2025 H1 Financial Report on New Energy Vehicle Startups: Rising Stars Overtake Established Players

![]() 09/09 2025

09/09 2025

![]() 645

645

Recently, with NIO releasing its Q2 financial results for this year, the first-half performance of the five major new energy vehicle (NEV) startups—NIO, XPeng, Li Auto, Leapmotor, and Xiaomi—has been fully disclosed. Among them, Li Auto leads in profitability but faces concerns over slowing sales growth; Leapmotor turns a profit and raises its annual sales target; XPeng continues to narrow losses and targets profitability in Q4; Xiaomi's automotive business nears break-even; NIO sees improved sales but remains under profit pressure.

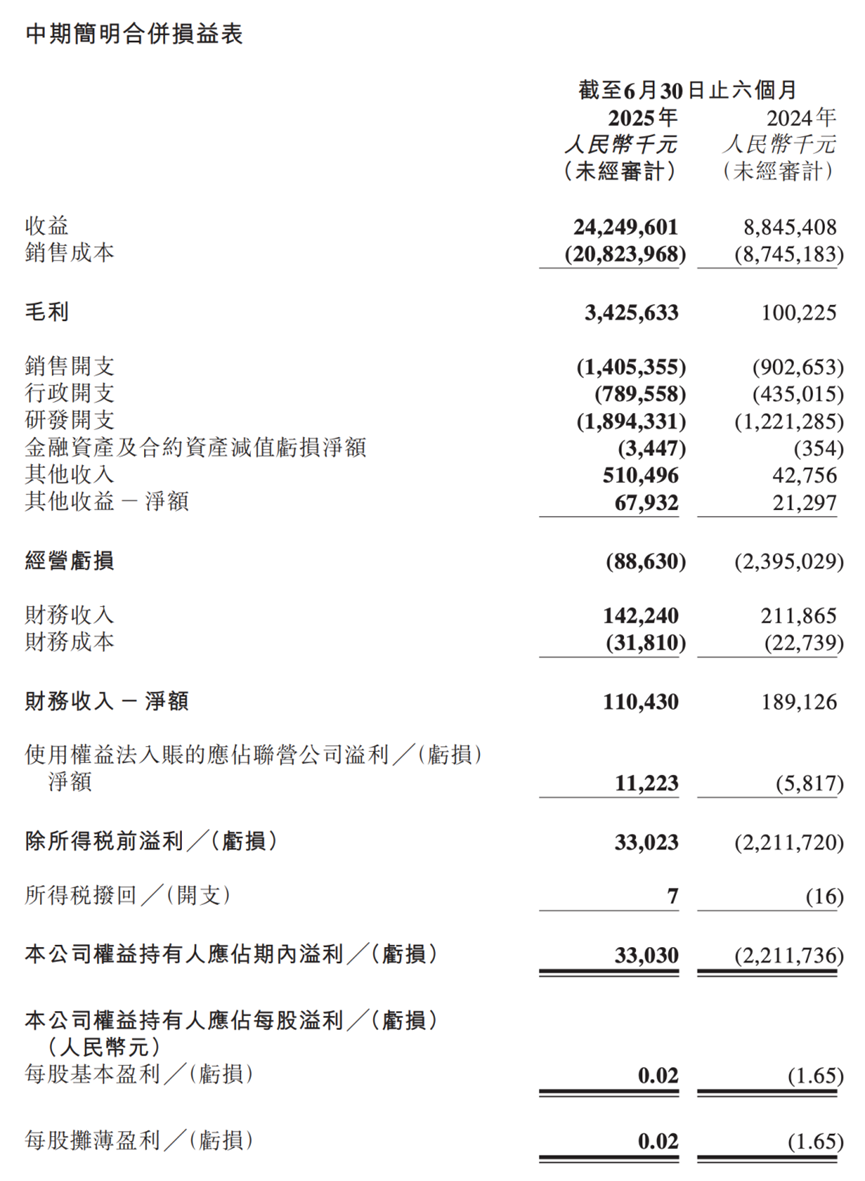

Amid intensifying competition in the automotive market, Leapmotor has delivered a standout half-year performance. Data reveals that in the first half of 2025, Leapmotor's revenue reached 24.25 billion yuan, marking a year-on-year increase of 174.1%. Its net profit stood at 30 million yuan, marking the first time it achieved positive half-year profits. The automotive gross margin reached 14.1%, a year-on-year increase of 13 percentage points.

The key to Leapmotor's turnaround lies in its sales breakthrough. In the first half of the year, Leapmotor delivered a cumulative total of 221,700 vehicles, a year-on-year surge of 155%, securing the top sales position among NEV startups. Behind this success, the four models—Leapmotor C10, C11, C16, and T03—contributed over 70% of the market share. Based on its better-than-expected performance, Leapmotor has raised its annual sales target to 500,000-650,000 vehicles. Meanwhile, according to Leapmotor Vice President Li Tengfei, the company aims to achieve full-year profitability in 2025, targeting a net profit of 500 million to 1 billion yuan. In the recently concluded July and August, Leapmotor's sales exceeded 50,000 vehicles for two consecutive months, frequently setting new historical highs.

It is evident that Leapmotor has emerged as the most prominent player among NEV startups. However, despite entering the profitable camp, its cost-effective route makes it challenging to scale up profitability significantly. It is reported that the highest-end D-series models will make their public debut as early as October this year, with the first new model expected to launch in the first quarter of next year. At that time, the market performance of the new models will be crucial to Leapmotor's success in the high-end segment.

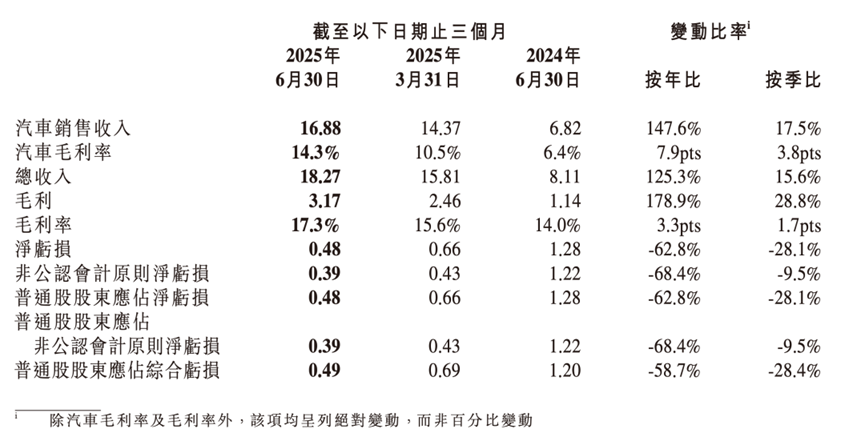

In the first half of this year, XPeng delivered a standout financial performance, with several core indicators showing strong growth momentum. Data shows that XPeng's total revenue for the first half reached 34.09 billion yuan, a year-on-year surge of 132.5%. Among this, automotive sales revenue was 31.25 billion yuan, a year-on-year increase of 152.8%. The automotive gross margin reached 12.6%, improving for eight consecutive quarters. The net loss was 1.14 billion yuan, narrowing compared to the same period last year. Cash reserves reached 47.57 billion yuan.

Sustained sales growth has been a key pillar supporting XPeng's revenue improvement. From January to June 2025, XPeng delivered a total of 197,000 vehicles, approaching 200,000 units and surpassing its total sales for the entire year last year. Behind this success, the cost-effective XPeng MONA M03 and XPeng P7+ have been absolute sales mainstays. Additionally, its collaboration with Volkswagen has contributed to XPeng's service and other revenues reaching 2.83 billion yuan in the first half of this year, a year-on-year increase of 23.3%.

Chairman He Xiaopeng clearly stated during the earnings call that the company will achieve its first quarterly profit in Q4 this year. Currently, the all-new XPeng P7, a 300,000-yuan-class luxury intelligent coupe, has officially launched, with the company stating that pre-orders have surpassed those of the best-selling MONA model, indicating its popularity. Meanwhile, the XPeng X9 extended-range version, positioned in the 400,000-yuan class, will enter mass production in Q4, potentially further expanding market share. The arrival of high-value models also increases the likelihood of XPeng achieving profitability in Q4.

Xiaomi's automotive financial report continues to impress. From January to June 2025, Xiaomi's innovative business segments, including smart electric vehicles and AI, generated a total revenue of 39.843 billion yuan, a year-on-year surge of 200%, accounting for 17.5% of Xiaomi Group's total revenue. Among this, revenue from smart electric vehicles was 38.7 billion yuan. Additionally, the gross margin for its innovative business segments, including smart electric vehicles and AI, reached approximately 24.8%.

Rapid delivery growth has also been the biggest contributor to Xiaomi's smart electric vehicle revenue growth. In the first half of this year, Xiaomi delivered 157,000 vehicles. In July and August, its monthly sales exceeded 30,000 units twice consecutively. Meanwhile, the average selling price of Xiaomi's vehicles has increased from 238,300 yuan to 253,600 yuan, a month-on-month increase of 6.4%, which will continue to optimize Xiaomi's profitability. Xiaomi President Lu Weibing stated that Xiaomi Automobile aims to achieve single-quarter or single-month profitability in the second half of the year. However, due to cumulative investments of over 30 billion yuan in its automotive business, overall profitability still requires time, and the company remains in a high-investment, loss-making phase.

Furthermore, he pointed out that Xiaomi Automobile's current top priority is still fulfilling existing orders. Data shows that as of the end of July, unfulfilled orders for Xiaomi's two models have exceeded 400,000 units. The official website indicates that the current delivery lead time for the YU7 standard version is 55-58 weeks, while the high-end version requires a 40-week wait. However, according to supply chain sources, Xiaomi Automobile's Phase II factory will add an annual production capacity of 80,000 units, which will partially alleviate production capacity pressures.

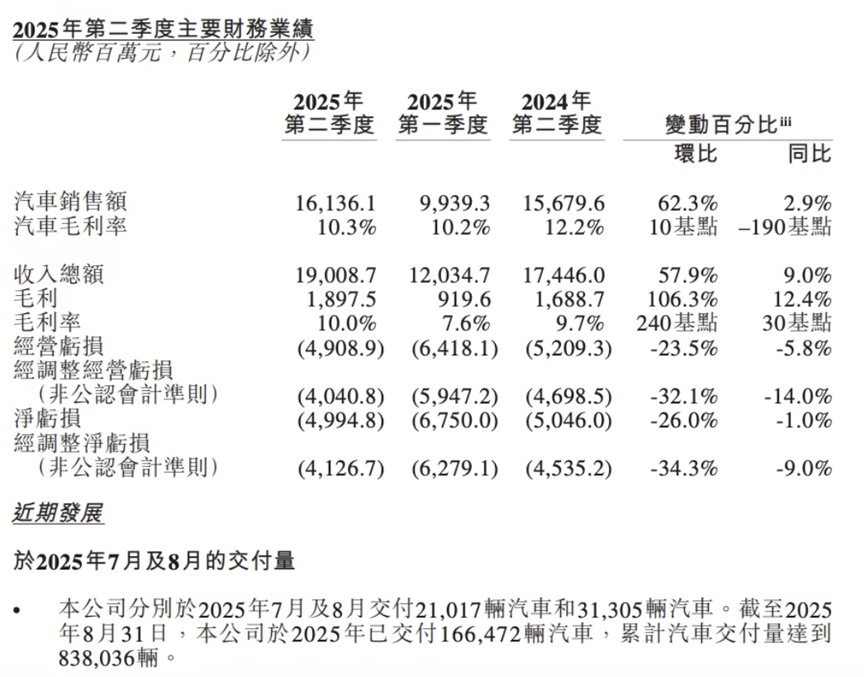

Despite NIO's performance improvements, profit pressure remains significant. In the first half of 2025, NIO achieved revenue of 31.04 billion yuan, a year-on-year increase of 13.49%. The net loss was 11.732 billion yuan, a year-on-year expansion of 14.67%. The gross margin was 9.07%, a year-on-year increase of 1.11 percentage points.

In terms of sales, NIO delivered a cumulative total of 114,100 vehicles in the first half, a year-on-year increase of 30.6%. Among this, the NIO brand delivered 74,400 vehicles, the Ledo brand delivered 31,900 vehicles, and the Firefly brand delivered 7,843 vehicles. Some public opinions point out that overall, NIO's sales growth in the first half is still far from reaching its break-even point.

The company stated that the expansion of net losses is attributed to high sales costs and various expenses, including a decline in vehicle gross margin after launching several mass-market products. However, NIO Chairman Li Bin previously stated that the company aims to challenge profitability in Q4 this year. Given NIO's current situation, he also admitted that achieving profitability in Q4 would be highly challenging. To address this, NIO Chairman Li Bin proposed striving to increase sales to a monthly delivery volume of 50,000 units in Q4 this year.

Recently, the Ledo L90 and the new-generation NIO ES8 have entered the market, both showing strong performance. It is reported that the Ledo L90 achieved over 10,500 deliveries in its first full month, becoming the fastest NIO model to surpass 10,000 units, while pre-orders for the new-generation NIO ES8 are better than those of the Ledo L90 during the same period. Whether these two models can help NIO achieve profitability in Q4 will soon be answered.

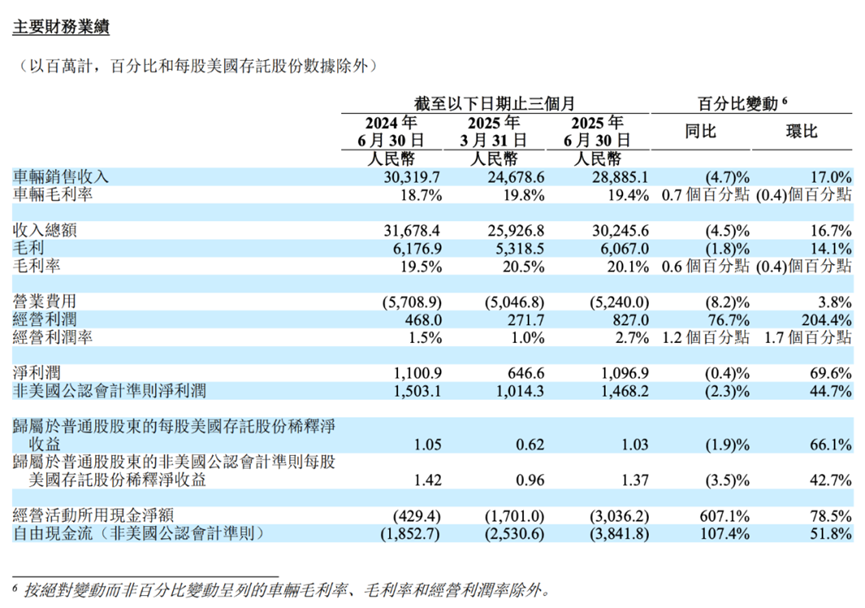

Li Auto continues to lead in profitability among NEV startups, but its sales growth has begun to slow. From January to June 2025, Li Auto achieved revenue of 56.17 billion yuan, a year-on-year decline of 2%. Net profit was 1.74 billion yuan, a year-on-year increase of 3%. Among this, revenue in Q2 was 30.246 billion yuan, a year-on-year decline of 4.5%. Net profit was 1.097 billion yuan, a slight year-on-year decrease of 0.4%.

In terms of sales, Li Auto delivered 203,900 vehicles in the first half, a year-on-year increase of only 7.9%. In July and August, its monthly sales declined by 40% year-on-year.

Poor market performance has led the company to lower its Q3 performance guidance. Data shows that Li Auto's sales guidance for Q3 is between 90,000-95,000 units, a year-on-year decrease of 37.8%-41.1%. Revenue is expected to be between 24.8 billion-26.2 billion yuan, a year-on-year decline of 38.8%-42.1%.

The exhaustion of market dividends in the extended-range segment and the lack of momentum in the pure electric market have made it difficult for Li Auto to sustain its past high growth. However, holding billions in cash provides Li Auto with more opportunities for a comeback. According to Li Auto Chairman Li Xiang, the stable monthly sales target for the Li Auto i8 is 6,000 units, while the upcoming Li Auto i6 aims for a stable monthly sales target of 9,000-10,000 units.

From the current situation, Li Auto's challenges in the pure electric segment have just begun, and whether it can achieve its targets remains uncertain.

Summary

Currently, profitability has become the collective pursuit of most NEV startups. Among them, XPeng aims to achieve profitability in Q4 by relying on high-end models after recovering with low-cost models; NIO needs to reach monthly sales of 50,000 units with cost-effective models in Q4 to achieve profitability; Xiaomi Automobile, while likely to achieve single-month or single-quarter profitability, still faces production capacity challenges. Additionally, Leapmotor, which has already achieved profitability, faces the dilemma of "maintaining profitability and expanding scale," while Li Auto urgently needs to overcome challenges in the pure electric segment.

(Image source: Internet. Infringement will be deleted.)