witnessed growth exceeding 1500%, propelling it into the top ten brands. This growth stands out starkly against the backdrop of traditional automakers.

Turkey's market has become a battleground for old and new forces: on one side, deeply entrenched European brands, and on the other, emerging electric vehicle players.

01

Overall Market Performance and Competitive Landscape

Turkey's automotive market exhibited strong recovery momentum in July, with sales up 14.5% year-on-year. Cumulative sales for the first seven months reached 715,695 units, an increase of 6.5% year-on-year, setting a new record for the period.

Overall, the market continues to display a trend of "traditional strong brands rebounding + new forces rapidly rising".

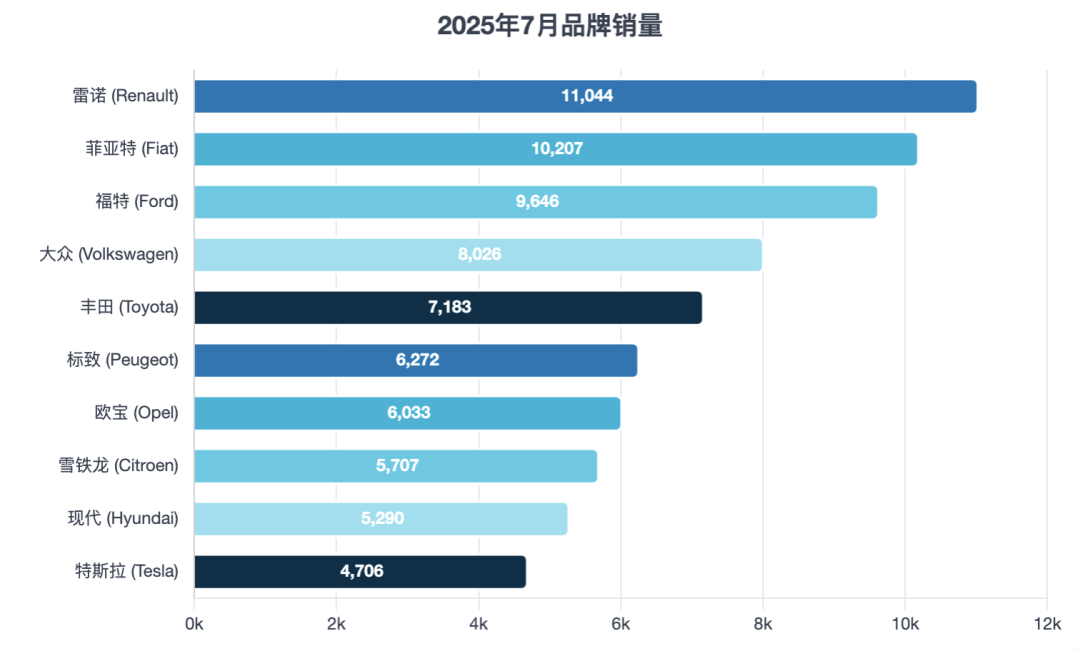

At the brand level

◎ Renault reclaimed the top spot with a 43% year-on-year increase and sales of 11,044 units, fueled by strong demand for its locally produced Megane sedan.

◎ Fiat saw a decline, selling only 10,207 units, down 8.2% year-on-year, failing to maintain its long-standing dominance in the Turkish market.

◎ Ford rose to third place with sales of 9,646 units, surpassing the declining Volkswagen.

◎ Toyota's performance was particularly noteworthy, with a 60% year-on-year increase, positioning it among the top five, highlighting its competitiveness in hybrid and compact sedans.

Tesla and BYD were undoubtedly the month's biggest highlights.

◎ Tesla created a sensation in the Turkish market with the Model Y, selling 4,706 units in July, a more than tenfold year-on-year increase, ranking tenth.

◎ BYD continued its explosive growth, selling 3,783 units, a more than 15-fold year-on-year increase, ranking eleventh.

◎ In contrast, traditional luxury brands such as Mercedes-Benz, BMW, and Audi, while experiencing growth, still have a limited share of the overall market.

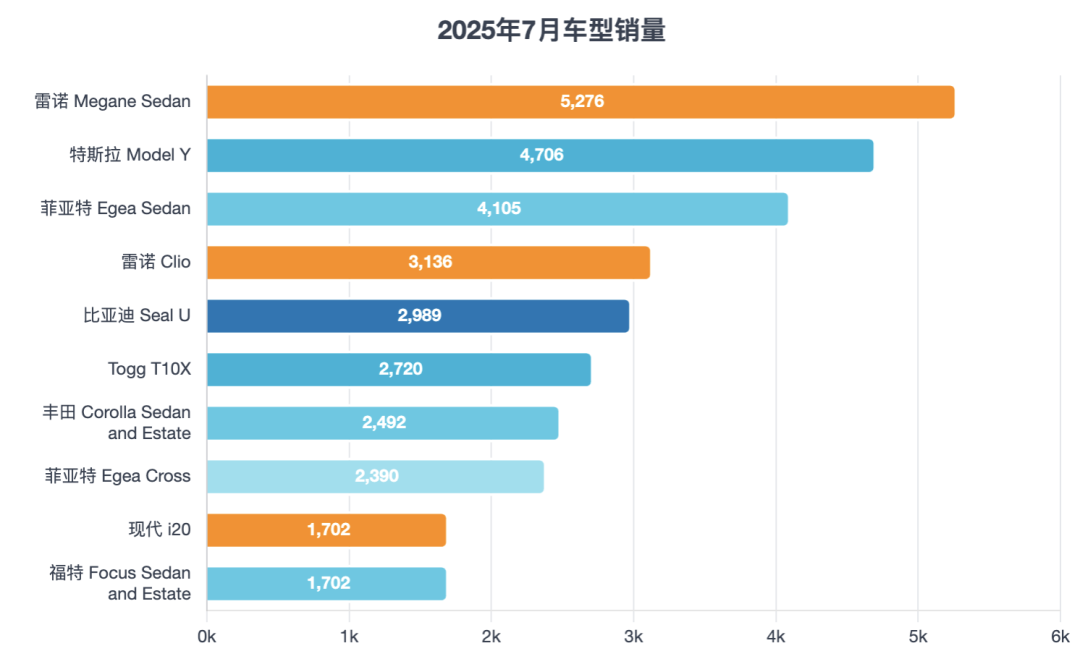

At the model level

◎ The Renault Megane sedan topped the sales chart with 5,276 units, a year-on-year increase of 133.8%, making it the most favored model among consumers.

◎ Tesla Model Y ranked second with 4,706 units and saw a significant jump in cumulative sales.

◎ Fiat's Egea sedan, though still in third place, declined by 19.2% year-on-year, indicating it is under competitive pressure.

◎ BYD's Song Plus (Seal U) continued its climb to fifth place.

◎ Turkey's local brand, Togg, also delivered 2,720 units of the T10X, a year-on-year increase of 121.7%, successfully entering the top ten.

◎ Toyota Corolla remained steady, holding onto seventh place.

From a powertrain perspective, the penetration of electric vehicles is on the rise.

The rapid growth of Tesla and BYD, coupled with the performance of local brand Togg's electric vehicles, signals accelerating acceptance of new energy vehicles in the Turkish market.

Hybrid models are primarily driven by Toyota, with the growth of both the Corolla and C-HR affirming this trend. In contrast, the advantage of traditional gasoline vehicles is gradually weakening, exemplified by the decline of Fiat Egea.

02

Performance of Chinese Brands in Turkey

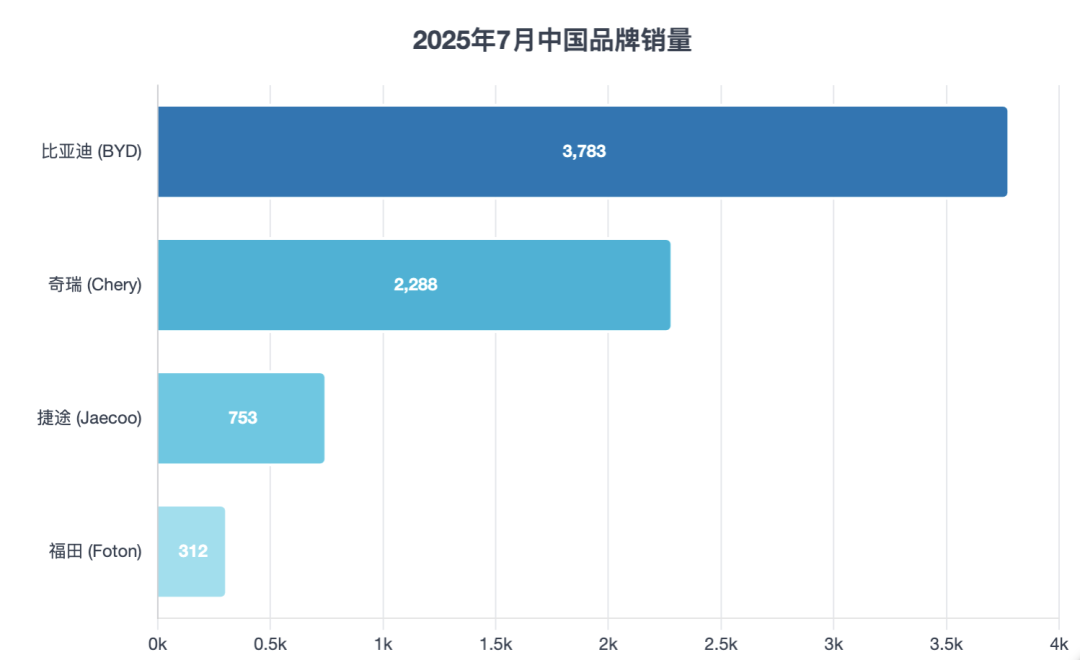

Competition among Chinese brands in the Turkish market is becoming increasingly polarized.

◎ BYD is undoubtedly the standout performer, with sales reaching 3,783 units in July, a year-on-year increase of over 15 times, and a market share of 3.5%, ranking eleventh.

Its main model, the Seal U (Song Plus), sold 2,989 units in a single month, firmly occupying fifth place in the overall market, with cumulative sales exceeding 20,000 units, demonstrating its strong competitiveness in the mid-size SUV segment.

BYD's rapid success is attributed to its pure electric product matrix and high cost-effectiveness, giving it a significant advantage in the rapidly growing electric vehicle market in Turkey.

◎ Turkey's local electric vehicle brand, Togg, has also emerged as a competitor to Chinese brands. The T10X sold 2,720 units in July, a year-on-year increase of 121.7%, ranking sixth.

As a local brand, it enjoys policy and identity advantages, directly competing with Chinese companies such as BYD in the new energy vehicle market.

◎ Chery faces significant challenges. Sales in July were 2,288 units, down 65.5% year-on-year, with a market share of only 2.1%.

Sales of its core model, the Tiggo 7 Pro Max, plummeted to 1,323 units, a year-on-year decrease of over 50%, while the Tiggo 8 Pro Max sold only 850 units. Compared to last year's high-profile performance on the sales chart, Chery is clearly under pressure from both local brands and other Chinese new energy vehicle brands.

◎ JEKOO, as a sub-brand of Chery, entered the market rankings for the first time in July with sales of 753 units, and its JEKOO 7 also entered the top 40 model list, ranking 35th.

This indicates that Chery is attempting to tap into the younger and differentiated market through a new brand to address the pressure of declining sales of its parent brand.

◎ NIO is still in the exploratory stage, with sales of only 22 units in July and 100 units for the entire year. MG, under SAIC, sold only 128 units in July, down over 90% year-on-year.

The performance of Chinese brands in the Turkish market is clearly polarized.

◎ BYD has successfully established a strong position in the electric vehicle market and is in direct competition with Tesla and local brand Togg.

◎ Chery has fallen from last year's high position and urgently needs to adjust its strategy.

◎ JEKOO is still in the cultivation stage, and whether it can achieve scale remains to be seen.

Summary

In July's Turkish automotive market, Renault overtook Fiat with its locally produced Megane Sedan, demonstrating that traditional gasoline vehicles still have a significant consumer base. However, the explosive growth of Tesla and BYD underscores the irreversible momentum of electric vehicles making inroads.

For established players like Fiat and Volkswagen, declining sales are just a symptom; the real challenge lies in maintaining their relevance amidst the wave of electrification. In Turkey's market, the old order has been disrupted, but the new landscape is still taking shape.