The Extended-Range Market Cools Down, Yet Automakers Remain Enthusiastic

![]() 09/05 2025

09/05 2025

![]() 585

585

Lead | Lead

The transformation of extended-range technology, from being used by whoever wanted it to being loved by everyone, took only five years.

Produced by | Heyan Yueche Studio

Written by | Cai Jialun

Edited by | He Zi

In early August, the Ministry of Industry and Information Technology released the 398th batch of the 'Road Motor Vehicle Production Enterprises and Products Announcement.' The Xpeng X9 extended-range version and the GAC Aion i60 extended-range version made their debut. Coupled with the announcement of extended-range models such as the Buick Envision L7, IM LS9, and SAIC Shangjie H5 in the July batch, a total of five extended-range models have been introduced in two months. This foreshadows that new energy players are flocking to the extended-range sector.

Extended-range technology, once regarded as 'outdated' by most automakers, has now become a highly anticipated 'game-changing tool' for brands. As China's new energy vehicle market enters the deep waters of its second half, both joint ventures and independent automakers, as well as new forces, are entering a period of transformation and expansion. Faced with choices in new energy technology routes, automakers have shifted from focusing on whether a technology is 'orthodox' to whether it is 'practical.' Extended-range technology has proven to be 'practical' in the Chinese market.

As the extended-range route gains acceptance among automakers, controversies surrounding extended-range technology have further escalated to questions like, 'Is extended-range a transitional form, or can it stand as an independent route in the long term? As the pure electric charging network becomes more mature and the cost of extended-range systems emphasizing pure electric operation rises, how much time and market share will be left for extended-range vehicles in the future?'

Automakers' Collective Shift

The reasons why automakers are vying to enter the extended-range sector or why capital is quickly entering the field can be boiled down to two aspects: on the one hand, the market prospects are good, with high user demand and successful cases; on the other hand, the technology is relatively simple, allowing for rapid deployment.

Looking back at the performance of extended-range vehicles over the past few years, in 2023, the market sales of extended-range models increased by 111% year-on-year. In 2024, sales of extended-range models reached 1.167 million units, a year-on-year increase of 78.7%, far outpacing the growth rates of pure electric vehicles (22.6%) and plug-in hybrids (76.3%). The market share of extended-range models also rose from 3% to 10%.

More importantly, in the large and mid-size SUV market, where premiums and profits are higher, extended-range vehicles have achieved a market share that pure electric vehicles have never reached. Especially notable are Li Auto and Seres, two dominant players. The former has become the fastest-profit-making new force brand relying on its extended-range L series, while the latter has further increased its per-vehicle profit through its leading electric control and intelligence, much to the envy of many automakers.

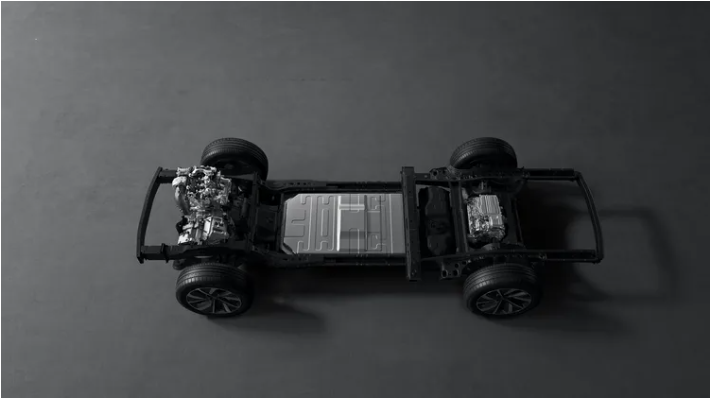

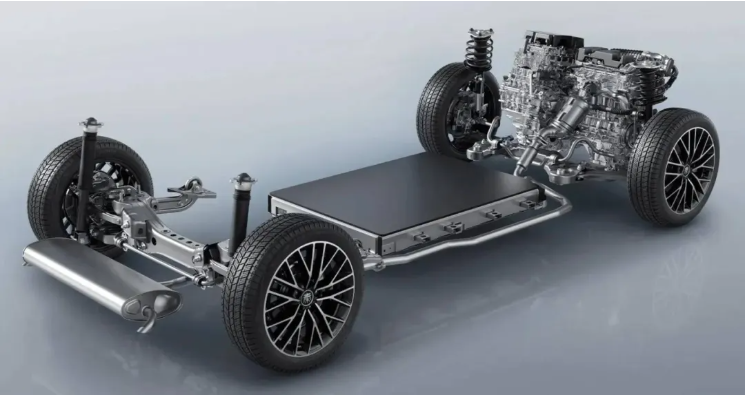

If the strong market performance of extended-range models is the driving factor, then the key determinant for automakers to collectively enter the sector is the simplicity of the extended-range technology. Especially for joint venture brands with deep expertise in internal combustion engines, the extended-range technology route, after eliminating the need for complex DHT transmission tuning and adopting a 'motor-driven + engine-powered generation' model, can fully leverage existing fuel vehicle platforms and engine data for modifications. After all, adjusting engine power to a 'stable, specific high-efficiency range' is essentially allowing traditional automakers to operate within their comfort zones.

As for the battery and electric control systems in extended-range vehicles, traditional automakers can achieve rapid mass production through purchases or third-party collaborations. CATL's Xiaoyao extended-range dedicated battery, released in 2024, can achieve a 400KM+ range with 4C ultra-fast charging. In the IM 'Stellar' extended-range system, a dedicated battery with a capacity of 66 kWh, 800V ultra-high voltage, and a range of 450KM+ was developed in collaboration with CATL. IM Motors, which sold less than 20,000 units in the first half of this year, plans to boost sales in the second half of the year through its 'Super Extended-Range' technology.

Not only independent brands but also mainstream joint venture brands have launched their own extended-range solutions. Buick's 'True Dragon' extended-range system, featuring the Xiaoyao architecture + Ultium battery + its own LD3 1.5T range extender, achieves a pure electric range of 302KM, a combined range of over 1400KM, and a fuel consumption of 5.9L per 100km.

BMW plans to launch the iX5 extended-range version in 2026, equipped with the fifth-generation eDrive electric drive system and a 2.0T range extender. SAIC Volkswagen's ID.ERA is undergoing extended-range modifications on the MEB platform, with an expected combined range of 1000KM.

Joint ventures have already missed the first wave of advantages in China's new energy market. Now, as extended-range technology enters a critical transition period from 'large fuel tank, small battery' to 'large battery, small fuel tank,' these traditional automakers can only seize the opportunity and rely on their accumulated fuel engine data and global supply chain advantages to take a gamble.

This is why Volkswagen, which once criticized extended-range technology as 'the worst solution' in 2020, publicly stated in 2025 that 'extended-range is not a transitional technology and will play an important role in the future.'

The Extended-Range Vehicle Market is Unpredictable

However, after four years of rapid growth, the extended-range market began to 'clear up' in 2025. In the first half of the year, the market share of extended-range vehicles in China's new energy vehicle market slipped from 10.7% in 2024 to 9.8%. From the cumulative retail sales from January to July this year, although extended-range vehicles saw a 12.1% year-on-year increase, it was far lower than the 35.2% growth of pure electric vehicles and the 25.2% growth of plug-in hybrids, indicating a significant slowdown in sales growth. Taking Li Auto as an example, in July, Li Auto delivered 30,700 new vehicles, a year-on-year decrease of 39.7% and a month-on-month decrease of 15.3%. From January to July, Li Auto delivered a total of 234,600 vehicles, a year-on-year decrease of 2.21%.

The extended-range market in 2025 may seem appealing, but it has already become a sweet trap. Li Auto, which achieved success through precise positioning of user needs, began exploring secondary growth points when it launched the MEGA in 2024. Leapmotor's multiple best-selling models, which once relied mainly on extended-range versions with pure electric versions as supplements, have now flipped this ratio. Even the newly launched B10 and B01 models this year did not offer extended-range versions.

Those inside the city want to get out, while those outside want to get in. The decline of the extended-range vehicle market in 2025 can be attributed to the fact that 'range anxiety' has been alleviated by an increasingly perfect (improved) charging network, battery technology, and charging technology. Especially with the significant decrease in the cost of raw materials for power batteries, the advantages of extended-range vehicles, such as 'high cost-effectiveness' and 'no range anxiety,' are gradually diminishing.

Returning to the issue of the cooling extended-range vehicle market and the continued enthusiasm of automakers, a dose of cold water needs to be poured in advance. After all, it is impossible to determine whether the automakers that are still heavily investing in the extended-range market in 2025 are opportunists or simply unable to keep up with changes. However, what is certain is that in the future Chinese automotive market, it will be much more difficult for extended-range vehicles to counterattack and seize market share from pure electric or plug-in hybrid vehicles than imagined.

Therefore, whether it is GAC, IM, Xpeng, NIO, or Volkswagen, Buick, Toyota, or BMW, they are all facing an increasingly high-threshold extended-range market. This high threshold does not only refer to the hard technological requirements of 'ultra-fast charging + large battery + long range' but also includes a series of soft indicators such as brand positioning, marketing methods, and product positioning.

Although there is room for development in the extended-range market, with the initial dividends of the extended-range vehicle market already divided up by Li Auto, Seres, and others, and the new energy vehicle market as a whole beginning to favor pure electric and plug-in hybrid vehicles, latecomers to the extended-range market will find it difficult to achieve long-term success by relying solely on configuration stacking and price reductions to gain short-term sales.

Commentary

If we zoom out and look at the global automotive landscape over an extended period, since the automotive industry began its electric transformation, no single technology route has been able to dominate indefinitely. Especially with internal combustion engine vehicles still holding a significant market share and battery technology still evolving, the 'engine + battery' model remains competitive. Even NIO plans to launch its first extended-range model in 2026, targeting the European market through its Firefly brand. The prospects of the extended-range vehicle market depend on the pace of competition between charging infrastructure and battery technology. In China, third- and fourth-tier cities and even rural areas still offer vast development space for extended-range vehicles. Globally, the slow construction of charging facilities makes extended-range vehicles even more promising.

(This article is original to 'Heyan Yueche' and may not be reproduced without authorization.)