Driving Forces Behind "Involution" in China's Automotive Industry: Are Subsidies to Blame?

![]() 08/25 2025

08/25 2025

![]() 678

678

Recently, the Rhodium Group published an article claiming that "Chinese subsidies exacerbate involutional competition in the automotive industry." Their perspective unfolds as follows:

China's eagerly anticipated car subsidy policies might intensify price wars and amplify the "involutional competition" within the industry. By setting subsidies at a fixed nominal level, consumers are incentivized to choose lower-priced cars to maximize the subsidy discount.

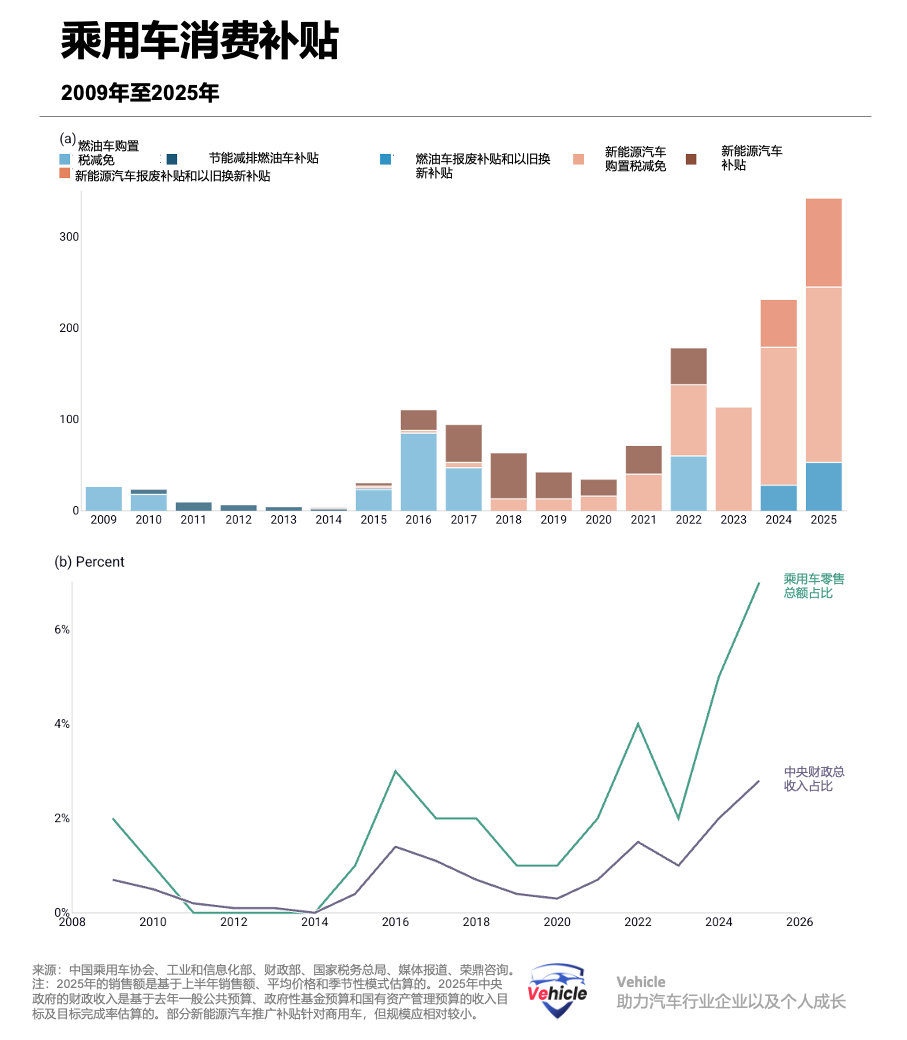

According to the institution's data, China offers substantial subsidies for cars. Taking 2025 figures as an estimate, car subsidies account for 3% of the central government's total fiscal revenue, equivalent to 7% of total car retail sales. The persistence and expansion of these subsidies have steered the industry towards competition among low-priced models.

The Rhodium Group predicts that car subsidies will continue at least until 2026 to prevent a significant sales decline. With the reduction in the purchase tax for new energy vehicles halved in 2026 and 2027, sales may still slow down in the coming years without additional measures to enhance subsidy effectiveness.

So, is their perspective accurate? Below is their data-driven analysis.

1. Competitive Pricing Pressures

Over the past few months, "involutional competition" has become a focal point in high-level discussions. In June 2024, the Ministry of Industry and Information Technology (MIIT) convened a meeting with nearly all automotive OEMs, urging them to cease price wars and shorten payment cycles to suppliers. It is reported that MIIT also took measures to prevent OEMs from declaring "zero-mileage" cars as used, thereby artificially boosting total sales. The State Council meeting in July promised to regulate unfair competition in the automotive industry and strengthen product quality supervision.

However, the Rhodium Group believes that subsidies driving car sales might themselves be fueling "involutional competition" among automakers, leading to across-the-board price declines. To validate this claim, the Rhodium Group examined indicators such as price, market structure, and market exit to understand how subsidies alter sales patterns. It also compared the impact of subsidies in the automotive industry with those in household appliances and consumer electronics.

Scrap subsidies (where cars must be scrapped to receive subsidies) and trade-in subsidies in the automotive industry are typically fixed levels rather than percentages, encouraging buyers to opt for lower-priced cars to achieve higher implied discount rates.

Furthermore, subsidy policies may have slowed the consolidation process in the automotive industry by sustaining more automakers' operations while dragging them into fierce low-price market competition, as illustrated in the figure below.

The Rhodium Group estimates that central government subsidies for car purchases will reach a record 342 billion yuan in 2025, comprising 150 billion yuan for scrap and trade-in subsidies and 192 billion yuan for new energy vehicle purchase tax reductions. This equates to 3% of the central government's fiscal revenue and 7% of passenger car retail sales for the year.

The Rhodium Group's model forecasting car sales in the coming years suggests that the continued slowdown in household income growth and consumption may compel policymakers to extend subsidies at least until 2026 and possibly until 2027.

2. Rising Revenue, Stagnant Profit

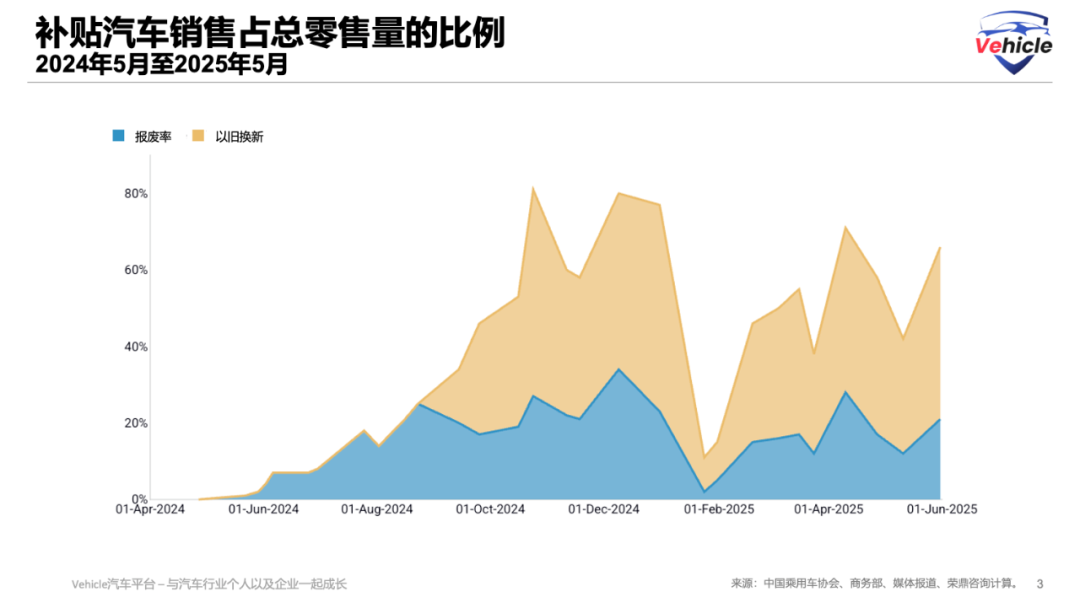

This round of automotive industry stimulus began in April 2024 with the official introduction of a new scrap subsidy policy (Figure 2). Eligible old vehicles scrapped and replaced with new internal combustion engine cars can receive a subsidy of 7,000 yuan, while those replaced with new energy vehicles can receive 10,000 yuan.

However, these initial subsidies had minimal impact on stimulating new car sales. Most old car owners bought their vehicles at low prices from the second-hand market, making these subsidies less attractive relative to new car prices.

In August 2024, the subsidy amounts for purchasing eligible fuel cars and new energy vehicles (after scrapping existing vehicles) doubled, reaching 15,000 yuan and 20,000 yuan, respectively.

Additionally, local governments initiated trade-in subsidy programs to further stimulate replacement demand. The central government also increased its subsidy coverage from 60% to 90%, reducing the financial burden on local governments.

The Rhodium Group believes that the scrap subsidy and trade-in policies supported passenger car retail sales in 2024, increasing sales by 5% to 23 million vehicles. However, about 29% of these sales received subsidies.

Both subsidies were extended into 2025 after a brief suspension in January, and the central government simultaneously expanded the eligibility criteria for scrap car subsidies. To avoid local governments competing to offer higher subsidies, local governments were capped at 15,000 yuan for new energy vehicle trade-ins and 13,000 yuan for fuel vehicles. Since the program's launch earlier this year, the proportion of subsidized sales is currently higher, reaching 47% as of May.

As some provinces have exhausted the first two batches of car subsidy funds, June's subsidy application data has not yet been released. The central government allocated 54% of the 300 billion yuan in trade-in subsidy funds for car, household appliance, and electronics sales in the first half of the year. A third batch of 69 billion yuan in subsidy funds was allocated in July, with another 69 billion yuan to be allocated in October. However, there's a risk that funds may dry up before or during the peak sales season in the fourth quarter, weakening retail sales growth at that time.

Despite concerns about subsidy availability in the second half of 2025, car subsidies drove passenger car retail sales to increase by 11% in the first half of the year to 11 million vehicles. However, according to National Bureau of Statistics data, these surging sales only drove a 0.8% increase in total car retail sales. This means the average car price fell by 10% year-on-year, lower than the implied average price decline of 4% in the first half of 2024.

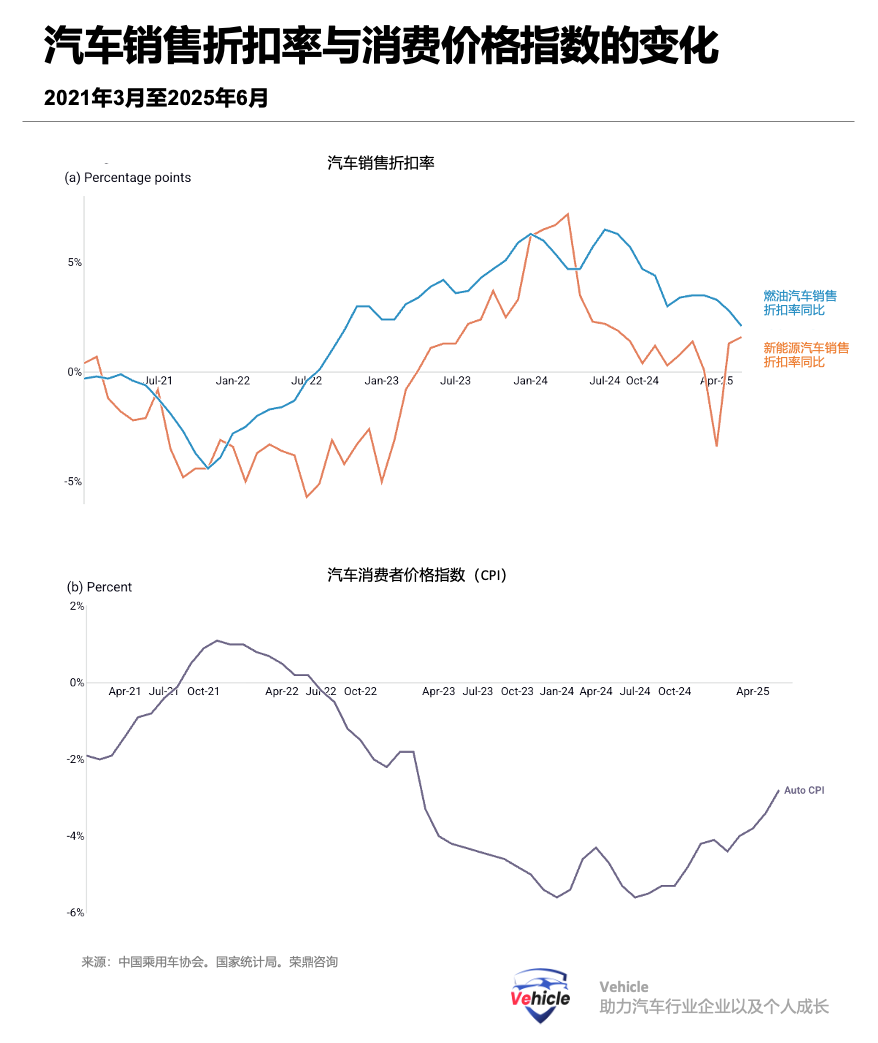

But the car discount rate and Consumer Price Index (CPI), as shown in the figure below, will decline less year-on-year in 2025 than in 2024. The CPI for internal combustion engine cars rebounded from a decline of 6% in June last year to -3.4% in June this year, and the CPI decline for new energy vehicles also narrowed from 7.4% to 2.5%.

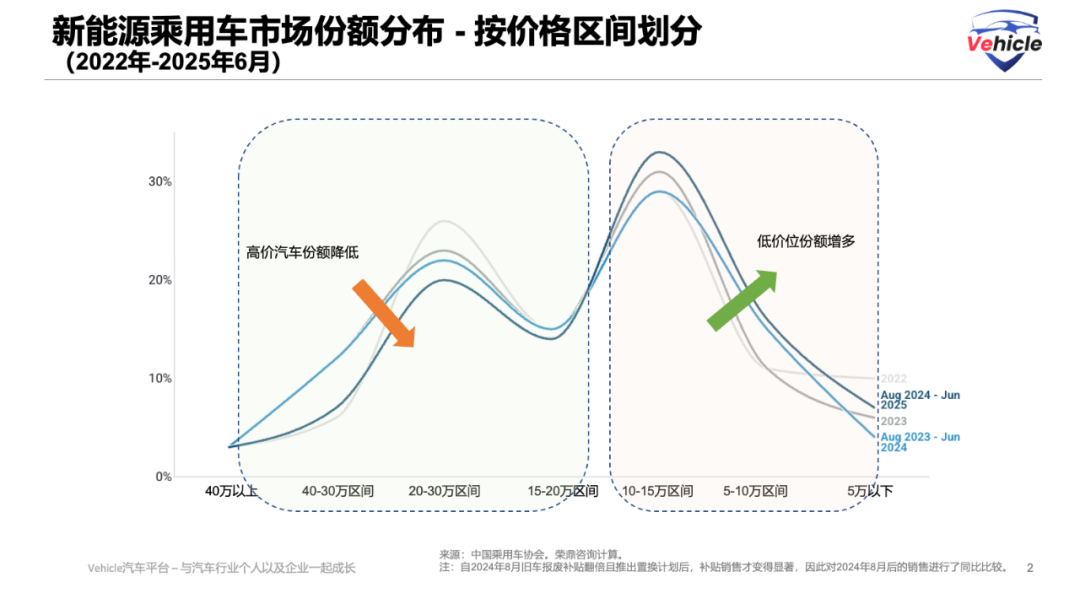

The data suggests that individual car prices are still declining but at a slower rate than last year. However, for the industry as a whole, the average price decline is more significant. This might indicate that the overall market structure has shifted, with cheaper models now accounting for a larger market share, especially new energy vehicles, which comprised over 50% of total sales in the first half of the year.

Other price data also supports this conclusion. We analyzed the market share of new energy vehicle passenger car retail sales across various price ranges from August 2024 to June 2025, post-doubling of scrap subsidies and the subsequent sales surge, and compared it to the sales distribution from August 2023 to June 2024 (as shown in the article's first figure). The market share of new energy vehicles priced above 150,000 yuan decreased by 8 percentage points, with high-end models priced between 300,000 and 400,000 yuan performing the worst. New energy vehicles priced between 100,000-150,000 yuan and below 50,000 yuan benefited the most, with market shares increasing by 4 percentage points and 3 percentage points, respectively.

3. Intensifying "Involutional Competition"

Car scrap subsidies and trade-in subsidies are typically fixed levels, while subsidies for household appliances and electronics are set at a discount rate of 15-20% with a maximum subsidy cap. Therefore, car buyers tend to prefer lower-priced cars to obtain higher implied discount rates. The maximum subsidy for new energy vehicles is 20,000 yuan per vehicle. To achieve a minimum discount rate of 15% (comparable to household appliances and electronics subsidies), buyers would only consider cars priced below 133,333 yuan. This aligns with the shift in market sales structure towards new energy vehicles priced below 150,000 yuan.

Current scrap car subsidies and trade-in subsidies might be the most "involutional" incentives for reducing the overall price level. Car purchase tax incentives are effectively a discount rate with a subsidy cap. These incentives do not excessively suppress sales of high-end cars and are also available to first-time car buyers. Promotion subsidies for new energy vehicles set different subsidy levels for models with different driving ranges and power systems (pure electric and hybrid), encouraging consumption upgrades by gradually raising standards.

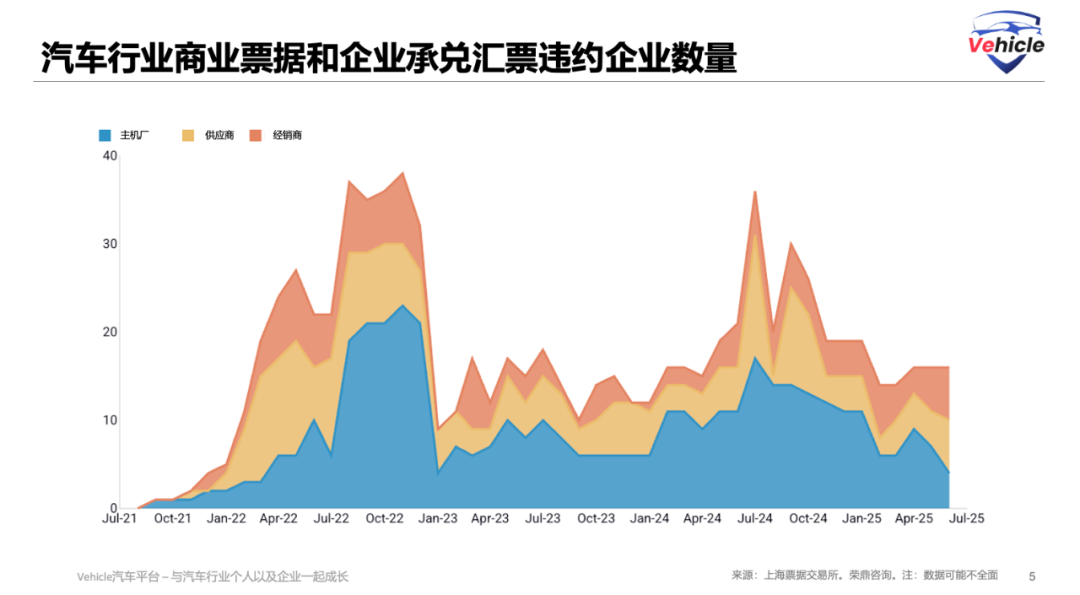

In contrast, scrap subsidies and trade-in subsidies stimulate consumption downgrades and sales growth, allowing more automakers to remain operational. Since mid-2024, the number of automakers defaulting on commercial paper and corporate acceptance bills in the automotive industry (an indicator of market exit) has declined (as shown in the figure below).

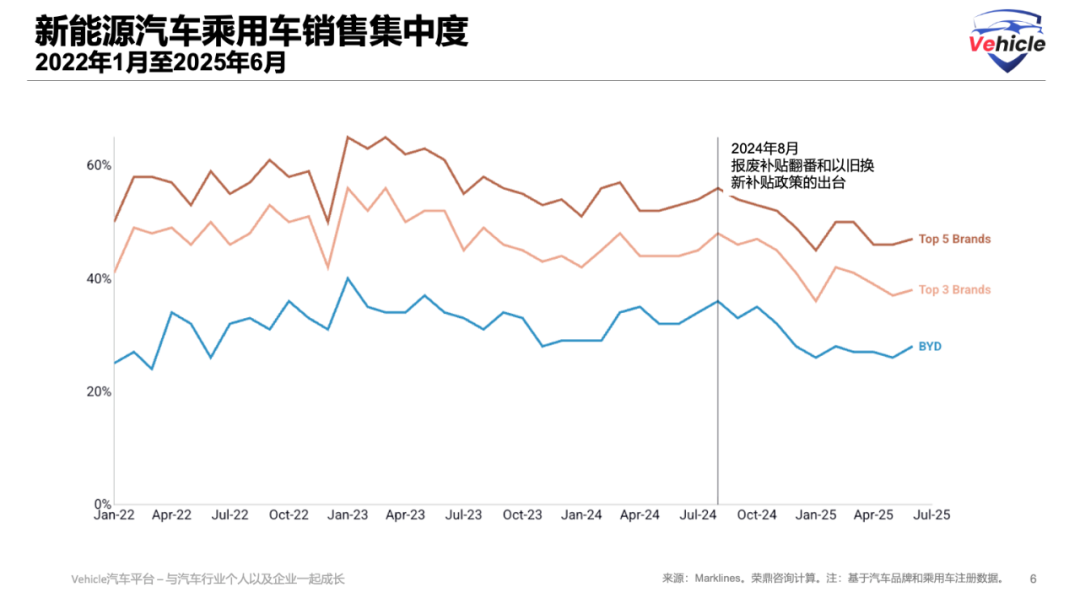

In the first half of 2024, the concentration of new energy vehicle sales among various enterprises tended to stabilize after previously declining in 2023. However, with the doubling of scrap subsidies and the introduction of trade-in subsidy policies, the upward trend in market share concentration reversed after August 2024 (as shown in the figure below). Even BYD's market share has declined since October last year, eroded by newly launched models such as Geely's Star Wish, Wuling Hongguang MINI, Geely Galaxy Starship 7 priced below 150,000 yuan, and XPeng Mona 03 mentioned in our article "Geely's First Half of 2025 - Pressure on BYD." Consolidation in the upstream battery industry has also stalled, with the market share of the top three battery manufacturers falling from 80% in May last year to 73% in May 2025.

The Rhodium Group stated that similar consequences also emerged during the 2008-2013 Home Appliance to the Countryside subsidy policy. Subsidies were limited to household appliances priced below a certain cap, helping low-end manufacturers regain market share and exacerbating overcapacity in these industries. By 2012, major manufacturers including Haier, Midea, and Gree opposed MIIT's extension of these subsidy programs.

The trade-in subsidy policy for household appliances has improved, but the automotive industry may now face similar consequences. Car subsidies may exacerbate "involutional competition," forcing automakers to compete at lower prices and hindering industry consolidation and market exit. The operating profit margin of the automotive industry has fallen from 5.1% in the first five months of last year to 4.2% as of May this year.

4. When Will Car Subsidies Decline?

The Rhodium Group estimates that central government subsidies for passenger car purchases will reach a record 342 billion yuan in 2025, comprising 150 billion yuan for scrap and trade-in subsidies and 192 billion yuan for new energy vehicle purchase tax reductions. This equates to approximately 3% of the central government's total fiscal revenue and about 7% of passenger car retail sales for the year (Figure 7). The scale of this round of subsidies far exceeds previous similar projects.

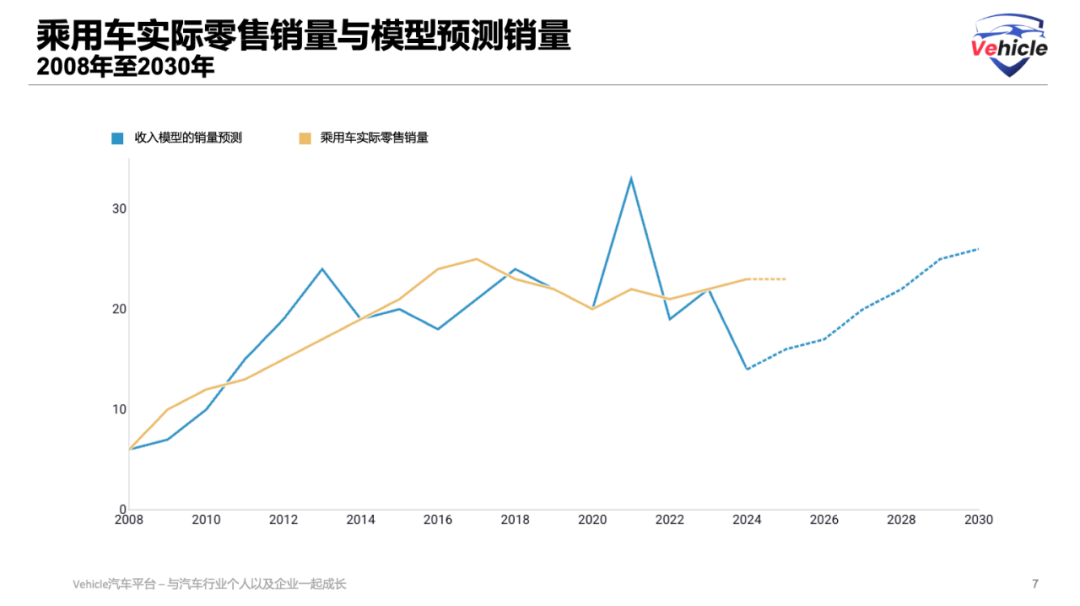

The Rhodium Group uses a Gompertz model based on the real wage index to predict car ownership growth and a survival curve model to predict scrap rates. Its approach compares actual sales after subsidies with theoretical sales without subsidies to assess the boost provided by car purchase subsidies to overall car sales.

Key indicators show that the Rhodium Group believes the likelihood of a rapid acceleration in wage growth in China in the coming years remains low, and temporary subsidies do not create new demand but rather bring forward future demand.

If car subsidies are removed before theoretical sales fully recover, price wars and additional subsidies from local governments may resurface. This would, of course, contradict the leadership's original intention of combating "involutional competition."

Based on the above assumptions and models, the Rhodium Group concludes that theoretical sales should further rebound from 2027 and return to the 23 million vehicle level in 2028, when car replacement demand will rebound, considering the scrapping of cars sold in previous years. This trend implies that subsidies need to continue at least until 2026 and possibly until 2027.

However, the substantial funding demand for subsidies poses a significant issue. Halving the reduction standards for the purchase tax for new energy vehicles would reduce the total subsidy amount by approximately 100 billion yuan. Based on this year's subsidy implications, if scrap subsidies and trade-in subsidies are also eliminated simultaneously, passenger car retail sales may experience a double-digit decline next year, which is unacceptable.

In light of China's economic slowdown, the Rhodium Group anticipates that subsidy programs will likely expand to a level somewhere between the "baseline" and "high" scenarios, aiming to counteract the negative impact of halving the reduction standards on sales.

Nevertheless, this expansion will also result in a further decline in the industry's average price level, as scrap car and trade-in subsidies continue to drive the purchase of low-priced vehicles. Consequently, shrinking domestic profit margins will incentivize automakers to more aggressively expand into overseas markets.

The Rhodium Group emphasizes that enhancing the incentive mechanisms and multiplier effects of subsidy programs is vital for mitigating the "involutional" consequences of subsidies and boosting sales.

Potential measures they foresee include:

- Implementing subsidies with a fixed discount rate and a maximum cap, mirroring trade-in subsidies for household appliances and electronics.

- Providing higher subsidies for cars with superior quality, energy efficiency, or advanced technologies like autonomous driving systems.

- Expanding eligibility criteria to encompass first-time car buyers. According to the China Passenger Car Association, the proportion of first-time car buyers in total sales is projected to decrease from 70% in 2016 to 35% by the first half of 2024. Although they cannot benefit from scrap or trade-in subsidies, first-time buyers remain a significant source of demand.

- Offering special subsidies for migrant workers and rural families, also known as the "car goes to the countryside" initiative. Currently, 31% of migrant workers and 35% of rural families own cars, lower than the national average of 42% from the 2020 census, suggesting greater growth potential in rural auto sales upon increased demand. These measures could be even more effective when combined with transfer payments to improve migrant workers' healthcare and pension benefits.

5. Final Thoughts

What are your thoughts on the Rhodium Group's inferences and predictions? Please share your comments and join the discussion.

Reference Articles and Images

"China's Subsidies Intensify the 'Involution' of the Auto Industry" - Rhodium Group

*Reproduction and excerpts are strictly prohibited without permission-*