Dongfeng Motor: Restructuring Complete, Yet New Horizons Await

![]() 08/25 2025

08/25 2025

![]() 486

486

Produced by | Boning Studio (gbngzs)

Nestled in Wuhan Economic and Technological Development Zone, Dongfeng Motor's headquarters stands like a sailboat braving wind, rain, and waves—a metaphor for the state-owned automaker's journey through reform. Spanning 56 years, Dongfeng's history is intertwined with that of China's automotive reform.

The latest milestone in this ongoing transformation was announced on August 22, 2025. That evening, Dongfeng Motor Group Co., Ltd. (Dongfeng Group) issued a statement revealing plans for its subsidiary, VOYAH Auto, to list independently on the Hong Kong Stock Exchange via an introduction listing. Concurrently, Dongfeng Group will delist from the public market through privatization.

Just ten days prior, Dongfeng Group's shares were suspended, trading at HK$5.97 with a market capitalization of HK$49.268 billion. Following the announcement on the 22nd, Dongfeng Group's American Depositary Receipts (ADRs) closed at $61, marking an 87.69% surge.

Multiple insiders shared with Boning Studio that Dongfeng Motor's innovative "VOYAH introduction listing + Dongfeng Group privatization delisting" strategy is driven by three primary factors.

Firstly, Dongfeng Group's shares have long suffered from a low valuation, effectively nullifying their financing capabilities.

In the first half of 2025, Dongfeng Group sold approximately 823,900 vehicles, a 14.7% year-on-year decrease. However, sales revenue reached RMB 54.533 billion, up 6.6% year-on-year, with gross profit increasing 28.0% to RMB 7.599 billion. Gross profit margin improved to 13.9%, a 2.3 percentage point increase. Net profit attributable to shareholders of the listed company was RMB 55 million, a 93% year-on-year decline attributed to decreased sales and profits from joint venture brands, coupled with increased investments in the smart electric sector.

Secondly, Dongfeng aims to secure a leading position among central enterprises in the new energy sector.

In the transition to new energy, VOYAH has emerged as one of Dongfeng Motor's most valuable and growth-oriented assets. From January to July 2025, VOYAH sold 68,300 vehicles, an 88% year-on-year increase, with monthly sales exceeding 10,000 vehicles from March to July. In 2023, VOYAH incurred a net loss of RMB 1.472 billion, which narrowed to RMB 18 million in 2024 and is expected to achieve full-year profitability this year.

Thirdly, this restructuring paves the way for future reforms.

Currently, Dongfeng Motor boasts three listed companies: Dongfeng Motor Group Co., Ltd. (listed on the Hong Kong Stock Exchange in 2005), Dongfeng Motor Co., Ltd. (listed on the Shanghai Stock Exchange in 1999), and Dongfeng Electronic Technology Co., Ltd. (listed on the Shanghai Stock Exchange in 1997). The business scopes of these entities are complex and overlapping, necessitating further clarification.

Boning Studio believes that post-restructuring, Dongfeng Motor may further delineate its business lines, more clearly differentiating and integrating its passenger vehicle, commercial vehicle, and components businesses.

The announcement detailed that VOYAH Auto will list on the Hong Kong Stock Exchange via an introduction listing, a process where existing shares are listed for trading without issuing new shares or raising additional funds.

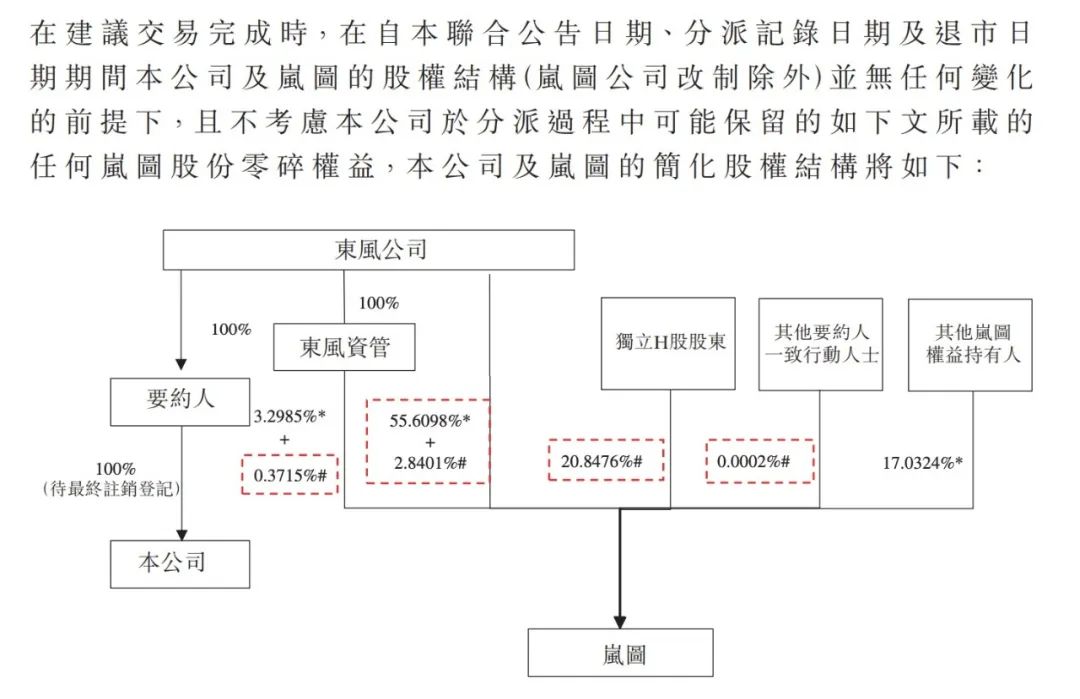

This transaction adopts a combined "equity distribution + merger by absorption" model, with both steps interdependent and progressing simultaneously. Initially, Dongfeng Group will distribute 79.67% of its equity in VOYAH Auto proportionally to all shareholders, facilitating VOYAH Auto's listing on the Hong Kong Stock Exchange. Subsequently, Dongfeng Motor's wholly-owned subsidiary, Dongfeng Motor Group (Wuhan) Investment Co., Ltd., will acquire 100% control of Dongfeng Group shares by paying equity consideration to Dongfeng Group's controlling shareholder and cash consideration to other minority shareholders.

The overall acquisition price per share is HK$10.85, comprising HK$6.68 in cash and HK$4.17 in VOYAH equity.

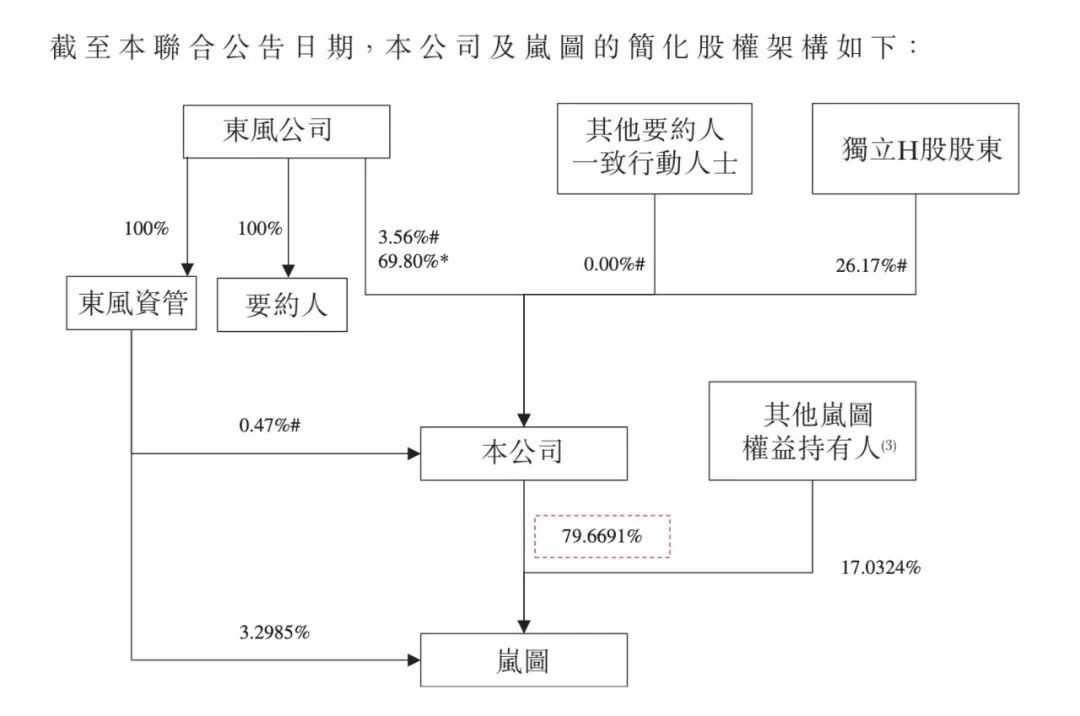

As Dongfeng Motor's premium new energy brand, VOYAH Auto has long signaled its intention to list. In June 2021, VOYAH Auto began independent operations and introduced an employee stock ownership plan. In 2023, VOYAH Auto's CFO Shen Jun stated that monthly sales of 10,000 vehicles would fulfill listing requirements. This year, on July 16, Dongfeng Group, Dongfeng Asset Management, VOYAH Auto, and other shareholders entered into a capital increase agreement, with Dongfeng Asset Management contributing RMB 1 billion. Post-capital increase, Dongfeng Group, Dongfeng Asset Management, and other shareholders held approximately 79.69%, 3.30%, and 17.01% equity in VOYAH Auto, respectively.

For VOYAH, a Hong Kong Stock Exchange listing will enhance financing channels, foster international governance integration, and facilitate global operations. For Dongfeng Group, VOYAH's listing will break valuation constraints, clarifying the company's business layout and igniting imagination for subsequent capital operations and resource allocation strategies.

With reform as its wind, Dongfeng Motor, this grand vessel, continues to navigate through waves and forge ahead.